BloombergNEF

This article was written by Claudio Lubis. It appeared first on the Bloomberg Terminal.

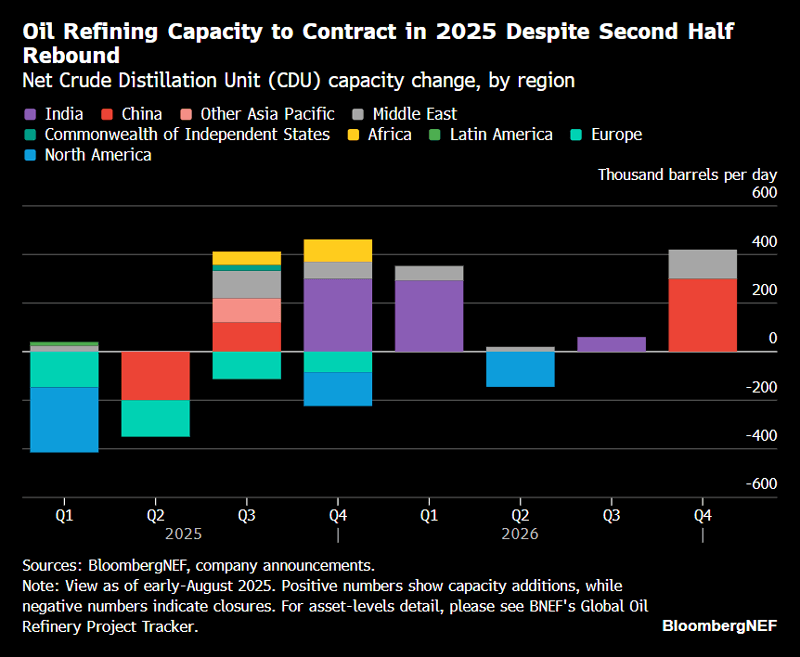

The capacity of the global oil refining sector contracted by 350,000 barrels per day in the second quarter of 2025 on the closure of PetroChina’s Dalian plant and Petroineos’s Grangemouth plant. While total net capacity may rise in the second half of 2025 with new refineries, the sector at large will shrink this year for the first time since 2021.

This Global Oil Refining Quarterly series compiles BloombergNEF’s latest analysis on refining capacity trends by tracking status of key projects that may significantly alter global product balances and trade, alongside relevant refinery developments and their implications.

By the Numbers

| 914,000 b/d | 1.1 million b/d | 56% |

|---|---|---|

| Global oil refining capacity additions in 2025, down 51% year-on-year | Announced oil refining capacity rationalizations in 2025, up 55% year-on-year | Average run rate at Mexico’s Pemex Dos Bocas refinery in June 2025, highest to date |

- BloombergNEF expects overall crude distillation nameplate capacity to reduce by 188,000 barrels per day (b/d) in 2025 – revised from a 75,000 b/d cut in our last publication – after including Prax’s Lindsey refinery closure. On a monthly basis, we anticipate net cumulative capacity added to remain negative for the rest of this year.

- Net annual refining capacity globally is expected to grow by 708,000 b/d in 2026 based on our outlook. This will be largely driven by expansion projects in India – namely Indian Oil Corporation’s Gujarat, Panipat and Barauni assets – alongside Saudi Aramco-backed Panjin integrated complex in China.

- Crude throughput for a couple of newly commissioned mega refineries is trending up. Petroleos Mexicanos’ 340,000 b/d Dos Bocas plant hit a record throughput of 192,000 b/d in June as its second crude train started operations. The refinery’s runs may top 210,000 b/d by year end. Meanwhile, Nigeria’s Dangote is also making steady progress, despite various issues surrounding its residual fluid catalytic cracker across the second quarter. Its throughput may inch up to just under 500,000 b/d by December, from over 460,000 b/d in June. Yulong has scaled up runs to 83% in early July with its second crude train online.

- Refinery closures will widen supply deficits for key fuels in Europe and the US. Europe’s refining capacity may contract by up to 495,000 b/d this year from closures in Germany and the UK, potentially widening its middle distillates shortfall. California’s gasoline deficit may increase more than fivefold due to planned closures by Phillips 66 and Valero. These regions would have to ramp up refined product imports.

- BNEF also publishes the Global Oil Refinery Project Tracker, available on the Terminal and on BNEF, in tandem with this publication. This is our central and underlying database listing more than 60 refining projects either adding or removing capacity from 2025 to 2030 and beyond, alongside historical data since 2022. It includes information such as project type, capacity change, commissioning period by month, ownership details, project investment and whether the refinery is integrated with a petrochemical unit.

The data included in these materials are for illustrative purposes only. The BLOOMBERG TERMINAL service and Bloomberg data products (the “Services”) are owned and distributed by Bloomberg Finance L.P. (“BFLP”) except (i) in Argentina, Australia and certain jurisdictions in the Pacific Islands, Bermuda, China, India, Japan, Korea and New Zealand, where Bloomberg L.P. and its subsidiaries (“BLP”) distribute these products, and (ii) in Singapore and the jurisdictions serviced by Bloomberg’s Singapore office, where a subsidiary of BFLP distributes these products. BLP provides BFLP and its subsidiaries with global marketing and operational support and service. Certain features, functions, products and services are available only to sophisticated investors and only where permitted. BFLP, BLP and their affiliates do not guarantee the accuracy of prices or other information in the Services. Nothing in the Services shall constitute or be construed as an offering of financial instruments by BFLP, BLP or their affiliates, or as investment advice or recommendations by BFLP, BLP or their affiliates of an investment strategy or whether or not to “buy”, “sell” or “hold” an investment. Information available via the Services should not be considered as information sufficient upon which to base an investment decision. The following are trademarks and service marks of BFLP, a Delaware limited partnership, or its subsidiaries: BLOOMBERG, BLOOMBERG ANYWHERE, BLOOMBERG MARKETS, BLOOMBERG NEWS, BLOOMBERG PROFESSIONAL, BLOOMBERG TERMINAL and BLOOMBERG.COM. Absence of any trademark or service mark from this list does not waive Bloomberg’s intellectual property rights in that name, mark or logo. All rights reserved. © 2025 Bloomberg.