Bloomberg Intelligence

This article was written by Bloomberg Intelligence Litigation Analyst Matthew Schettenhelm. It appeared first on the Bloomberg Terminal.

Trump’s AI action reiterates focus on light-touch AI framework

President Trump’s AI Action Plan released on July 23 again demonstrates the US government will both avoid onerous AI regulation and try to knock out disruptive US state laws. Though Congress failed in preempting state regulation of AI in a tax and spending bill that Trump signed into law on July 4, we expect lawmakers to revisit it and new state laws could catalyze those efforts. Onerous federal limits will remain off the table.

Our Thesis: An aggressive, comprehensive US approach to AI regulation — which we don’t expect — could damp growth for companies like Alphabet, IBM, Meta, Micron, Microsoft and Nvidia. Federal preemption would keep a patchwork of state restrictions from hindering AI’s expansion.

Congress’ focus will remain winning AI race, not guardrails

President Trump’s AI Action Plan again backs the notion of this administration focusing more on advancing AI than regulating it. Though the plan doesn’t broadly call for preemption of state laws, it says federal funding shouldn’t be directed to states with burdensome AI regulations. It also says states may pass laws that aren’t “unduly restrictive” to innovation. President Trump’s Jan. 23 Executive Order on “Removing Barriers to American Leadership” in AI focused on rescinding regulation that impedes the technology.

The Action Plan calls for driving adoption of AI while preventing adversaries from free riding. Trump’s administration has worked to ease export-control changes proposed during the Biden administration. Those changes are generally exempt from the Administrative Procedure Act.

Preemption more likely than heavy federal hand

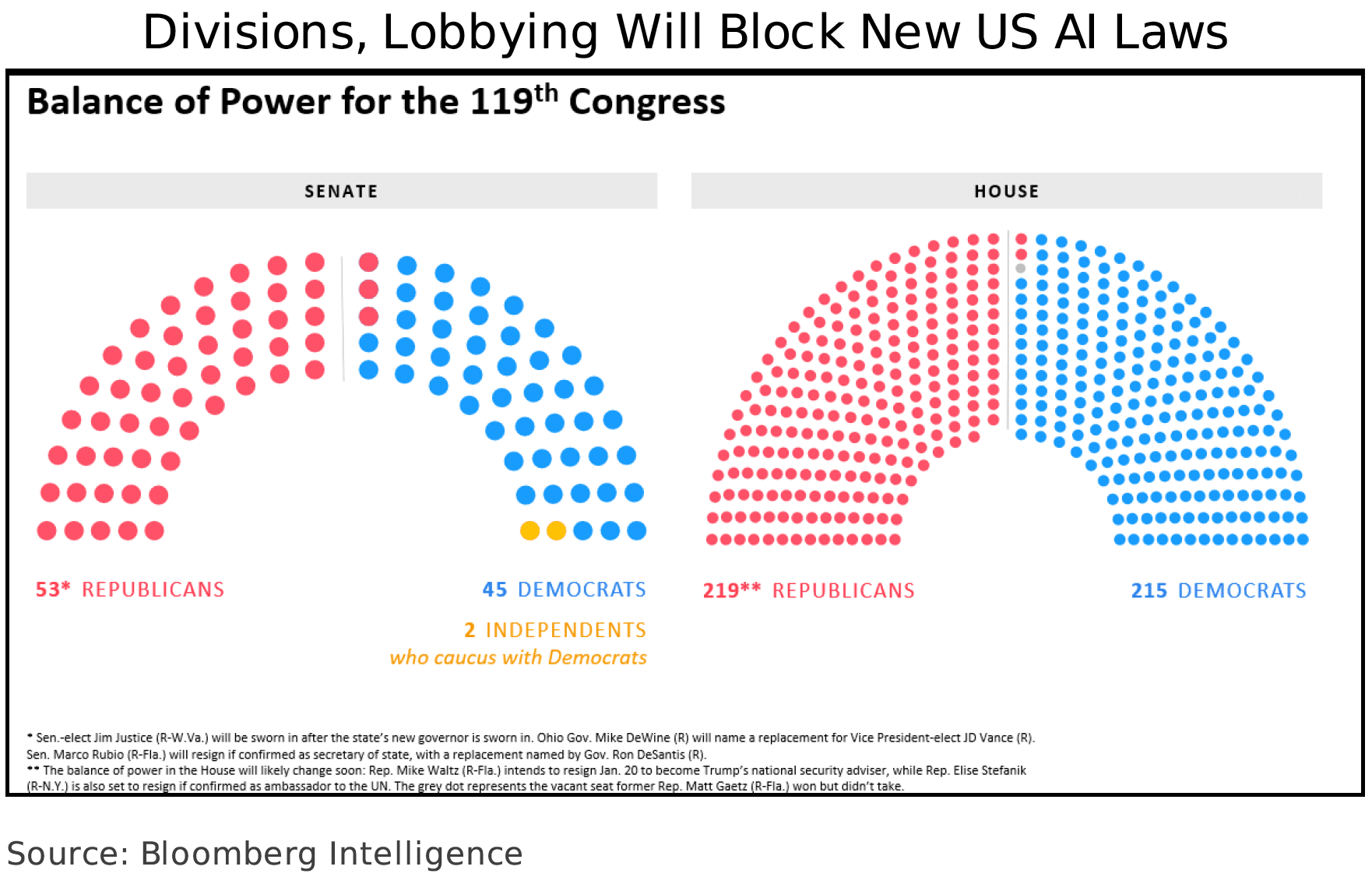

With Congress unlikely to pursue comprehensive regulation of artificial intelligence, the key federal legislative issue for the technology through 2026 is whether lawmakers block state laws. That effort fell short in the Senate on July 1 as it passed President Donald Trump’s tax and spending bill without a much-discussed preemption clause. Congress will likely keep pursuing such measures. They face a tough climb to win the 60 votes needed in the Senate to overcome a filibuster, but a reconciliation bill, requiring just a simple majority, might be a closer call.

Without preemption, states could adopt aggressive AI regulations, though the industry often is effective at lobbying to defeat such measures. A much-criticized California bill nearly became law in 2024, though Democratic Governor Gavin Newsom declined to sign it.

Thune’s 2023 bill pushed lighter-touch approach

Senate Majority Leader John Thune’s “Artificial Intelligence Research, Innovation, and Accountability Act of 2023” may be an example of some light-touch guardrails for AI regulation that Congress may still explore, especially if some catalyst drives a renewed push for safeguards. The South Dakota Republican’s bill mostly focused on transparency. Some internet platforms must report if they’re using AI systems; “high-impact” AI systems must file annual reports, and “critical-impact” ones must be certified. An advisory committee including industry members would advise the Commerce Department on certification standards.

Though the general framework isn’t onerous or disruptive, it would take a significant new development showing AI risk for this Congress to enact it.

Dedicated US agency no longer on the table

The difference between May’s AI Senate hearing and one in May 2023 could not be more stark, especially on the need for a federal agency to lead comprehensive federal AI oversight. Then, Senators including Republicans were surprisingly optimistic about such a regulatory body. In the May 2025 hearing, the idea had little or no backing. Though a dedicated federal agency could develop AI expertise, and monitor and adjust regulations better than Congress, it could also interfere in a market that lawmakers don’t want to disrupt. The idea is a non-starter in the Republican-controlled House or Senate.

Senators at the May 2025 hearing supported the idea of industry-created standards, which a government body like the National Institute of Standards and Technology could then adopt.

Old US laws will strain to keep up with new AI

With Congress unlikely to adopt disruptive approaches to AI regulation — like creating a new agency with broad power or developing a new licensing model — expect AI to be governed by existing federal laws, even if they’re not always a good fit. The FTC, for example, will monitor for unfair and deceptive practices, and existing sector-specific laws may limit AI applications in different industries. AI should thrive in the US under such a hands-off approach.

Unlike social-media companies, however, AI probably won’t get broad protection from lawsuits by Section 230 of the Communications Decency Act. As a result, if AI results in concrete harms, companies won’t be as easily able to avoid lawsuits related to those hazards.

The data included in these materials are for illustrative purposes only. The BLOOMBERG TERMINAL service and Bloomberg data products (the “Services”) are owned and distributed by Bloomberg Finance L.P. (“BFLP”) except (i) in Argentina, Australia and certain jurisdictions in the Pacific Islands, Bermuda, China, India, Japan, Korea and New Zealand, where Bloomberg L.P. and its subsidiaries (“BLP”) distribute these products, and (ii) in Singapore and the jurisdictions serviced by Bloomberg’s Singapore office, where a subsidiary of BFLP distributes these products. BLP provides BFLP and its subsidiaries with global marketing and operational support and service. Certain features, functions, products and services are available only to sophisticated investors and only where permitted. BFLP, BLP and their affiliates do not guarantee the accuracy of prices or other information in the Services. Nothing in the Services shall constitute or be construed as an offering of financial instruments by BFLP, BLP or their affiliates, or as investment advice or recommendations by BFLP, BLP or their affiliates of an investment strategy or whether or not to “buy”, “sell” or “hold” an investment. Information available via the Services should not be considered as information sufficient upon which to base an investment decision. The following are trademarks and service marks of BFLP, a Delaware limited partnership, or its subsidiaries: BLOOMBERG, BLOOMBERG ANYWHERE, BLOOMBERG MARKETS, BLOOMBERG NEWS, BLOOMBERG PROFESSIONAL, BLOOMBERG TERMINAL and BLOOMBERG.COM. Absence of any trademark or service mark from this list does not waive Bloomberg’s intellectual property rights in that name, mark or logo. All rights reserved. © 2025 Bloomberg.