Bloomberg Intelligence

This article was written by Bloomberg Intelligence Market Structure Analyst Nicholas Phillips and Senior Associate Analyst Deniz Besiroglu. It appeared first on the Bloomberg Terminal.

Buyside starts to deploy AI, not yet for execution: BI study

Buyside firms have begun using artificial intelligence to support investment analysis and boost operational efficiency, but aren’t ready yet to hand over execution decisions even as some test AI in broker algorithms. European traders are stepping up use of algo wheels — tools that automate broker selection for trades to reduce bias and improve performance. Algorithmic execution is gaining importance as a core component of broker services, with each fund using 7.8 algo brokers on average, though most trades remain concentrated with the top two providers.

Disclaimer: Bloomberg LP, the parent of Bloomberg Intelligence, offers one or more of the products or services identified in this research. Any views in this note are those of the author and Bloomberg Intelligence and don’t necessarily reflect those of Bloomberg LP.

AI use in trading is largely experimental; EMS competition rises

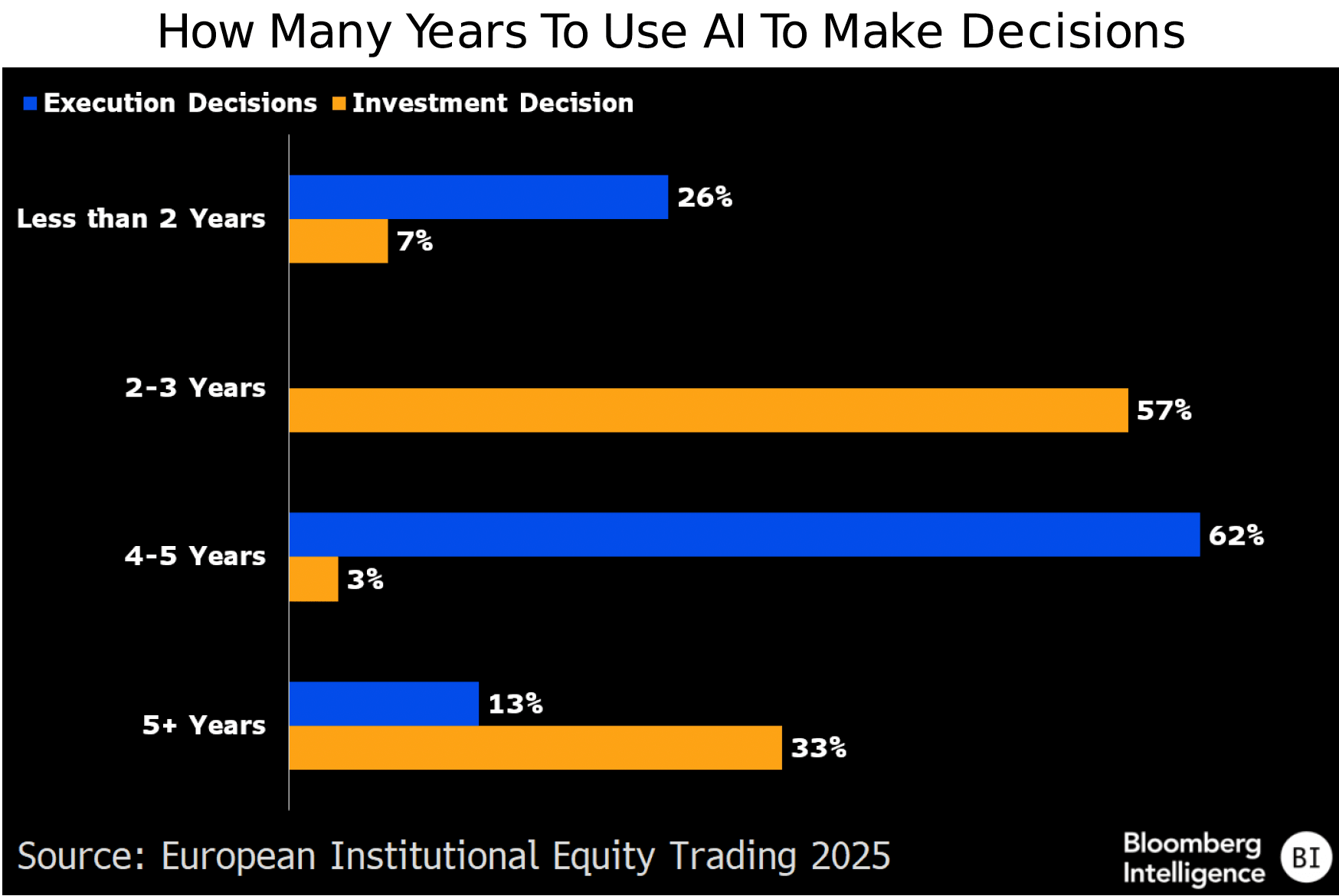

Bloomberg AIM and EMSX remain the top order- and execution-management systems but face rising competition, especially in EMS, according to our 2025 European Institutional Equity Trading Study. AI adoption on trading desks is still cautious, focused mainly on analysis and operations. European buyside traders see execution decisions as more suitable for near-term AI use than investment decision making, which is expected to take longer.

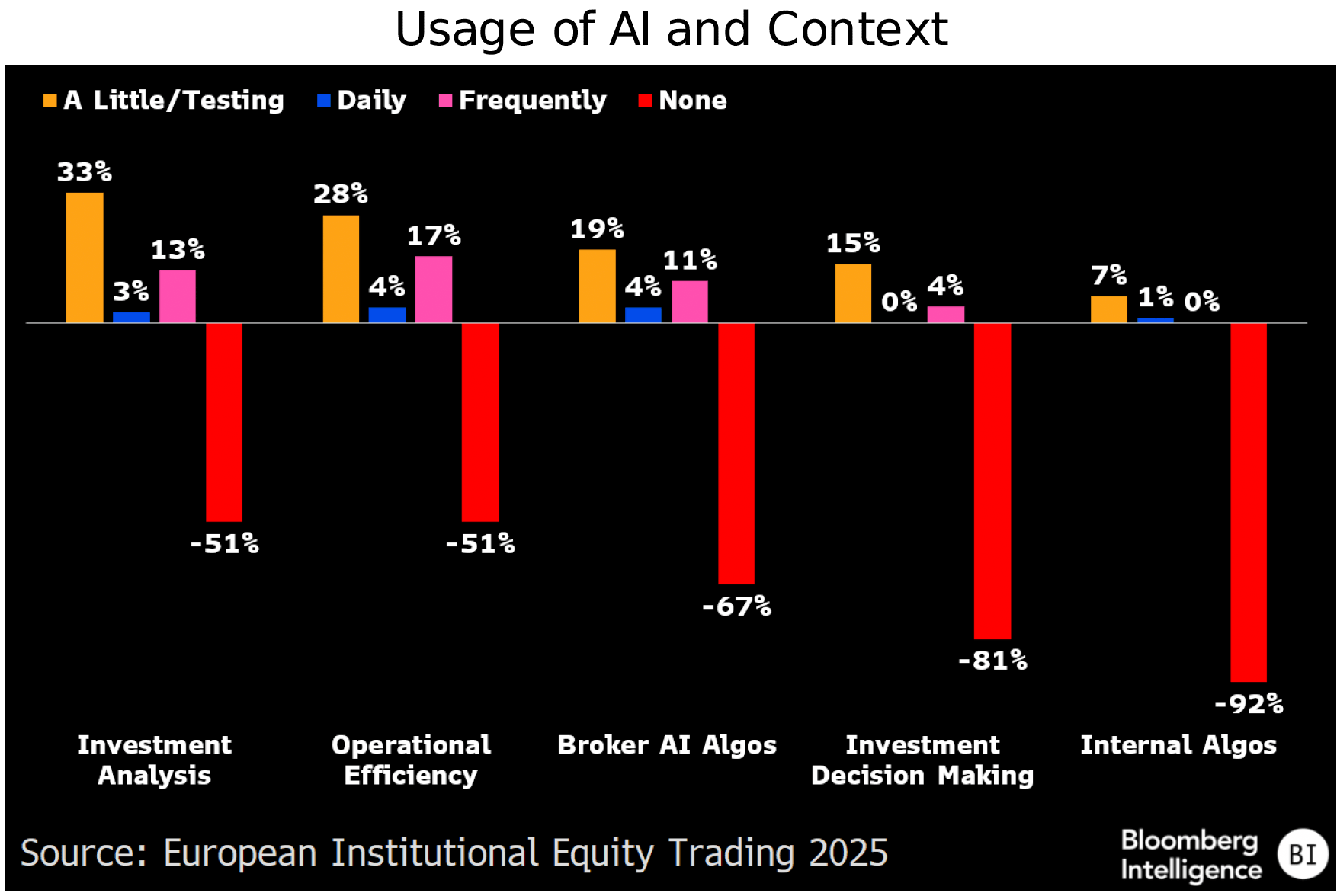

AI use on trading desks still largely experimental

Data from our 2025 European Institutional Equity Trading Study shows AI adoption on trading desks remains limited and mostly in testing. Most buyside respondents report no use of AI in key areas, such as internal algos (92%), investment decision making (81%) and broker algos (67%). The highest AI adoption rates were in investment analysis (33%) and operational efficiency (28%), but even there, use is largely experimental. Frequent or daily AI use remains rare, suggesting that while interest in AI is growing, institutional trading workflows are still in early-stage adoption.

AI seen coming to execution before investment decisions

European buyside traders anticipate faster AI adoption in execution than in investment decision-making, with 62% expecting the former within 4-5 years, while only 13% say it will take longer. For investment decisions, 57% forecast adoption in 2-3 years, but a notable 33% expect it to take more than five. Conversely, only 26% report using AI in execution (for less than two years) and just 7% use it in investment, underlining a clear gap. Traders appear more comfortable introducing AI in execution workflows, where performance is easier to monitor and control, than for investment decisions.

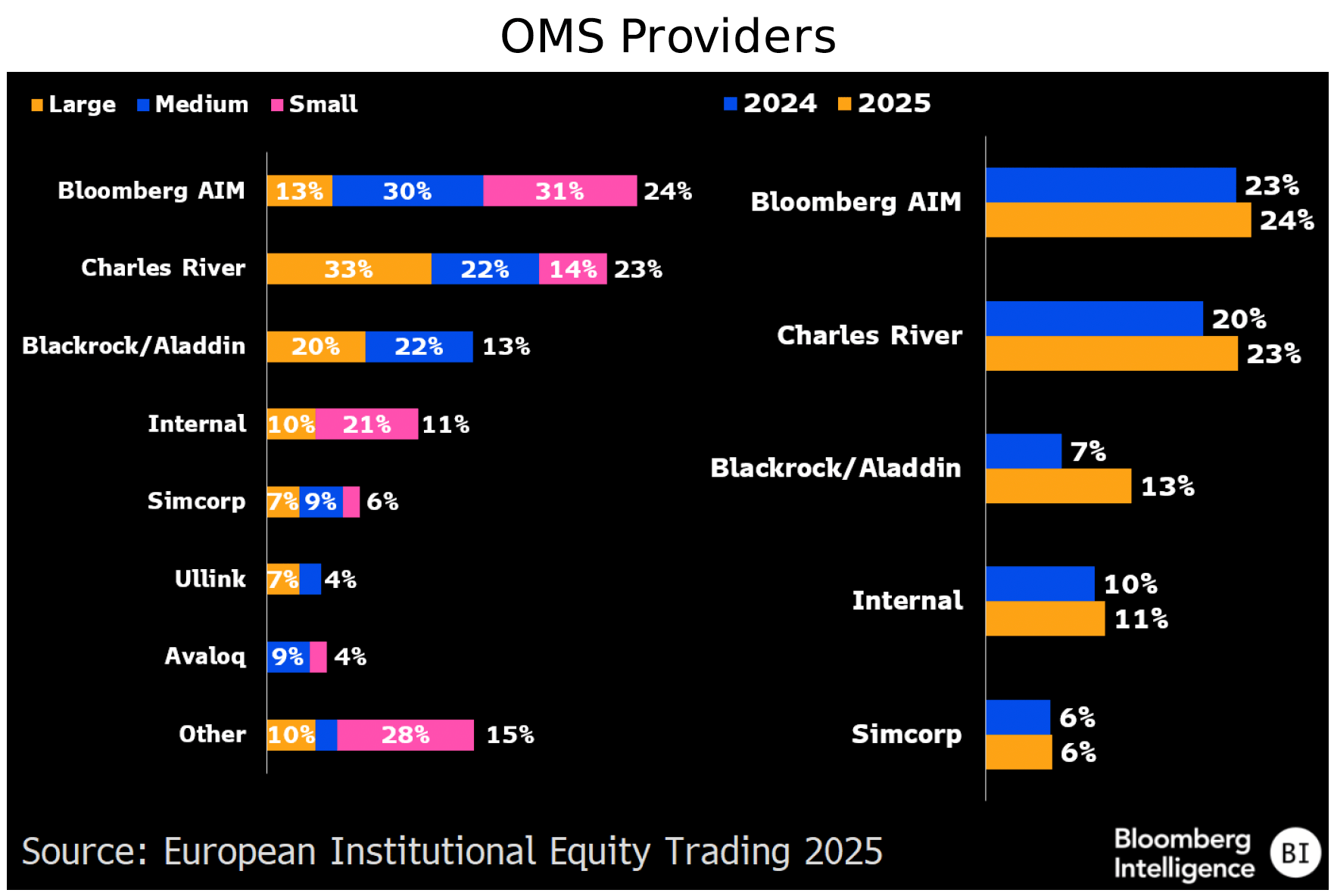

Bloomberg still top OMS, Charles River close behind

Bloomberg AIM remains the most widely used order-management system (OMS) among European buyside traders, holding a 24% share across all firm sizes, a 1 percentage point increase from last year. Charles River follows closely at 23%, narrowing last year’s gap of 3 percentage points. Charles River continues to dominate market share among large firms (33%), while Bloomberg AIM leads among medium (30%) and small (31%) firms. Notably, internal systems maintain a modest foothold at 11% and usage of Blackrock’s Aladdin has grown slightly to 13%.

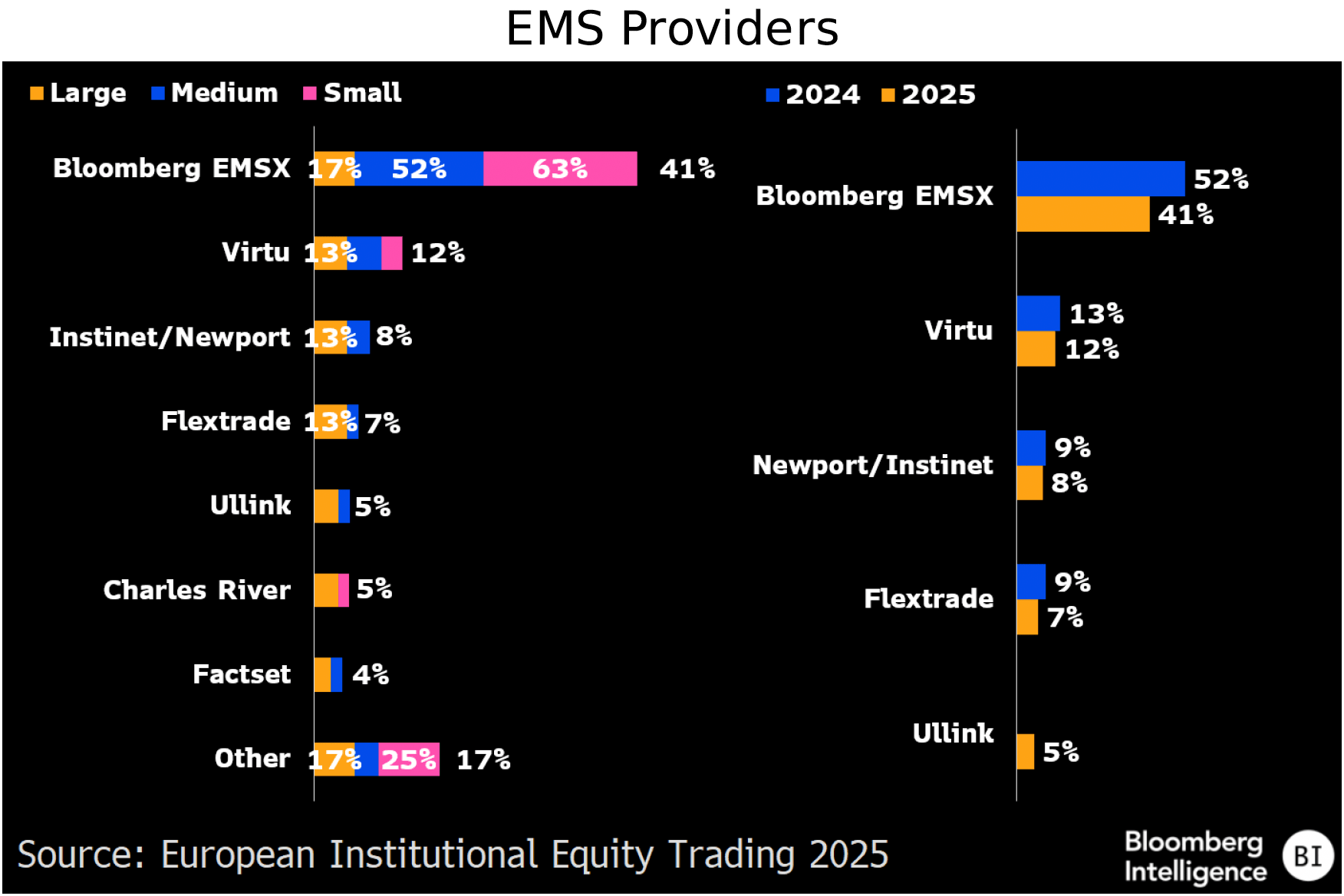

Top EMS providers lose share as market diversifies

Bloomberg EMSX remains the most-used execution management system (EMS) among European buyside firms in our study, with a 41% share, down from 52% last year. EMSX still leads among small (63%) and medium-sized firms (52%). Virtu, FlexTrade and Instinet’s Newport each hold 13% share among large companies, with their combined footprint capturing more than a third of the market. Overall, the top four EMS providers lost a combined 15% share year over year as Bloomberg alone shed 11%. This shift points to rising adoption of emerging platforms, with Ullink ranking fifth in this year’s study.

EET 2025 TCA Trends

Europe funds embrace algo wheels, consolidate brokers’ flows

Funds in Bloomberg’s 2025 European Institutional Equity Trading Study use an average of 7.9 providers for algorithmic order execution, but half of that flow is concentrated in just two brokers. Algorithm wheels, which automate order routing across broker strategies, continue to gain traction as funds streamline execution and performance tracking. We also note the rising importance of algorithmic execution as a core component of broker services.

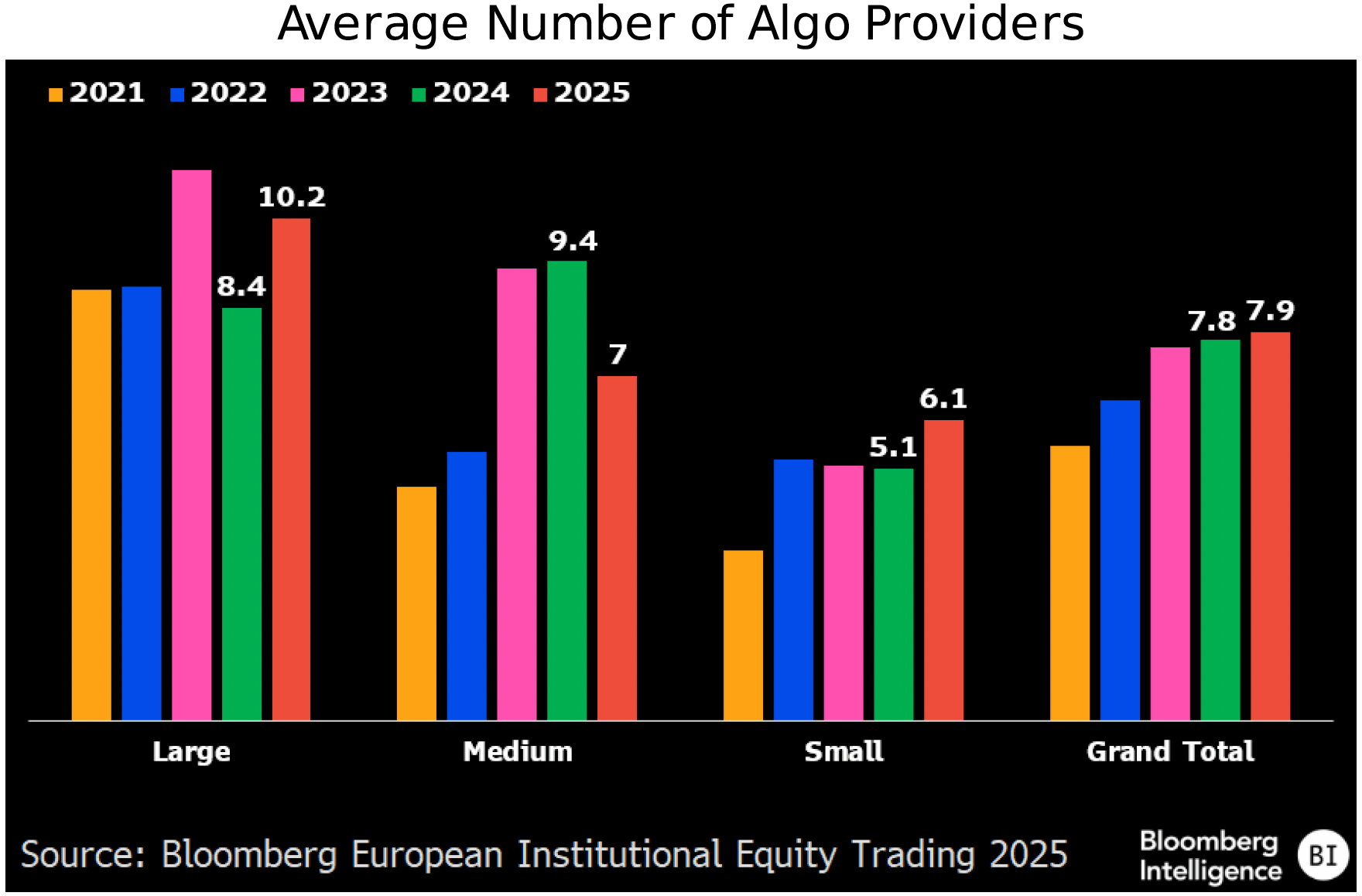

Large funds boost number of algo providers; midsized cut back

Large European buyside funds increased their use of algorithmic-trading providers by 21% year over year, averaging 10.2 providers in 2025 vs. 8.4 in 2024, according to our European Institutional Equity Trading Study. The rise may reflect efforts to boost liquidity access. Midsized funds cut back, trimming average broker use to 7 from 9.4, while smaller funds increased slightly to 6.1 from 5.1. Overall, average provider use ticked up to 7.9 from 7.8.

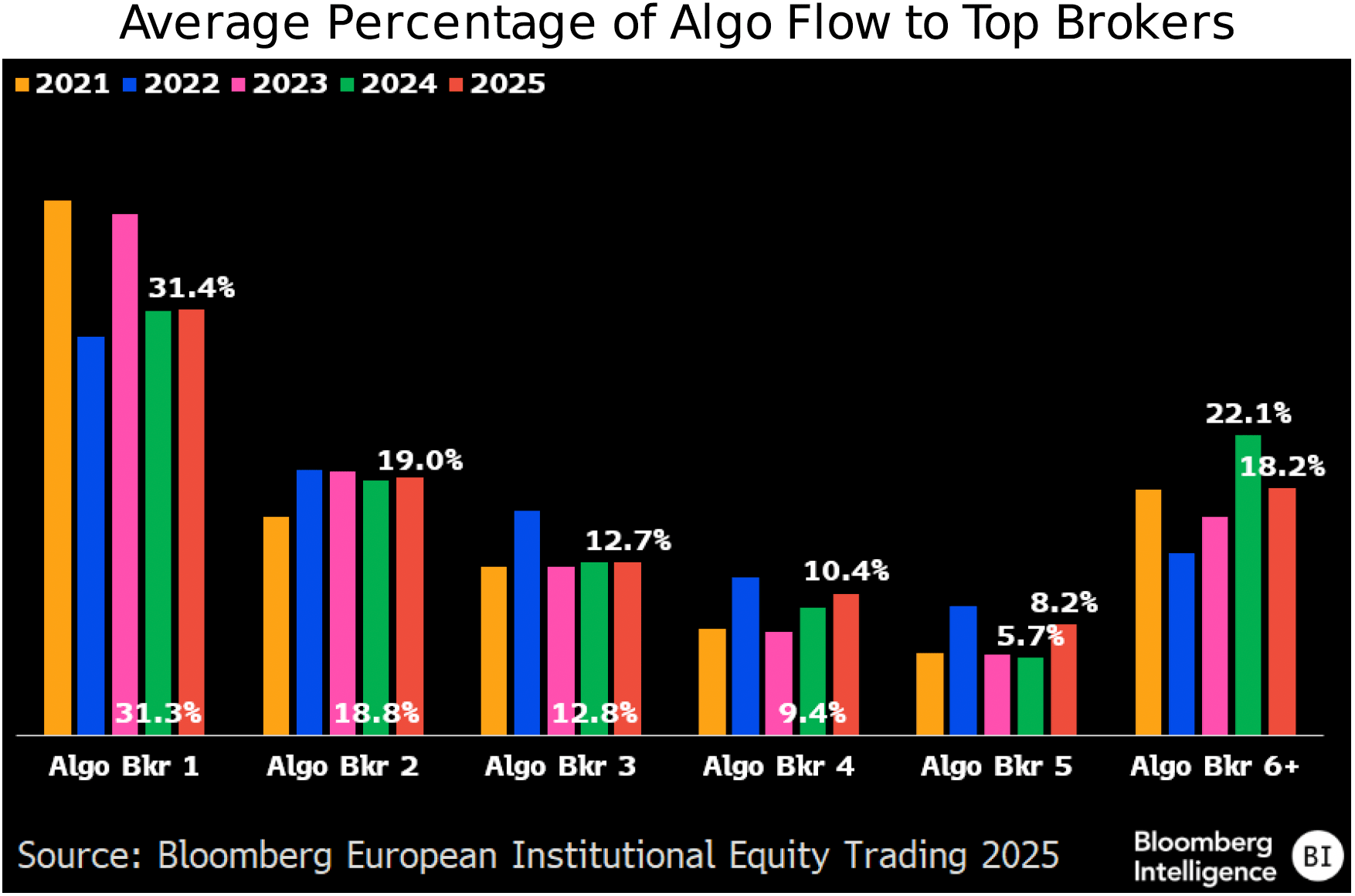

Top two brokers still account for half of the flow

The top two algorithmic brokers on a fund’s roster retained a 50% share of equity flow, based on fund averages in our trading study — unchanged from 2024. Brokers ranked fourth and fifth gained ground, rising to 10.4% and 8.2% respectively. Meanwhile, brokers outside the top five saw their share fall to 18.2% from 22.1% last year. In total, the top five brokers captured 82% of algo equity flow, up from 78% in 2024, a shift likely driven by higher equity volumes amid tariff-related volatility.

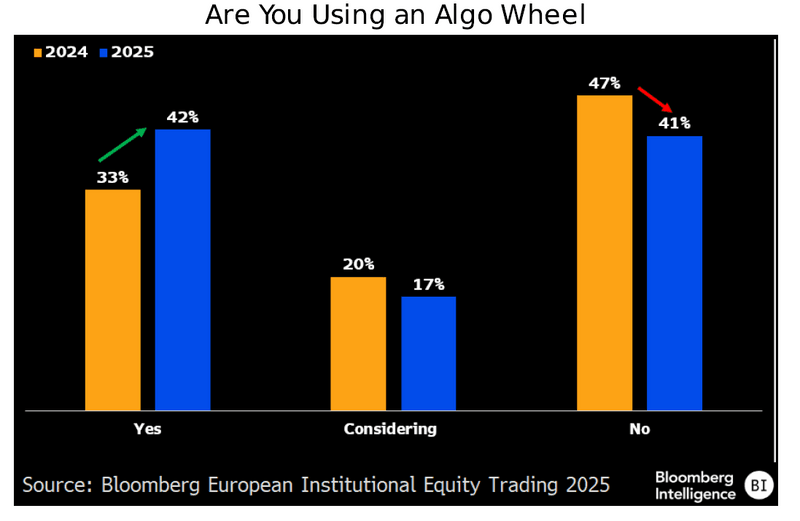

Algo wheels are gaining popularity in Europe

Algorithm wheels — tools that automate order allocations and allow unbiased A/B testing of algorithms — are gaining traction in Europe, according to feedback from 103 head and senior traders. In 2025, 42% of buyside firms use an algo wheel, up from 33% in 2024. In last year’s survey, 20% said they were considering one, but that figure has dipped to 17%. Traders cite reduced manual input and less bias in broker selection as key benefits. These features also support best execution obligations, which may be helping to drive broader use across the region.

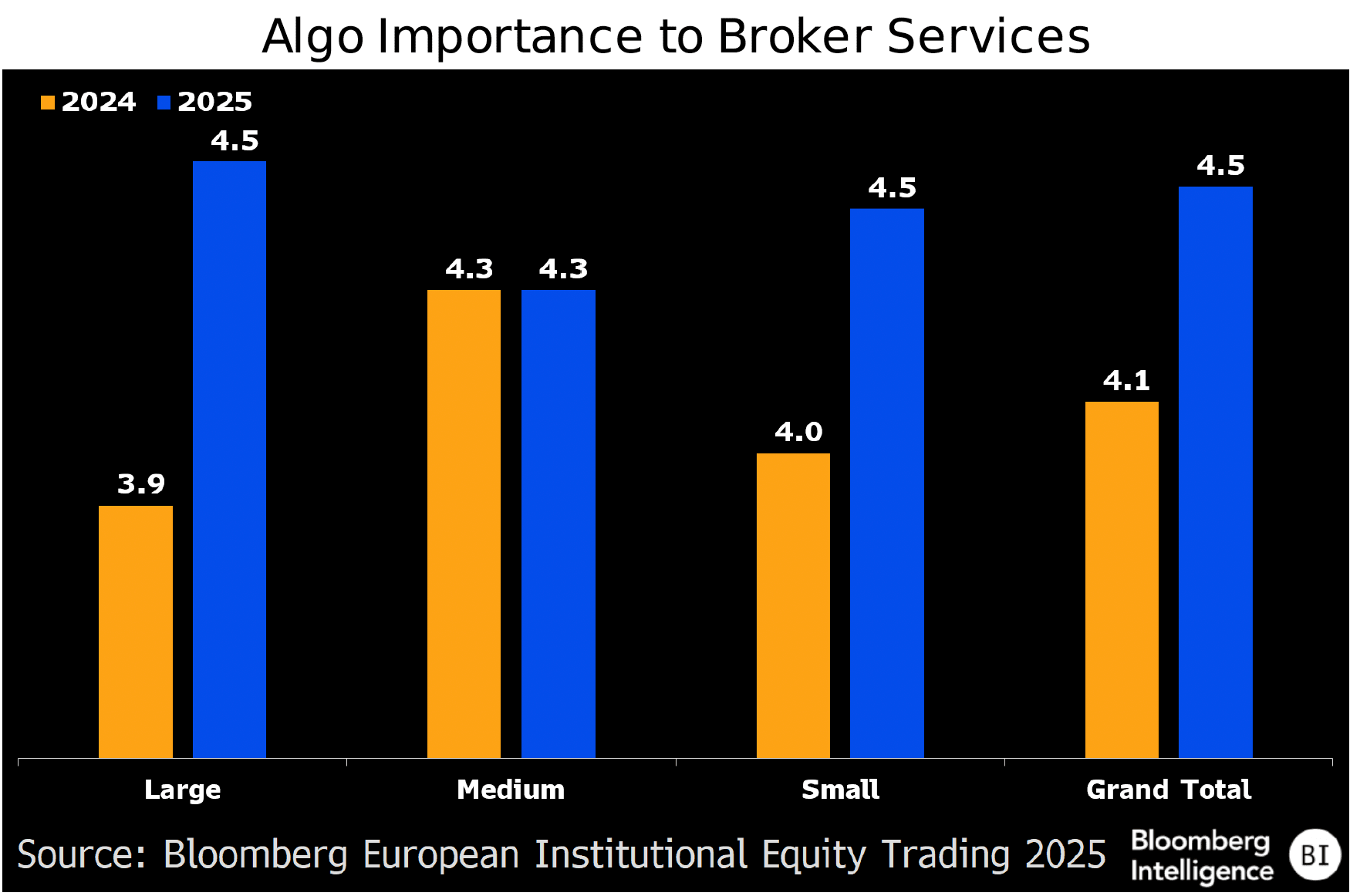

Algos cement role in buyside broker service

UK and European traders continue to rank trading algorithms as an important broker service. The average importance rating for algos in our study rose to 4.5 in 2025 from 4.1 in 2024, on a 1-5 scale (with 5 being most important). With liquidity consistently ranking among the top two challenges, the ability to efficiently source and deliver liquidity has become a critical broker function. Institutional clients increasingly expect brokers to provide algos that help uncover and access meaningful liquidity across fragmented markets.

The data included in these materials are for illustrative purposes only. The BLOOMBERG TERMINAL service and Bloomberg data products (the “Services”) are owned and distributed by Bloomberg Finance L.P. (“BFLP”) except (i) in Argentina, Australia and certain jurisdictions in the Pacific Islands, Bermuda, China, India, Japan, Korea and New Zealand, where Bloomberg L.P. and its subsidiaries (“BLP”) distribute these products, and (ii) in Singapore and the jurisdictions serviced by Bloomberg’s Singapore office, where a subsidiary of BFLP distributes these products. BLP provides BFLP and its subsidiaries with global marketing and operational support and service. Certain features, functions, products and services are available only to sophisticated investors and only where permitted. BFLP, BLP and their affiliates do not guarantee the accuracy of prices or other information in the Services. Nothing in the Services shall constitute or be construed as an offering of financial instruments by BFLP, BLP or their affiliates, or as investment advice or recommendations by BFLP, BLP or their affiliates of an investment strategy or whether or not to “buy”, “sell” or “hold” an investment. Information available via the Services should not be considered as information sufficient upon which to base an investment decision. The following are trademarks and service marks of BFLP, a Delaware limited partnership, or its subsidiaries: BLOOMBERG, BLOOMBERG ANYWHERE, BLOOMBERG MARKETS, BLOOMBERG NEWS, BLOOMBERG PROFESSIONAL, BLOOMBERG TERMINAL and BLOOMBERG.COM. Absence of any trademark or service mark from this list does not waive Bloomberg’s intellectual property rights in that name, mark or logo. All rights reserved. © 2025 Bloomberg.