ARTICLE

AI boom may drive over 60% surge in US nuclear capacity by 2050

Bloomberg Intelligence

This article was written by Bloomberg Intelligence industry analyst Nikki Hsu, with contributing analysis by Scott J. Levine and Gabriela Privetera. It appeared first on the Bloomberg Terminal.

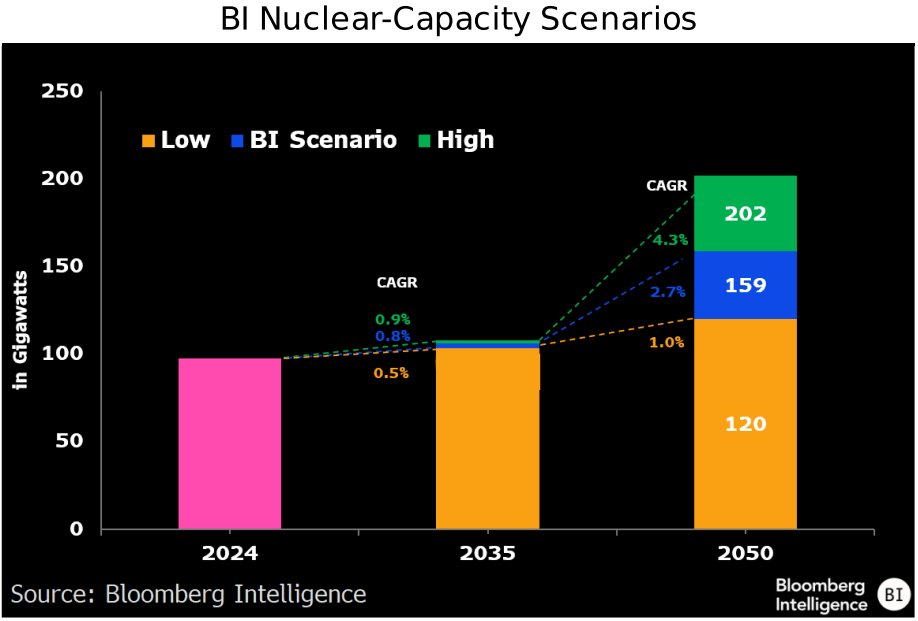

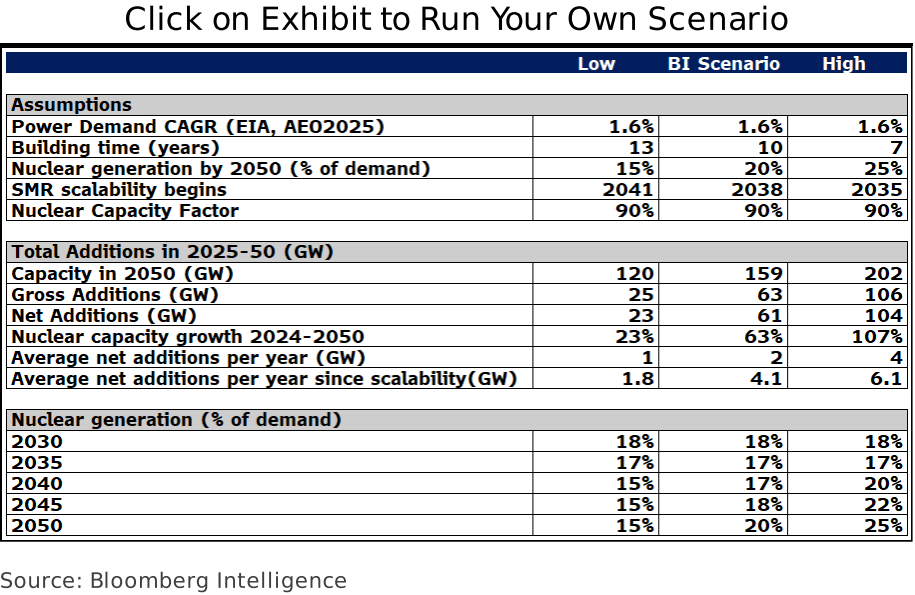

US nuclear power is primed for a resurgence, with capacity rising 63% to 159 gigawatts by 2050 in our scenario — a $350 billion-plus build-out fueled by AI data centers’ hunger for reliable, carbon-free energy. Policy support and narrowing cost gaps with renewables will spur growth, with early gains from plant upgrades and restarts, and small modular reactors scaling after 2035.

AI demand, policy incentives power nuclear rise

Net nuclear capacity may climb 52 GW from 2036-50 — a 2.7% compound annual growth rate — driven by policy support and AI data-center demand for clean, reliable power. Most additions arrive after 2035, as progress on small modular reactors (SMRs) may be constrained by permitting timelines, first-of-a-kind construction and financing risks and immature supply chains. BI’s scenario assumes new reactors start by 2038, mirroring the 1970-90 pace of 4.5 GW a year. The high end reflects faster SMR adoption and favorable policy. The low end assumes delays on all fronts, resulting in more muted growth. We also factor in the retirement of 2 GW in 2049-50 as three reactors reach 80 years of operation.

Overall, BI projects 61 GW of net additions in 2025-50, lifting nuclear’s share of US power generation to 20% from 18% in 2024.

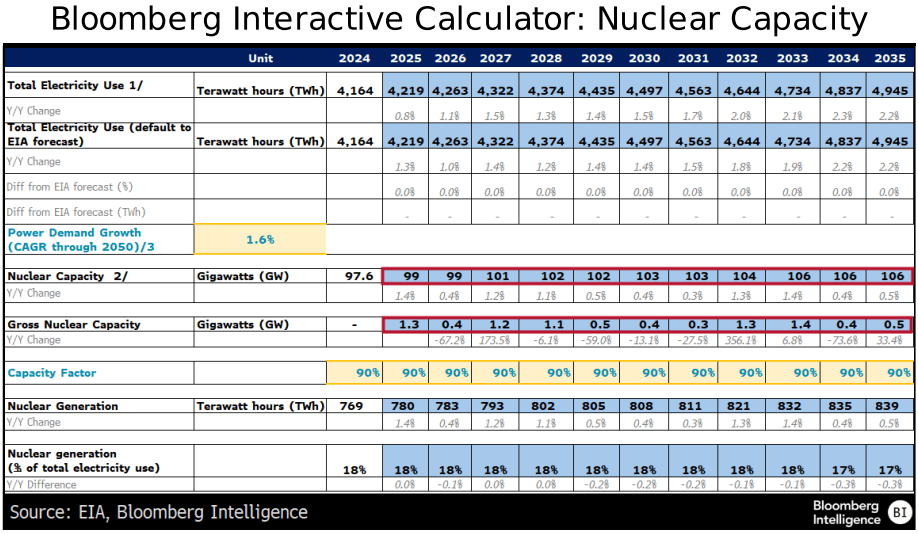

Nuclear comeback: US may add 9 GW by 2035

US nuclear capacity is set to grow almost 9 GW through 2035 in our scenario, reaching just over 106 GW — an average of 800 megawatts a year, or a 0.8% CAGR. Gains may be limited to upgrades at existing plants, restarts of retired units and the completion of abandoned V.C. Summer reactors in South Carolina. Widespread SMR adoption is unlikely before 2035. Meanwhile, tech giants like Meta, Microsoft and Amazon.com have struck long-term nuclear deals to support AI and cloud operations.

Three planned restarts could add about 2.3 GW by decade’s end: Holtec Palisades (0.8 GW, this year), Constellation’s Three Mile Island Unit 1 (0.8 GW, 2027) and NextEra’s Duane Arnold (0.6 GW, 2028). Santee Cooper seeks buyers to finish the two V.C. Summer units (1.1 GW each), though they likely won’t come online before the early 2030s.

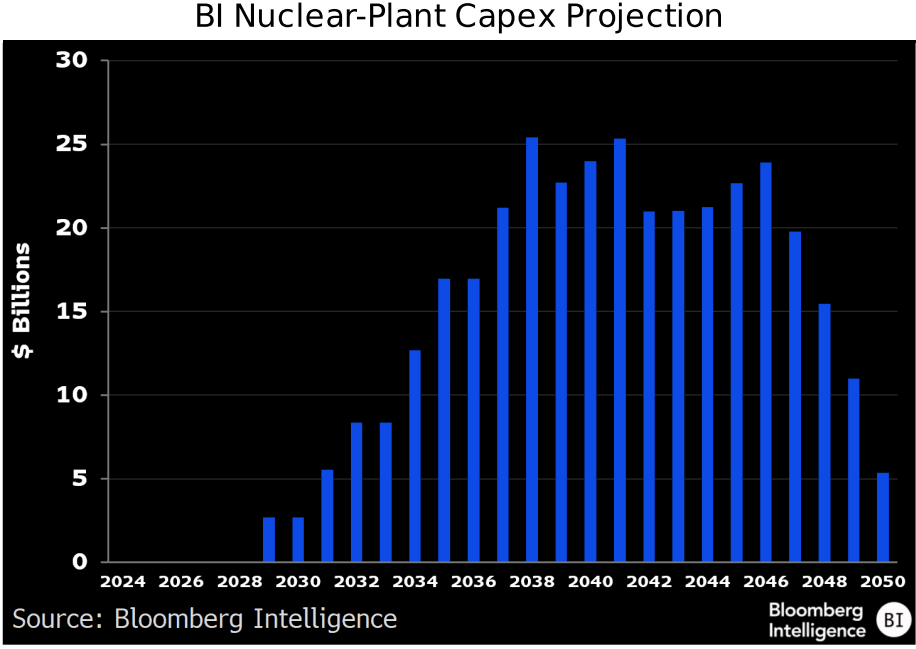

$350 billion bet on America’s energy future

Building 63 GW of additional US nuclear capacity by 2050 could cost $354 billion under BI’s scenario, excluding any plants entering service after that date. This assumes new reactors will start to come online in 2038, with initial build times of 10 years at $10,000 per kilowatt, improving to five years and $5,000/kW by 2048 as efficiencies scale. Our low- and high-end scenarios imply capital spending of $113-$578 billion, corresponding to 25-106 GW of new capacity.

The Vogtle plant in Georgia, the first US nuclear project completed in five decades, took 15 years to construct and came online in 2023–24, with an estimated cost of $13,876/kW.

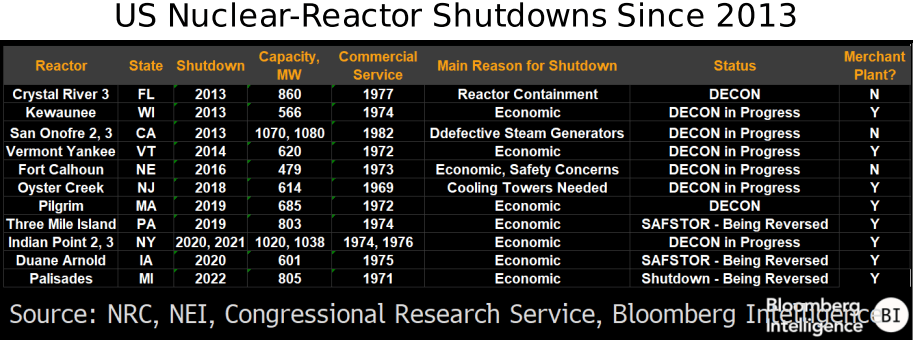

Few US reactors viable for restart by 2030

AI data centers’ pursuit of reliable, carbon-free power are driving efforts to revive shuttered reactors. But of the 13 reactors permanently closed since 2013, only Holtec’s Palisades, NextEra’s Duane Arnold and Constellation’s Three Mile Island Unit 1 (renamed Crane Clean Energy Center) are candidates for restart. Retired in 2019 or later, mainly for economic reasons, the facilities remain largely intact — in so-called SAFSTOR status. That contrasts with DECON, or dismantling, which poses greater hurdles for bringing a reactor back online.

The Nuclear Regulatory Commission defines SAFSTOR as safe enclosure or deferred dismantling, whereby a facility is placed into a safe-storage configuration until its eventual disassembly, while DECON involves immediate dismantling or early site releases.

Policy support key to unlocking private capital

Private investment in new nuclear capacity will likely require US support beyond the tax incentives preserved under the Trump administration’s tax and spending law. Additional measures, such as federal loan guarantees similar to the about $15 billion for the two Vogtle reactors, will be critical to addressing high costs, construction risks, supply-chain constraints and long lead times. President Donald Trump’s recent executive orders signal strong government backing, calling for streamlined reactor licensing and a 400-GW nuclear target by 2050.

Surging demand from AI data centers for clean, always-on power could ignite a new wave of nuclear construction — especially SMRs and the supply chains behind them.

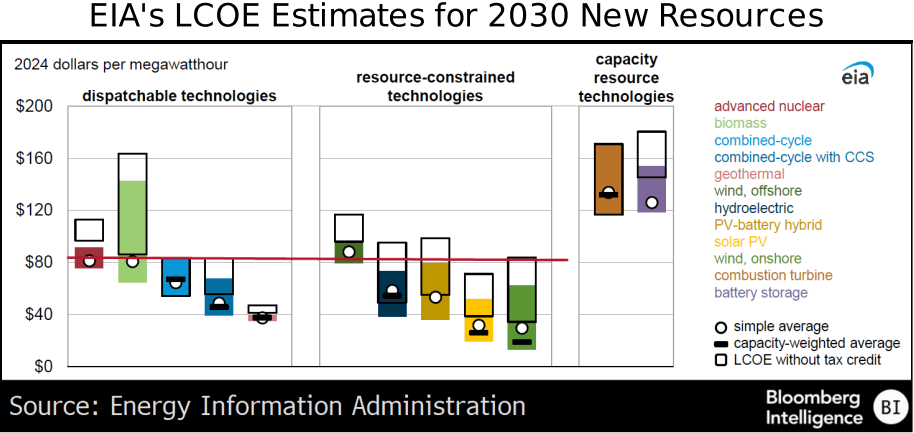

Cost gap to narrow for nuclear vs. renewables

Nuclear power is poised to close much of its cost gap with weather-dependent renewables after 2027, when key solar and wind tax credits under the Inflation Reduction Act are set to expire. The Energy Information Administration’s April outlook — issued before recent policy updates — puts the levelized cost of electricity (LCOE) for new builds entering service in 2030 at $81.45 per megawatt-hour for advanced nuclear, $29.58 for onshore wind, $31.86 for solar and $53.44 for photovoltaic-battery hybrids. With renewable tax credits valued at $25-$30/MWh, the cost differential is expected to narrow substantially.

Nuclear stands as the priciest dispatchable option today — 26% above combined-cycle gas ($64.55/MWh) — but it’s emissions-free, adding unique value to the grid beyond what LCOE alone measures.

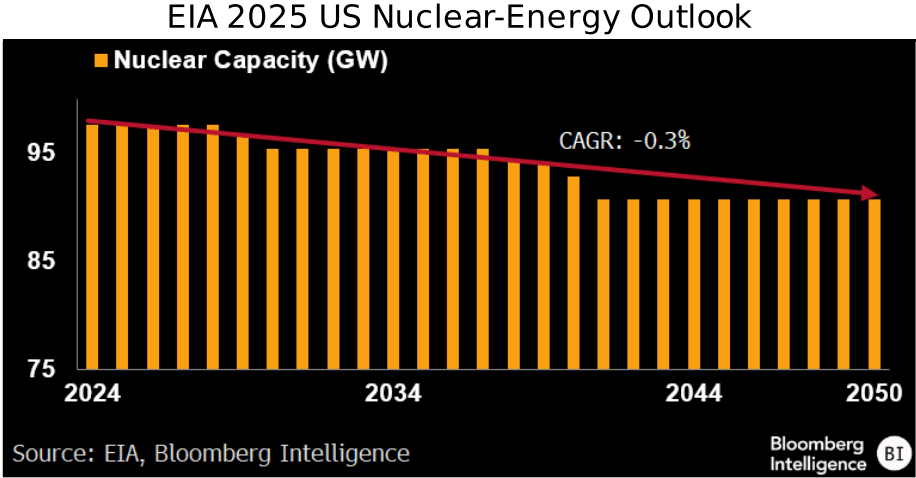

EIA may understate nuclear-capacity outlook

The EIA’s Annual Energy Outlook forecasts US nuclear capacity to drop to 90.7 GW in 2050 from 97.6 GW in 2024, driven by reactor retirements and assuming no plant upgrades — an implied 0.3% decline, compounded annually. In contrast, our scenario projects a 1.9% CAGR, fueled by demand for clean, reliable electricity from AI data centers and government support. Even in the EIA’s most optimistic case — with low oil and gas supply — net nuclear capacity would rise just 13.5 GW, for a 0.5% CAGR.

The Trump administration’s tax and spending law expanded IRA nuclear tax credits, while an executive order targets 400 GW by 2050 with accelerated permitting. Multiple states are considering new reactors. Constellation plans to pursue a plant in upstate New York, where it already operates three.

The data included in these materials are for illustrative purposes only. The BLOOMBERG TERMINAL service and Bloomberg data products (the “Services”) are owned and distributed by Bloomberg Finance L.P. (“BFLP”) except (i) in Argentina, Australia and certain jurisdictions in the Pacific Islands, Bermuda, China, India, Japan, Korea and New Zealand, where Bloomberg L.P. and its subsidiaries (“BLP”) distribute these products, and (ii) in Singapore and the jurisdictions serviced by Bloomberg’s Singapore office, where a subsidiary of BFLP distributes these products. BLP provides BFLP and its subsidiaries with global marketing and operational support and service. Certain features, functions, products and services are available only to sophisticated investors and only where permitted. BFLP, BLP and their affiliates do not guarantee the accuracy of prices or other information in the Services. Nothing in the Services shall constitute or be construed as an offering of financial instruments by BFLP, BLP or their affiliates, or as investment advice or recommendations by BFLP, BLP or their affiliates of an investment strategy or whether or not to “buy”, “sell” or “hold” an investment. Information available via the Services should not be considered as information sufficient upon which to base an investment decision. The following are trademarks and service marks of BFLP, a Delaware limited partnership, or its subsidiaries: BLOOMBERG, BLOOMBERG ANYWHERE, BLOOMBERG MARKETS, BLOOMBERG NEWS, BLOOMBERG PROFESSIONAL, BLOOMBERG TERMINAL and BLOOMBERG.COM. Absence of any trademark or service mark from this list does not waive Bloomberg’s intellectual property rights in that name, mark or logo. All rights reserved. © 2025 Bloomberg.