Products / Indices

Bloomberg Currency Indices

Currency tracking across the globe

Representative baskets

Indices consider both currency market liquidity and trading partners of the respective market.

Diversified markets

Our index families offer broad coverage of both developed and emerging markets.

Dynamic updating

Indices rebalance once a year to capture the annual survey of major trading partners.

A suite of coverage

Our index family consists of FX Allocation and FX Beta Indices.

KEY STATS

174

Indices

40

Currency markets

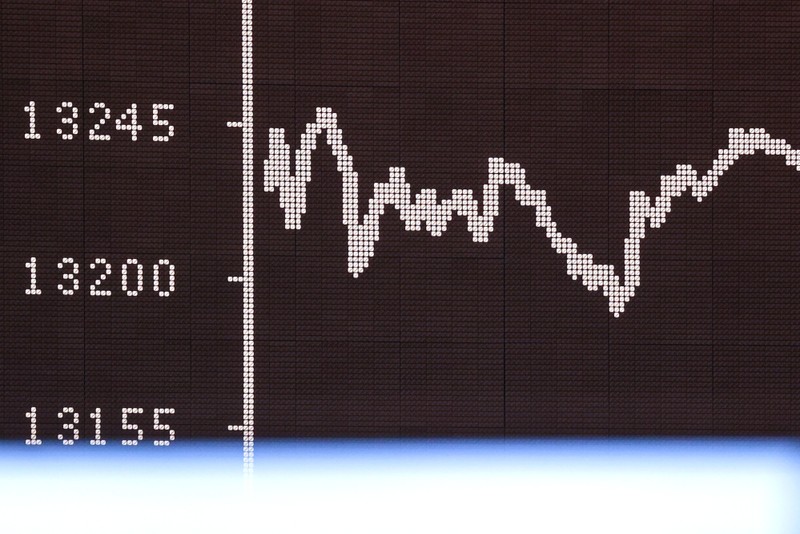

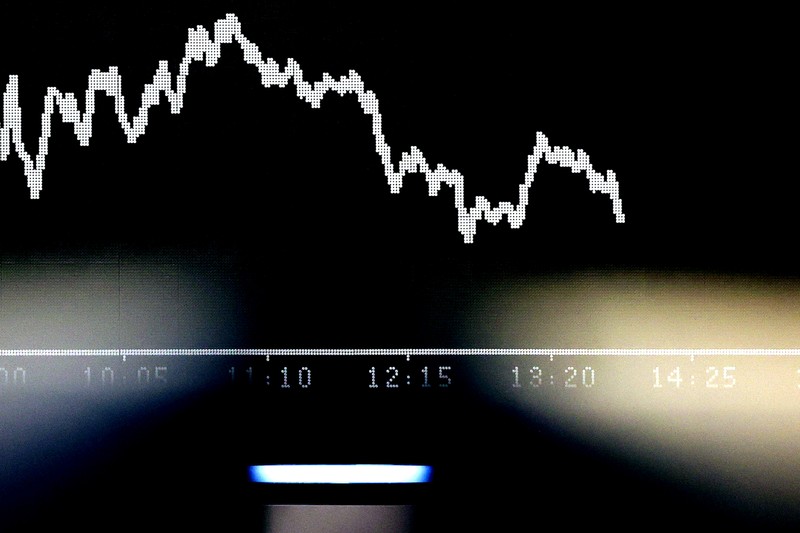

Real-time measures of currency markets

FX Allocation Indices contain predefined baskets with rules-based construction, and our Beta Indices feature rolling schedules and multiple structures.

Bloomberg Currency Indices

Sign up for indices insights

Select your areas of interest to receive the latest news, research and event invitations.

Cross-asset coverage

Bloomberg’s index team delivers high-quality benchmarks across asset classes.