Bloomberg Intelligence

This article was written by Bloomberg Intelligence Quantitative Equity Strategist Christopher Cain and Data Scientist Andy Barton. It appeared first on the Bloomberg Terminal.

Shareholder yield — a measure that combines dividends, buybacks and debt reduction — has outpaced traditional dividend strategies, nearly doubling their returns both year-to-date and over the past decade. Unlike dividend yield, which tilts heavily toward value at the expense of growth, shareholder yield retains exposure to profitability and momentum. Crown Holdings, Cigna and Pilgrim’s Pride stand out with high shareholder yields and strong multifactor profiles across value, momentum, profitability and low volatility.

Total capital return beats pure dividend yield

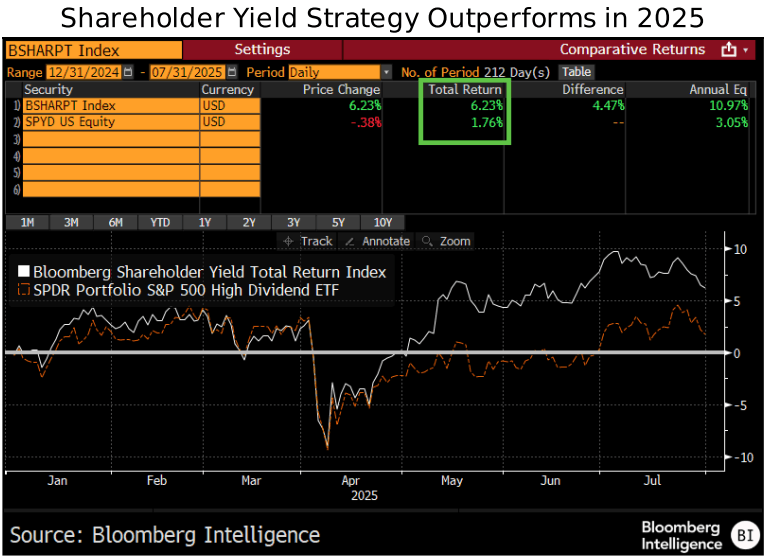

Stocks with elevated shareholder yield have continued to outperform in 2025, extending their long-term track record of stronger returns relative to high dividend yield stocks. Year-to-date, the Bloomberg Shareholder Yield Index (BSHARPT Index) is up 6.24%, compared to a 1.75% gain for the SPDR Portfolio S&P 500 High Dividend ETF (SPYD), which selects the 80 S&P 500 stocks with the highest indicated dividend yields. Shareholder yield offers a more comprehensive measure of capital return, incorporating dividends, buybacks and changes to both long- and short-term debt – – unlike dividend yield, which captures only stated payouts.

Neither the shareholder yield nor the dividend yield factors in our study are neutralized by sector.

Shareholder yield avoids dividend yield’s growth drag

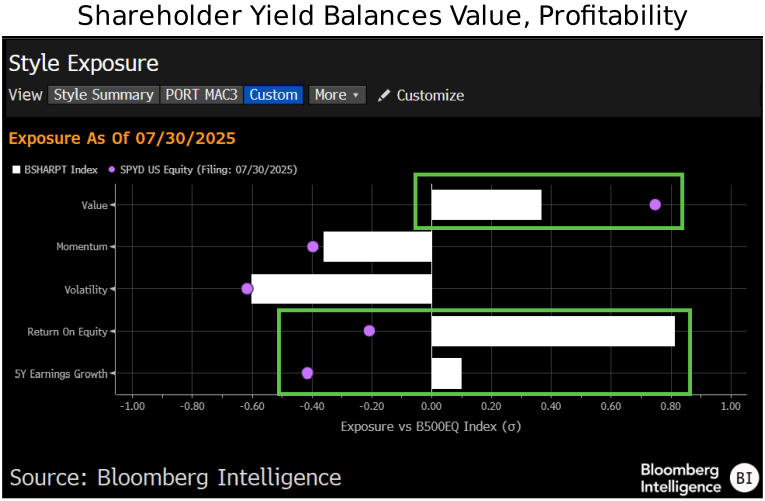

A cross-factor analysis highlights the sharp divergence between shareholder yield (BSHARPT Index) and dividend yield (SPYD Index). Both strategies load positively on value, but dividend yield is more of a pure value play, with a 0.75 sigma loading above the Bloomberg 500 equalweight index (B500EQ Index) vs. a more moderate positive 0.36 loading for shareholder yield. The differences are more pronounced in growth and profitability factors: shareholder yield loads positive 0.81 sigma on profitability (return on equity) and modestly positive on growth, In contrast, dividend yield scores negative 0.20 on profitability and shows a highly negative growth tilt. In short, shareholder yield leans toward value — but without sacrificing growth or quality.

Crown, Cigna, Pilgrim’s Pride stand out on yield + factors

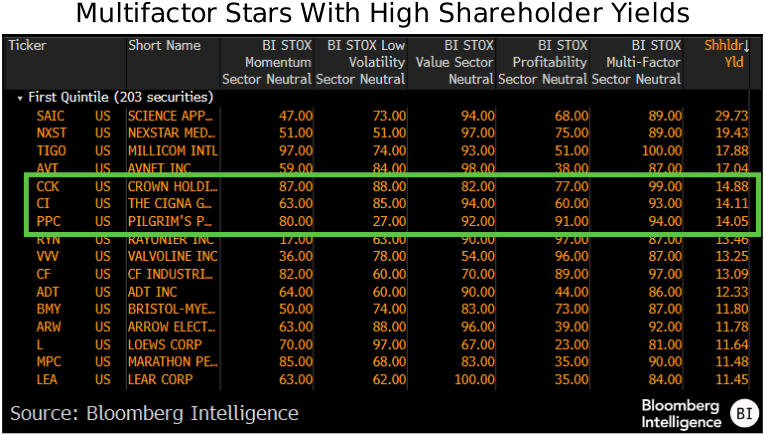

Crown Holdings, Cigna and Pilgrim’s Pride are standout examples of stocks that combine strong multifactor profiles with high shareholder yield. These Q1 high multifactor names exhibit historically attractive combinations of momentum, value, profitability and low volatility. Crown Holdings ranks in the 99th multifactor percentile, with strong BI momentum (87th) and low volatility (88th), paired with a 14.88% shareholder yield. Cigna ranks in the 93rd multifactor percentile with a 14.11% yield. Pilgrim’s Pride scores in the 94th multifactor percentile overall, including an 82nd percentile BI value rank, and shows a 14.05% shareholder yield.

Click out exhibit or follow the link to the left to access a BI factor-scored Russell 1000 universe along with shareholder yield statistics.

Shareholder yield doubles dividend yield over 10 years

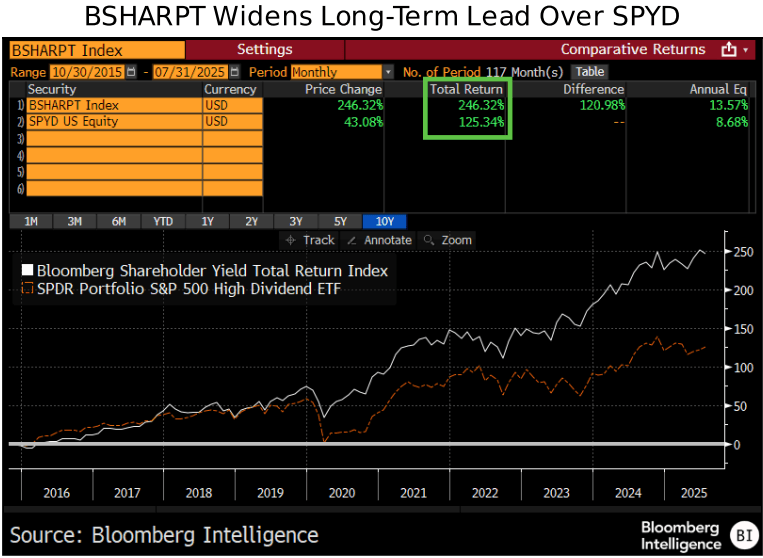

Shareholder yield’s strong relative results in 2025 extend its long-term track record of outperformance versus the more traditional dividend yield factor. Over the past decade, the Bloomberg Shareholder Yield Index has returned a cumulative 246.32% (13.57% annualized), compared to just 125.34% (8.68% annualized) for the SPDR Portfolio S&P 500 High Dividend ETF. The data underscores the long-term strength of shareholder yield as a more comprehensive capital return strategy.

Bloomberg Terminal subscribers can find more equity research via BI STOX<GO>.

The data included in these materials are for illustrative purposes only. The BLOOMBERG TERMINAL service and Bloomberg data products (the “Services”) are owned and distributed by Bloomberg Finance L.P. (“BFLP”) except (i) in Argentina, Australia and certain jurisdictions in the Pacific Islands, Bermuda, China, India, Japan, Korea and New Zealand, where Bloomberg L.P. and its subsidiaries (“BLP”) distribute these products, and (ii) in Singapore and the jurisdictions serviced by Bloomberg’s Singapore office, where a subsidiary of BFLP distributes these products. BLP provides BFLP and its subsidiaries with global marketing and operational support and service. Certain features, functions, products and services are available only to sophisticated investors and only where permitted. BFLP, BLP and their affiliates do not guarantee the accuracy of prices or other information in the Services. Nothing in the Services shall constitute or be construed as an offering of financial instruments by BFLP, BLP or their affiliates, or as investment advice or recommendations by BFLP, BLP or their affiliates of an investment strategy or whether or not to “buy”, “sell” or “hold” an investment. Information available via the Services should not be considered as information sufficient upon which to base an investment decision. The following are trademarks and service marks of BFLP, a Delaware limited partnership, or its subsidiaries: BLOOMBERG, BLOOMBERG ANYWHERE, BLOOMBERG MARKETS, BLOOMBERG NEWS, BLOOMBERG PROFESSIONAL, BLOOMBERG TERMINAL and BLOOMBERG.COM. Absence of any trademark or service mark from this list does not waive Bloomberg’s intellectual property rights in that name, mark or logo. All rights reserved. © 2025 Bloomberg.