Bloomberg Professional Services

- Geopolitical realignment is emerging as the dominant macro driver for equity markets in 2026, reshaping trade, capital flows, and regional equity performance across developed and emerging markets.

- U.S.-aligned economies, defense, energy security, and infrastructure themes may benefit from sustained capital expenditure as supply chains and security priorities are restructured.

- Concentration risks from the magnificent seven are prompting investors to reassess diversification.

This article was written by Steve Hou, PhD, Quantitative Researcher at Bloomberg, Mike Pruzinsky, and Sean Murphy, Equity Index Product Managers at Bloomberg Index Services Limited (BISL).

The year geopolitics becomes the macro

With markets entering 2026 near record highs, investors may be asking a different set of questions than expected just a few weeks ago. The defining issue for the year ahead may not be whether we are in a stock market bubble, how company earnings are trending, or where we are in the business cycle, but rather how a rapidly evolving geopolitical order may reshape the structure of equity markets.

PRODUCT MENTIONS

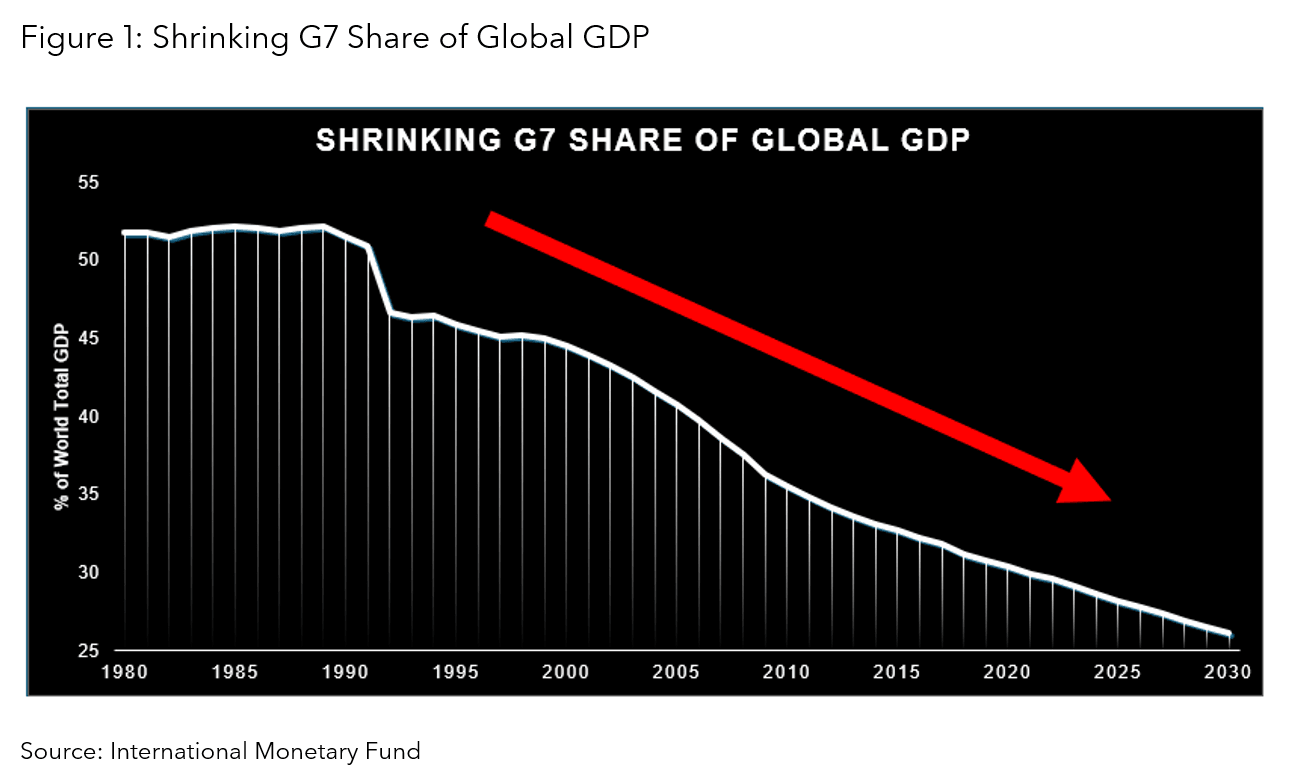

For decades, the United States has played an expansive role in the global economy by anchoring trade, underwriting security, and sustaining the post–war system. That model is now changing as the underlying arithmetic has shifted. The G7 share of global GDP no longer supports the same breadth of commitments, and domestic political constraints are steadily pushing policy toward a more selective and strategic form of engagement. The result is not a retreat from influence, but a reconfiguration of how that influence is exercised.

At the same time, broader market sentiment remains cautiously optimistic. The prevailing view is that the macro environment remains broadly supportive of risk assets, with growth proving resilient, inflation pressures moderating, and financial conditions easing. Meanwhile, ongoing investment in AI infrastructure and signs of broader market leadership support a constructive outlook, even as elevated U.S. stock market valuations argue for strategic and disciplined allocations.

Against this backdrop, U.S. economic policy is increasingly shifting away from a universal global system toward a sharper “camp” model of preferential supply chains, trusted investment corridors, and security commitments that are more selective and regional. In this new direction, the most important questions for investors may become: who is inside the preferred “camp” system, who is outside, and what equity markets are levered to that redesign?

New “camp” system winners are U.S.-aligned

Inside this preferred system are countries that align with U.S. strategic objectives and industries deemed critical to national resilience. This includes the United States itself, its developed-market allies such as Japan, South Korea, and much of Europe, as well as a growing group of emerging market democracies. These economies share key attributes: civil liberties, relatively stable governance, and transparent regulatory environments. Together, they form the productive perimeter of the U.S.-aligned “camp”.

Outside this system sit countries where political risk, state control of capital, proximity, or geopolitical misalignment prevent new-wave integration. China and India are notable countries that increasingly fall into this category. While these markets may still offer tactical opportunities, they face structural headwinds as capital, technology transfer, and supply-chain investment are gradually redirected elsewhere. For global investors, this shift matters because exclusion from the preferred system limits long-term access to the U.S. economy which has proven to be the most dynamic sources of demand, innovation, and financing.

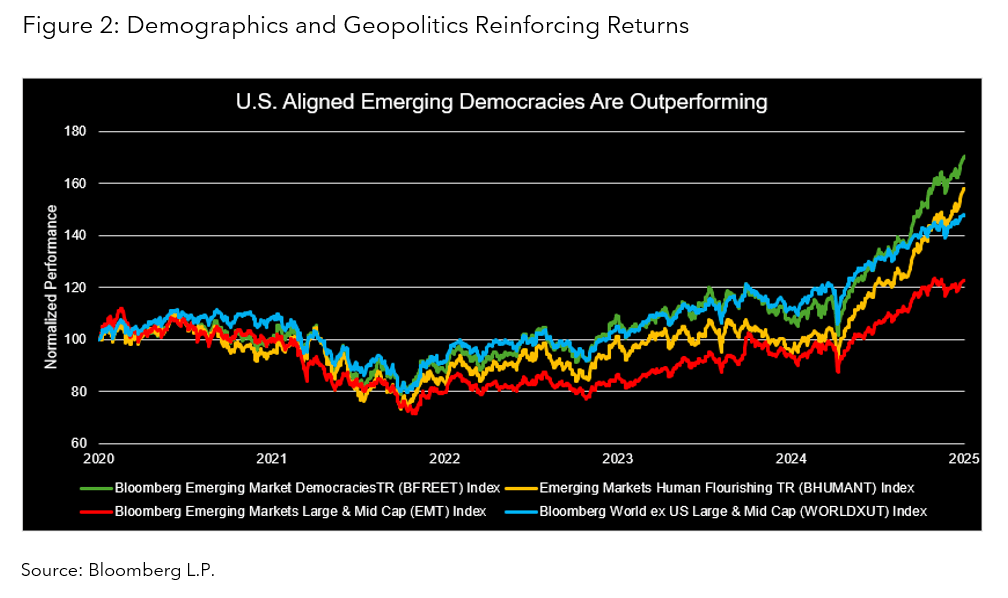

Demographics amplify this divide. In particular, the emerging U.S.–aligned economies may be ripe for future gains with faster growing populations and relatively young labor forces. These countries are also positioned to absorb the manufacturing, infrastructure, and service-sector investment now being reallocated as supply chains are redesigned. That advantage is already evident as illustrated in Figure 2 above, which shows the Bloomberg Market Democracies TR (BFREET) Index and Emerging Markets Human Flourishing TR (BHUMANT) Index both outperforming the emerging markets and world ex U.S. equity benchmarks over the last five years.

From a developed markets perspective, Japan enters 2026 as one of the more quietly compelling stories. After decades of stagnation, the economy is showing signs of renewed momentum as nominal GDP growth accelerates, fiscal policy remains supportive, and Japanese companies deepen their role in global supply chains tied to automation, semiconductors, and advanced manufacturing.

A weaker yen continues to support export demand, while government incentives aimed at productivity and technological upgrades are reinforcing domestic investment. Together, these forces position Japan as a developed market with improving cyclical and structural fundamentals.

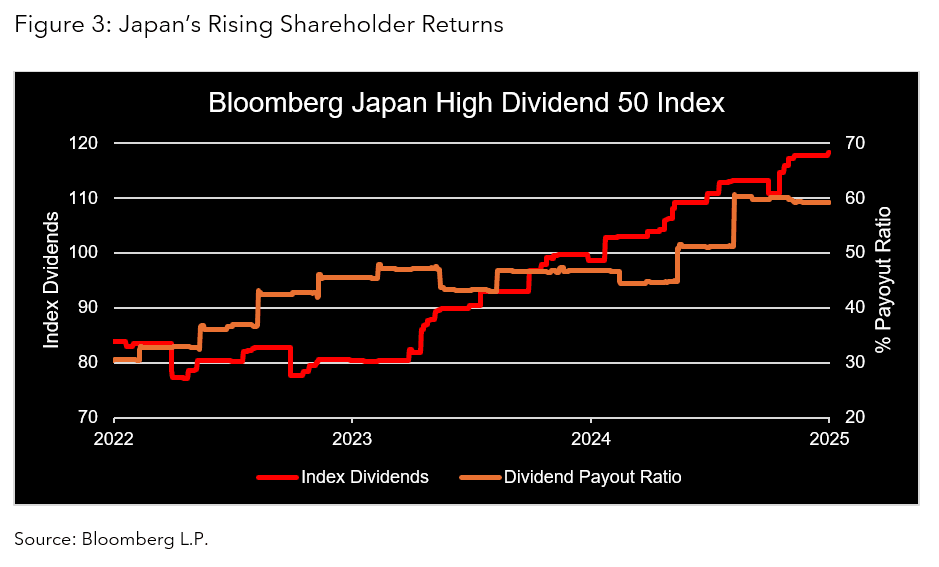

Just as important, the corporate landscape is undergoing a meaningful transformation. Long criticized for balance-sheet conservatism and limited shareholder focus, Japanese companies are responding to governance reforms and stock exchange pressure to improve capital efficiency. The result is a tangible shift toward shareholder returns, particularly through dividends. The Bloomberg Japan High Dividend 50 (BJHD50) Index highlights this change, with the index’s payout ratio rising a remarkable 94% over the past three years.

Policy shifts trigger bullish repricing in Latin America

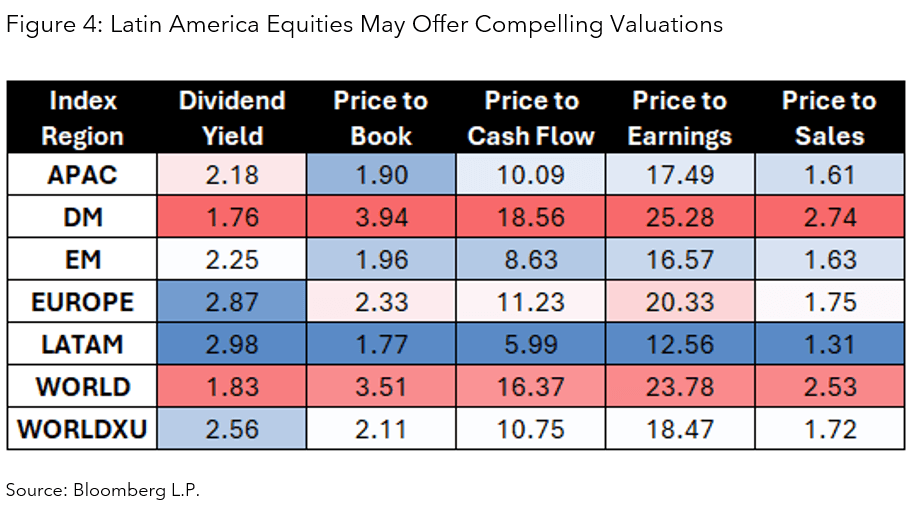

A renewed U.S. geopolitical focus on the Latin America region with the recent developments in Venezuela might offer a compelling macro-strategic rationale for stronger regional equity performance. The recently articulated U.S. policy corollary to the Monroe Doctrine embedded in the 2025 U.S. National Security Strategy signals a reorientation of U.S. foreign policy toward hemispheric engagement, a shift that may translate into greater political and economic cooperation with Latin American governments.

For Latin America equities, improved investor sentiment, policy alignment with a major global power, and competitive valuations versus global markets could drive multiple expansion, particularly in the Financials, Materials, and Energy sectors. Collectively, these dynamics bear watching and may support a constructive case for inclusion in diversified 2026 portfolios.

Defensive realignment and the security investment cycle

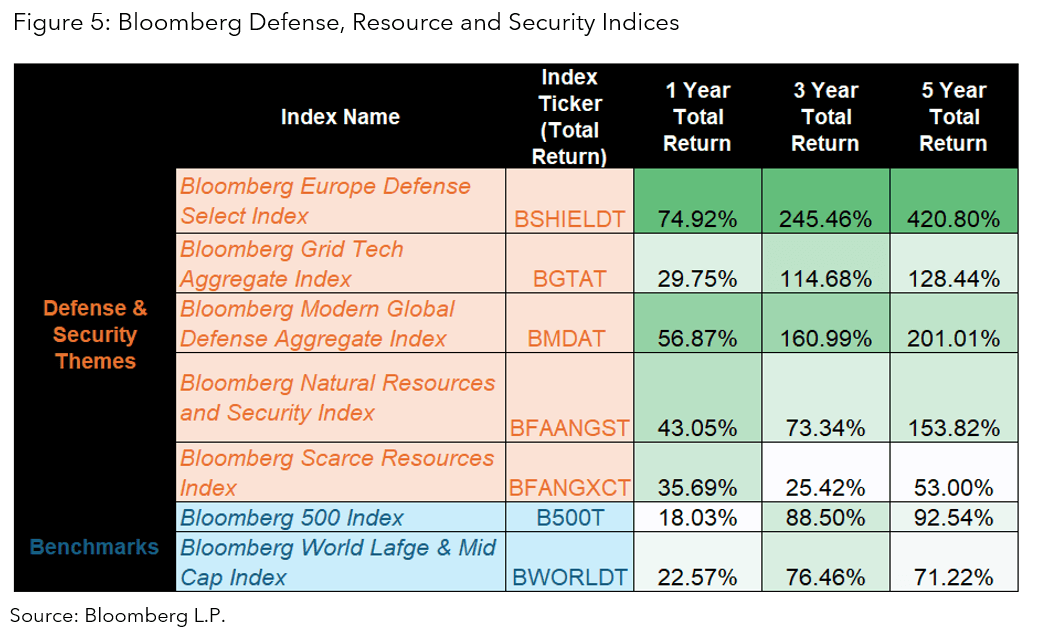

What is unfolding in Latin America is an expression of a broader security realignment now taking shape across the United States and being reinvented in Europe. As geopolitical competition intensifies, defense policy is being recalibrated toward resilience, regional stability, and control over critical inputs. This shift extends beyond traditional military spending and increasingly encompasses energy security, critical materials, the grid, and supply-chain infrastructure.

For investors, the implication is clear. Defense and security-related capital expenditure is becoming a structural feature of the global economy rather than a cyclical response to isolated risks. These trends are reinforced by parallel policy shifts in Europe, where governments are modernizing defense capabilities and expanding industrial capacity.

This transition elevates defense and resource security from niche allocations to a secular investment theme worth closer attention to for the remainder of the decade. To track these evolving dynamics, Bloomberg Indices has developed a targeted suite of benchmarks spanning defense, critical materials, energy security, and strategic infrastructure. Together, these indices provide investors with transparent, rules-based gauges to monitor thematic performance.

Growing energy demand supports the energy sector

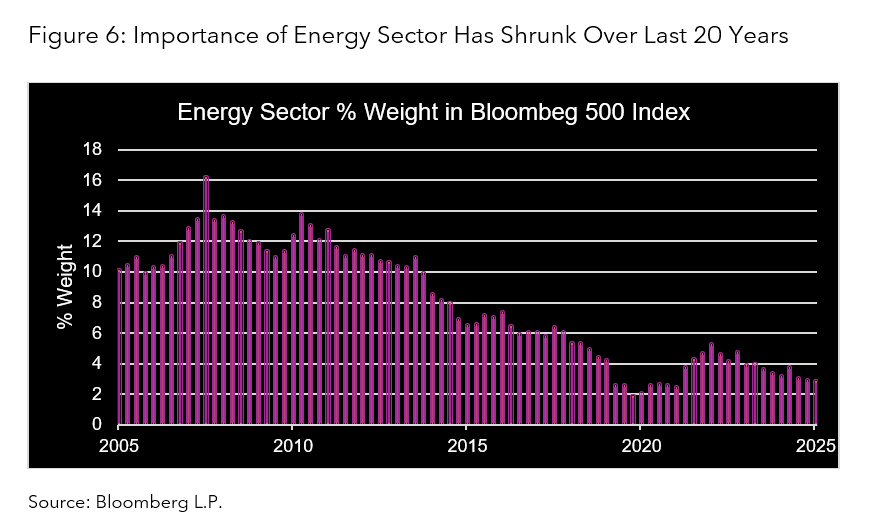

As supply chains are redesigned across the U.S., Europe, and allied economies, they are colliding with a hard physical constraint: energy and grid capacity. Years of underinvestment have left developed-world power systems ill-equipped to support growing energy demand. This reality makes energy security a defining investment theme for 2026, especially as the energy sector’s index weight in the Bloomberg 500 (B500) Index sits near multi-decade lows representing just 2.87% of the overall market.

For investors, the focus is broadening beyond oil and gas production to encompass a wider energy ecosystem. This includes companies that are set to increase energy efficiency, scale power generation and support renewed interest in nuclear. Solar is also getting in on the action. Once viewed as facing government policy headwinds, the industry has been bolstered by rising demand for electrification and emerging power needs from data centers. Power equipment manufacturers, grid and transmission providers, storage solutions, logistics networks, and suppliers of critical materials all stand to benefit in a world where energy capacity increasingly constrains economic growth.

Battleground of U.S. and China rivalry centers on AI

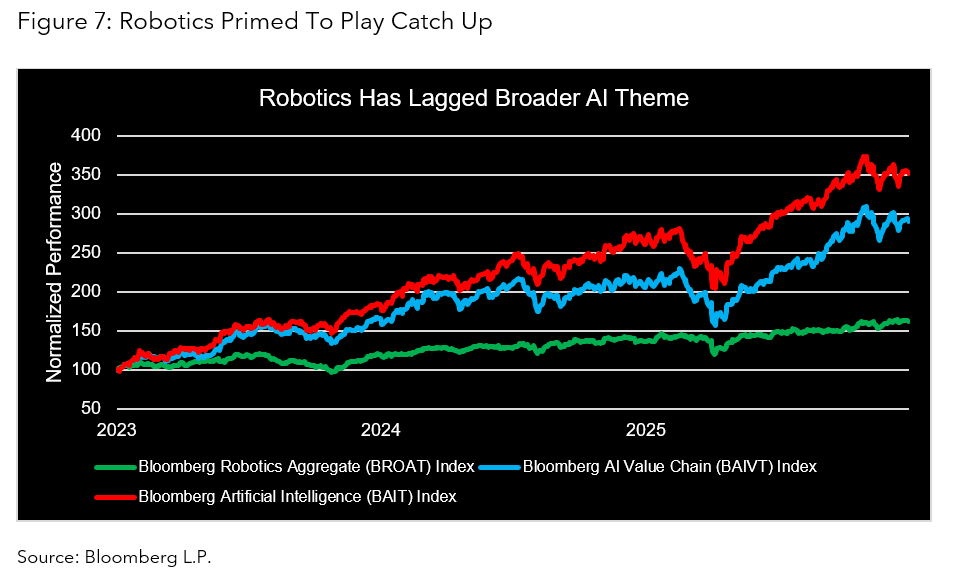

Artificial intelligence is the defining technology of our time and the primary battleground in the intensifying rivalry between the United States and China. Both governments increasingly treat leadership in AI, including the journey toward superintelligence, as critical to economic strength and national security. For investors, effective exposure requires looking beyond the most visible technology leaders and deeper into the AI value chain, particularly as both the U.S. and China pursue state-directed strategies that are increasingly bifurcated, duplicative, and capital-intensive. With expectations rising rapidly, Bloomberg Intelligence estimates that generative AI alone could generate more than $1.8 trillion in annual revenue by 2032, highlighting the scale of this transformation.

In 2026, the acceleration of humanoid robots could also mark a breakout year for robotics. While attention has remained concentrated on software-centric AI, the robotics ecosystem is advancing more rapidly than many expect, driven by companies across sectors turning to automation to offset structural labor shortages and aging demographics. To date, the Bloomberg Robotics Aggregate (BROAT) Index has materially lagged comparable AI-focused indices setting the stage for potential catch-up as capital allocation broadens.

Rethinking U.S. exposure and the Mag 7

The Magnificent Seven stocks are heavily owned by both domestic and international investors. Even with resilient U.S. fundamentals, such concentrated positioning raises the bar for further outperformance and increases vulnerability to any disappointment. As geopolitics becomes the macro driver, investors may increasingly focus on the earlier themes mentioned including international equities, defense, infrastructure, energy systems and robotics.

While this is not a call to abandon U.S. technology leadership, it is a word of caution that diversifying away from over-owned momentum and allocating toward the companies enabling the geopolitical reshaping may be beneficial.

Conclusion: A single catalyst with many expressions

The coherence of the 2026 outlook lies in a single underlying force: geopolitical realignment that is reshaping trade, security, energy systems, and technological competition. The relevant framework is no longer debates over growth versus value or incremental shifts in inflation, but a world reorganizing into strategic camps. This reconfiguration is driving supply chain redesign, forcing sustained capital expenditure, and redefining winners and losers across regions and sectors. These dynamics appear more structural than cyclical and may remain the dominant driver of markets heading into 2026.

To learn more about Bloomberg Indices, click here.

Bloomberg Indices Disclaimer: The data and other information included in this publication is for illustrative purposes only, available “as is”, non-binding and constitutes the provision of factual information, rather than financial product advice. BLOOMBERG and BLOOMBERG INDICES (the “Indices”) are trademarks or service marks of Bloomberg Finance L.P. (“BFLP”). BFLP and its affiliates, including BISL, the administrator of the Indices, or their licensors own all proprietary rights in the Indices. Bloomberg L.P. (“BLP”) or one of its subsidiaries provides BFLP, BISL and its subsidiaries with global marketing and operational support and service. Certain features, functions, products and services are available only to sophisticated investors and only where permitted. Bloomberg (as defined below) does not approve or endorse these materials or guarantee the accuracy or completeness of any information herein, nor does Bloomberg make any warranty, express or implied, as to the results to be obtained therefrom, and, to the maximum extent allowed by law, Bloomberg shall not have any liability or responsibility for injury or damages arising in connection therewith. Nothing in the Services or Indices shall constitute or be construed as an offering of financial instruments by Bloomberg, or as investment advice or investment recommendations (i.e., recommendations as to whether or not to “buy”, “sell”, “hold”, or to enter or not to enter into any other transaction involving any specific interest or interests) by Bloomberg. Information available via the Index should not be considered as information sufficient upon which to base an investment decision. All information provided by the Index or in this publication is impersonal and not tailored to the needs of any person, entity or group of persons. Absence of any trademark or service mark from this list does not waive Bloomberg’s intellectual property rights in that name, mark or logo. For the purposes of this publication, Bloomberg includes BLP, BFLP, BISL and/or their affiliates.

BISL is registered in England and Wales under registered number 08934023 and has its registered office at 3 Queen Victoria Street, London, England, EC4N 4TQ. BISL is authorized and regulated by the Financial Conduct Authority as a benchmark administrator. © 2026 Bloomberg. All rights reserved.

Bloomberg Intelligence Disclaimer

Bloomberg Intelligence is a service provided by Bloomberg Finance L.P. and its affiliates (“Bloomberg”). Bloomberg is not an officially recognized credit rating agency in any jurisdiction, and customers should not use or rely on Bloomberg Intelligence to comply with applicable laws or regulations that prescribe the use of ratings issued by accredited or otherwise recognized credit rating agencies. Bloomberg Intelligence, including Credit and Company research, may not be available in certain jurisdictions.

No aspect of the Bloomberg Intelligence service is based on the consideration of a customer’s individual circumstances. Customers should determine on their own whether they agree with Bloomberg Intelligence. Bloomberg Intelligence should not be construed as tax or accounting advice or as a service designed to facilitate any Bloomberg Intelligence customer’s compliance with its tax, accounting, or other legal obligations. Bloomberg believes that the information it uses in Bloomberg Intelligence comes from reliable sources but does not guarantee the accuracy or completeness of the information contained in Bloomberg Intelligence, which is subject to change without notice, and nothing in this service shall be construed as such a guarantee. Employees involved in Bloomberg Intelligence may hold positions in the securities analyzed or discussed on Bloomberg Intelligence.

Bloomberg makes no claims or representations, or provides any assurances, about the sustainability characteristics, profile or data points of any underlying issuers, products or services, and users should make their own determination on such issues.

The data included in these materials are for illustrative purposes only. The BLOOMBERG TERMINAL service and Bloomberg data products (the “Services”) are owned and distributed by Bloomberg Finance L.P. (“BFLP”) except (i) in Argentina, Australia and certain jurisdictions in the Pacific islands, Bermuda, China, India, Japan, Korea and New Zealand, where Bloomberg L.P. and its subsidiaries (“BLP”) distribute these products, and (ii) in Singapore and the jurisdictions serviced by Bloomberg’s Singapore office, where a subsidiary of BFLP distributes these products. BLP provides BFLP and its subsidiaries with global marketing and operational support and service. Certain features, functions, products and services are available only to sophisticated investors and only where permitted. BFLP, BLP and their affiliates do not guarantee the accuracy of prices or other information in the Services. Nothing in the Services shall constitute or be construed as an offering of financial instruments by BFLP, BLP or their affiliates, or as investment advice or recommendations by BFLP, BLP or their affiliates of an investment strategy or whether or not to “buy,” “sell,” or “hold” an investment. Information available via the Services should not be considered as information sufficient upon which to base an investment decision. The following are trademarks and service marks of BFLP, a Delaware limited partnership, or its subsidiaries: BLOOMBERG, BLOOMBERG ANYWHERE, BLOOMBERG MARKETS, BLOOMBERG NEWS, BLOOMBERG PROFESSIONAL, BLOOMBERG TERMINAL and BLOOMBERG.COM. Absence of any trademark or service mark from this list does not waive Bloomberg’s intellectual property rights in that name, mark or logo. All rights reserved. © 2026 Bloomberg.