Functions for the Market

- Following President Maduro’s ouster, the US plans to help rebuild Venezuela’s oil sector, which led shares in Chevron and debt in state-run PDVSA to rally despite a planned US “oil quarantine”.

- Venezuela possesses the world’s largest proven oil reserves and a recovery toward its mid-2000s peak of 3 million barrels per day could create downside risk for global oil prices.

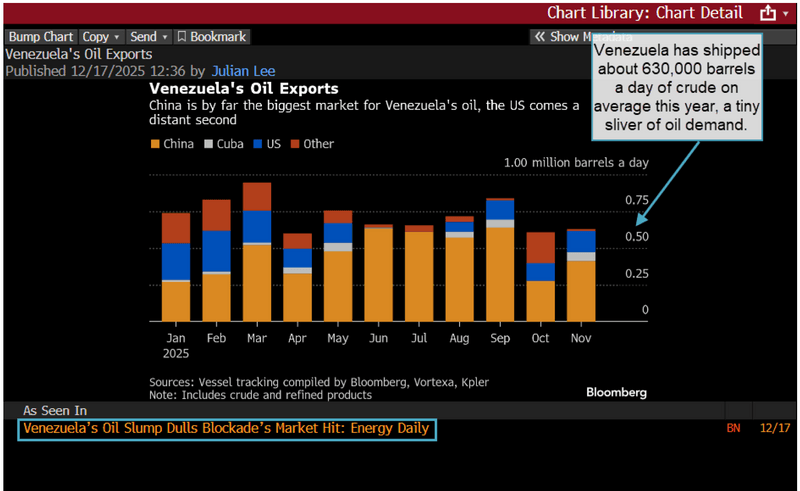

- China remains the largest market for Venezuelan oil exports, with the US being a distant second, largely driven by US oil giant Chevron, one of the few remaining official customers.

Background

US President Donald Trump said Venezuela will provide up to 50 million barrels of oil to the US and that proceeds will be used to benefit both countries. At the current market price, this would sell for about $2.8 billion. In a social media post, Trump wrote, “I am pleased to announce that the Interim Authorities in Venezuela will be turning over between 30 and 50 MILLION Barrels of High Quality, Sanctioned Oil, to the United States of America.”

This volume would represent about 30 to 50 days of Venezuelan oil production before the US’s partial blockade of the country. Following Trump’s comments, West Texas Intermediate, the US oil benchmark, dropped 2.4%.

PRODUCT MENTIONS

As events have rapidly unfolded in the first week of 2026, Secretary of State Marco Rubio has demanded Venezuela sever ties with Iran, Hezbollah and Cuba, cease drug trafficking and ensure that its oil industry doesn’t benefit US adversaries.

“There’s a quarantine right now in which sanctioned oil shipments — there’s a boat, and that boat is under US sanctions, we go get a court order — we will seize it,” Rubio said. That’s “a tremendous amount of leverage” for the US to demand change in Venezuela, he said.

The issue

At an estimated 300 billion barrels, Venezuela sits atop the world’s largest proven oil reserves. Bloomberg Intelligence estimates production could rise to 1.25 million barrels per day, nearing 2017 production levels, while JPMorgan sees up to 1.4 million barrels per day within two years.

Goldman Sachs warns a “gradual and partial” recovery toward the 3 million barrels per day mid-2000s peak adds downside risk to global oil prices. Analyst Daan Struyven said such a recovery “would require strong incentives for substantial upstream investment.”

Oil production in other Latin American nations has met or surpassed that of Venezuela. Both Guyana and Argentina are now approaching Venezuela’s 2025 production levels of around 1 million barrels a day, estimates show. Production in Brazil is now four times larger than in Venezuela, though they were about the same size a decade ago.

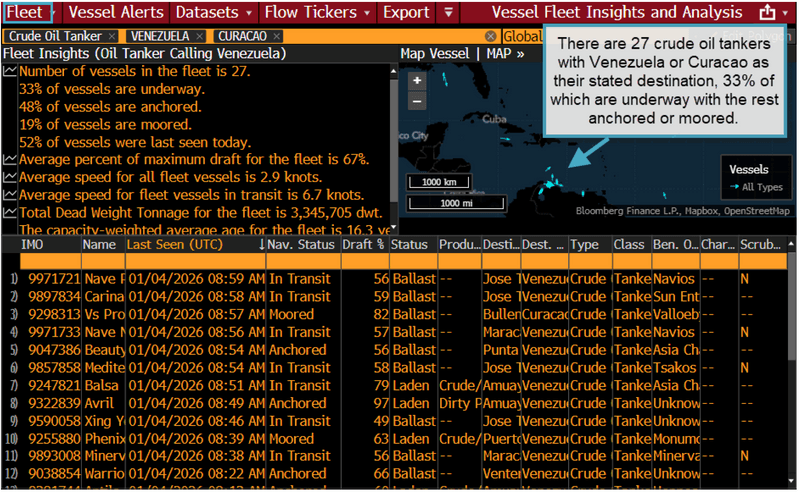

In the short run, the blockade has created a logjam, leaving ships holding 7.33 million barrels unable to depart for their final destination in China, according to shipping reports, vessel movements and data from intelligence firm Kpler. Venezuelan oil exports fell to a 17-month low in December. Meanwhile, the number of crude cargoes from Russia stuck at sea have soared.

China, the biggest buyer of Venezuelan oil, often uses Venezuela’s Merey crude to make bitumen to pave roads. As the construction outlook has softened, an ample supply of crude held by global refiners has given China the ability to hold out for better prices.

Tracking

Track Venezuela’s oil exports with the Bloomberg Chart Library.

- Type “chart library” in the command line and select CHRT.

- Type “venezuela” in the amber box and select Match This Phrase.

- Click Venezuela’s Oil Exports by Julian Lee on 12/17/25.

- Click Venezuela’s Oil Slump Dulls Blockade’s Market Hit in As Seen In to read the analysis.

For more information on this or other functionality, click here to request a demo with a Bloomberg sales representative. Existing clients can press <HELP HELP> on their Bloomberg keyboard.