ARTICLE

Can the AI workhorses carry the world’s markets – yet again?

Bloomberg Intelligence

This article was written by Bloomberg Intelligence Equity Strategist Gillian Wolff and Senior Associate Analyst Nathaniel T Welnhofer. It appeared first on the Bloomberg Terminal.

The world’s biggest stocks enter earnings season with rising optimism — and one all-too-familiar question: Can artificial intelligence keep doing the heavy lifting, as it has for two years? Earnings forecasts for 3Q have improved broadly, yet the strength still flows through a narrow band of tech giants. The setup echoes early 2025, when hopes for a broader profit recovery faded and AI only grew more dominant. That long-promised convergence? Try 2026. With sentiment buoyant and the bar for earnings higher after an easy 2Q, this season may reveal whether global markets are finally broadening — or still leaning on the same few digital giants.

BI’s Global Bellwethers, a group of 133 of the world’s largest companies across markets and sectors, will offer the first real test of how long AI can keep carrying the load.

Global relief rally faces test as earnings expectations rise

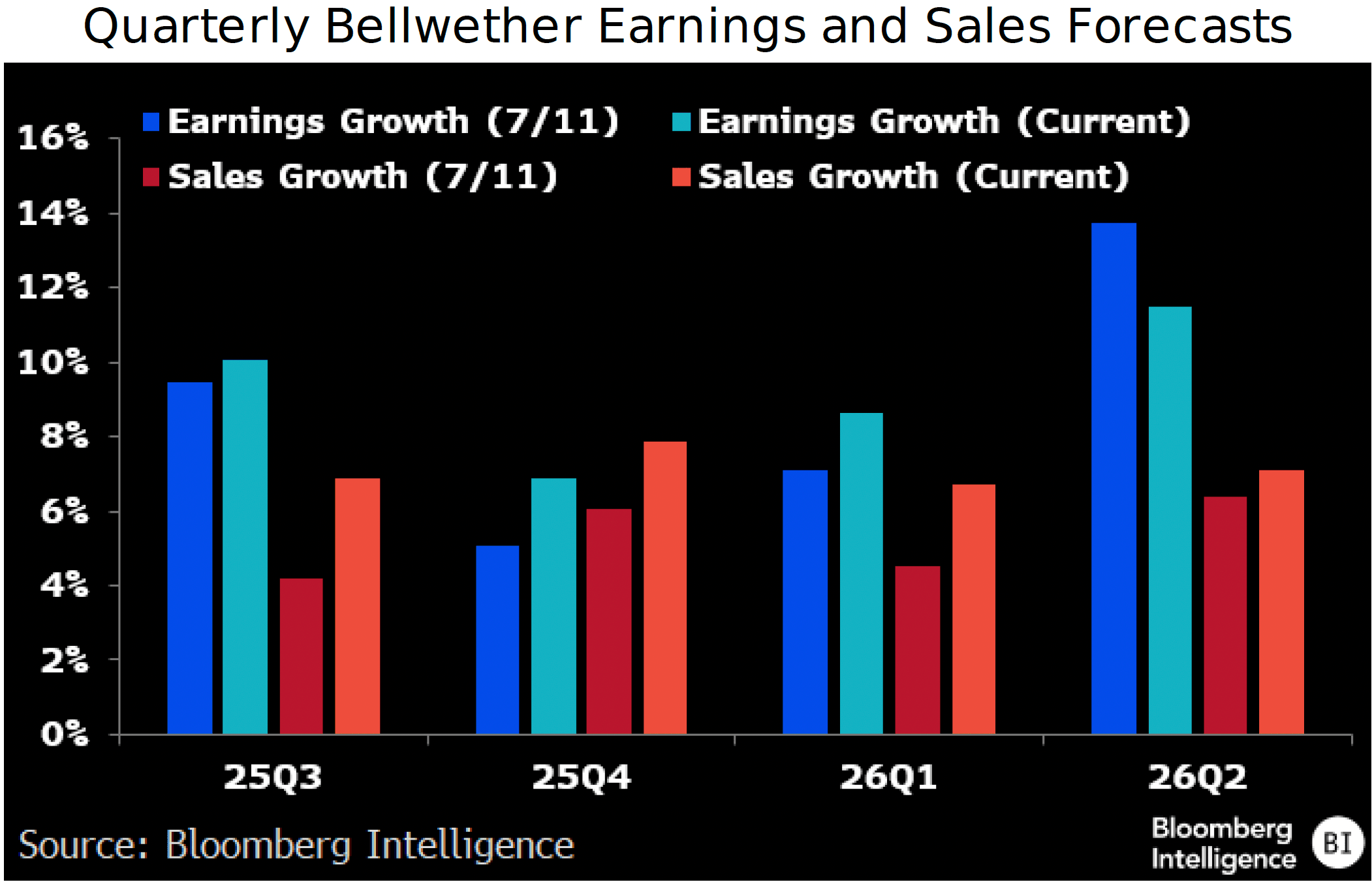

Global earnings and sales estimates have climbed over the past three months, helping fuel the equity market’s sharp rebound. The revisions, however, appear more the market’s sigh of relief than a surge of confidence — reassured that a full-blown trade war hasn’t erupted, but not convinced that fundamentals are entirely out of the woods. Despite the upgrades, forecasts remain below levels seen at the start of the year, underscoring how the persistent threat of escalating trade tensions continues to weigh on sentiment and limit the upside for corporate fundamentals. Markets surged as companies easily beat low 2Q expectations, but 3Q forecasts are higher, as 4Q25 and 1Q26 keep improving. As the bar lifts, outsized earnings beats — and the strong market gains that followed last season — may be harder to replicate.

Non-AI earnings catch-up delayed as AI keeps surging

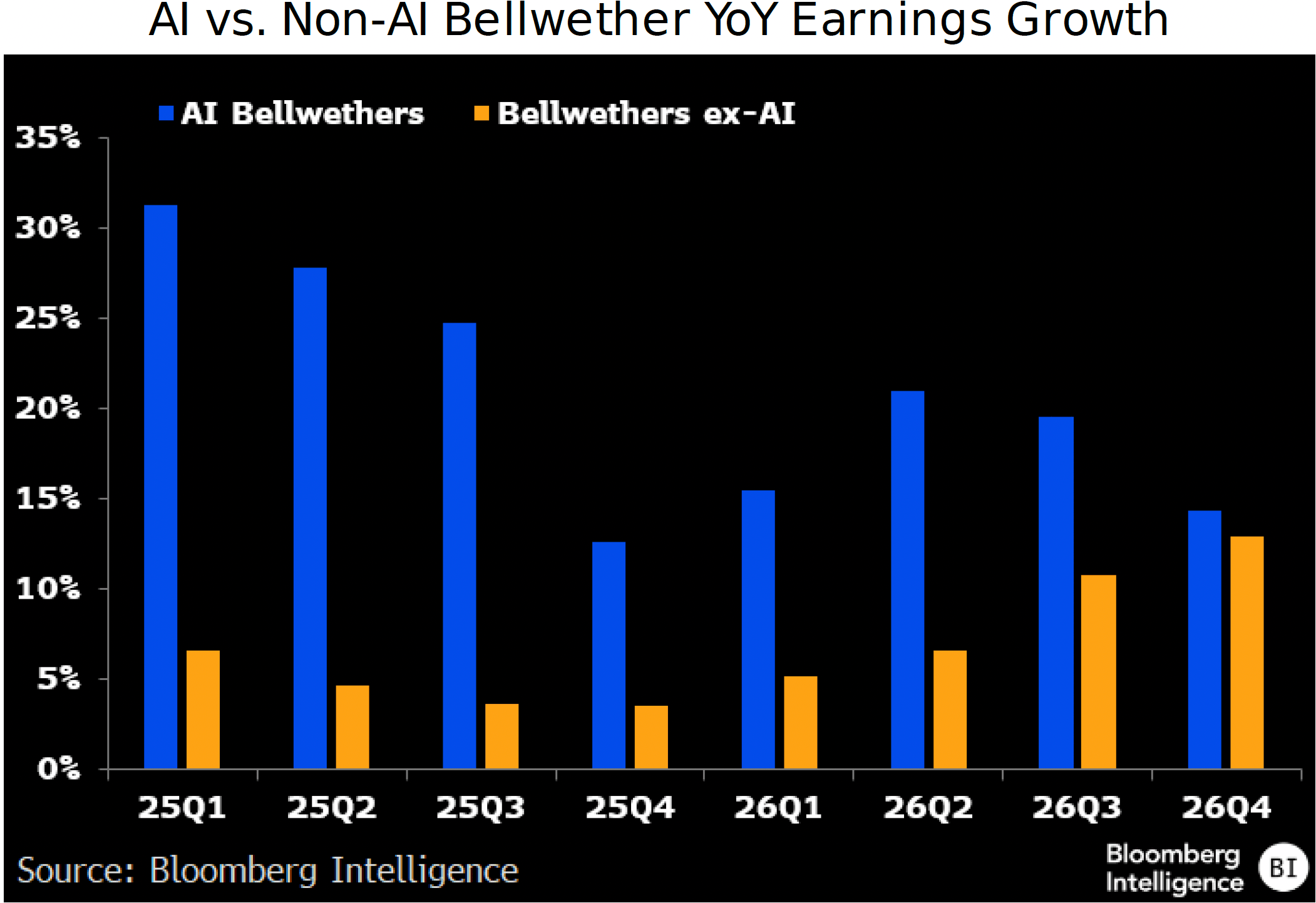

At the start of 2025, consensus worried the AI trade had overheated, with 2024’s comparisons would be too tough to beat. Many analysts expecting non-AI earnings growth to catch up by year-end as AI momentum cooled. Those concerns proved misplaced: AI firms blew past expectations in the first half, while forecasts for non-AI companies were cut amid trade tensions and softer global demand. As AI comparables grow even tougher, the convergence thesis has shifted to 2026, with Wall Street again questioning whether AI can sustain its pace into the next year. Now, both AI and non-AI earnings growth are set to cool in late 2025, but AI should remain more resilient, supported by capital investment and productivity demand. By 2026, non-AI earnings growth is expected to accelerate as AI moderates, narrowing the gap steadily.

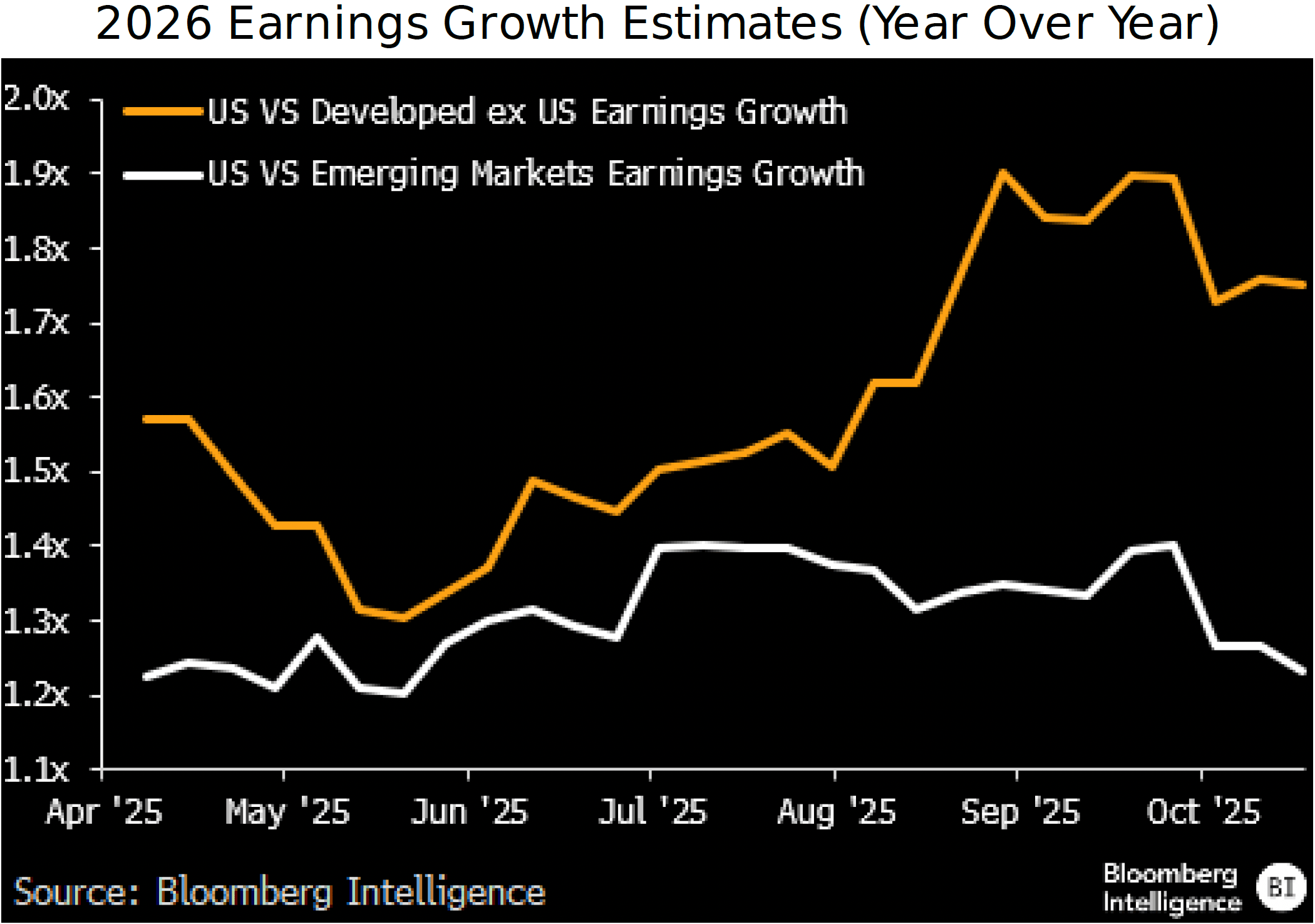

US earnings advantage narrows amid global rebound for 2026

After strengthening for much of the year, the US earnings outlook for 2026 has started to lose ground to other markets. Tariff tensions initially boosted US forecasts, but upgrades abroad the past month have narrowed the gap, raising doubts over how much the US ultimately stands to gain from the new trade regime. In April, US growth was expected to outpace emerging markets by 1.23x (13.5% vs. 11.3%) and other developed markets by 1.57x (8.6%). After a volatile summer of tariff escalation and demand uncertainty, those ratios widened to 1.34x and 1.9x. They’ve since narrowed to 1.23x and 1.75x — leaving the US no better positioned versus emerging markets than before the trade war began. Developed markets outside the US, still more reliant on American remain at greater risk if global growth stumbles.

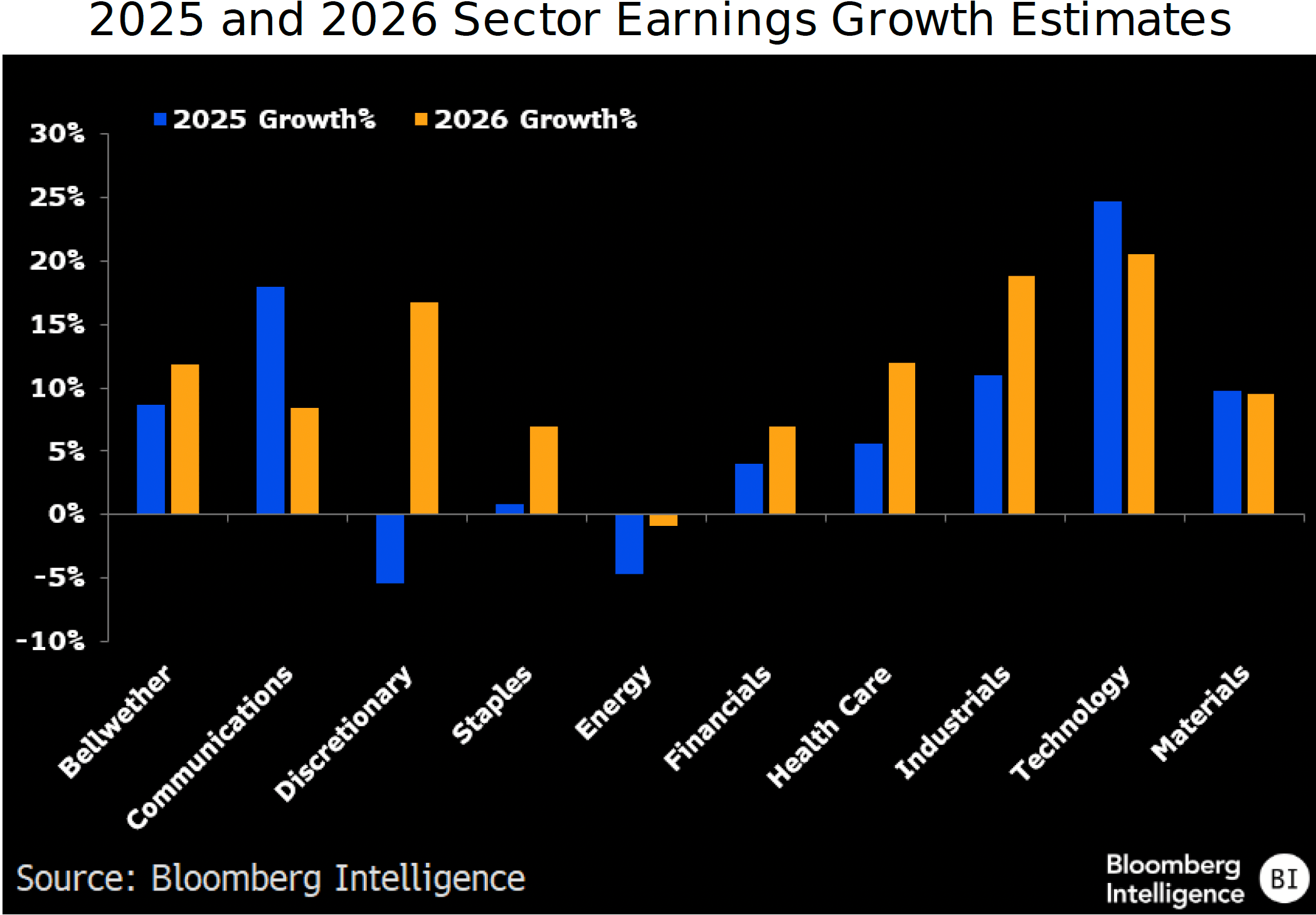

2026 earnings outlook brightens as sectors step up beyond tech

Sectors outside tech are expected to narrow the earnings-growth gap with 2025’s leader in 2026, offsetting a potential slowdown in the global favorite and keeping the broader equity outlook on solid footing. Tech is set to post the strongest 2025 earnings gain — up 24.6% after 27% in 2024 — but ease to 20.5% in 2026. Despite the slowdown, tech will likely remain the fastest-growing sector in ’26, albeit by a slimmer margin. All other major sectors except communications (due to US tech-adjacent giants Alphabet and Meta) are set for faster growth. Discretionary is set to lead the rebound, flipping from a 5.4% contraction in 2025 to 16.8% growth in 2026. Staples, financials, health care and industrial earnings growth is set to accelerate, while energy’s decline moderates and materials hold steady post a strong 2025.

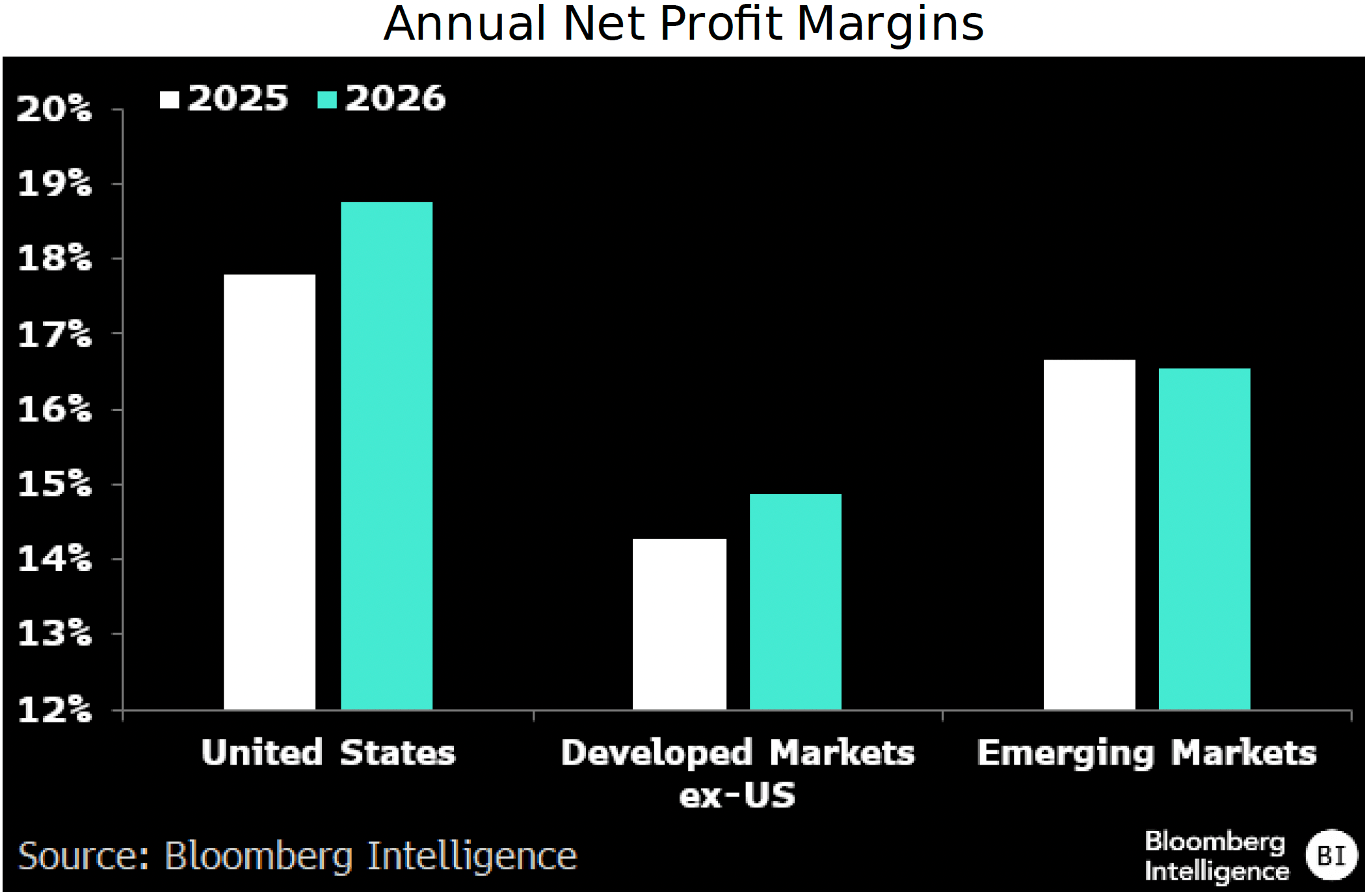

AI boost helps US margins to keep outpacing global peers

The US’s relatively strong margins — often cited to justify its valuation premium over global peers — are expected to extend their lead through 2026, helped by high-margin AI exposure that’s offsetting ongoing tariff headwinds. US bellwether company margins are projected to rise67 bps to 17.8% in 2025 and another 95 bps next year, up to 18.8%. Emerging-market bellwethers, meanwhile, are poised to gain 127 bps in 2025 to 16.7% before slipping 13 bps in 2026. Meanwhile, developed ex-US peers could drop 36 bps from 2024 to 14.3% in 2025, before a modest recovery off14.9% in 2026.

AI bellwether margins are projected to surge 222 bps from 2024 to 2026 (24.7% to 26.9%), more than four times the 51 bps gain for non-AI firms (14% to 14.5%) — driving the US and EM bellwethers margin lead over developed markets outside the US.

The data included in these materials are for illustrative purposes only. The BLOOMBERG TERMINAL service and Bloomberg data products (the “Services”) are owned and distributed by Bloomberg Finance L.P. (“BFLP”) except (i) in Argentina, Australia and certain jurisdictions in the Pacific Islands, Bermuda, China, India, Japan, Korea and New Zealand, where Bloomberg L.P. and its subsidiaries (“BLP”) distribute these products, and (ii) in Singapore and the jurisdictions serviced by Bloomberg’s Singapore office, where a subsidiary of BFLP distributes these products. BLP provides BFLP and its subsidiaries with global marketing and operational support and service. Certain features, functions, products and services are available only to sophisticated investors and only where permitted. BFLP, BLP and their affiliates do not guarantee the accuracy of prices or other information in the Services. Nothing in the Services shall constitute or be construed as an offering of financial instruments by BFLP, BLP or their affiliates, or as investment advice or recommendations by BFLP, BLP or their affiliates of an investment strategy or whether or not to “buy”, “sell” or “hold” an investment. Information available via the Services should not be considered as information sufficient upon which to base an investment decision. The following are trademarks and service marks of BFLP, a Delaware limited partnership, or its subsidiaries: BLOOMBERG, BLOOMBERG ANYWHERE, BLOOMBERG MARKETS, BLOOMBERG NEWS, BLOOMBERG PROFESSIONAL, BLOOMBERG TERMINAL and BLOOMBERG.COM. Absence of any trademark or service mark from this list does not waive Bloomberg’s intellectual property rights in that name, mark or logo.

All rights reserved. © 2025 Bloomberg.