Bloomberg Intelligence

This article was written by Bloomberg Intelligence Geo-Economics Analysts Sarah Zheng and Michael Deng. It appeared first on the Bloomberg Terminal.

President Donald Trump signed three new executive orders on AI, revealing the top priorities of his sweeping AI Action Plan. While the high-level plan outlines a broad vision for US dominance, these three orders – on accelerating infrastructure build-out, export promotion, and ideological neutrality – show where the administration will concentrate most of its efforts, implying that other items in the plan rank lower on its agenda.

- The export-promotion executive order advances a new strategy of government-enabled commercial expansion, leveraging federal resources to push the full American AI stack into global markets and counter China.

- The infrastructure executive order reinforces the build-at-any-cost priorities highlighted by the AI Action Plan, subordinating longer-term environmental and public health risks to the immediate goal of accelerating construction.

- The executive order on neutrality injects a domestic culture-war issue into technology policy and federal procurement, a move that appears aimed to satisfy Trump’s political base.

- Taken together, the directives revive a familiar playbook of deregulation paired with a Silicon Valley-style growth mandate to accelerate industry-led AI expansion.

Supporting AI exports

The order on exporting the full American technology stack shifts the government’s role from regulator to promoter, aiming to turn “Made in America” into the global gold standard for AI technologies.

- In line with Trump’s core focus on trade, the order seeks to work closely with industry to promote the export of American AI. It calls for industry players to submit proposals for the export of full packages — including not only AI models but also chips, data-center storage, cloud services, AI applications, data pipelines, and cybersecurity tools. The package-level export promotion is an effort to incentivize the buildout of the broader AI ecosystem within the US, beyond the usual focus on large language models.

- The order also calls for federal financing to support the export of these AI packages, including direct loans and loan guarantees, equity investments, co-financing, political-risk insurance, and credit guarantees. Its deployment will be paired with investment in American small businesses, diplomatic efforts to remove trade and market barriers, and support for other countries to best deploy American AI systems.

- This order represents the “carrot” side of the US’ push for partners and allies to adopt American technology — but inherent in the order is pressure to reject AI models and tools from competitors like China. It remains to be seen how the US will leverage its trade deal-making to do so. The order did not touch on the escalated technology export controls laid out in the White House’s AI Action Plan, its threats to use tools like secondary tariffs or the leveraging of location-verification features on advanced chips to enforce technology controls.

AI infrastructure deregulation

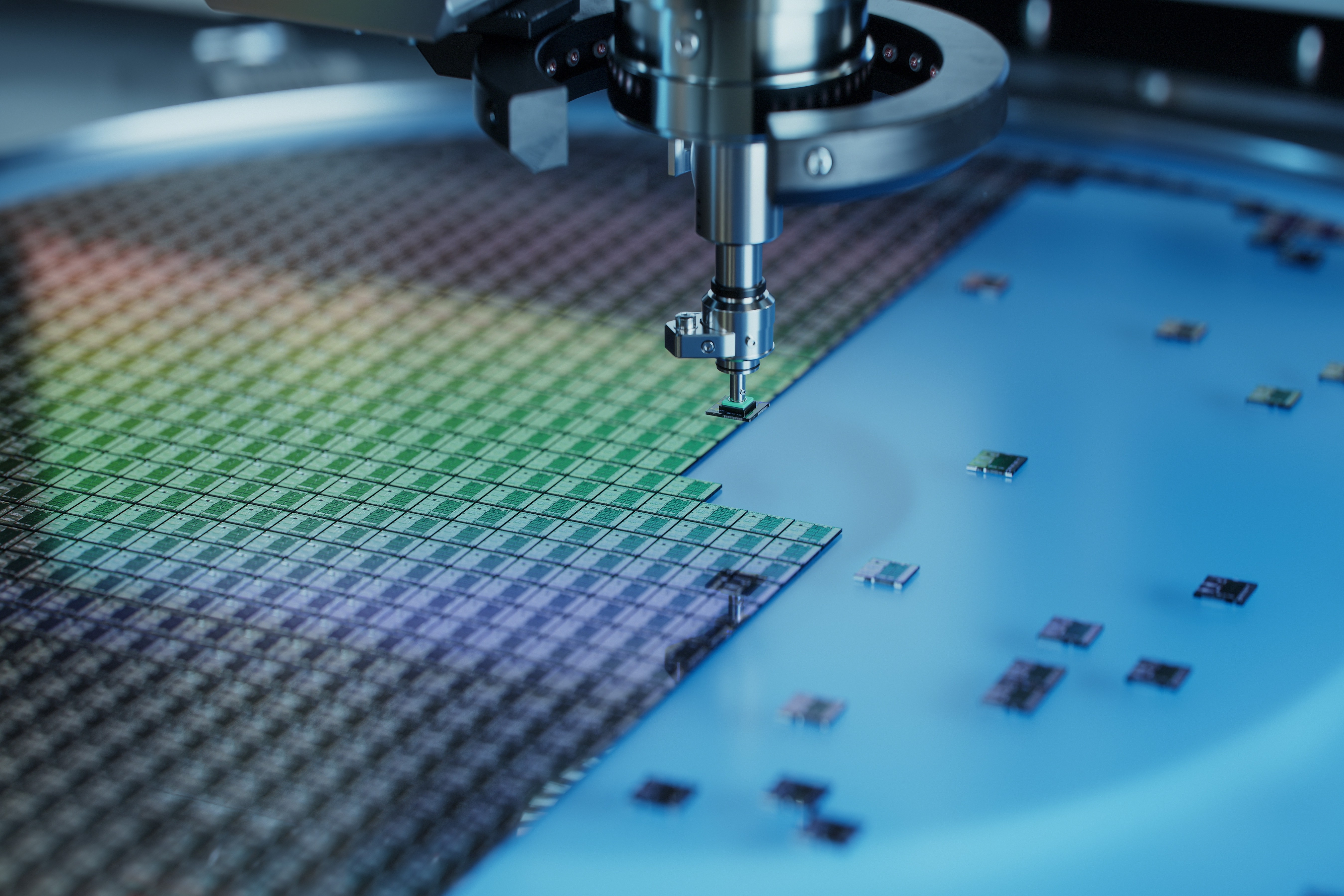

This order focuses on accelerating the construction of AI infrastructure through deregulation and permitting, in a pivot from the previous administration’s strategy to use grants and tax credits to boost semiconductor manufacturing through the CHIPS Act.

- The guidance seeks to use federal lands to build new data centers, high-voltage transmission lines, electrical infrastructure, and semiconductor plants. It aims to streamline the process by directing federal agencies to expedite the review and permitting for projects, including by modifying regulations under the Clean Air Act, the Clean Water Act, and the Toxic Substances Control Act. Bypassing normal environmental reviews could have unintended consequences, given that data centers consume significant amounts of water and semiconductor plants release PFAS (often called “forever chemicals” because they don’t break down naturally).

- In a blow to sustainability advocates, the order asks the Environmental Protection Agency to identify some of the country’s most contaminated areas, including Superfund and brownfield sites, for potential use to build AI infrastructure. While Superfund sites require federal clean-up efforts, the clean-up and redevelopment of brownfield sites often are supported by state programs. The EPA in Trump’s first term also focused on redevelopment of Superfund sites. New construction on heavily polluted land could carry unprecedented environmental and public health risks.

- The order also launches an initiative to provide financial support for these projects, including through loans and loan guarantees, grants, tax incentives, and off-take agreements (in which buyers agree to purchase goods produced in the future). While the language is vague, it suggests the reallocation of existing funding to support new projects. Trump has criticized the CHIPS Act for providing semiconductor companies with grants, so this could be a way to repackage funding for new data center and chips plants in a politically palatable way

- The build-out of data and energy infrastructure is an ambitious but necessary step for the US to stay in the lead on cutting-edge AI development. It reflects the administration’s understanding that —- given Chinese advantages on data and power generation — rapidly increasing US energy and AI-related capacity are critical to winning the global AI race.

Ideological neutrality

The executive order to prevent “woke AI” is an easy political win for Trump’s domestic base — one that’s limited to federal procurement and offers off-ramps for technical implementation.

- The order takes aim at diversity, equity and inclusion efforts as they pertain to AI, a direct response to conservative criticism of perceived liberal bias in Big Tech. It references instances when Google’s Gemini model generated AI images in which historical figures like the Pope were represented by different races or genders. While acknowledging that the federal government should not regulate private AI models, the guidance seeks to support models that are deemed factually accurate or ideologically neutral.

- The spirit of the order has some concerning analogues to content guidelines in countries like China — which requires its domestic AI models to adhere to socialist values — but is narrowly applied to the federal government’s procurement of models. It’s technically impossible to achieve perfect neutrality and accuracy, so it’s uncertain how demanding compliance would be.

- The order takes care to reduce the potential for disruption to companies’ development. Its guidelines ask agencies to account for technical limitations, avoid over-prescription, and make exceptions for model usage in national-security systems. This offers companies considerable latitude to continue to work with the government, without having to adopt the explicit “anti-woke” marketing of models like Grok.

The data included in these materials are for illustrative purposes only. The BLOOMBERG TERMINAL service and Bloomberg data products (the “Services”) are owned and distributed by Bloomberg Finance L.P. (“BFLP”) except (i) in Argentina, Australia and certain jurisdictions in the Pacific Islands, Bermuda, China, India, Japan, Korea and New Zealand, where Bloomberg L.P. and its subsidiaries (“BLP”) distribute these products, and (ii) in Singapore and the jurisdictions serviced by Bloomberg’s Singapore office, where a subsidiary of BFLP distributes these products. BLP provides BFLP and its subsidiaries with global marketing and operational support and service. Certain features, functions, products and services are available only to sophisticated investors and only where permitted. BFLP, BLP and their affiliates do not guarantee the accuracy of prices or other information in the Services. Nothing in the Services shall constitute or be construed as an offering of financial instruments by BFLP, BLP or their affiliates, or as investment advice or recommendations by BFLP, BLP or their affiliates of an investment strategy or whether or not to “buy”, “sell” or “hold” an investment. Information available via the Services should not be considered as information sufficient upon which to base an investment decision. The following are trademarks and service marks of BFLP, a Delaware limited partnership, or its subsidiaries: BLOOMBERG, BLOOMBERG ANYWHERE, BLOOMBERG MARKETS, BLOOMBERG NEWS, BLOOMBERG PROFESSIONAL, BLOOMBERG TERMINAL and BLOOMBERG.COM. Absence of any trademark or service mark from this list does not waive Bloomberg’s intellectual property rights in that name, mark or logo. All rights reserved. © 2025 Bloomberg.