Bloomberg Professional Services

Welcome to Data Spotlight, our series showcasing insights derived from Bloomberg’s 8,000+ enterprise datasets available on data.bloomberg.com via Data License.

In this edition we take a look at transaction data, and credit metrics and how they can help with investment thesis development.

Our previous editions of Data Spotlight can be found here:

1. Gaining an early read on industry trends

When inflation rises, restaurant spending is often one of the first expenses consumers look to trim. How was that reflected during the period of high inflation in 2023? Research Data products, such as Company Financials Point-in-Time and Bloomberg Second Measure transaction data, can help users get an early read on a company’s performance.

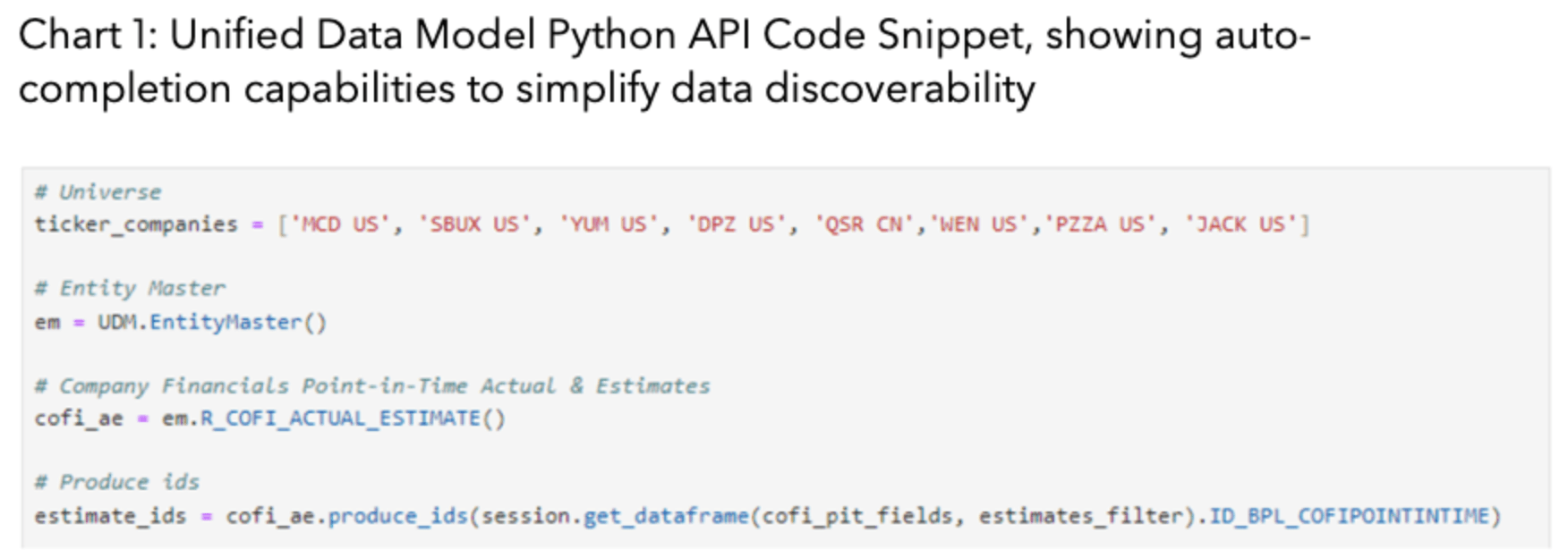

To do so, as illustrated in Chart 1, necessary data can be queried throughout the latest tool available: a python UDM* API to simplify data query for a set of US restaurant companies. One important feature is auto-completion of fields helping researchers and data scientists with data discoverability.

*Unified Data Model, a Bloomberg proprietary data model helping its clients with an advanced data model to link all datasets into Entities, Instruments, Markets and Pricing.

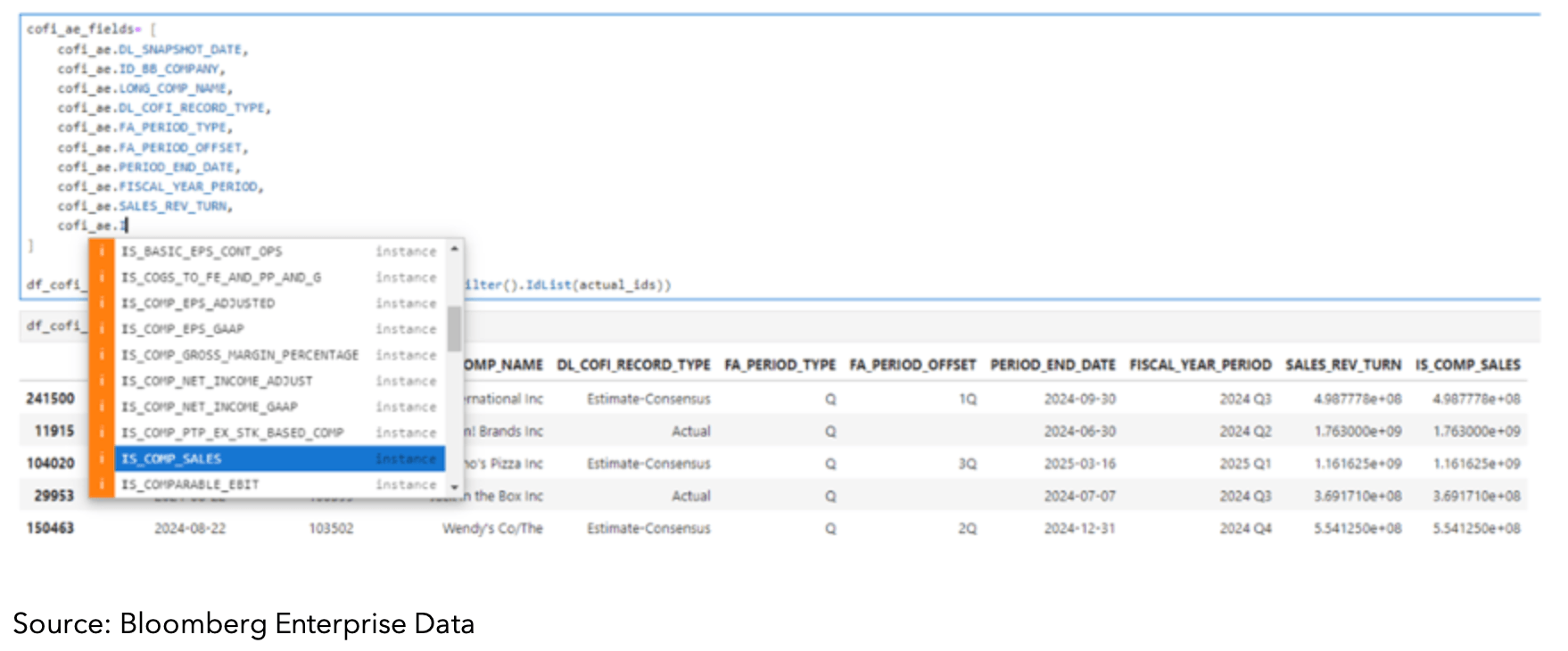

On an individual company-level, investors can get an early read on the potential sales performance of companies in the quarter compared to the consensus estimates by using alternative data, such as transaction data.

The divergence between observed sales and consensus can help to get an early read on company earnings ahead of the company public announcement. Chart 2 shows the reported earnings of the most recent 15 quarters for Starbucks, 80% of the time Bloomberg Second Measure pointed in the right direction, while consensus was either over or under estimating earnings.

Bloomberg Second Measure transaction data analytics available via Bloomberg Data License is delivered daily with a 3-day lag to enable faster decision-making. Additionally, Bloomberg Second Measure data analytics are available via Bloomberg Terminal ALTD <GO> function on a 7-day lag.

Theme: Systematic Investing

Roles: Quant Portfolio Managers, Traders, Systematic Investors

Bloomberg Datasets: Company Financials, Estimates and Pricing Point-in-Time, Bloomberg Second Measure Transaction Data

2. Using credit metrics backtesting in bonds selection

Systematic investment in corporate credit typically involves strategies to choose a set of bonds to buy based on an investor’s desired risk-return profile. In recent years, this area has experienced significant growth as an increasing percentage of corporate bond trades are being executed electronically.

Investment strategies in this space traditionally rely on credit ratings typically published by third-party rating agencies. However, as more reliable company financials and bond market data become available, more quantitative credit risk measures are increasingly used in this space. Bloomberg’s credit analysis tools product provides access to both model-based Default Risk (DRSK) and Market Implied Probability of Default (MIPD) measures which can investors develop systematic trading strategies for corporate bonds.

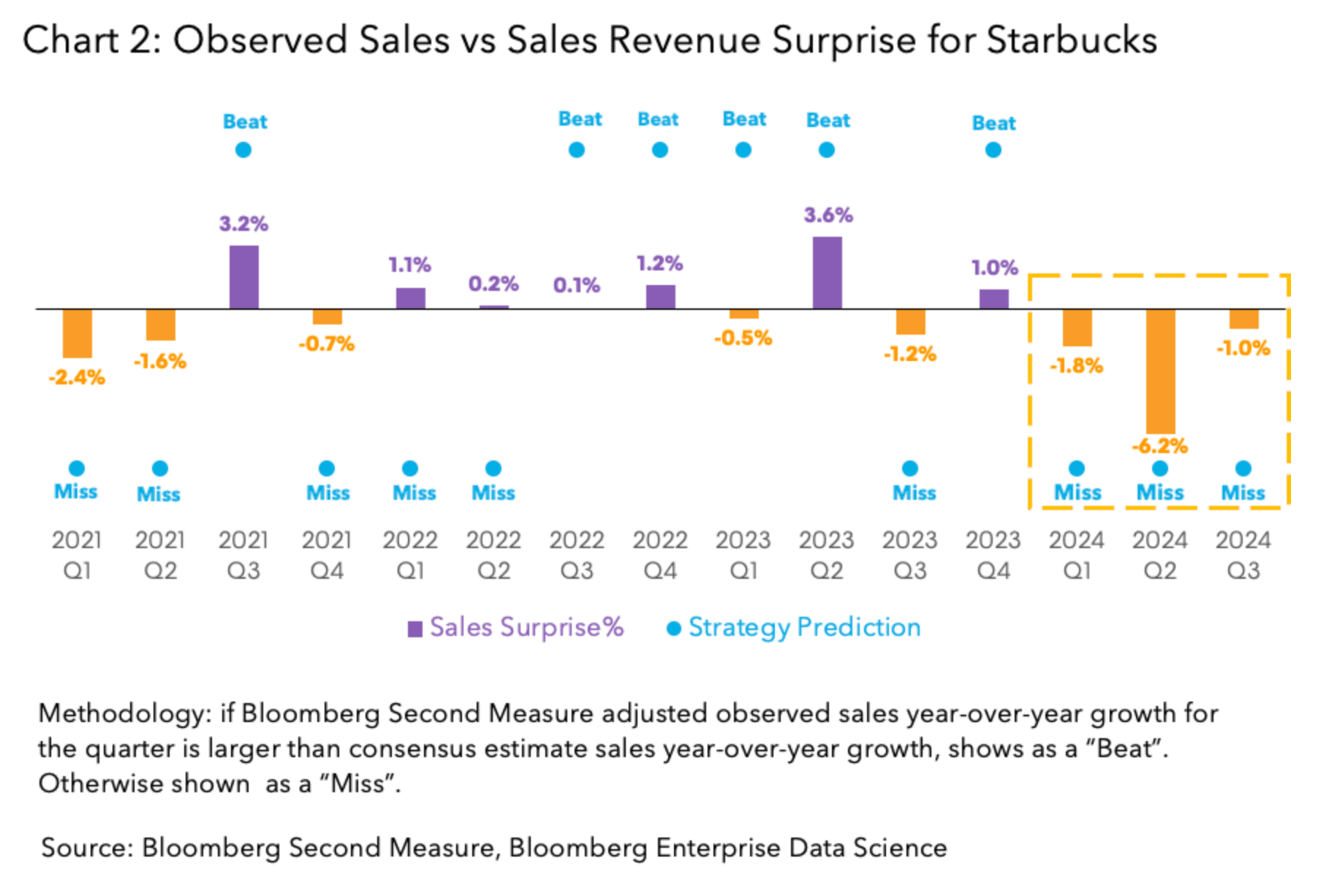

Both DRSK and MIPD data solutions calculate the probability of default for a bond issuer over a specific time horizon (such as six months or five years into the future) but are derived differently.

DRSK uses the Bloomberg corporate default database to fit a proprietary quantitative model pointing to such events based on company’s characteristics, performance measures and, for public companies, stock price.

MIPD, on the other hand, directly implies default probabilities using BVAL’s evaluated bond prices. MIPD metrics offer a daily snapshot of market sentiment for an issuer’s creditworthiness.They can quickly capture the impact of issuer-specific news and broader market events for the 36,000+ companies and sovereigns globally that issue bonds.

As a result, MIPD is typically significantly higher than DRSK reflecting the market risk premium embedded in bond prices. Essentially, DRSK offers a risk profile driven by both equity market dynamics and fundamentals, whereas MIPD provides a primarily bond market-driven outlook.

Chart 1 shows the time evolution of the average overall issuers present in the US Corporate High Yield Index for these two measures.

Note the sharp increase in market-implied credit risk after Silicon Valley Bank collapse in March 2023, which was not reflected to the same degree in the more fundamentals-driven DRSK measure suggesting that a potential trading opportunity might have existed at that time.

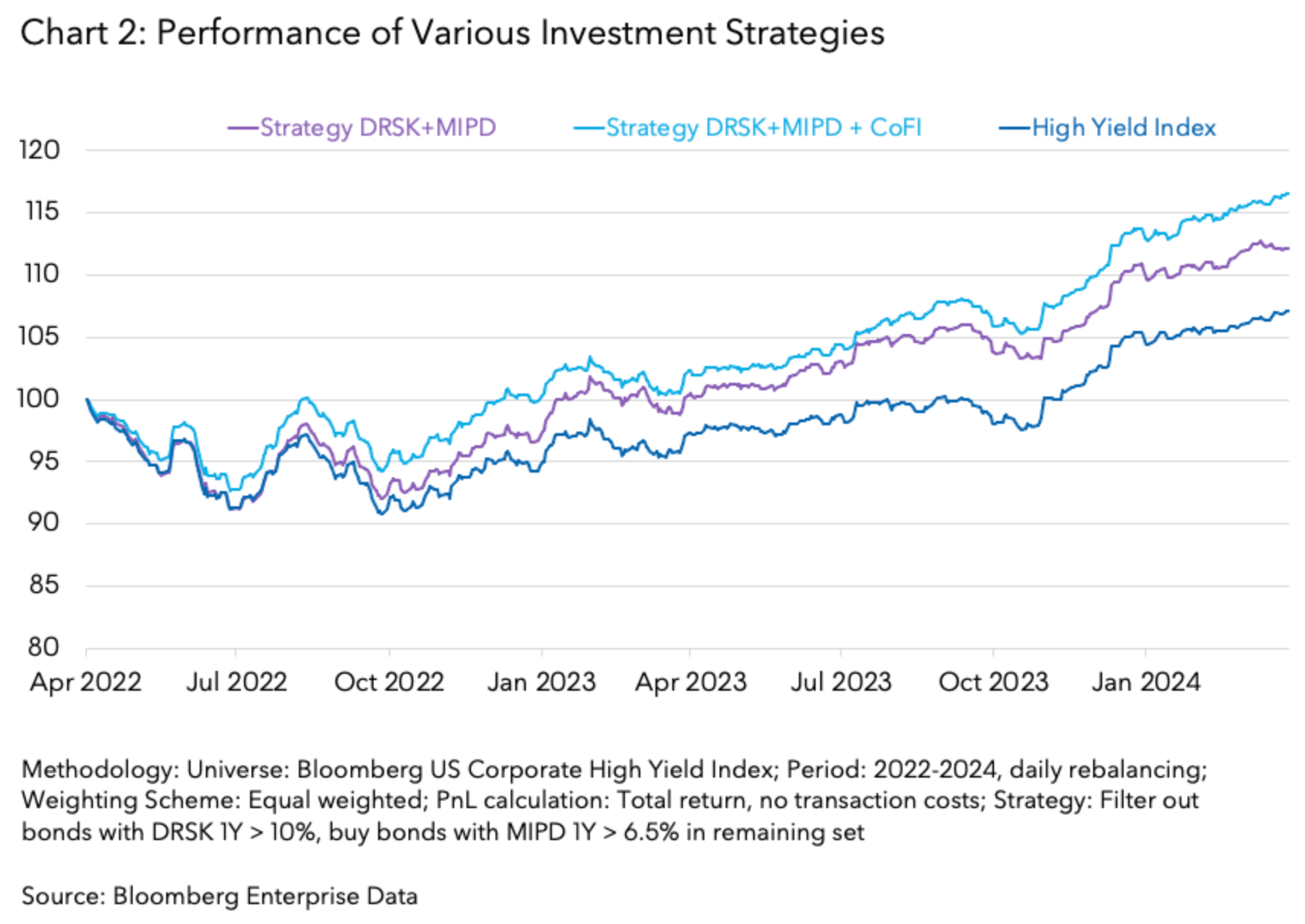

We analyzed a systematic strategy of avoiding high DRSK values (to reduce fundamental default risk) and buying the highest MIPD values in the remaining universe. The DRSK and MIPD thresholds were chosen in a way that corresponded to distressed and low grade bonds, respectively.

The result of this exercise can be seen on Chart 2. Over the period of study (2022-2024) this simple strategy (the purple line on Chart 2) beats the overall index (dark blue line).

Looking to further enhance the analysis by adding another fundamental dimension we analyzed a second strategy by incorporating Company’s data from Bloomberg Company Financials, Estimates and Pricing Point-in-Time (CoFi) product which provides a wealth of measures of company reported and analyst-estimated performance.

To illustrate this, we added a filter on top of the strategy described above to buy only the lower half of the bonds according to Net Debt to EBITDA ratio over the last twelve months. It would seem that a lower debt-to-earnings ratio would be a positive indicator for a company’s ability to repay its debt. Indeed, adding this filter appears to noticeably improve strategy returns (light blue line).

There are several simplifying assumptions used in this example, which may significantly affect the results in practice, such as ignoring transaction costs by assuming all bonds can be traded at BVAL mid-market prices. However, this demonstrates powerful ways these data solutions can be used for comprehensive, proactive credit risk analysis.

Theme: Systematic Investing

Roles: Credit Portfolio Managers, Traders, Systematic Investors

Bloomberg Datasets: Credit Risk Indicators, Company Financials, Estimates and Pricing Point-in-Time

Interested to learn more about our data offering? Bloomberg’s Enterprise Data business transforms the way customers extract value from data by providing the most comprehensive coverage and highest data quality in the industry. Bloomberg’s OneData approach makes all of the data easily discoverable on data.bloomberg.com, via Data License, instantly usable and delivered via APIs on the Cloud, to a customer’s hosting provider or data center. Our data management solutions aggregate, organize, and link your data to make it accessible through a diverse set of delivery mechanisms.

The data included in these materials are for illustrative purposes only. The BLOOMBERG TERMINAL service and Bloomberg data products (the “Services”) are owned and distributed by Bloomberg Finance L.P. (“BFLP”) except (i) in Argentina, Australia and certain jurisdictions in the Pacific Islands, Bermuda, China, India, Japan, Korea and New Zealand, where Bloomberg L.P. and its subsidiaries (“BLP”) distribute these products, and (ii) in Singapore and the jurisdictions serviced by Bloomberg’s Singapore office, where a subsidiary of BFLP distributes these products. BLP provides BFLP and its subsidiaries with global marketing and operational support and service. Certain features, functions, products and services are available only to sophisticated investors and only where permitted. BFLP, BLP and their affiliates do not guarantee the accuracy of prices or other information in the Services. Nothing in the Services shall constitute or be construed as an offering of financial instruments by BFLP, BLP or their affiliates, or as investment advice or recommendations by BFLP, BLP or their affiliates of an investment strategy or whether or not to “buy”, “sell” or “hold” an investment. Information available via the Services should not be considered as information sufficient upon which to base an investment decision. The following are trademarks and service marks of BFLP, a Delaware limited partnership, or its subsidiaries: BLOOMBERG, BLOOMBERG ANYWHERE, BLOOMBERG MARKETS, BLOOMBERG NEWS, BLOOMBERG PROFESSIONAL, BLOOMBERG TERMINAL and BLOOMBERG.COM. Absence of any trademark or service mark from this list does not waive Bloomberg’s intellectual property rights in that name, mark or logo. All rights reserved. © 2024 Bloomberg.

DRSK, SRSK, MRSK, and Market Implied Probability of Default (“MIPD”) (together, the “Additional Services”) are provided by Bloomberg Finance L.P. and its affiliates (“Bloomberg”). Bloomberg is not a Nationally Recognized Statistical Rating Organization (NRSRO) in the United States or an officially recognized credit rating agency in any other jurisdiction. Neither the Additional Services nor any other data in the Additional Services constitute a credit rating issued in accordance with the credit rating agency regulations promulgated by the European Securities and Markets Authority or any other regulatory authority in any jurisdiction. The outputs of the Additional Services have not been solicited by issuers and issuers do not pay Bloomberg any fees to generate the outputs or to evaluate issuers’ securities. Customers should not use or rely on the Additional Services to comply with applicable laws or regulations that prescribe the use of ratings issued by accredited or otherwise recognized credit rating agencies.

BVAL, IBVAL and BVAL Derivatives (collectively, “BVAL”) are services provided by Bloomberg Finance L.P. and its affiliates (“Bloomberg”). BVAL valuations do not express an opinion on the future or projected value of any instrument and are not investment recommendations (i.e., recommendations as to whether or not to “buy,” “sell,” “hold,” or to enter or not to enter into any other transaction involving any specific interest), a recommendation as to an investment or other strategy, or commodity trading advice. No aspect of the BVAL valuation or other data is based on the consideration of a customer’s individual circumstances and information available via BVAL should not be considered as information sufficient upon which to base an investment decision. Customers should determine on their own whether they agree with BVAL valuations. BVAL may not be available in certain jurisdictions. BVAL is not recognized or licensed as an official pricing provider in any jurisdiction, and should not be relied upon to comply with any laws or regulations that prescribe the use of prices issued by authorized pricing providers. BVAL should not be construed as tax, accounting, legal or regulatory advice or opinions, or sufficient to satisfy any tax, accounting, legal or regulatory requirements. Customers are solely responsible for the selection and use of appropriate parameters, inputs, models, formulas and data for meeting their tax, accounting, legal or regulatory requirements. Bloomberg believes that the information it uses in providing the BVAL services comes from reliable sources, but does not guarantee BVAL’s accuracy. Employees involved in the BVAL services may hold positions in the securities included in the BVAL services.