Products / Indices

Bloomberg Multi-Asset Indices

Complete coverage across all asset classes

Built on flagship indices

Multi-Asset Indices can be constructed as a composite of indices across asset classes.

Selection & rebalance

Indices are consistently rebalanced on the first business day of the month.

Different weighting schemes

Fixed weight indices are rebalanced to the respective pre-set target weights each month.

Robust and scalable

We are always investing in our index calculation platform, introducing new security types and increasing speed to market.

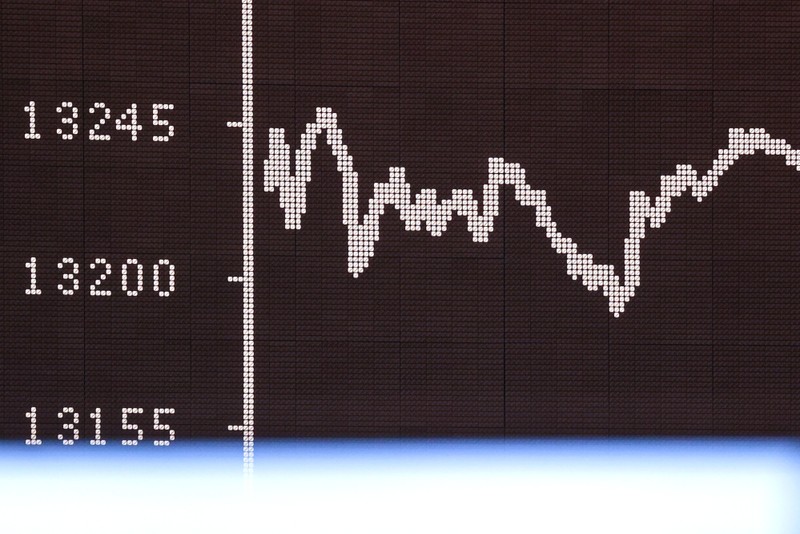

Balancing risk and return in a single index

The Bloomberg Global EQ:FI 60:40 Index is designed to measure cross-asset market performance globally. The index rebalances monthly to 60% equities and 40% fixed income and are represented by Bloomberg Developed Markets Large & Mid Cap Total Return Index DMTR and Bloomberg Global Aggregate Index LEGATRUU respectively.

In addition to the widely used 60/40 blend, Bloomberg offers a suite of off-the-shelf fixed weight combinations as well as customized indices.

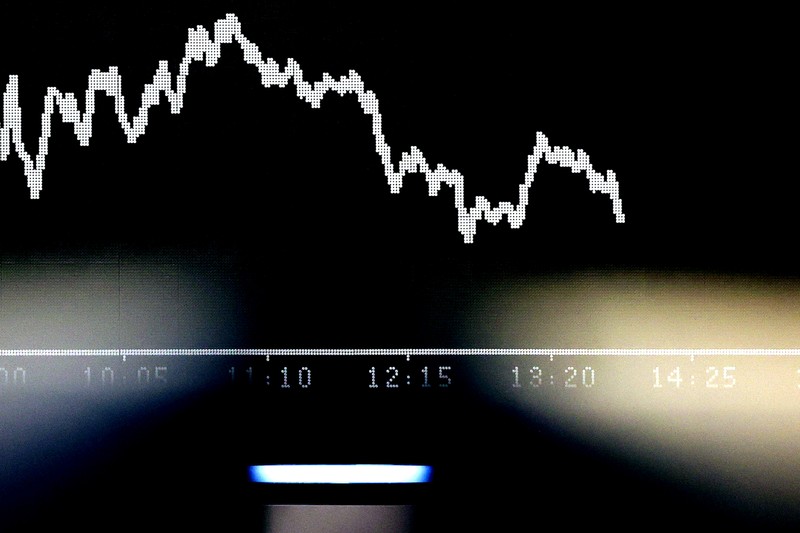

Performance

Sign up for indices insights

Select your areas of interest to receive the latest news, research and event invitations.

Cross-asset coverage

Bloomberg’s index team delivers high-quality benchmarks across asset classes.