ARTICLE

Life insurers eye AI gains in costs, claims

Bloomberg Intelligence

This article was written by Bloomberg Intelligence Industry Analyst Jeffrey Flynn. It appeared first on the Bloomberg Terminal.

Life insurers are prime candidates to capitalize on surging spending on AI-tools given their data-heavy business models. The line from these investments to positive financial statement impacts is getting clearer to us, with obvious gains around service-center costs and claims-adjuster productivity emerging, particularly in worksite units. Canadian lifecos, Principal and other US large-cap peers stand out so far on progress.

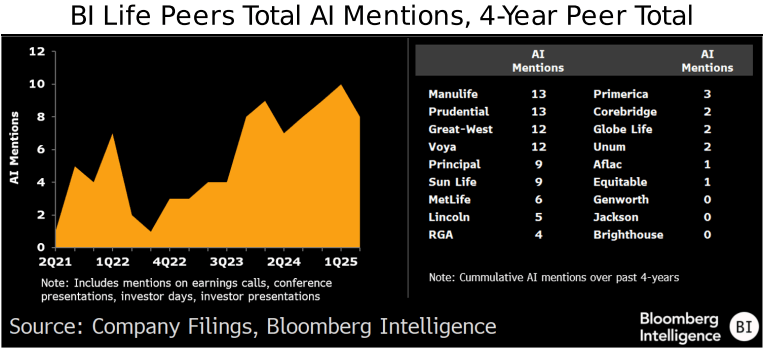

Canadians, larger peers lead accelerating AI commentary

Mentions of AI and related synonyms by BI life insurer peers on earnings conference calls and presentations have unsurprisingly scaled up over the past several years, with peer-to-peer relative frequencies broadly in line with our anecdotal conclusions. In general, the data show Canadian life insurers, as well as certain larger-capitalization peers, discussing this topic more. This isn’t unexpected given some smaller and midsized peers, including RGA, Primerica, Globe, Genworth, Jackson and Brighthouse, likely have smaller IT budgets. But lower readings from Corebridge, Aflac and Equitable could suggest a somewhat earlier stage despite their relative scale.

Voya’s mentions were a bit higher than we expected based on our anecdotal review, while MetLife, Prudential, Principal and Lincoln were in the group’s top half.

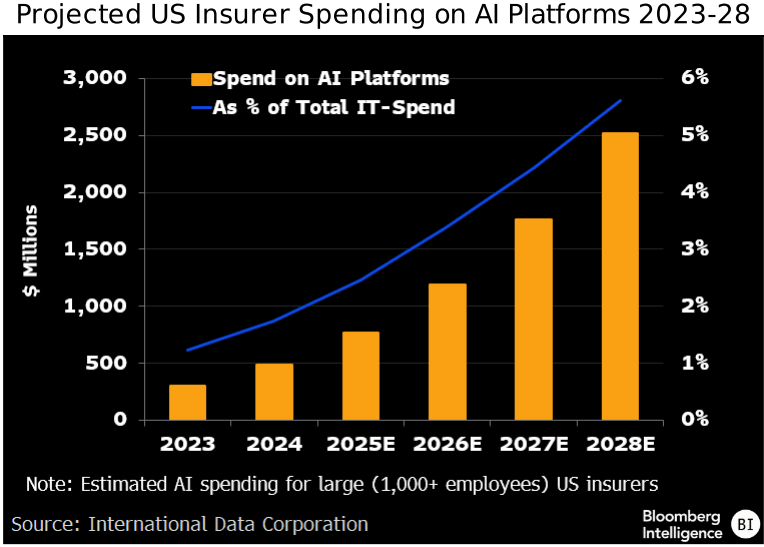

IDC sees AI platform spending up 800% in five years

Surging outlays on AI platforms and associated gains in worker efficiency, along with expanding use cases and momentum on 2023-24 projects, could begin to ease life insurer’s already slow pace of general-expense growth by 2026. Based on IDC data, large US insurers may invest over $2.8 billion on AI platforms in 2028, an 800% rise vs. 2023. AI would then account for about 6% of their IT spending vs. 1-2% in 2023-24. Benefit ratios should also improve incrementally, but initial gains may be mostly in lines (disability, long-term care, dental) where complex medical patient/claimant data can be better understood and organized.

Since 2018, BI life peers’ median annual growth in general expenses (including commissions) was 3%. This low pace reflects cost actions by a number of companies and the industry’s relatively slow growth.

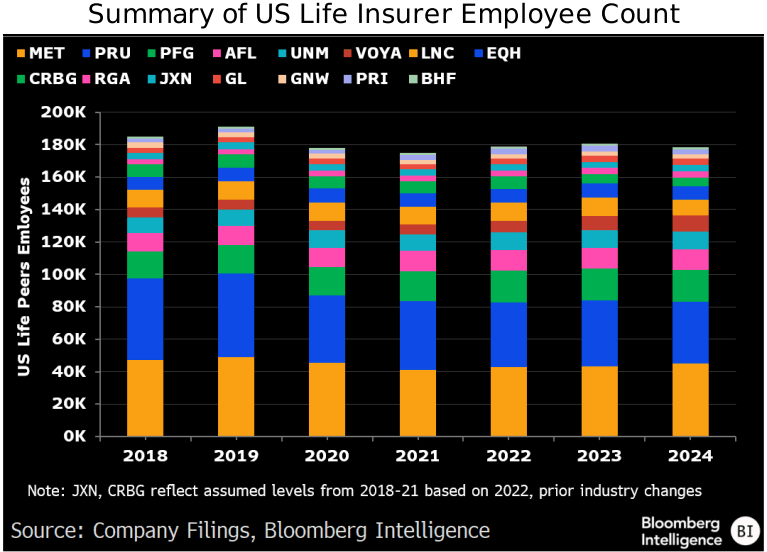

Annual median employee growth of 1% may go lower

Average annual median employee expansion for US BI life-insurer peers since 2018 was just 1%, and it’s possible it could be flat or even slightly negative over the next five. In general, the group’s businesses are gradually trending toward institutional-focused areas, including benefits and asset management, which can be less service-intensive vs. retail. Also, the bar for acquisitions — often compared against buybacks — is high while increasing spending on AI should drive efficiency gains, easing staff needs in some areas.

It’s potentially notable that in 2024, amid a favorable business backdrop, over half (53%) of peers had fewer employees vs. 2023. This was the most since 2018 outside of 2021’s 60%, which was likely elevated by the pandemic. The group’s employee count ended 2024 at about 178,000, down 3% vs. 2018.

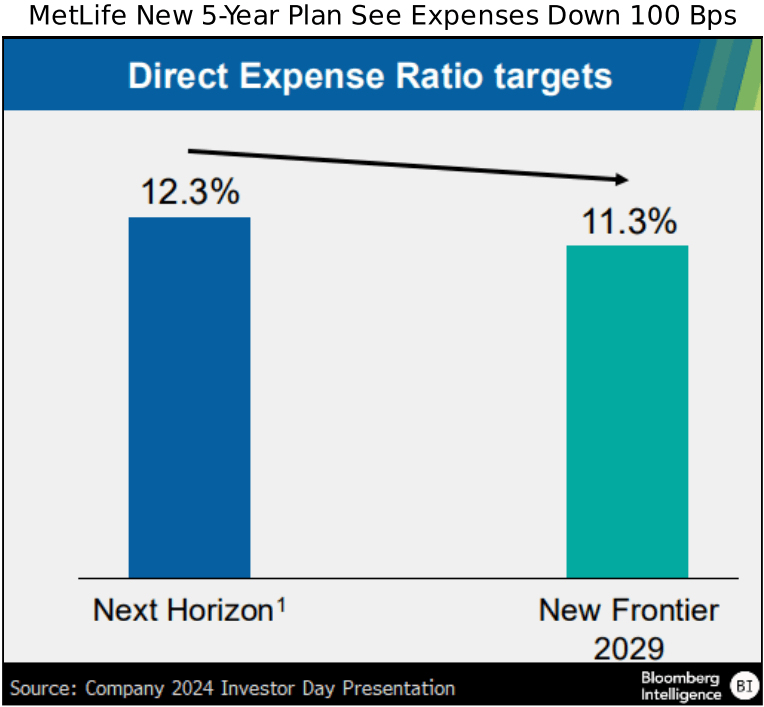

Lower target expense ratios begin to reflect AI support

Life insurers are already driving operational efficiency with AI, particularly at service centers, but this is likely to accelerate. Principal recently noted natural-language processing built into enhanced chatbots has helped cut phone-aided benefit verification in its millions of calls to 7% from 50%. Sun Life’s new Advisor Buddy in the Philippines deploys generative AI to support new advisors, ramping up service faster. Using its new gen-AI assistant called ChatMFC, Manulife, among others, is driving more task automation across its workforce.

Companies aren’t breaking out AI’s contribution to improved expense targets, but it’s a notable contributor, including at Manulife and MetLife. In 2024, the former cut its efficiency ratio goal 5 percentage points while MetLife trimmed its expense target to about 11% from 12%.

Long-term claim-adjuster productivity boost may surprise

AI tools are aiding life insurance underwriting by boosting claim examiners’ productivity and accuracy, while driving added volume in some cases. By ingesting, organizing and summarizing complex documents, AI frees up time to work with policyholders. Prudential, Principal and Lincoln partner with Evolution IQ on disability lines, with digital agents identifying cases requiring human attention and spotting optimal return-to-work outcomes. Dental claims, including at Sun Life and Principal, are also being streamlined by AI. MetLife’s Upside platform that offers AI-driven, personalized recommendations is helping benefits utilization.

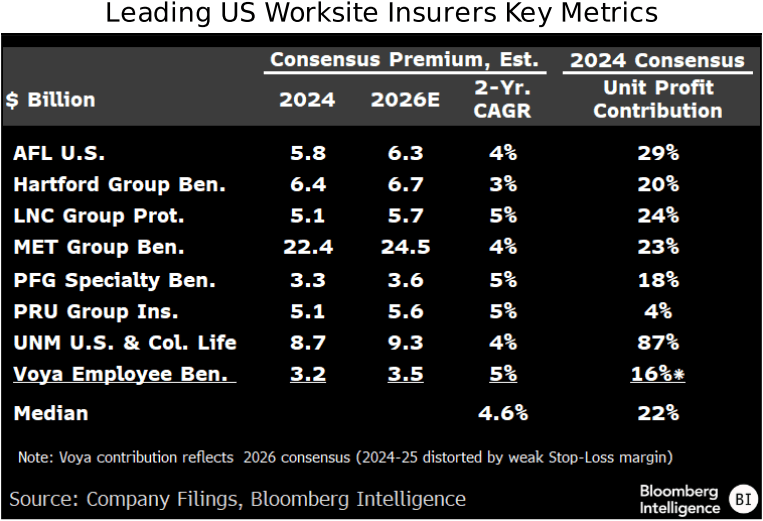

Insurers with US group and disability units, such as MetLife, Sun Life, Unum, Lincoln, Principal, Voya and Aflac, may initially be best placed to garner an incremental underwriting boost from AI.

The data included in these materials are for illustrative purposes only. The BLOOMBERG TERMINAL service and Bloomberg data products (the “Services”) are owned and distributed by Bloomberg Finance L.P. (“BFLP”) except (i) in Argentina, Australia and certain jurisdictions in the Pacific Islands, Bermuda, China, India, Japan, Korea and New Zealand, where Bloomberg L.P. and its subsidiaries (“BLP”) distribute these products, and (ii) in Singapore and the jurisdictions serviced by Bloomberg’s Singapore office, where a subsidiary of BFLP distributes these products. BLP provides BFLP and its subsidiaries with global marketing and operational support and service. Certain features, functions, products and services are available only to sophisticated investors and only where permitted. BFLP, BLP and their affiliates do not guarantee the accuracy of prices or other information in the Services. Nothing in the Services shall constitute or be construed as an offering of financial instruments by BFLP, BLP or their affiliates, or as investment advice or recommendations by BFLP, BLP or their affiliates of an investment strategy or whether or not to “buy”, “sell” or “hold” an investment. Information available via the Services should not be considered as information sufficient upon which to base an investment decision. The following are trademarks and service marks of BFLP, a Delaware limited partnership, or its subsidiaries: BLOOMBERG, BLOOMBERG ANYWHERE, BLOOMBERG MARKETS, BLOOMBERG NEWS, BLOOMBERG PROFESSIONAL, BLOOMBERG TERMINAL and BLOOMBERG.COM. Absence of any trademark or service mark from this list does not waive Bloomberg’s intellectual property rights in that name, mark or logo. All rights reserved. © 2025 Bloomberg.