ARTICLE

Banks enter agentic AI era as tech race heats up, ROI in focus

Bloomberg Intelligence

This article was written by Bloomberg Intelligence Senior Industry Analyst Tomasz Noetzel and Industry Analyst Mar’Yana Vartsaba. It appeared first on the Bloomberg Terminal.

Agentic AI’s impact on bank productivity and efficiency is likely to exceed expectations from Bloomberg Intelligence’s late-2024 generative AI survey. Yet the path to full autonomy could take more than five years because of data governance, legacy systems and regulatory scrutiny. As deployment scales, ROI will emerge as the defining benchmark.

Banking prepares for agentic AI transformation

The next major shift in banking will come from autonomous agents that reason, plan and act, based on our conversations at June’s Money 20/20 conference. Agentic AI can handle complex workflows like resolving customer queries, optimizing account balances and executing transactions. Yet major technology upgrades are needed to realize this potential as well as robust deployment architectures and integration with core platforms. Data governance, legacy systems and regulatory scrutiny suggest the path to full autonomy could take more than five years.

Bloomberg Intelligence’s late-2024 survey highlights a growing divide between early AI adopters and laggards: nearly 50% of banks expect lower costs in the next 3-5 years (half predict a 5-10%drop), while more than 40% expect rising costs, with 15% of respondents by over 10%.

Evolution of AI in banking

AI is advancing rapidly in banking, evolving from narrow, task-specific tools to autonomous, decision-making systems. Traditional AI delivers efficiency in areas like fraud detection and credit scoring using structured data. Generative AI adds creative and flexible outputs — such as automated reporting — boosting productivity. Agentic AI represents a step-change: it combines reasoning, planning and execution using real-time, unstructured data, enabling end-to-end automation. Though still in early stages, its potential is transformative.

Banks that invest in the right data infrastructure, orchestration frameworks and governance can shift to fully autonomous operations from digital-support systems, redefining scale, speed and service in the next decade. Lloyds’ recent hire of a head of agentic AI signals growing momentum.

Commerzbank’s implied 120% ROI underpins AI push

Commerzbank’s projected €300 million in benefits from €140 million of AI investments implies are turn on investment (ROI) of nearly 120% — a figure underpinning its AI push. The expected gains, equal to about 25% of its guided profit growth through 2028, stem from cost efficiencies and improved fraud detection. Realizing them will depend heavily on upgrading IT platforms to fully leverage AI capabilities. Bloomberg Intelligence’s November 2024 survey found legacy systems still absorb around 60% of banks’ tech budgets, highlighting a key barrier.

As banks face mounting pressure to implement AI tools across functions, total cost and benefit analysis is becoming a central focus for management – and will be closely scrutinized by analysts assessing AI’s impact on underlying profitability.

ROI on AI may gain focus with agents push

Agentic AI — enabling more autonomous, end-to-end processes — may have an even greater impact on productivity, than at least a 5% lift from generative AI over the next 3-5 years expected by respondents in our November survey. Productivity increase gains importance amid deteriorating top-line prospects as rates fall.

As AI adoption advances, management focus is likely to shift from theoretical gains to measurable P&L impact, specifically, how freed-up resources are redeployed and how returns on AI investments are tracked. With rising regulatory scrutiny and competitive pressure, realizing tangible ROI from AI could become a central performance metric.

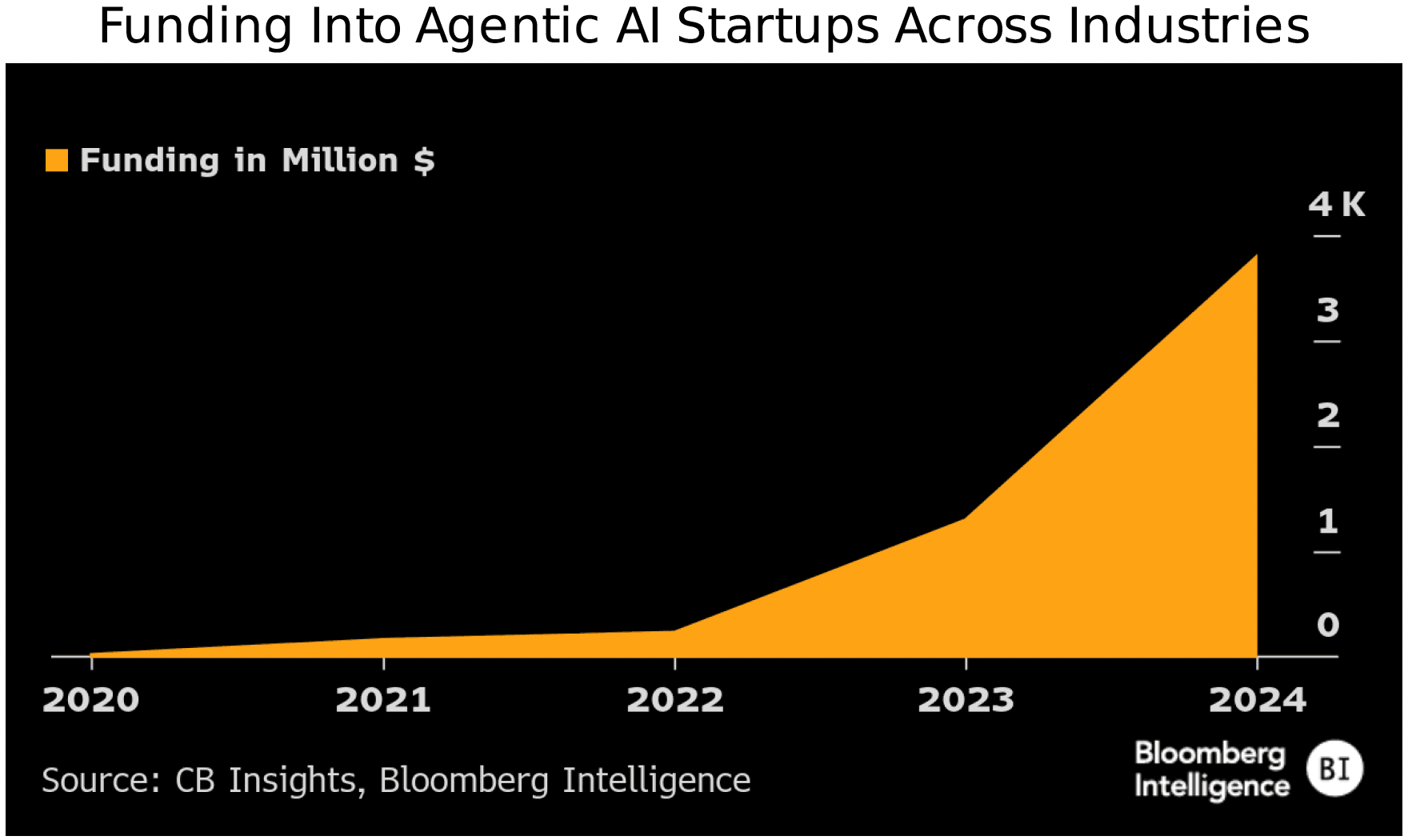

Agentic AI funding on the rise after tripling in 2024

The potential benefits of agentic AI are driving a surge in funding, with even more capital likely as adoption scales. In 2024 alone, funding of AI agent startups nearly tripled to $3.8 billion across 162 deals from $1.3 billion the year before. Mentions of AI agents — acting autonomously in areas like lead generation, compliance and operations — on earnings calls rose 4x in 4Q24, according to CB Insights, reflecting rising executive focus. Over half the companies building agent infrastructure or applications were founded since 2023, signaling a young but fast-growing market.

Autonomous agents may power smarter lending

In an agentic AI loan approval system, specialized autonomous agents would collaborate to automate the process end-to-end. A data aggregation agent collects financial data, which feeds into a credit scoring agent using predictive analytics to assess creditworthiness. A risk assessment agent evaluates income and market volatility, while a decision agent approves or denies the loan with regulatory rationale. A customer engagement agent then tailors terms and next steps. This agent-based structure enables scalable, efficient and auditable automation-highlighting investment opportunities in AI orchestration, lending infrastructure and vertical financial AI platforms.

IT departments can become next HR departments

Agentic AI may start as a single-agent task this year, getting more complex and potentially interacting with each other next year overseen by human employees, according to presentations at Money 20/20. Broader adoption can lead to future agentic factories where humans operate agents and measure their success. It will also potentially transform the workforce, making employees more multidisciplinary with the use of AI. IT departments may take on the role of HR, overseeing onboarding and learning, governing digital agents and their interaction with each other and with humans. These changes will transform the workforce, with more repetitive task roles possibly disappearing, but more Al-centric roles created.

Agentic AI’s impact on jobs a key unknown

Job elimination is one of the main concerns around agentic AI, especially in 2-3 years, as it opens up new possibilities for analyzing and predicting more complex, multi-step tasks, while generative AI can replace jobs that are based on repetitive tasks. In BI’s November survey, respondents expected only about 3% average net job cuts from AI over the next 3-5 years, equal to about 200,000 banking positions across the 92 banks in our peer group. About 60% of respondents forecast a decrease in total workforce over the period.

Banks may have leaner workforce over time, but jobs will also be created that are tied to overseeing and running digital agents, shifting workforce composition and redefining existing roles. Agentic AI may complement rather than replace traditional roles freeing up time for more complex tasks.

The data included in these materials are for illustrative purposes only. The BLOOMBERG TERMINAL service and Bloomberg data products (the “Services”) are owned and distributed by Bloomberg Finance L.P. (“BFLP”) except (i) in Argentina, Australia and certain jurisdictions in the Pacific Islands, Bermuda, China, India, Japan, Korea and New Zealand, where Bloomberg L.P. and its subsidiaries (“BLP”) distribute these products, and (ii) in Singapore and the jurisdictions serviced by Bloomberg’s Singapore office, where a subsidiary of BFLP distributes these products. BLP provides BFLP and its subsidiaries with global marketing and operational support and service. Certain features, functions, products and services are available only to sophisticated investors and only where permitted. BFLP, BLP and their affiliates do not guarantee the accuracy of prices or other information in the Services. Nothing in the Services shall constitute or be construed as an offering of financial instruments by BFLP, BLP or their affiliates, or as investment advice or recommendations by BFLP, BLP or their affiliates of an investment strategy or whether or not to “buy”, “sell” or “hold” an investment. Information available via the Services should not be considered as information sufficient upon which to base an investment decision. The following are trademarks and service marks of BFLP, a Delaware limited partnership, or its subsidiaries: BLOOMBERG, BLOOMBERG ANYWHERE, BLOOMBERG MARKETS, BLOOMBERG NEWS, BLOOMBERG PROFESSIONAL, BLOOMBERG TERMINAL and BLOOMBERG.COM. Absence of any trademark or service mark from this list does not waive Bloomberg’s intellectual property rights in that name, mark or logo. All rights reserved. © 2025 Bloomberg.