ARTICLE

DeepSeek’s updated model showcases China’s core AI competency

Bloomberg Intelligence

This article was written by Bloomberg Intelligence Senior Industry Analyst Robert Lea and Associate Analyst Jasmine Lyu. It appeared first on the Bloomberg Terminal.

DeepSeek’s updated R1 reasoning AI model helped propel the Chinese firm to fourth place in LiveBench’s global large language model performance rankings in May, amid a two-horse race between China and the US for global dominance. China’s tech platforms continue to narrow the gap with DeepSeek domestically, though the sector’s commodity-like characteristics remain a barrier to monetization.

China’s top tech platforms to narrow gap in AI

US firms continued to dominate the global AI large language model (LLM) performance rankings in May, in what has become a two-horse race with China. The continued absence of European and Indian companies in the top 15 is notable, especially given the latter’s strength in software services. Continued efforts by China’s large tech platforms to develop reasoning models should ultimately help them bridge the gap with DeepSeek.

Although we expect low technical barriers to entry in AI software to facilitate more players entering, deep-pocketed large tech platforms should ultimately dominate, given their ample resources and established ecosystems. However, the sector’s monetization outlook looks to remain challenging, as firms continue in their quest to develop killer AI apps.

DeepSeek rises up global AI LLM rankings in may

DeepSeek and Alibaba took four of the top 15 positions on LiveBench’s global LLM performance rankings in May, up from two slots in April. Though OpenAI, Anthropic and Google continued to lead the sector, DeepSeek overtook xAI to reach the number four spot globally following the release of its enhanced R1 reasoning model, which ranked seventh overall. The new model performed well in data analysis, math and reasoning, faring less well in coding and language.

While the US continued to dominate the global LLM performance league table, the volatile nature of the rankings reflects the fast-changing competitive dynamics and rapid pace of technological progress in the global AI sector.

Tech platforms progress as startup momentum wanes

Chinese LLMs continued to rank well on OpenCompass’s benchmark during May, though Google’s Gemini model jumped ahead of counterparts from ByteDance, Alibaba and DeepSeek to become the chart topper. Ten of the top 15 models came from Chinese firms — up from nine in January — showcasing China’s growing global influence.

The rising prominence of reasoning models from Alibaba and ByteDance in recent months highlights the progress China’s large tech platforms made to catch up with DeepSeek. The high ranking of several startups is a testament to their technical competence, though it also highlights the sector’s low barriers to entry. The limited ability of China’s leading firms to build a defensive moat around their businesses poses a significant challenge to their monetization outlook.

Chinese firms maintain LLM pricing advantage

China’s AI software firms look set to maintain a significant cost advantage, allowing them to undercut the pricing of most international rivals, after US export restrictions on Nvidia chips prompted a shift to smaller, computationally efficient AI models. Output token pricing onDeepSeek’s models was just $2.19 at the end of May, an approximate 78% discount to GPT-4o and 85% cheaper than the output pricing at Claude Sonnet 4.

The ability for China’s AI firms to maintain their competitive performance at a lower cost highlights the country’s core competency in “cost-down.” Software enhancements and the transition to lower-power, locally sourced AI accelerator chips from Huawei should allow China’sAI firms to deliver further cost reductions through 2025.

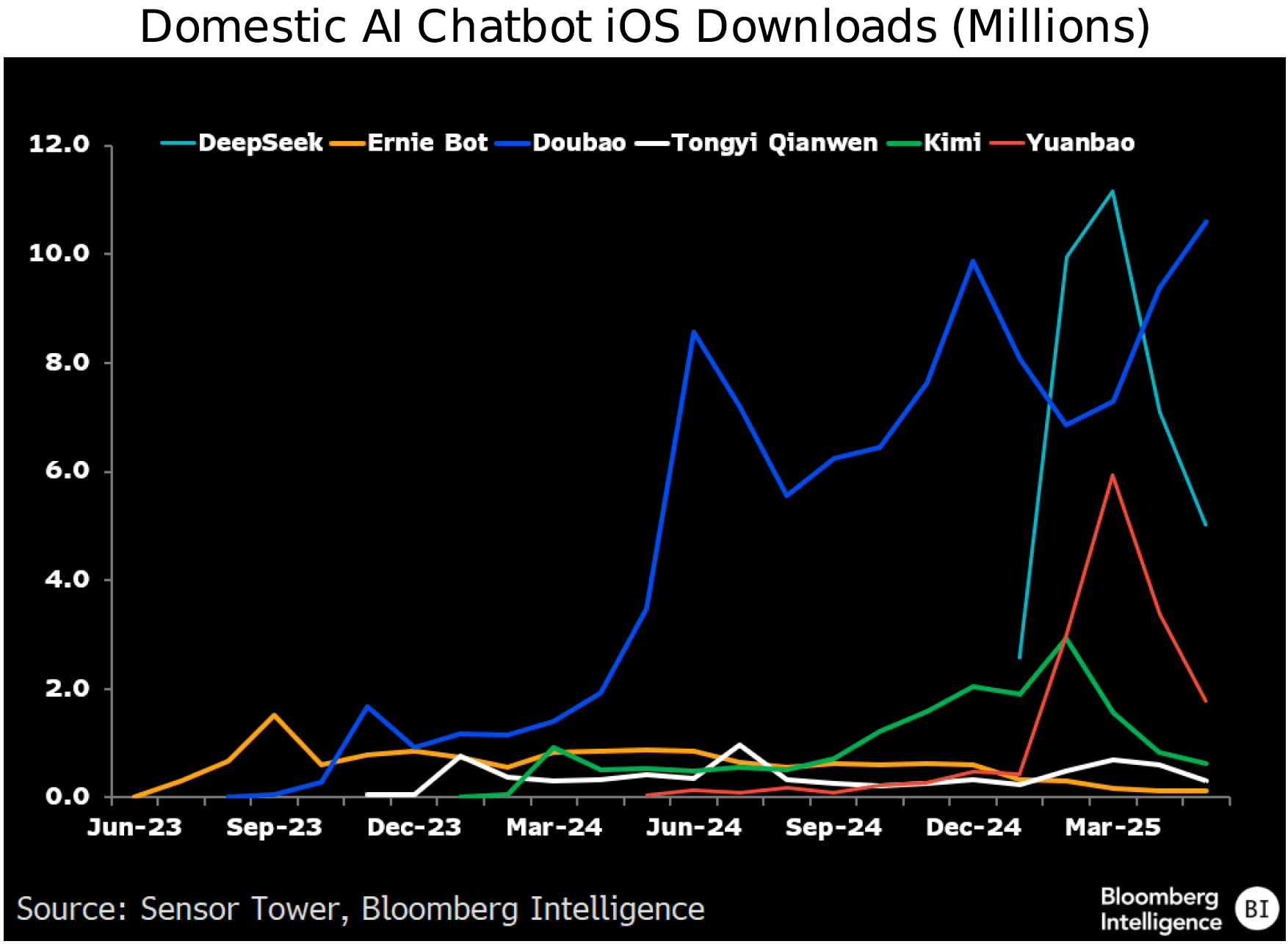

Doubao remains top downloaded chatbot

Doubao extended its lead as China’s most-downloaded AI chatbot in May after claiming the top spot in April, following upgrades to its image-generation and video-chat features. Monthly downloads for the tool rose 13% to 10.6 million, exceeding DeepSeek’s 5 million, which were down 29% sequentially. Downloads on Tencent’s Yuanbao app fell 47%, following the integration of DeepSeek’s model in February. Kimi downloads recorded a 24% sequential drop, marking the third consecutive month of decline.

Demand for Baidu’s once sector-leading tools remained suppressed, highlighting its first-mover advantage in the face of rising competition in the sector. Monthly downloads on Ernie Bot peaked in September 2023 at 1.5 million, one month after its release, and have declined 81% over the past six months.

AI monetization outlook remains challenged

The monetization outlook for China’s AI apps and chatbots remains highly challenged, reflecting the low level of product differentiation in the market and consumer indifference. Doubao, DeepSeek and Yuanbao — three of the most downloaded AI apps during May — remained free of charge. ByteDance’s Jimeng AI text-to-video app took in a mere $758,658 in receipts during the month, which it generated from a modest active user base of just 6.6 million.

Alibaba’s Quark app generated nearly $7 million of sales in May, but this primarily came from associated advertising and cloud-storage services. Basic access to Quark, a leading Chinese AI office assistant, remains free, with users charged a fee for premium access.

China AI firms face long, winding road to profit

China’s AI firms are unlikely to generate significant revenue in the consumer sector during the next three years given the lack of “killer AI apps” and the predominance of free-to-access products in the market. Intense competition in China’s fragmented software sector presents an additional challenge to the sector’s monetization efforts, making it difficult for firms to expand their user bases. Although a sector shakeout would help firms scale more easily, a consolidation currently looks unlikely given the abundance of large tech platforms and well-funded startups active in the market.

Putting the sector on a sustainable profit footing would require a cooling of competitive pressures and a more rational approach to pricing. This will be hard to achieve while many firms remain willing to sacrifice profit for market share.

The data included in these materials are for illustrative purposes only. The BLOOMBERG TERMINAL service and Bloomberg data products (the “Services”) are owned and distributed by Bloomberg Finance L.P. (“BFLP”) except (i) in Argentina, Australia and certain jurisdictions in the Pacific Islands, Bermuda, China, India, Japan, Korea and New Zealand, where Bloomberg L.P. and its subsidiaries (“BLP”) distribute these products, and (ii) in Singapore and the jurisdictions serviced by Bloomberg’s Singapore office, where a subsidiary of BFLP distributes these products. BLP provides BFLP and its subsidiaries with global marketing and operational support and service. Certain features, functions, products and services are available only to sophisticated investors and only where permitted. BFLP, BLP and their affiliates do not guarantee the accuracy of prices or other information in the Services. Nothing in the Services shall constitute or be construed as an offering of financial instruments by BFLP, BLP or their affiliates, or as investment advice or recommendations by BFLP, BLP or their affiliates of an investment strategy or whether or not to “buy”, “sell” or “hold” an investment. Information available via the Services should not be considered as information sufficient upon which to base an investment decision. The following are trademarks and service marks of BFLP, a Delaware limited partnership, or its subsidiaries: BLOOMBERG, BLOOMBERG ANYWHERE, BLOOMBERG MARKETS, BLOOMBERG NEWS, BLOOMBERG PROFESSIONAL, BLOOMBERG TERMINAL and BLOOMBERG.COM. Absence of any trademark or service mark from this list does not waive Bloomberg’s intellectual property rights in that name, mark or logo. All rights reserved. © 2025 Bloomberg.