Bloomberg Intelligence

This article was written by Bloomberg Intelligence Industry Analyst Brett Gibbs and Senior Associate Analyst Sabrina Gutierrez. It appeared first on the Bloomberg Terminal.

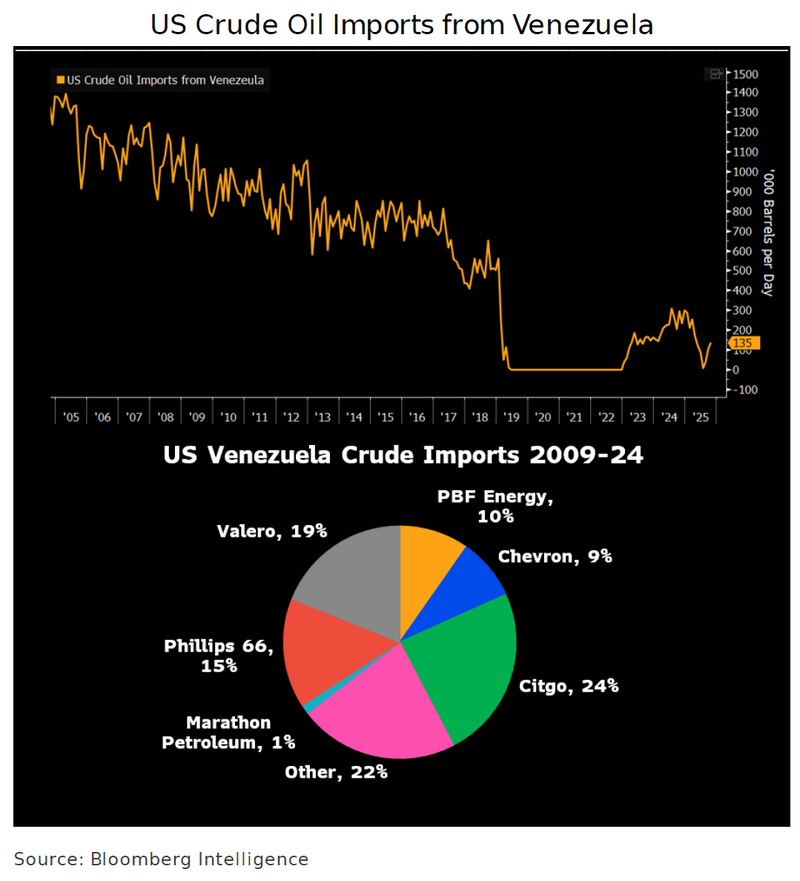

Greater flows of Venezuelan heavy crude to the US would favor complex refiners like Valero, Chevron and PBF Energy that have been forced to run lighter, sweeter barrels amid the shale boom. Gulf and East Coast plants would benefit first, pressuring Canada’s WCS prices. This should support inland and West Coast operators, while improving diesel supply that could dampen recent premiums.

Refinery diets to shift toward heavy crude as Venezuela returns

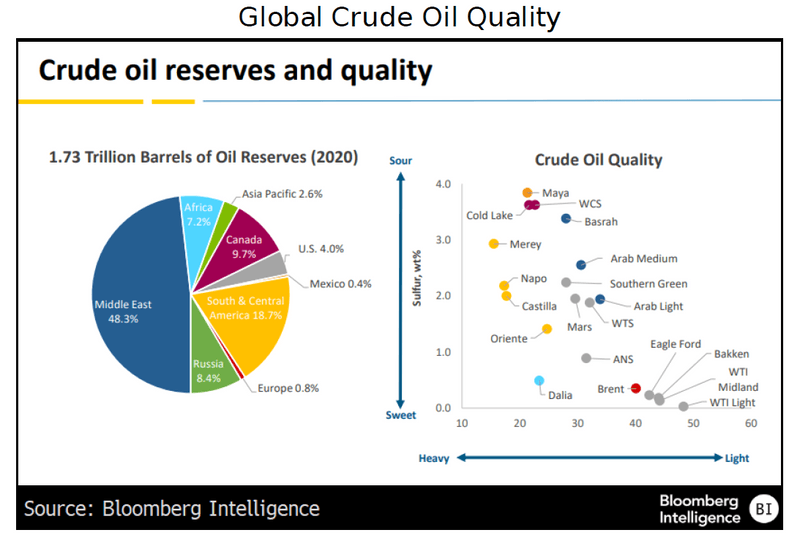

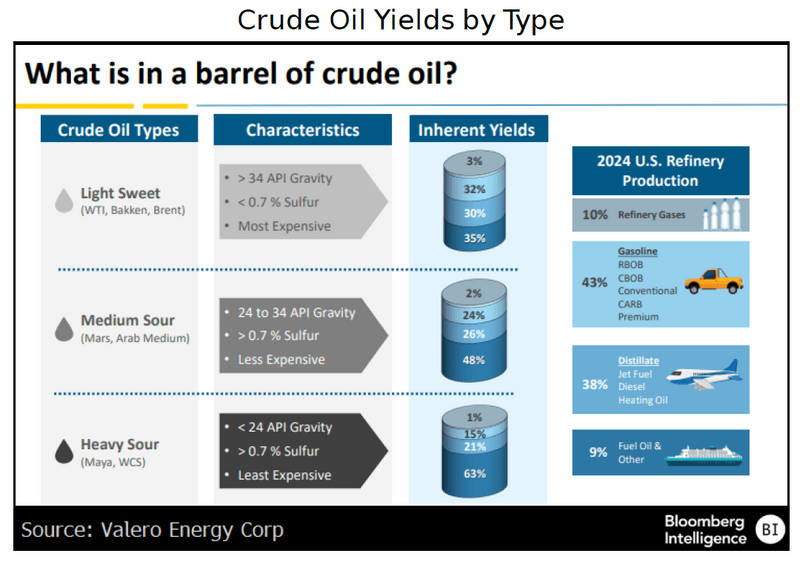

Before the shale boom, US refiners were designed to process heavy, lower-value crude from Canada, Venezuela and the Middle East. They underwent over a decade of modifications to run more US light-sweet grades, but could retain heavy-crude preference if discounts widen as the US intervenes in Venezuela. Coking and hydrocracking units, which represent about 29% of US refining capacity, must be fed with low-quality residual from simple refining or heavy crude oil not native to the US. Today, about 60% of US crude imports are heavy, though egress, regional declines and geopolitical sensitivity have throttled access. This has compelled operators to optimize for lighter crude with inherently higher gasoline and chemical input yields.

Highly complex refiners can achieve a 33% distillate yield vs. 30% for medium-complexity plants.

Heavy, sour supply requires highly complex refining

Greater Venezuelan oil supply provides a competitive advantage for highly complex refiners with substantial coking capacity that can process discounted heavy crudes into high-value products. Public refiners with the most coking capacity include Valero, Exxon, Marathon Petroleum, Phillips66 and PBF Energy. TotalEnergies, BP and Chevron also have significant coking capacity relative to crude oil distillation. Venezuela’s Merey crude from the Orinoco belt, among the highest in sulfur content and lowest in API gravity globally, requires specialized refinery units to remove impurities and break down the heaviest molecules. Less than half of US refineries have a coker.

Relaxation of sanctions could help restart flows of US naphtha to Venezuela as a diluent, enabling a moderate near-term increase in exportable crude.

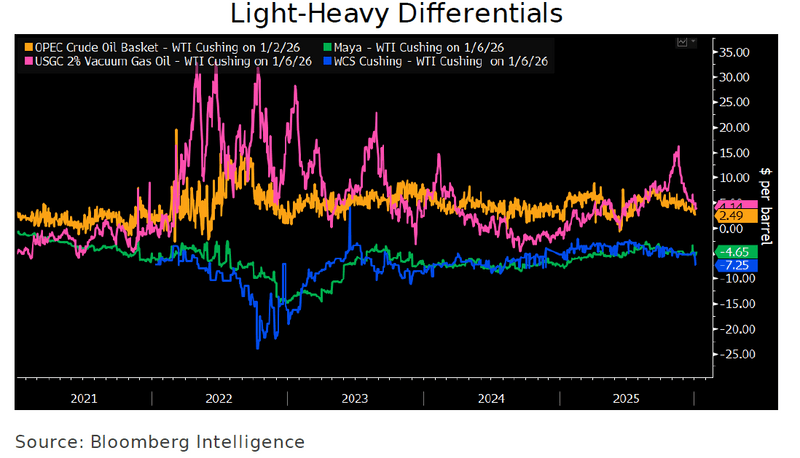

WCS may weaken amid Venezuelan heavy alternatives

Increased availability of Venezuelan heavy-sour crude would favor complex US refiners on the Gulf and East Coasts as those barrels compete with WCS, Middle Eastern grades and Mexican Maya. The largest importers of Venezuelan crude from 2009-24 included Valero, Phillips 66 and PBF Energy. The US still absorbs nearly 80% of Canada’s crude output, despite the TMX expansion improving access to Asia, keeping WCS prices tied to US refinery demand and alternative heavy grades. Venezuela could provide additional lower-cost supply to the Gulf and East Coasts, which are currently more dependent on Canadian and Mexican imports, pressuring those benchmarks.

Mid-continent and West Coast refiners, including BP and HF Sinclair, would be benefit next from greater WCS discounts if Gulf Coast demand is displaced.

Greater heavy-crude supply to alleviate diesel tightness

Additional supplies of diesel-rich heavy crude could help ease distillate tightness caused by renewable-diesel conversions, the transition to a lighter crude slate and geopolitical supply-chain reshuffling, notably driven by Russia. Many US refineries have invested in topping units to optimize a US diet, yet coking units still drive premiums in residuals or other intermediates like high-sulfur vacuum gas oil. Distillate yields of 31% are 2% above 2017-19 averages and reflect refiners’ goal to maximize the durable industrial-linked mix, but they have stepped away from original designs that may support cheaper supply and less electrification-risked gasoline.

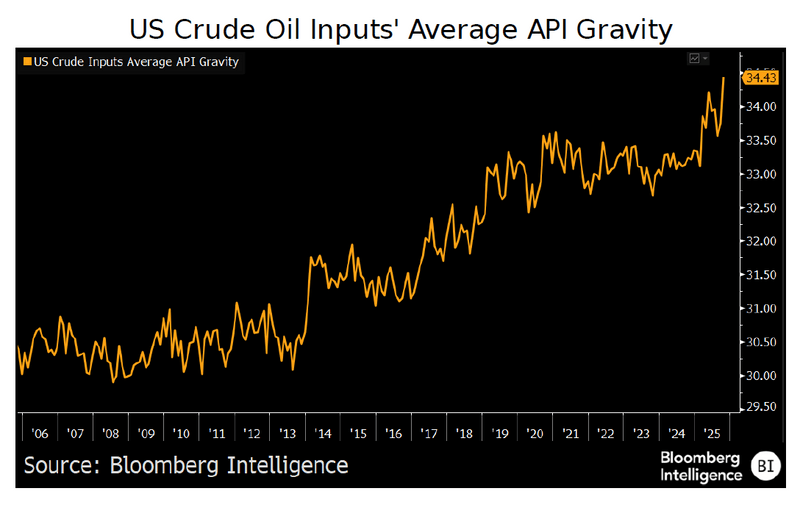

The shift in API gravity of crude imports to 34 in 2025 from 32 in 2017-19 is evidence of dwindling heavy-crude access.

Old friends wait in line

The data included in these materials are for illustrative purposes only. The BLOOMBERG TERMINAL service and Bloomberg data products (the “Services”) are owned and distributed by Bloomberg Finance L.P. (“BFLP”) except (i) in Argentina, Australia and certain jurisdictions in the Pacific Islands, Bermuda, China, India, Japan, Korea and New Zealand, where Bloomberg L.P. and its subsidiaries (“BLP”) distribute these products, and (ii) in Singapore and the jurisdictions serviced by Bloomberg’s Singapore office, where a subsidiary of BFLP distributes these products. BLP provides BFLP and its subsidiaries with global marketing and operational support and service. Certain features, functions, products and services are available only to sophisticated investors and only where permitted. BFLP, BLP and their affiliates do not guarantee the accuracy of prices or other information in the Services. Nothing in the Services shall constitute or be construed as an offering of financial instruments by BFLP, BLP or their affiliates, or as investment advice or recommendations by BFLP, BLP or their affiliates of an investment strategy or whether or not to “buy”, “sell” or “hold” an investment. Information available via the Services should not be considered as information sufficient upon which to base an investment decision. The following are trademarks and service marks of BFLP, a Delaware limited partnership, or its subsidiaries: BLOOMBERG, BLOOMBERG ANYWHERE, BLOOMBERG MARKETS, BLOOMBERG NEWS, BLOOMBERG PROFESSIONAL, BLOOMBERG TERMINAL and BLOOMBERG.COM. Absence of any trademark or service mark from this list does not waive Bloomberg’s intellectual property rights in that name, mark or logo.

All rights reserved. © 2025 Bloomberg.