Bloomberg Professional Services

This article was written by Jim Wiederhold, Commodity Indices Product Manager at Bloomberg.

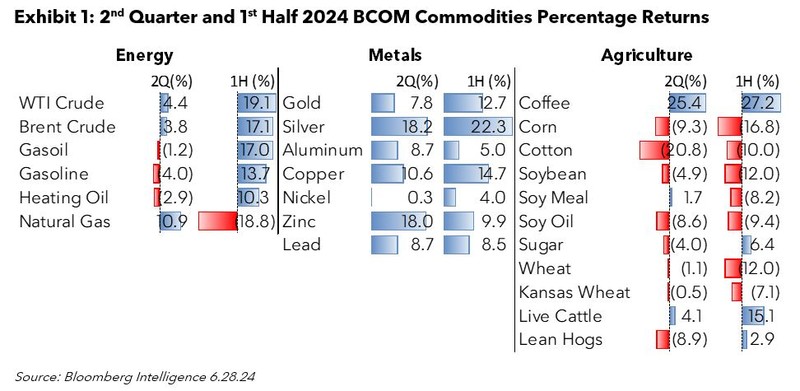

The world experienced the hottest May on record with an average global temperature of 15.91C and 2024 is on track to be the hottest year on record. Commodities also experienced a sizzling second quarter after a solid first quarter on the back of new tailwinds on the demand side and investors refocusing on the asset class. The Bloomberg Commodity Index (BCOM) rose 2.9% and is now higher by 5.1% in 2024. Copper and gold rose to new all-time highs. Metals, natural gas, and coffee led the advance while most of the agriculture commodities continued to lag. A few of the 2024 key themes we presented to start the year contributed to price action like the energy transition and geopolitics, but new interesting macro themes were also brought to light in the second quarter, like the extensive power requirements of Artificial Intelligence (A.I.). and the commodities needed. Volatility picked up after dropping in the first quarter, seasonality played a role and most commodity futures curves moved into steeper contango structures.

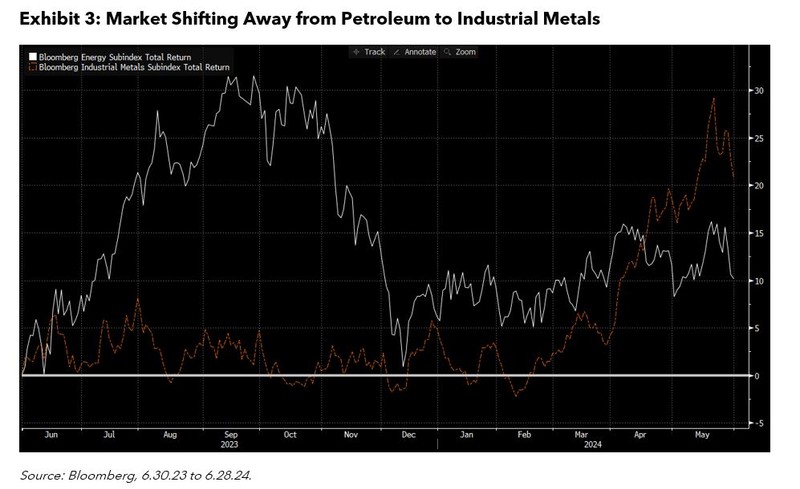

In our 2024 Commodities Outlook, we highlighted the energy transition as one of the 6 key themes to look out for this year. The industrial and precious metals most important to the macroeconomic shift from fossil fuels to electrification rose in the second quarter as investors shifted focus. The A.I.-driven equity market theme spilled over into the commodities markets as long positions were placed in natural gas with demand picking up from the very high-power use from A.I. technologies.

Two other themes from the outlook involved inflation and futures curve structures. After several higher-than-expected readings to start the year, inflation moderated in the second quarter but remained elevated above the US Fed’s target level. Commodities gave back some performance in June, but April and May were constructive with underlying strong inflation data lurking. For the constituents of BCOM, most commodity futures curves moved toward a steeper contango structure (spot prices lower than deferred contracts). BCOM’s current position as of the end of the quarter moved from strong backwardation one year ago towards contango implying a market participant holding long exposure would experience a negative roll yield (Exhibit 2). This could be a headwind for commodity returns if this move towards negative territory continues for the rest of the year.

According to the 14-day relative strength indicator (RSI), equities went from oversold in April to overbought by the end of the quarter. An allocation to commodities would’ve performed well during this period as most individual commodities rose as equities and fixed income sold off. With equities making several new all-time highs in the 2nd quarter, there has been a recent tech stock exit from the hedge fund community. Sector rotation occurs when expectations for an inflection point are high. Within equities, it appears that a shift to Utilities is occurring and this sector is becoming more commodity focused than most sectors.

Overall commodity volatility (BCOMTR Index Historical 30D Volatility) picked up to close out the first half of 2024, moving closer to historical averages. Equity volatility moved lower with each new all-time high in US equity indices. Commodities tend to have explosive bouts of volatility from time to time as extreme weather, geopolitical events, or specific delivery nuances of futures contracts cause issues with supply. The last driver occurred as copper prices shot higher in May, with a massive squeeze in the CME’s copper contract. Copper is one of the most important metals for the energy transition theme with its high conductivity compared to other industrial metals. Copper has the highest weight in the Bloomberg industrial Metals Index. The move higher in industrial metals prices showcased the shift away from fossil fuel focused energy from a year ago (Exhibit 3).

Seasonality is one of the things to consider when a market participant is involved in the commodity markets. For grains, producers harvest their crop and hedge their exposure typically adding selling pressure on certain futures contracts during certain periods. Seasonality is also prevalent in the energy commodities on the demand side depending on building heating/cooling needs during different seasons of the year. Precious metals prices are affected by demand from jewelry sales ahead of holidays around the world. For the broad commodities landscape, all the individual commodity seasonal factors came together in the second quarter with BCOM’s performance this year in line with the 10-year averages. (Exhibit 4).

In conclusion, commodities rose in the second quarter led by energy and metals. The hottest global temperatures on record will be a key theme to watch as we shift from El Nino to La Nina, which could lead to increased hurricane activity in the Atlantic in the second half of the year. This could disrupt energy production and distribution as well as agriculture crops like cotton. Commodities futures curves are moving away from an accommodative positive roll yield environment, but remain a source of positive carry. Coupled with the power needs of A.I., the energy transition theme could be seeing an inflection point this year based on price action between energy and industrial metals. Commodities performance was strong and forecasted by seasonality. What will the second half of 2024 have in store for commodities? Keeping a close eye to the macro themes driving the markets would help market participants understand the commodities asset class and BCOM, the commodities benchmark.

The data and other information included in this publication is for illustrative purposes only, available “as is”, non-binding and constitutes the provision of factual information, rather than financial product advice. BLOOMBERG and BLOOMBERG INDICES (the “Indices”) are trademarks or service marks of Bloomberg Finance L.P. (“BFLP”). BFLP and its affiliates, including BISL, the administrator of the Indices, or their licensors own all proprietary rights in the Indices. Bloomberg L.P. (“BLP”) or one of its subsidiaries provides BFLP, BISL and its subsidiaries with global marketing and operational support and service.