Functions for the Market

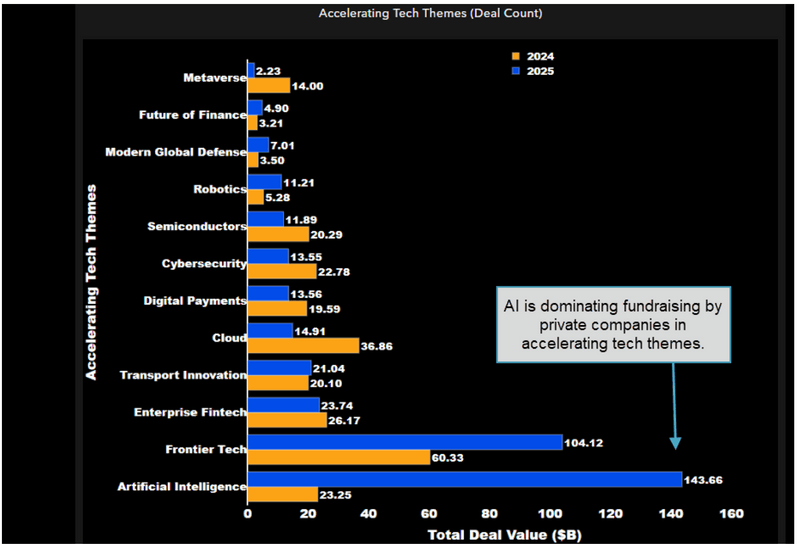

- Bloomberg Intelligence estimates that the deal value for AI private companies has dramatically increased to over $150 billion this year, up from $23 billion in 2024.

- OpenAI, Anthropic, Scale AI, and xAI are identified as the companies at the forefront of private dealmaking for AI projects.

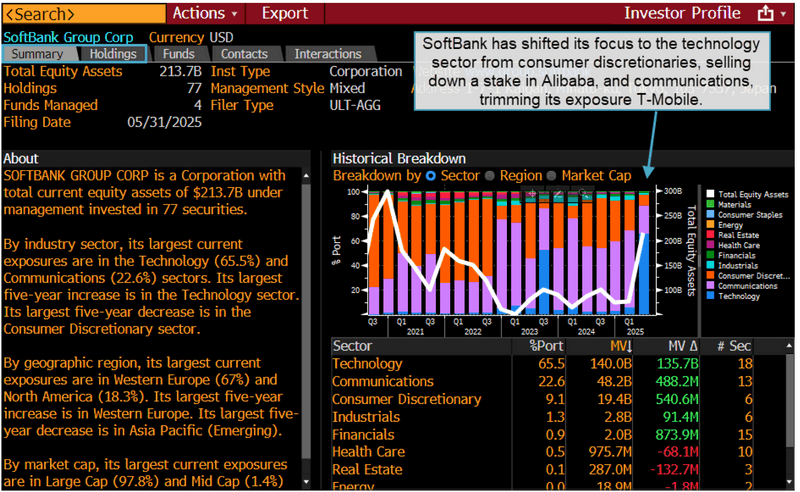

- SoftBank is shifting its focus away from consumer discretionaries and communications investments as it moves towards massive AI projects.

Background

A flurry of investments in AI startups and the infrastructure needed to support them has dominated headlines in 2025. Elon Musk may be seeking to raise another than $10 billion for xAI, while OpenAI’s latest $40 billion funding round has reportedly drawn interest from Saudi Arabia’s Public Investment Fund. Meanwhile, Anthropic is in talks with Qatar’s sovereign wealth fund over a massive funding round that would value the startup at $170 billion.

Apple Inc. is reportedly considering bidding on a stake in startup Perplexity AI Inc., which recently closed a new funding round with a $14 billion valuation. This follows discussions with Meta Platforms Inc. that fell through after the companies failed to reach an agreement. Soon after, Meta bought a 49% slice of Scale AI for $14.3 billion, and hired Scale’s CEO Alexandr Wang to lead their internal AI division, now called Superintelligence Labs. Meta plans to continue aggressively investing in AI tech and talent.

PRODUCT MENTIONS

“In some ways, this race is historically akin to the races for the PC, web browser, search engine and smartphone,” Mike Proulx, an analyst at Forrester, wrote in a note. “But the big difference is that this race is pacing so much faster because AI — the very thing that Meta and others are racing towards — helps to accelerate itself.”

The issue

Beneath the headlines, private markets are providing much of the finance to train artificial intelligence. Bloomberg Intelligence estimates AI private company deal value soared above $150 billion this year from $23 billion in 2024.

OpenAI, Anthropic, Scale AI and xAI led private dealmaking among companies involved in AI projects, ahead of Chinese peers. Tiger, Andreesen and Sequoia are among active investors. Sequoia was an early investor in AI, pumping $10 billion into OpenAI in April 2023 and $6 billion into xAI in May 2024.

AI is dominating deals by private companies in accelerating tech themes, attracting more than $144 billion in the year to June 1. Meta’s subsequent $14.3 billion Scale AI deal pushes that amount to well over $150 billion.

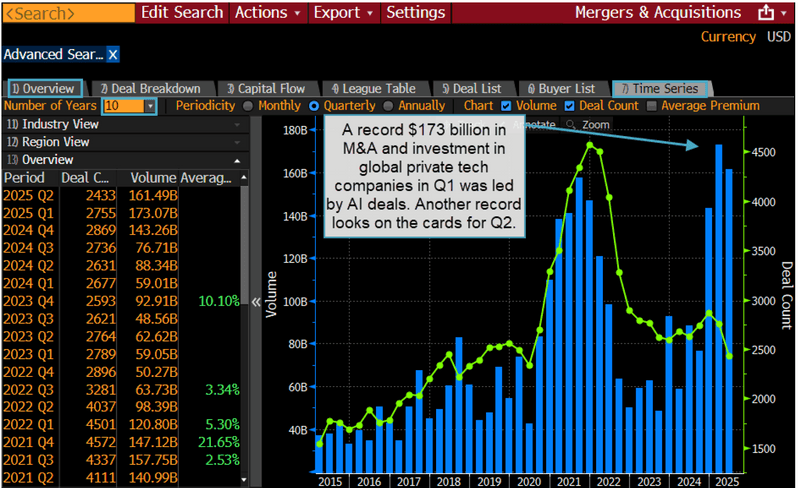

The draw of AI was also clear as cloud-computing provider CoreWeave rallied 280% since its $1.6 billion March IPO. AI deals led to an all-time high $173 billion in M&A and investment in global private tech companies in Q1. Another record looks in reach for Q2 the technology sector, which includes hardware and software.

In January, OpenAI, SoftBank, Oracle and Abu Dhabi-based investment firm MGX were all part of the $500 Billion Stargate Project. SoftBank raised $4.8 billion selling its T-Mobile stake to fund that project and is proposing a $1 trillion robotics and AI venture in Arizona.

SoftBank has shifted its focus to the technology sector from consumer discretionaries, selling down a stake in Alibaba, and from communications. That’s helped the value of its equity assets soar this year to $214 billion. ARM Holdings Plc, whose chips help perform AI computing, is its biggest holding. It has also been boosting holdings of Nvidia, Taiwan Semiconductor and Oracle.

Tracking

Track SoftBank’s evolving portfolio with the IP function. To track Softbank’s AI investments:

- Type “softbank” in the command line and select 9984 JT Equity.

- Type “investor profile” and select IP. The shortcut is 9984 JT Equity IP <GO>.

- Run M&A Buyer Intent to see a number of AI investments this year.

For more information on this or other functionality, click here to request a demo with a Bloomberg sales representative. Existing clients can press <HELP HELP> on their Bloomberg keyboard.