Bloomberg Intelligence

37%

CAGR for 2.5D/3D packaging from 2025-30, outpacing 10% for the semiconductor industry

16%

OSATs’ advanced- packaging market share could double by 2023, from 8% in 2024

3X

Average Al chip-package size to triple by 2030 for more memory and computing cores

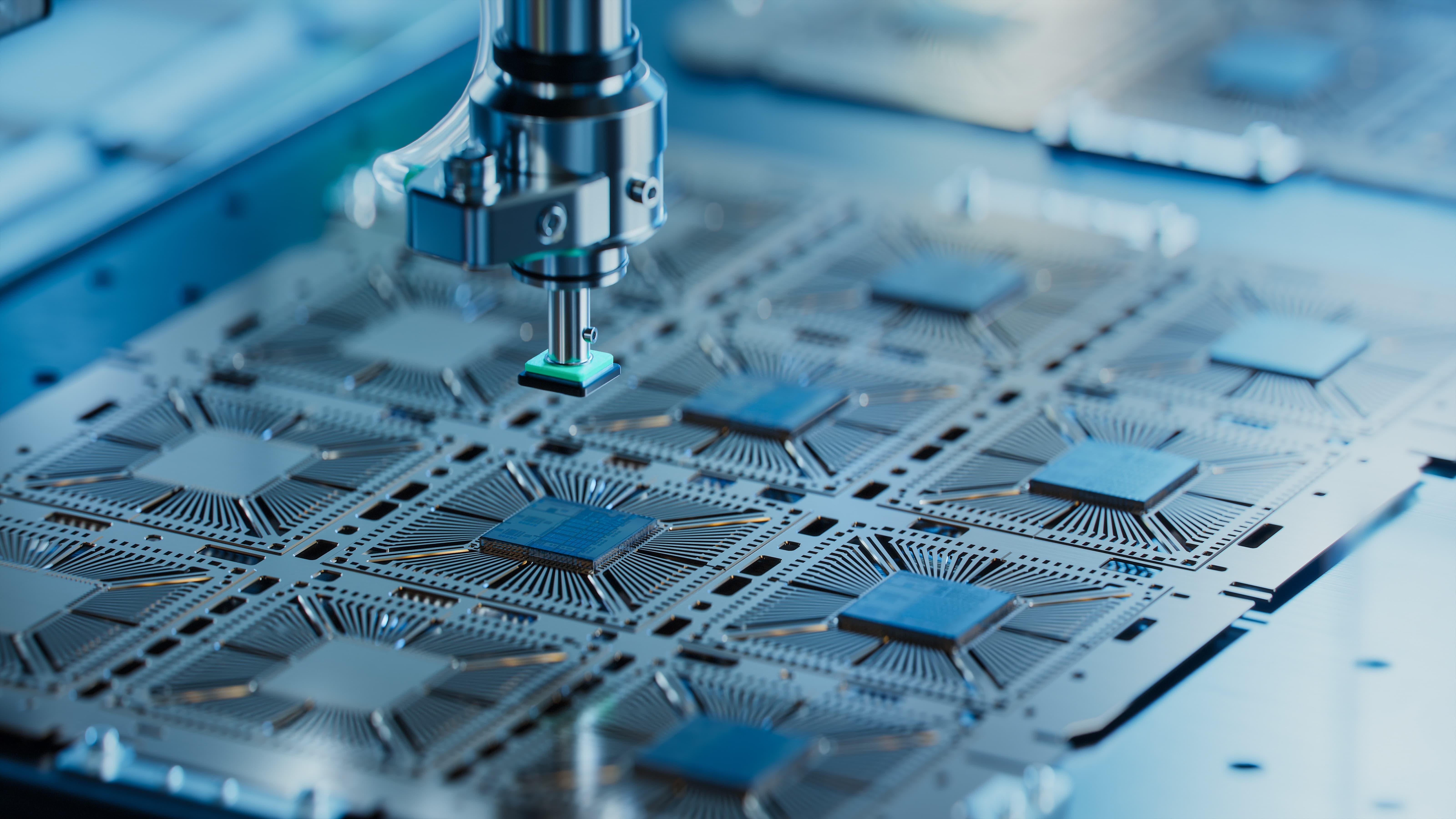

Advanced packaging is becoming a core driver of semiconductor performance and profitability as artificial intelligence reshapes chip design. Foundries such as Taiwan Semiconductor Manufacturing Company, Intel and Samsung are expanding vertically into packaging, while outsourced semiconductor assembly and test (OSAT) providers, the independent companies that assemble and test chips for clients, are scaling capacity to capture the next wave of Al-driven demand.

- Technology Transition Gains Pace: New packaging technologies from chiplet architectures and hybrid bonding to glass substrates are blurring the boundary between chip design and assembly. The next 12-24 months will test which platforms can balance cost and performance at scale

- Foundry and OSAT Competition Redrawn: Expansion of advanced packaging is redrawing market boundaries between foundries such as TSMC, Intel and Samsung and outsourced assemblers ASE, Amkor and JCET. Control of packaging capacity and design integration is becoming as important as node leadership

- Ecosystem Expansion Beyond Data Centers: Advanced packaging is moving downstream from Al accelerators to edge devices, creating new demand across PCs, smartphones and vehicles. As on-device Al becomes mainstream, suppliers with scalable, thermally efficient solutions stand to gain most

- Material and Process Breakthroughs: Glass substrates, copper-to-copper hybrid bonding and panel-level packaging could define the next decade’s manufacturing frontier. A European initiative and new US investments will test regional ability to scale these technologies

- Policy and Supply-Chain Realignment: Export controls, regional investment programs and rising security priorities are reshaping where advanced-packaging capacity is built and who benefits. The evolving policy landscape will influence technology access, competitiveness and long-term industry balance

Advanced-packaging stocks have outperformed in 2025, rising about 55% compared with the S&P 500’s 18% gain on strong demand for high-bandwidth memory and next-generation chip architectures. Foundries such as Intel and TSMC have led gains on capacity expansion and design integration, while traditional assemblers have lagged, except for China’s Tongfu Micro. Valuations remain tiered, with foundries commanding premiums and memory suppliers trading at discounts amid caution over the cyclical DRAM market.