ARTICLE

Tariff risk may reshape semiconductor demand – AI most resilient

Bloomberg Intelligence

This analysis is by Bloomberg Intelligence Senior Industry Analyst Kunjan Sobhani and Senior Associate Analyst Oscar Hernandez Tejada. It appeared first on the Bloomberg Terminal.

While semiconductors are exempt from new tariffs, we believe most will face indirect pressure via demand destruction, as chips are assembled into final products through global supply chains. AI-focused players like Nvidia appear most insulated, supported by enterprise demand, CSP-driven AI buildouts and low price elasticity.

By contrast, analog and consumer semiconductors — exposed to PCs, handsets, autos, and industrials — may see more disruption. USMCA exemptions, onshoring incentives and potential policy offsets tied to AI investment could soften the blow for some.

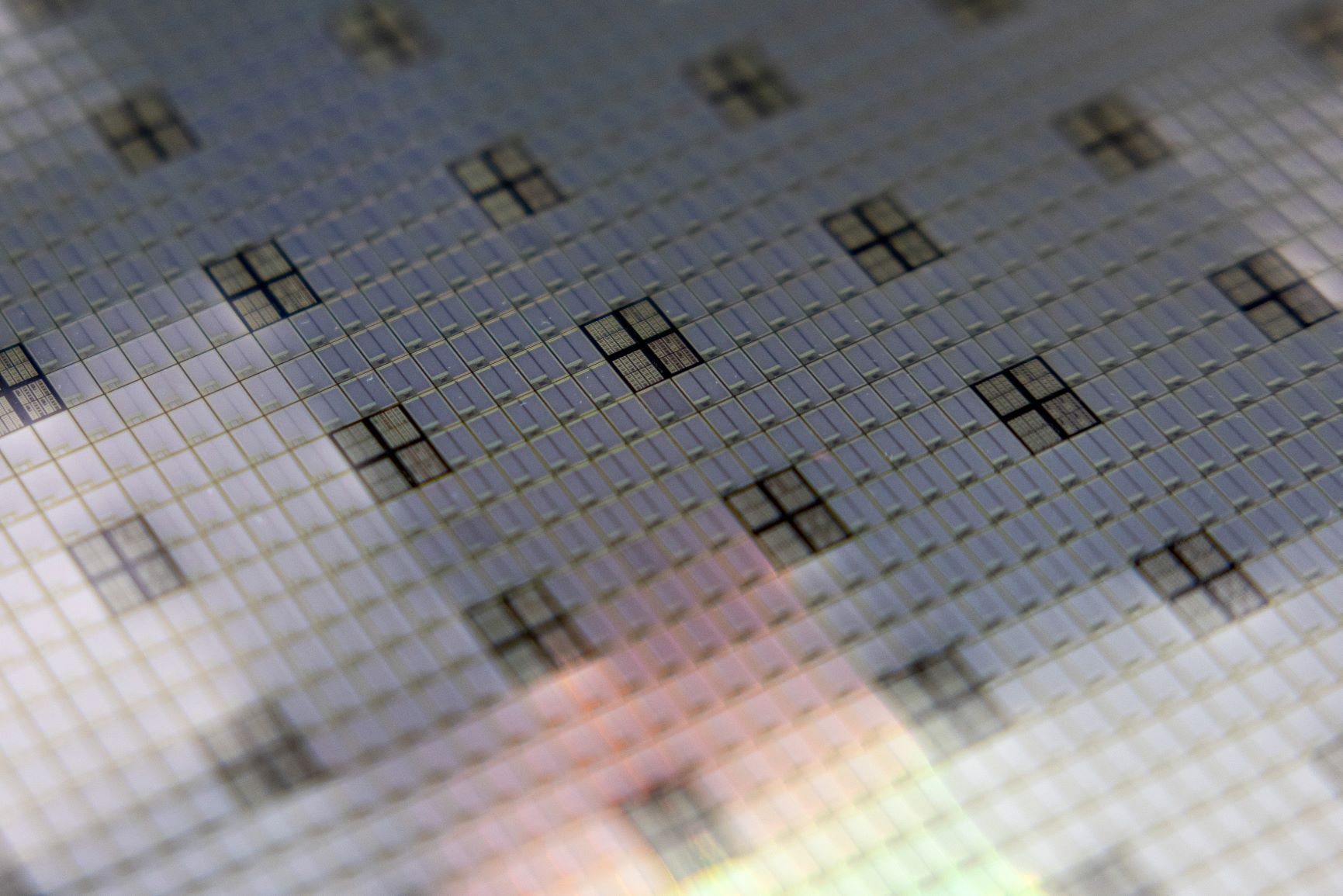

US semiconductor tariff impact matrix

Nvidia more tariff resistant than peers with AI, USMCA exposure

AI semiconductor makers, especially Nvidia, might be more resilient than other chipmakers in a tariff-driven downturn thanks to stable enterprise and hyperscaler demand. Most Nvidia GPUs are part of systems with Mexican supply chains that could exempt over half of its US imports, softening supply-side pressure from trade tensions.

Tariff risk cut by Mexico, Canada exemption

Nvidia’s AI systems could be party insulated from tariff risk. Though most GPUs aren’t sold as stand-alone semiconductors, they ship in complex systems packed with nonchip components, many assembled abroad and possibly subject to levies. But a large share of those can qualify for USMCA exemptions if built in Mexico or Canada. We believe 40-60% of Nvidia’s US-bound system imports could fall into that category, limiting tariff exposure.

AI-server OEMs, which integrate Nvidia GPUs into full racks, also have significant manufacturing capacity in Mexico and the US, further blunting the direct impact from duties. That said, as much as half of Nvidia’s components — especially switches, networking gear and gaming SKUs — are built in Asia, primarily Taiwan, and may remain exposed even if final assembly occurs in the US.

Bloomberg Terminal subscribers can access full version of this analysis via BI <GO>.

The data included in these materials are for illustrative purposes only. The BLOOMBERG TERMINAL service and Bloomberg data products (the “Services”) are owned and distributed by Bloomberg Finance L.P. (“BFLP”) except (i) in Argentina, Australia and certain jurisdictions in the Pacific Islands, Bermuda, China, India, Japan, Korea and New Zealand, where Bloomberg L.P. and its subsidiaries (“BLP”) distribute these products, and (ii) in Singapore and the jurisdictions serviced by Bloomberg’s Singapore office, where a subsidiary of BFLP distributes these products. BLP provides BFLP and its subsidiaries with global marketing and operational support and service. Certain features, functions, products and services are available only to sophisticated investors and only where permitted. BFLP, BLP and their affiliates do not guarantee the accuracy of prices or other information in the Services. Nothing in the Services shall constitute or be construed as an offering of financial instruments by BFLP, BLP or their affiliates, or as investment advice or recommendations by BFLP, BLP or their affiliates of an investment strategy or whether or not to “buy”, “sell” or “hold” an investment. Information available via the Services should not be considered as information sufficient upon which to base an investment decision. The following are trademarks and service marks of BFLP, a Delaware limited partnership, or its subsidiaries: BLOOMBERG, BLOOMBERG ANYWHERE, BLOOMBERG MARKETS, BLOOMBERG NEWS, BLOOMBERG PROFESSIONAL, BLOOMBERG TERMINAL and BLOOMBERG.COM. Absence of any trademark or service mark from this list does not waive Bloomberg’s intellectual property rights in that name, mark or logo. All rights reserved. © 2025 Bloomberg