Functions for the Market

- AI stocks have outperformed the broader market for three consecutive years, with gains driven by actual earnings growth rather than speculation.

- Infrastructure spending underpins continued momentum with TSMC announcing a record $52-56 billion capital spending plan for 2026, while the six largest US hyperscalers are collectively projected to invest over $500 billion in AI infrastructure.

- Investor appetite remains strong, with AI and robotics-themed ETFs pulling in record inflows in 2025 as part of a broader $1.4 trillion surge into US-listed ETFs.

Background

Taiwan Semiconductor Manufacturing Co. announced plans for as much as $56 billion in capital spending for 2026, a stronger-than-anticipated projection that marks a sharp increase from prior years. TSMC’s announcement underscores how deeply the semiconductor industry is betting on sustained AI demand.

PRODUCT MENTIONS

The AI rally has, so far, proven resilient. The Bloomberg Artificial Intelligence Aggregate Equal Weight Index rose 36% in 2025, outperforming the S&P 500’s equal-weight gauge for a third straight year. Meanwhile, some investors have grown cautious about the scale of tech industry capital expenditure.

“You’re trying to ask us whether AI demand is real or not. I’m also very nervous about it,” TSMC CEO C.C. Wei said on a conference call. “We’re investing $52 billion to $56 billion in capex, right? If we don’t do it carefully, that’d be a big disaster for TSMC.”

The issue

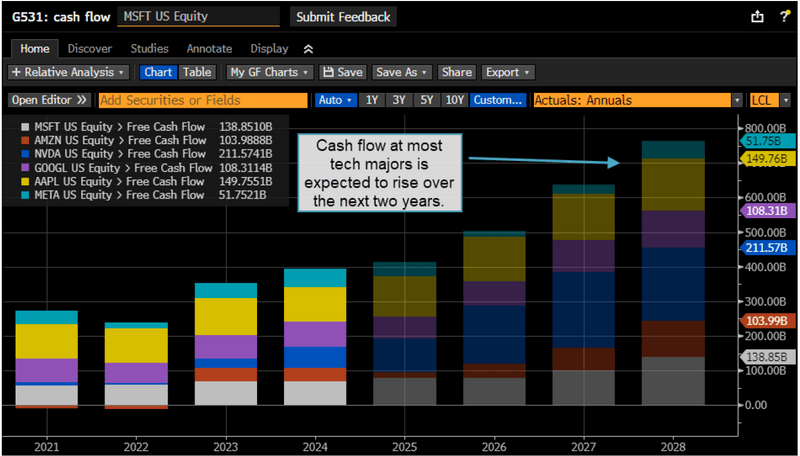

Unlike previous tech booms, this advance has been underpinned by fundamental earnings growth rather than valuation expansion alone. Cash flow projections for most major AI players continue to rise, with Nvidia forecast to generate $168 billion in 2026. Consensus estimates for the six largest US hyperscalers point to more than $575 billion in combined capital expenditure this year.

The infrastructure buildout extends beyond chips. Meta Platforms struck a series of nuclear power deals in January that could total more than 6 gigawatts, enough to power roughly 5 million homes. The agreements underscore how far tech giants will go to secure electricity for the AI boom.

Investor appetite has extended into adjacent sectors. AI-focused ETF inflows jumped to $19 billion last year from $4.2 billion in 2024, while defense-related funds topped the thematic category at $22 billion. Nuclear and infrastructure themes also attracted more capital.

This comes as the broader ETF industry had a banner year. US-listed funds attracted $1.4 trillion in 2025, shattering the annual record, while launches and trading volume also hit new highs. The last time all three measures peaked in a single year was 2021.

“Maybe we don’t hit the ‘Triple Crown’ again for a few years, but I would be shocked if flows don’t continue to break records, especially as ETF adoption really hits its stride,” said Todd Sohn, senior ETF strategist at Strategas.

Tracking

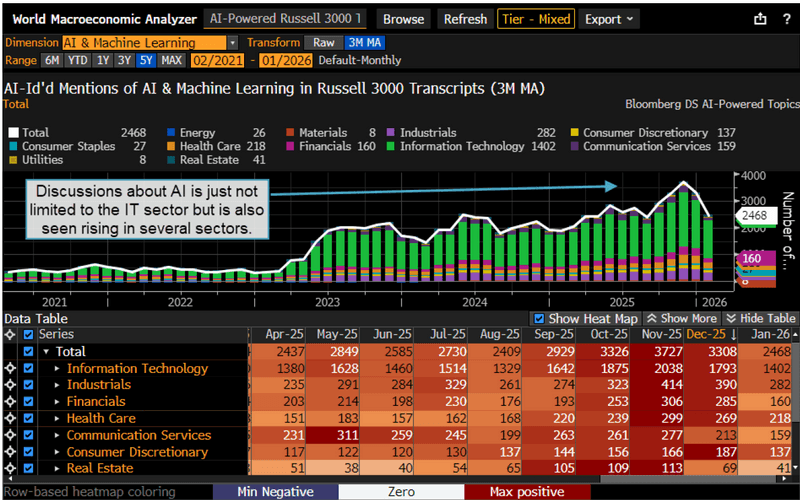

Track discussion of AI with the ECAN function:

- Type “ecan” in the command line and select ECAN – World Economic Analyzer.

- Click the amber box at top left and select AI-Powered Russell 3000 Topic Trends. The shortcut is ECAN US DS RAY TOPICS.

- Select AI & Machine Learning from the Dimension dropdown.

For more information on this or other functionality, click here to request a demo with a Bloomberg sales representative. Existing clients can press <HELP HELP> on their Bloomberg keyboard.