Bloomberg Professional Services

This article was written by Sean Murphy, Multi-Asset Index Product Manager at Bloomberg Index Services (BISL).

While equity selloffs have garnered much attention this year, volatility in the fixed income market has also increased. Whether it’s inflation, job numbers, dot plots, or tax bills, there are many reasons behind this uptick in bond price fluctuations. However, these market gyrations have created opportunities to explore income-oriented strategies that were once available only to equity investors.

With the proliferation of fixed income ETF launches and adoption, an equity-like derivative ecosystem has evolved. This has made it possible for fixed-income ETF investors to implement covered call strategies, which involve writing (selling) calls on long positions to generate additional income. It’s worth noting that covered call strategies involve risks, including limited upside potential if the underlying asset appreciates above the call strike price, and the possibility that premium income may not fully offset potential losses. In a best-case scenario, the price of an ETF does not exceed the strike price of the call, allowing for full upside participation in the underlying position, while also generating income from the premium received on the call.

The income generated from writing calls depends on various factors, such as the volatility of the underlying asset, call maturity, strike price, as well as coverage percentage. With the volatility seen in the rates market, the income potential for fixed income ETF investors has translated into higher premiums. This has historically offered investors a potential source of income during uncertain periods, even for high quality bonds like treasuries. But there are trade-offs with such a strategy.

PRODUCT MENTIONS

Considerations for treasury ETFs

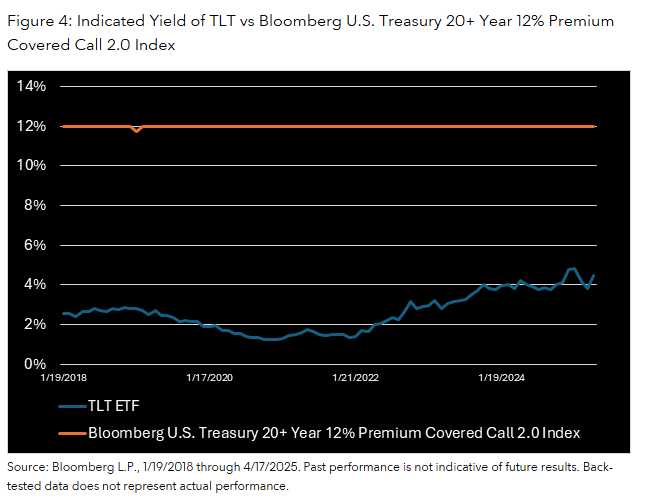

While the Fed has kept the short-end of the treasury curve stable, the long-end has experienced notable moves in 2025. Yields on the 20-year US treasury have ranged between 4.45% to 5.12%. These moves have allowed investors in ETFs that hold longer dated treasuries to generate higher-than-usual premiums through a covered call strategy. But not all such strategies are created equal, and investors may want to consider the historical tradeoffs of different approaches, not just on a standalone basis, but in the context of a multi-asset portfolio.

Long-duration, high quality bonds, are often owned alongside equities in a diversified portfolio to generate income, but also to provide diversification and ballast to equity risk, helping investors to weather equity drawdowns. This is important to keep in mind, as writing a call on an underlying holding can generate income, but it also limits potential upside. Should the underlying asset rally, the investor’s upside participation will be capped at the strike price of the call sold.

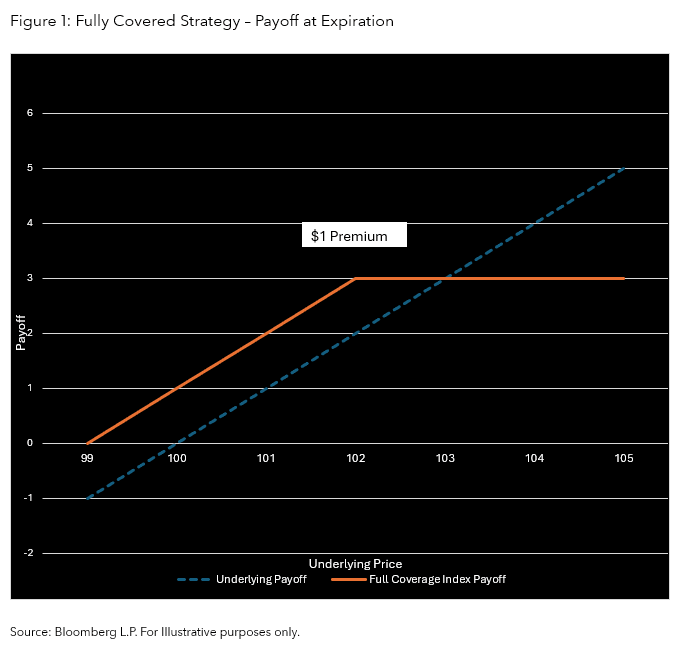

It is important for investors, therefore, to consider the coverage ratio. A fully covered strategy may maximize income from premiums, however, gains of the underlying will be capped. Consider the illustration below of a full coverage call strategy where calls are written with a strike price 2% above the current price. If the price of the underlying asset exceeds the strike, the investor will not participate in that move.

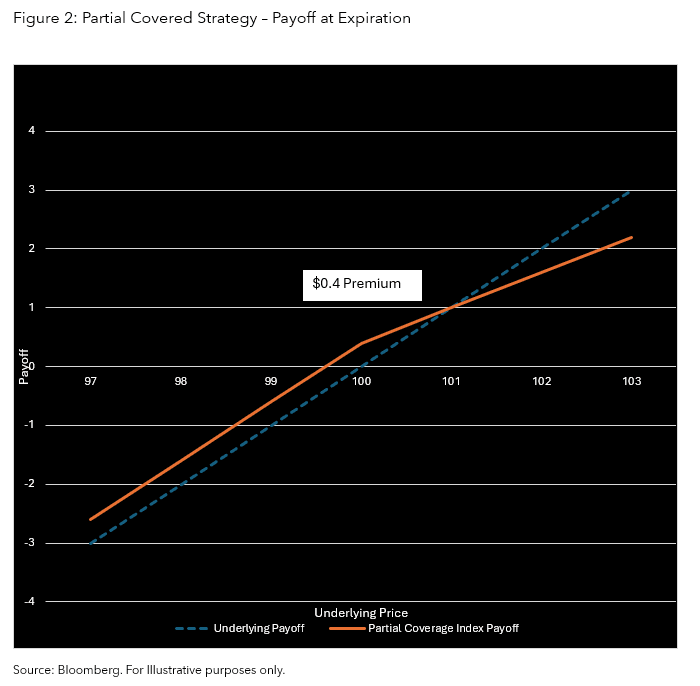

In contrast, a partial covered call strategy sells options on only a portion of the underlying position. Such an approach will reduce the level of income generated from the call premium, while increasing the upside participation of the underlying position relative to a full coverage strategy.

But coverage ratio is not the only consideration. Call options have a finite life and will cease to exist after a certain date (which is referred to as expiration), at which point the call option will either be exercised or expire worthless. Holding all else equal, writing longer-date calls may command higher premiums, but there are important trade-offs as well. Using calls with shorter expirations allows for greater flexibility, as an investor will get more opportunities to adjust their strategy.

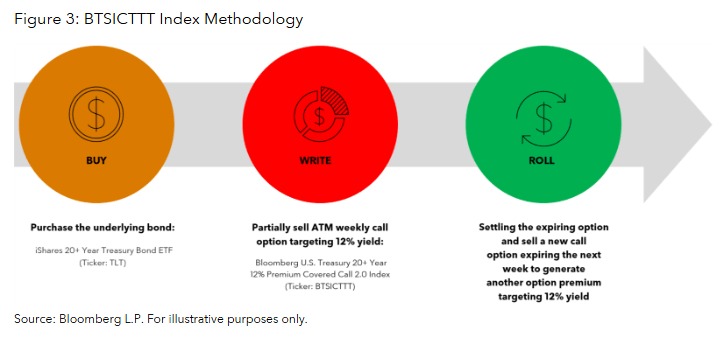

With so many considerations, employing a flexible covered call strategy on fixed income ETFs is key for multi-asset investors. The Bloomberg U.S. Treasury 20+ Year 12% Premium Covered Call 2.0 Index (BTSICTTT) takes such a dynamic approach by targeting an income level rather than a coverage ratio. There is an ETF that tracks this index offered by Amplify, TLTP.

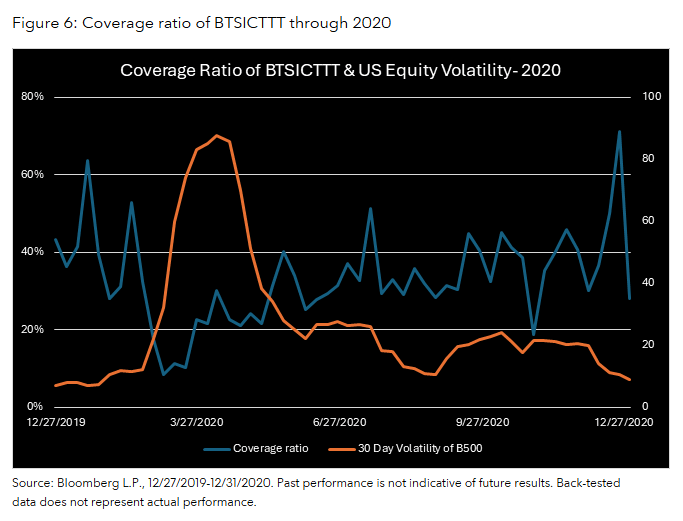

The index consists of an ETF that owns treasury bonds with 20+ years to maturity (TLT) and calls written on that ETF. For such investors, the dynamic nature of the coverage ratio may be appealing, as the coverage ratio will vary depending on the number of calls needed to generate the income target. To that effect, the index seeks to put the “fixed” in fixed-income. Where the yield-to-maturity on a bond or a bond ETF can change over time, BTSICTTT targets a consistent 12% yield, which is generated through a combination of coupons and call premiums.

Covered call treasuries in the COVID-19 selloff

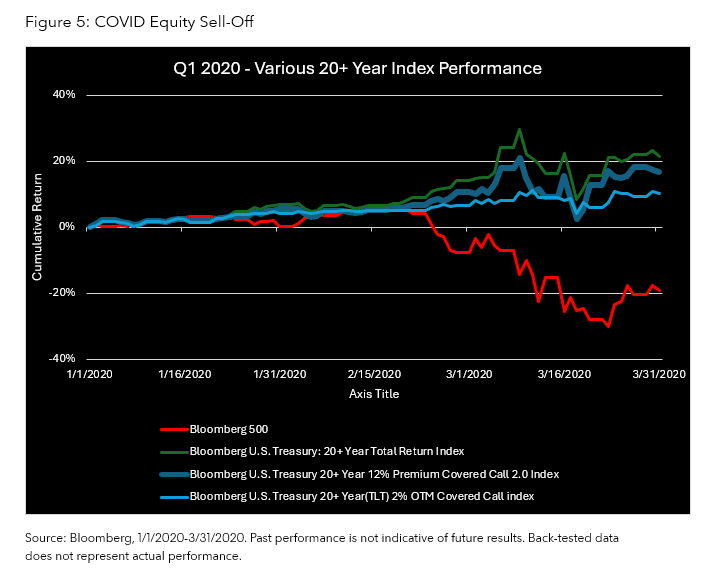

To understand the benefits of such an approach, it is helpful to examine how differing strategies perform during spikes in equity volatility, when equity investors count on high-quality fixed income to soften the blow. One such period was during Q1 of 2020, as COVID spread throughout the globe. The Bloomberg 500 Index (B500) finished the quarter down nearly 20%. As in many risk-off scenarios, investors sought the safety and stability of treasuries, particularly on the long end of the curve. As such, the Bloomberg U.S. Treasury 20+ Year Index (I00850US) was up 21% during that quarter. But investors who employed a covered call strategy in the lead up and during that period would have experienced different degrees of return. For an investor who had employed a fully covered strategy, their upside would have been capped based on the terms of the options written. For example, the Bloomberg U.S. Treasury 20+ Year 2% OTM Covered Call Index (BTSICOTL), which writes calls on 100% of the underlying position using calls that are 2% out of the money, was up only 10.4% during that quarter.

The Bloomberg U.S. Treasury 20+ Year 12% Premium Covered Call 2.0 Index (BTSICTTT), on the other hand, entered 2020 with a coverage ratio of 43.4% using calls that expired weekly. As volatility rose, the coverage ratio needed to generate 12% yield decreased. During the quarter, the average coverage ratio of the index was roughly 30%. As such, the index was able to capture more of the upside in the underlying bonds, returning 16.7%. The need to hold diversifiers to equity risk persisted throughout 2020, as equity volatility remained elevated. For multi-asset investors, a partial rather than fully covered call strategy may have been preferred to ensure some upside participation in the underlying bond move.

Conclusion

In an environment where volatility is both a challenge and an opportunity, covered call strategies on fixed income ETFs offer a potential method for income generation, particularly when thoughtfully designed. As illustrated during periods of market stress like early 2020, a dynamic, partial-coverage approach can potentially provide not only consistent income but also preserve the defensive characteristics of long-duration treasuries within a multi-asset portfolio. The Bloomberg U.S. Treasury 20+ Year 12% Premium Covered Call 2.0 Index demonstrates how targeting a yield, rather than a static coverage ratio, can enhance flexibility and responsiveness to changing market conditions. Investors interested in balancing income potential with portfolio resilience may wish to consider such adaptable strategies.

The data and other information included in this publication is for illustrative purposes only, available “as is”, non-binding and constitutes the provision of factual information, rather than financial product advice. BLOOMBERG and BLOOMBERG INDICES (the “Indices”) are trademarks or service marks of Bloomberg Finance L.P. (“BFLP”). BFLP and its affiliates, including BISL, the administrator of the Indices, or their licensors own all proprietary rights in the Indices. Bloomberg L.P. (“BLP”) or one of its subsidiaries provides BFLP, BISL and its subsidiaries with global marketing and operational support and service. Certain features, functions, products and services are available only to sophisticated investors and only where permitted. Bloomberg (as defined below) does not approve or endorse these materials or guarantee the accuracy or completeness of any information herein, nor does Bloomberg make any warranty, express or implied, as to the results to be obtained therefrom, and, to the maximum extent allowed by law, Bloomberg shall not have any liability or responsibility for injury or damages arising in connection therewith. Nothing in the Services or Indices shall constitute or be construed as an offering of financial instruments by Bloomberg, or as investment advice or investment recommendations (i.e., recommendations as to whether or not to “buy”, “sell”, “hold”, or to enter or not to enter into any other transaction involving any specific interest or interests) by Bloomberg. Information available via the Index should not be considered as information sufficient upon which to base an investment decision. All information provided by the Index or in this publication is impersonal and not tailored to the needs of any person, entity or group of persons. Absence of any trademark or service mark from this list does not waive Bloomberg’s intellectual property rights in that name, mark or logo. For the purposes of this publication, Bloomberg includes BLP, BFLP, BISL and/or their affiliates.

BISL is registered in England and Wales under registered number 08934023 and has its registered office at 3 Queen Victoria Street, London, England, EC4N 4TQ. BISL is authorised and regulated by the Financial Conduct Authority as a benchmark administrator.

© 2025 Bloomberg. All rights reserved.