Bloomberg Intelligence

This analysis is by Bloomberg Intelligence Analyst David Cohne and Associate Analyst Sharoon Francis. It appeared first on the Bloomberg Terminal.

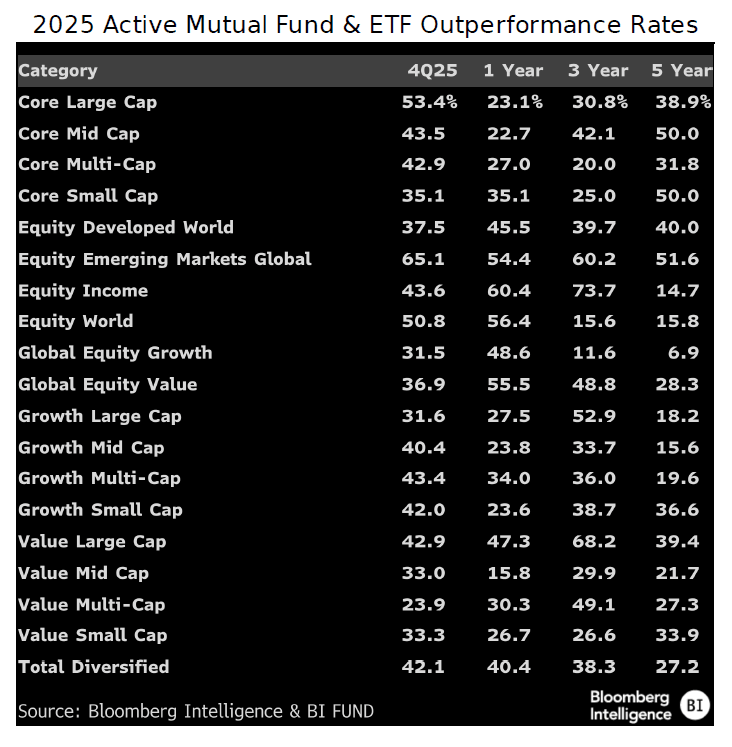

Active ETF and mutual fund managers benefited unevenly from 2025’s market backdrop. Beat rates improved as dispersion rose, yet success was concentrated outside of US core equities. Global and emerging-market managers captured the clearest gains from regional divergence and country-level dispersion, while US core strategies faced benchmark-aligned returns that limited value-adding opportunities.

PRODUCT MENTIONS

2025 did favor stock pickers, just not broadly

Last year was expected to mark a broad comeback for stock pickers as dispersion rose and market leadership widened. The beat rate for active diversified equity mutual funds and ETFs climbed to 42.1% from a five-year average of 27.2%, yet outperformance was scarce in large-cap core and growth. International and global managers benefited most, where regional divergence created clearer opportunities for active positioning.

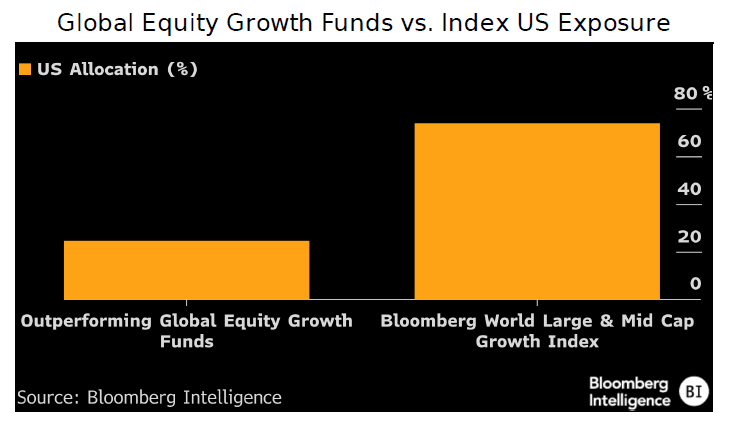

Global equity growth managers were clear beneficiaries of 2025’s market backdrop. Nearly 49% beat the Bloomberg World Large & Mid Cap Growth Index, far above the five-year beat rate of 6.9%. Outperformance stemmed largely from much lower US exposure, as stronger returns in several non-US markets lifted globally diversified portfolios. Outperformers held an average US allocation of 24.6%vs. 73.9% for the Index.

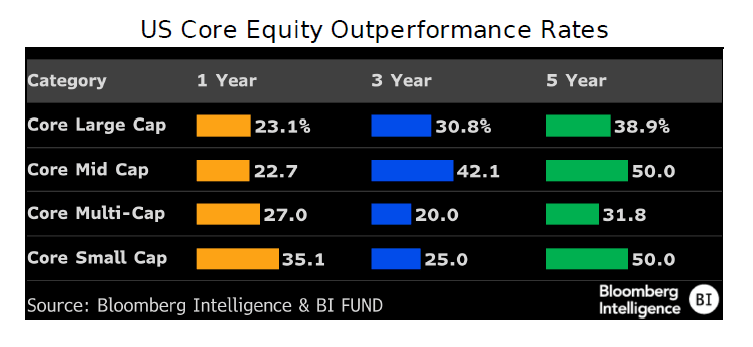

US core equity managers struggled relative to history and global peers. Only 23% of core midcap managers outperformed the Bloomberg US Mid Cap Index in 2025 vs. a five-year average of 50%. Despite broader global leadership, US core index returns stayed tightly benchmark-aligned, limiting dispersion and constraining active value addition.

Emerging markets show rare active consistency

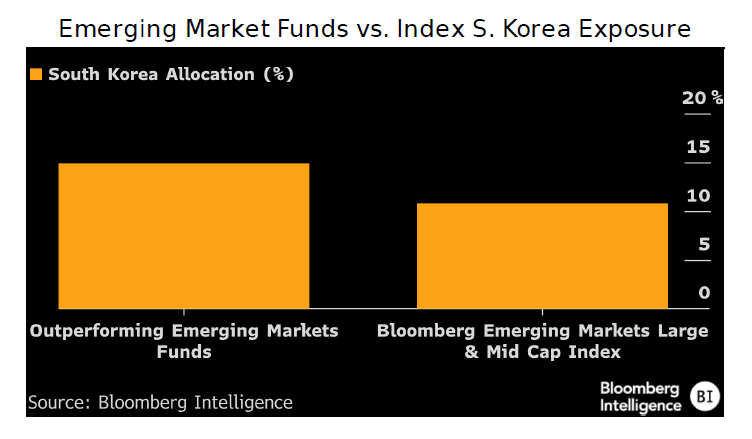

Emerging markets delivered rare consistency for active managers. In 2025, 54.4% beat the Bloomberg Emerging Markets Large & Mid Cap Index, broadly in line with five-year results. Outperformance was driven by overweight exposure to South Korea, where the large-mid index surged 102.1% vs. 31.3% for emerging markets overall, supported by a rebound in the global semiconductor cycle and stronger export momentum. Outperforming managers averaged a 14.9% allocation to South Korea vs. 10.8% for the index.

The data included in these materials are for illustrative purposes only. The BLOOMBERG TERMINAL service and Bloomberg data products (the “Services”) are owned and distributed by Bloomberg Finance L.P. (“BFLP”) except (i) in Argentina, Australia and certain jurisdictions in the Pacific Islands, Bermuda, China, India, Japan, Korea and New Zealand, where Bloomberg L.P. and its subsidiaries (“BLP”) distribute these products, and (ii) in Singapore and the jurisdictions serviced by Bloomberg’s Singapore office, where a subsidiary of BFLP distributes these products. BLP provides BFLP and its subsidiaries with global marketing and operational support and service. Certain features, functions, products and services are available only to sophisticated investors and only where permitted. BFLP, BLP and their affiliates do not guarantee the accuracy of prices or other information in the Services. Nothing in the Services shall constitute or be construed as an offering of financial instruments by BFLP, BLP or their affiliates, or as investment advice or recommendations by BFLP, BLP or their affiliates of an investment strategy or whether or not to “buy”, “sell” or “hold” an investment. Information available via the Services should not be considered as information sufficient upon which to base an investment decision. The following are trademarks and service marks of BFLP, a Delaware limited partnership, or its subsidiaries: BLOOMBERG, BLOOMBERG ANYWHERE, BLOOMBERG MARKETS, BLOOMBERG NEWS, BLOOMBERG PROFESSIONAL, BLOOMBERG TERMINAL and BLOOMBERG.COM. Absence of any trademark or service mark from this list does not waive Bloomberg’s intellectual property rights in that name, mark or logo.

All rights reserved. © 2026 Bloomberg.