Bloomberg Professional Services

- Equities ended 2025 stronger than many expected after a volatile first half, with performance driven by patterns that closely echoed 2017, which was the first year of President Donald Trump’s first term.

- Large cap and growth equities outperformed, momentum remained a key factor in market performance, and innovation-driven themes such as solar and digital finance recorded strong growth. International equities outpaced the U.S. amid broad global strength and a softer dollar, while companies with strong earnings resilience continued to attract investor interest even as shareholder-yield strategies lagged.

- On balance, many of the themes outlined in our 2025 Outlook unfolded largely as anticipated despite early year turbulence.

This article was written by Sean Murphy and Mike Pruzinsky, Equity Index Product Managers at Bloomberg.

If 2025 taught equity investors anything, it’s that calm seas don’t always lead to the strongest gains. Markets spent the early months wrestling with market volatility that shook conviction and tested risk appetite. Yet by year-end, equity markets moved sharply higher, delivering positive returns that felt improbable during the spring’s most pronounced drawdowns.

It may be hard to remember now, but the first half of the year included one of the sharpest equity drawdowns in recent years. Despite bouts of elevated volatility and cross-asset turbulence, stocks rebounded steadily through the second half, ultimately rewarding investors who stayed the course.

PRODUCT MENTIONS

Positive returns notwithstanding, 2025 challenged many assumptions. This makes it an ideal year to look back at the forecasts we laid out in our Indices 2025 Equity Outlook. What did we get right? Where did the market surprise us? And how did early-year volatility reshape the trajectory of themes we thought would define the year?

Much of our 2025 Outlook drew on historical precedent, specifically the market behavior observed in 2017 during the first year of President Trump’s previous term. That year’s return profile and macro backdrop offered a useful analogue for what might unfold this time around, shaping many of the themes we expected to dominate 2025.

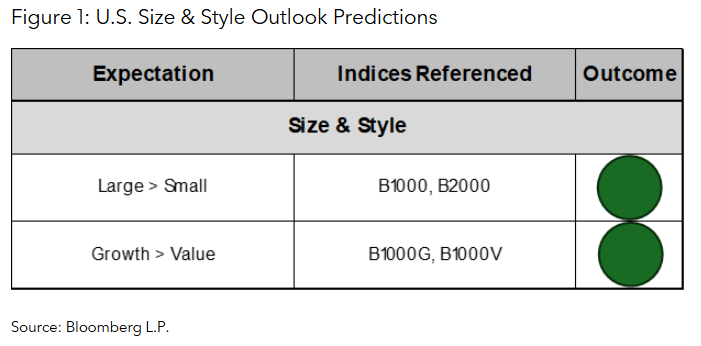

How did U.S size and style leadership evolve in 2025?

Prediction: Large caps could outperform small caps, mirroring 2017, where easing regulatory expectations initially boosted smaller companies before rate dynamics reasserted themselves.

Outcome: Right

The B1000 Index is up 17% this year, outpacing the B2000 Index’s 14% gain. Market moves in the US have largely been the result of strong gains in some of the largest names such as the Magnificent 7.

Prediction: Growth could continue to outpace Value, as it did in 2017.

Outcome: Right

The B1000 Growth Index advanced 17.3%, beating the B1000 Value Index at 16.9%. The equity style leadership pattern from 2017 repeated, with investors rewarding earnings durability and high-quality balance sheets throughout bouts of market volatility.

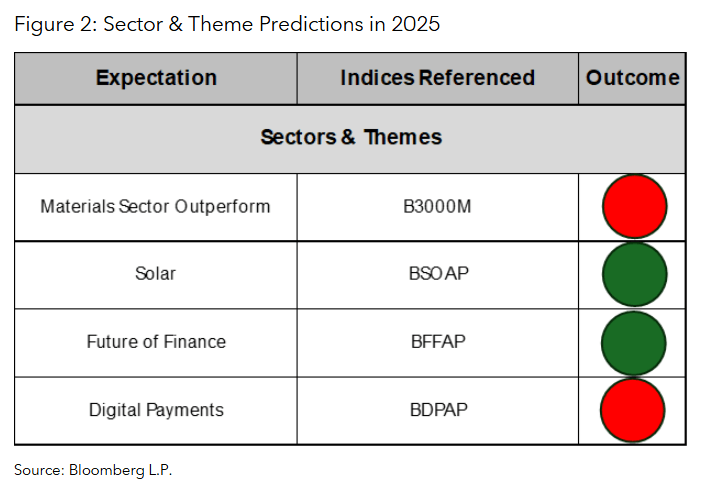

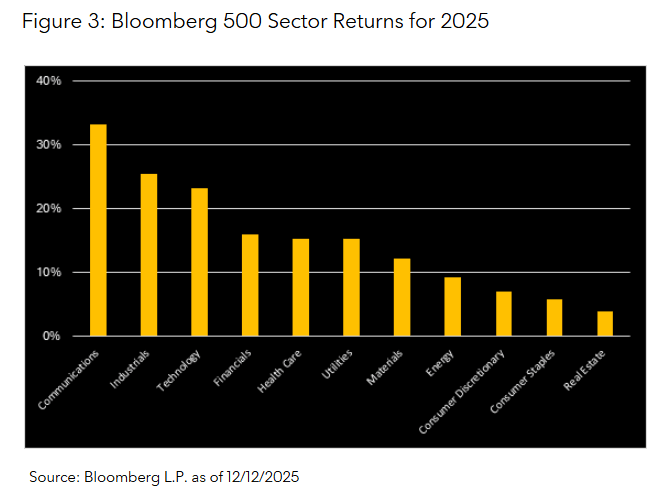

Which sectors and innovation themes led the market in 2025?

Prediction: Materials might benefit from tariff dynamics, similar to the strong performance from that sector in 2017.

Outcome: Wrong

Instead of leading, the Materials sector lagged. The Bloomberg 500 Materials (B500MA) Index returned just 11.3%, trailing the broad B500, while Communications (B500C) was the standout at +33.3%. Tariff expectations and industrial-metal dynamics did not repeat the 2017 pattern, underscoring the importance of distinguishing between tariff speculation versus tariff implementation.

Which innovation themes led or lagged equity markets in 2025?

Prediction: Solar, digital finance, and broader innovation-driven themes could experience strong performance—reflecting their 2017 surge.

Outcome: Mixed to Right

- Solar (BSOAP): Right. Up 33.9%, closely tracking 2017’s strong results. Even though the underlying solar industry still faces challenges, investors responded to both positive catalysts and changing expectations throughout the year.

- Future of Finance (BFFAP): Right. Up 46.1%, echoing 2017’s structural-disruption enthusiasm. Many crypto linked stocks, such as Robinhood and Cipher Mining, have benefited from increased regulatory clarity and stronger investor participation in digital asset markets.

- Digital Payments (BDPAP): Wrong. While the index is up 15.8% this year, it trailed global equities. Payment companies have been under antitrust scrutiny and litigation over swipe fees and merchant network practices. Some investors also viewed the loosening of crypto regulations as increasing the risk of disruption to traditional card payment models.

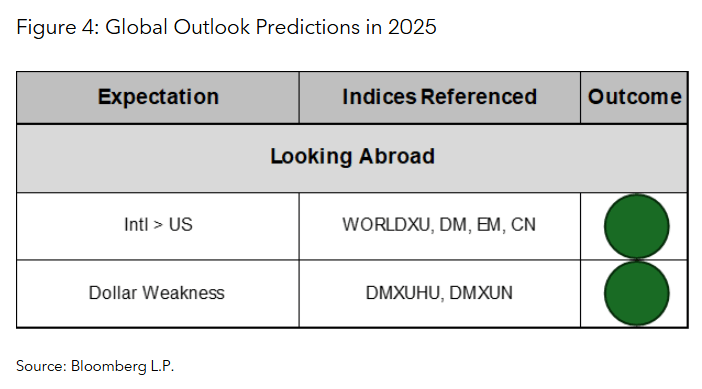

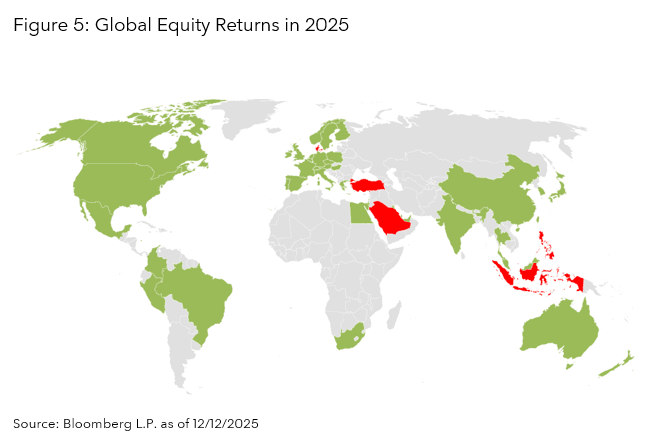

Which global regions led equity performance in 2025?

Prediction: Despite early selling pressure, Emerging Markets could ultimately outperform—just as it did in 2017— raising questions on whether trade-war fears were overstated.

Outcome: Right

Both the Bloomberg Emerging Market (EM) Index and the Bloomberg China (CN) Index outperformed the B500 by over 10%. Even developed markets (DM Index) beat the U.S. by 2.5%. Fears of renewed trade tensions proved excessive, much as they did in 2017. Moreover, with U.S. equity concentration remaining a key concern for many investors, demand for additional portfolio diversification has strengthened. In fact, of the 47 countries included in the Bloomberg World Index (WORLD), only 5 produced negative returns in 2025.

How did currency movements influence equity returns in 2025?

Prediction: In 2017, the dollar weakened against other major currencies, as many investors were concerned about U.S. fiscal and monetary policy.

Outcome: Right

The DMXUHU (hedged) Index gained 20.5%, trailing the unhedged DMXUN Index at 28.1%. Even with post-election dollar strength (+4% vs EUR, +3% vs JPY and GBP), the return benefit of foreign-currency exposure mirrored the pattern seen in 2017’s weaker-dollar environment. Uncertainty related to U.S. fiscal policy has left some investors less inclined to hold dollar assets.

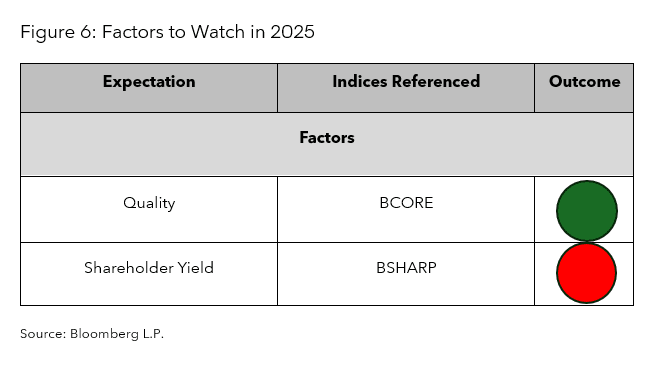

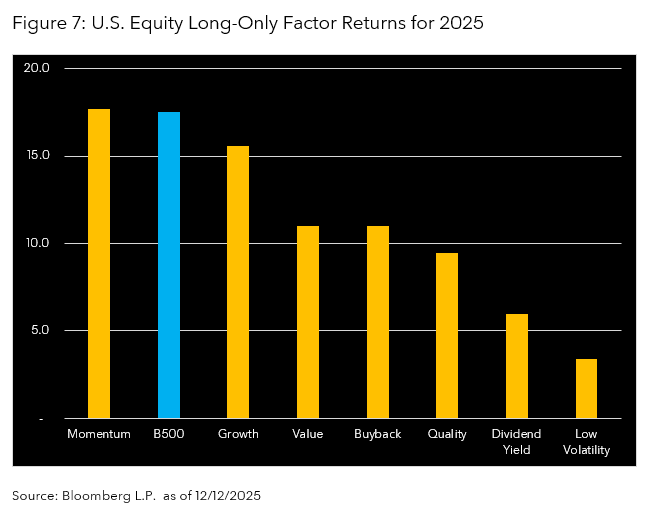

Which equity factors mattered most in 2025?

Prediction: Companies with strong fundamentals either through core-earnings strength (BCORE) or disciplined capital returns (BSHARP) would attract greater investor interest.

Outcome: Mixed

The market leaders of 2024 largely maintained their strength into 2025, resulting in a strong year for the momentum factor. Although conventional factor-based methods outside of momentum offered limited excess return, some alternative or updated factor approaches demonstrated more meaningful results.

- BCORE: Right. Up 27.0%, confirming that investors rewarded earnings resilience in a volatile environment. The index consists of names like Applovin, which reported strong financial results, with big year-over-year revenue growth and expanding profitability.

- BSHARP: Wrong. While the index is up 9%, its muted relative performance may reflect investors preference for higher growth names over dividends and buybacks.

As 2025 draws to a close, markets have rewarded investors who recognized the familiar rhythms reminiscent of 2017, a period where patience, discipline, and thoughtful thematic positioning proved their worth.

What will 2026 bring for equities? Will leadership finally broaden? Will investors grow more confident in an environment where moderate growth and steady policy can support continued returns? And will security selection and thematic exposure regain prominence as dispersion picks up? Look out for our 2026 equity outlook in January, where we will weigh these questions and highlight the themes that are poised to shape the year ahead.

Learn more about Bloomberg Equity Indices here.

The data and other information included in this publication is for illustrative purposes only, available “as is”, non-binding and constitutes the provision of factual information, rather than financial product advice. BLOOMBERG and BLOOMBERG INDICES (the “Indices”) are trademarks or service marks of Bloomberg Finance L.P. (“BFLP”). BFLP and its affiliates, including BISL, the administrator of the Indices, or their licensors own all proprietary rights in the Indices. Bloomberg L.P. (“BLP”) or one of its subsidiaries provides BFLP, BISL and its subsidiaries with global marketing and operational support and service. Certain features, functions, products and services are available only to sophisticated investors and only where permitted. Bloomberg (as defined below) does not approve or endorse these materials or guarantee the accuracy or completeness of any information herein, nor does Bloomberg make any warranty, express or implied, as to the results to be obtained therefrom, and, to the maximum extent allowed by law, Bloomberg shall not have any liability or responsibility for injury or damages arising in connection therewith. Nothing in the Services or Indices shall constitute or be construed as an offering of financial instruments by Bloomberg, or as investment advice or investment recommendations (i.e., recommendations as to whether or not to “buy”, “sell”, “hold”, or to enter or not to enter into any other transaction involving any specific interest or interests) by Bloomberg. Information available via the Index should not be considered as information sufficient upon which to base an investment decision. All information provided by the Index or in this publication is impersonal and not tailored to the needs of any person, entity or group of persons. Absence of any trademark or service mark from this list does not waive Bloomberg’s intellectual property rights in that name, mark or logo. For the purposes of this publication, Bloomberg includes BLP, BFLP, BISL and/or their affiliates.

BISL is registered in England and Wales under registered number 08934023 and has its registered office at 3 Queen Victoria Street, London, England, EC4N 4TQ. BISL is authorised and regulated by the Financial Conduct Authority as a benchmark administrator. © 2025 Bloomberg. All rights reserved.