Functions for the Market

- The Federal Reserve held rates unchanged at 3.5%-3.75% on Jan. 28 in a 10-2 vote, with Chair Jerome Powell citing an improved economic outlook, as early S&P 500 earnings showed a 20% aggregate jump in profits.

- The Bloomberg Dollar Spot Index has tumbled 11% from its January 2025 peak, with Treasury Secretary Scott Bessent reaffirming a strong dollar policy even as administration comments sent mixed signals to markets.

- Investors seeking yield-supported assets may find renewed dollar demand as rate differentials favor the US over peers, with Fed implied rates for June rising nearly 50 basis points since mid-October to 3.45%.

Background

The Federal Reserve held interest rates steady in its January meeting, with Chair Jerome Powell telling reporters the outlook for economic activity had “clearly improved” since the December meeting. Governors Christopher Waller and Stephen Miran dissented in favor of a reduction, but the 10-2 vote signaled the central bank sees little urgency to ease policy further as the economy shows resilience.

PRODUCT MENTIONS

The decision came as the dollar experienced sharp volatility following conflicting signals from Washington. The Bloomberg Dollar Spot Index rallied 0.5% after Treasury Secretary Scott Bessent affirmed the administration’s commitment to the dollar. Asked whether the US was intervening in currency markets to support the Japanese yen, Bessent was unequivocal in an interview: “Absolutely not.”

“The US always has a strong dollar policy, but a strong dollar policy means setting the right fundamentals,” Bessent said. “If we have sound policies, the money will flow in.”

The issue

If President Donald Trump’s first term is any guide, the dollar may soon find a base supported by the yield appeal of US assets. Bloomberg’s gauge of the currency has tumbled 11% from its January 2025 peak over 377 days, while its drop from January 2017 was almost 13% over 402 days, putting the current decline on a similar trajectory to the first term.

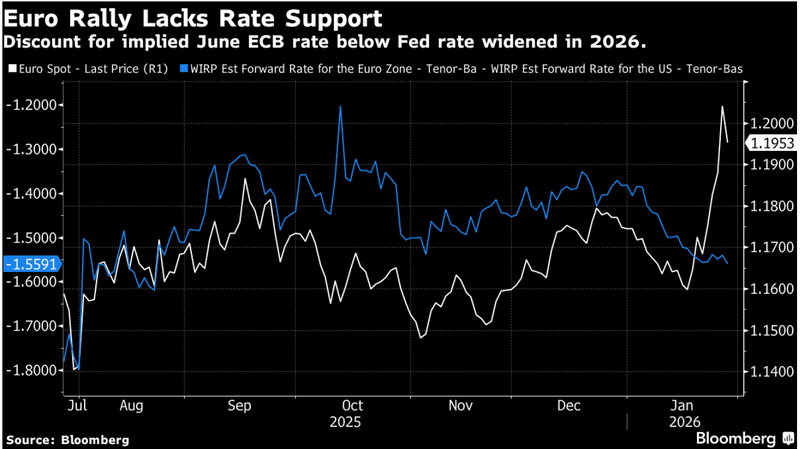

The US dollar’s reputation as a safe haven has taken some hits from unpredictable policymaking, but its yield advantage over most peers keeps it well supported. The discount for the implied June ECB rate below the similar Fed rate normally influences euro moves. But that relationship broke down as geopolitical tensions strained global alliances, causing gold and silver to rally as investors diversified from the dollar.

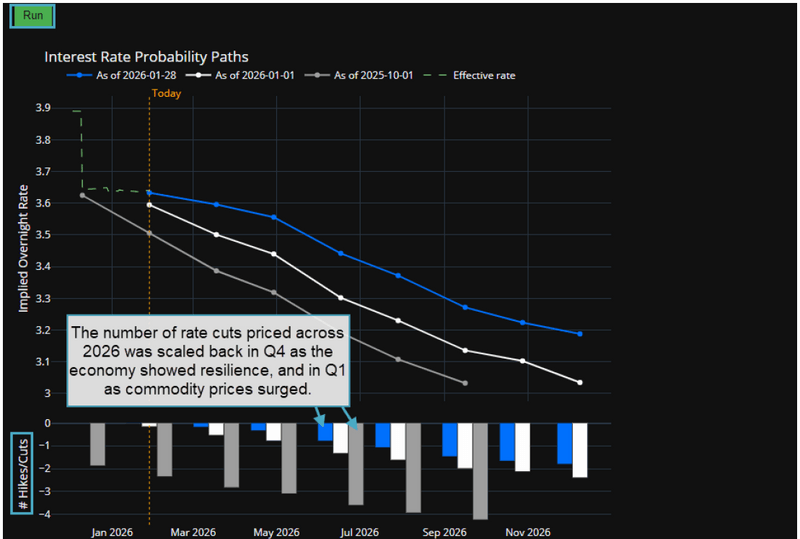

The BQuant Help Center offers tools for charting moves in the futures-implied rate paths across specific dates, allowing users to visualize how rate expectations have shifted. The number of rate cuts priced across 2026 was scaled back in Q4 as the economy showed resilience, and in Q1 as commodity prices surged.

Speaking to reporters in Iowa on Jan. 27, Trump indicated he was comfortable with the currency’s decline. “No, I think it’s great,” he said when asked if he was worried about the dollar’s drop. He suggested he could manipulate the currency’s strength, saying “I could have it go up or go down like a yo yo.” He went on to criticize China and Japan for seeking to devalue their currencies.

Since Trump’s inauguration, Bloomberg’s dollar gauge has tumbled close to 10% and traders are wagering on further losses. The premium for short-dated options that profit from a weaker US currency reached the highest since Bloomberg began compiling the data in 2011.

Some observers caution that prolonged dollar weakness carries risks for an economy carrying substantial debt. Robert Kaplan, vice chairman at Goldman Sachs Group Inc. and a former Dallas Fed President, offered a counterpoint in an interview on Bloomberg Television. “It is true, a weaker dollar boosts exports. However, the United States has $39 trillion of debt on its way to $40 trillion plus, and when you have that much debt, I think stability of the currency probably trumps exports,” Kaplan said.

Tracking

Track interest rate expectations and currency moves with the WIRP (World Interest Rate Probability) function:

- Type “us ois probabilities” and select WIRP US OIS.

- Click the value in the Implied Rate column and the 06/17/2026 meeting date row. The shortcut is US0BFR JUN2026 Index GP.

- Click 6M for periodicity. The Fed June implied rate rose nearly 50 bps since mid October to 3.45%.

- Type “EZ0BFR JUN2026 Index” in the Add Data box. The similar ECB implied rate rose 15 bps to 1.89%.

- Add “EZ0BFR JUN2026 Index” again. Click the pencil icon next to Last Px. Set Spread or Ratio to Spread (-). Set second Security to US0BFR JUN2026 Index and hit Update.

- Add “EUR Curncy.” Untick both implied rate lines for clarity. The shortcut is G #FFM 2425.

For more information on this or other functionality, click here to request a demo with a Bloomberg sales representative. Existing clients can press <HELP HELP> on their Bloomberg keyboard.