Bloomberg Professional Services

- Long-only commodity exposure delivered through futures is influenced by roll yield and term structure effects, not just changes in spot prices.

- Curve- and carry-focused frameworks are designed to capture structural premia embedded in commodity futures markets across different sectors.

- Bloomberg Enhanced Roll Yield Index (BERY) illustrates how combining curve positioning with carry exposure can enhance returns relative to standard commodity indices. Commodities often sit within portfolios as tools for diversification, inflation protection, and long-term risk management. In practice, most exposure is delivered through futures-based benchmarks, which shape how returns are realized over time.

This article was written by Jigna Gibb, Head of Commodities and Digital Assets Product Management at Bloomberg.

Outcomes, however, frequently diverge from what spot price performance alone might suggest. Roll costs from repeatedly selling expiring contracts and buying longer-dated ones, and curve dynamics driven by price differences across contract maturities, can materially influence results across market cycles. For example, the BCOM Spot Index has gained 27.5% since December 2023, while the BCOM is up 15.4%.

This creates a practical challenge for investors and product designers. How can futures-based commodity benchmarks reduce structural headwinds from roll yield while remaining transparent, systematic, and investable across sectors with very different behaviors?

PRODUCT MENTIONS

This question is not purely theoretical. It comes into sharper focus when viewed through the lens of an index designed to systematically engage with curve structure and carry effects, helping clarify how those features influence returns over time.

In this article, we address how curve positioning and carry premia have contributed to returns in enhanced roll strategies, using the example of Bloomberg Enhanced Roll Yield Index (BERY), and how overlaying sector-specific trend signals can further diversify outcomes within a single framework.

Putting curve-aware design into practice

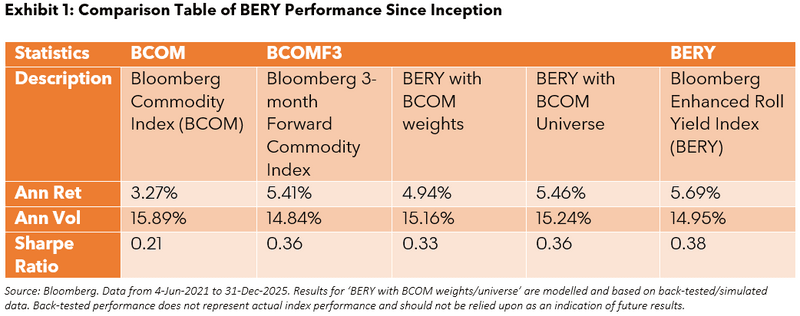

Two years ago, we published Very BERY: Bloomberg Enhanced Roll Yield Index, which introduced the Bloomberg Enhanced Roll Yield Index (BERY), a long-only commodity benchmark that incorporates aspects of risk premia strategies. As BERY approaches its fifth year of live performance, we reassess how its out-of-sample results compare with long-term history.

BERY addresses this challenge of investing in a static front month index in two ways. First, it allocates exposure across deferred contracts rather than concentrating solely on the nearby contract, reducing roll losses when curves are upward sloping. Second, it dynamically tilts weights away from commodities in contango and toward those in backwardation, harvesting both curve and carry premia. While carry opportunities were more limited in 2025 — particularly as precious metals performed strongly and were underweighted — the curve contribution remained a consistent source of excess return.

Based on our attribution framework, since its live inception, BERY has outperformed the Bloomberg Commodity Index by approximately 2.4% per annum, as per the table in Exhibit 1. Around 70% of this outperformance has come from curve positioning, with the remaining 30% attributable to carry. These results reaffirm the conclusions of the original Very BERY paper and demonstrate their continued relevance when assessed against live performance.

Introducing the Adaptive Roll Carry Framework

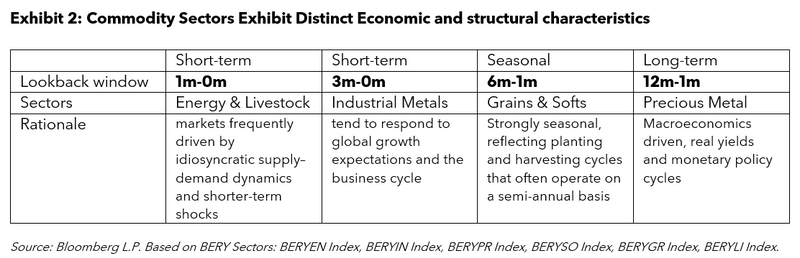

While curve and carry premia form a robust foundation, commodity returns are also influenced by persistent price trends. Building on the more recent BERY Rainbow Trend research, we also explore how applying trend signals to BERY sectors can create a diversified long/short strategy—BERY Adaptive Roll Carry “ARC”—designed to provide exposure to curve, carry, and trend premia within a single framework. A key principle of BERY ARC is that commodity sectors differ meaningfully in their fundamental drivers, and trend signals should reflect these differences rather than relying on a single, uniform lookback window.

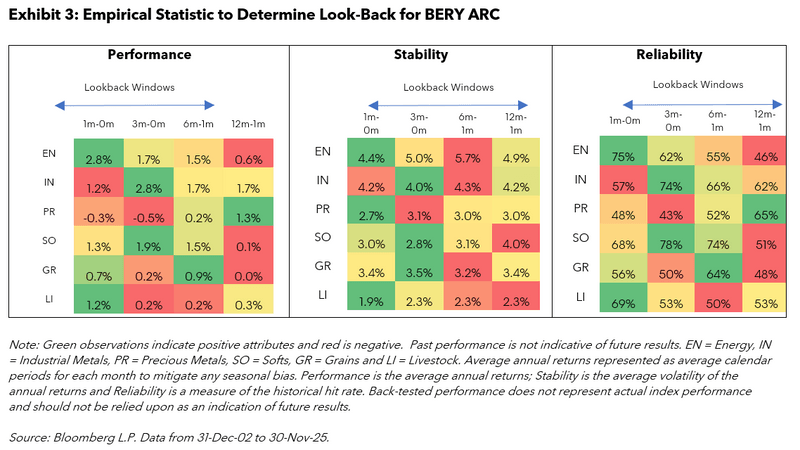

Signal-based strategies are often optimized using a single parameter, which can lead to overfitting and sensitivity to specific market regimes. In the BERY ARC framework criteria are employed: 1) Historical performance, 2) Stability of annual returns, 3) Reliability (hit rate), and 4) Fundamental rationale. Historical performance measures average annual returns generated by each signal. Stability is assessed through the volatility of those annual returns, while reliability captures the proportion of periods with positive performance. Together, these metrics provide a more robust basis for parameter selection than performance alone.

Colors of BERY ARC Sectors

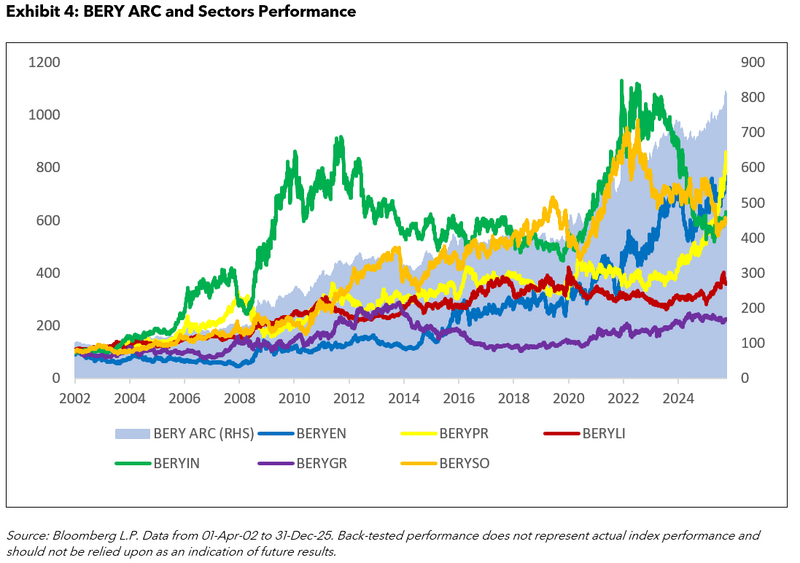

Trend signals derived from these sector-specific lookback windows are applied monthly to the corresponding BERY sector indices. Each sector exhibits trending behavior, although the strength and persistence of trends vary over time.

As seen in Exhibit 4, precious metals, industrial metals, energy, and softs have displayed stronger trend characteristics, while livestock and grains have been less directional. By combining these sector signals with the annual BERY weights, BERY ARC forms a diversified long/short strategy that captures multiple sources of return across commodity markets.

Performance in a challenging environment

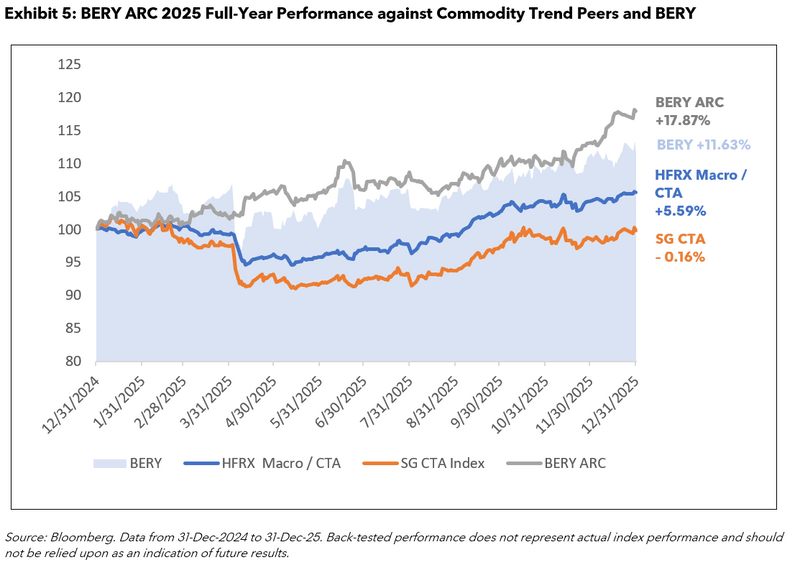

Commodity trend strategies faced a difficult environment in 2025, as markets were repeatedly whipsawed by geopolitical developments, trade tensions, and shifting macro expectations. Many traditional trend-following benchmarks struggled under these conditions.

Despite this backdrop, BERY ARC recorded a robust positive return of 17.9% for the year, outperforming both long-only BERY (11.6%) and several trend peers over the same period. The strategy maintained long exposure to precious metals and mostly long in livestock, which performed strongly, while positions in energy, grains, and industrial metals adjusted dynamically through monthly rebalancing. This adaptability highlights the benefits of aligning signal construction with underlying market fundamentals.

Curve premia are a well-established source of returns in commodity markets, and BERY has demonstrated their persistence in live performance. However, when carry opportunities diminish, incorporating trend signals provides an effective way to diversify return drivers. By combining curve, carry, and fundamentally informed trend signals, BERY Adaptive Roll Carry “ARC” offers a systematic and diversified approach to commodity investing, designed to provide exposure to a wide range of market environments.

The data and other information included in this publication is for illustrative purposes only, available “as is”, non-binding and constitutes the provision of factual information, rather than financial product advice. BLOOMBERG and BLOOMBERG INDICES (the “Indices”) are trademarks or service marks of Bloomberg Finance L.P. (“BFLP”). BFLP and its affiliates, including BISL, the administrator of the Indices, or their licensors own all proprietary rights in the Indices. Bloomberg L.P. (“BLP”) or one of its subsidiaries provides BFLP, BISL and its subsidiaries with global marketing and operational support and service. Certain features, functions, products and services are available only to sophisticated investors and only where permitted. Bloomberg (as defined below) does not approve or endorse these materials or guarantee the accuracy or completeness of any information herein, nor does Bloomberg make any warranty, express or implied, as to the results to be obtained therefrom, and, to the maximum extent allowed by law, Bloomberg shall not have any liability or responsibility for injury or damages arising in connection therewith. Nothing in the Services or Indices shall constitute or be construed as an offering of financial instruments by Bloomberg, or as investment advice or investment recommendations (i.e., recommendations as to whether or not to “buy”, “sell”, “hold”, or to enter or not to enter into any other transaction involving any specific interest or interests) by Bloomberg. Information available via the Index should not be considered as information sufficient upon which to base an investment decision. All information provided by the Index or in this publication is impersonal and not tailored to the needs of any person, entity or group of persons. Absence of any trademark or service mark from this list does not waive Bloomberg’s intellectual property rights in that name, mark or logo. For the purposes of this publication, Bloomberg includes BLP, BFLP, BISL and/or their affiliates.

BISL is registered in England and Wales under registered number 08934023 and has its registered office at 3 Queen Victoria Street, London, England, EC4N 4TQ. BISL is authorised and regulated by the Financial Conduct Authority as a benchmark administrator.

© 2026 Bloomberg. All rights reserved.