Bloomberg Professional Services

Momentum in commodities continued through the third quarter, supported by global demand and macro resilience. The Bloomberg Commodity Index (BCOM) is up year-to-date in 2025, with precious metals leading gains and industrial metals showing renewed strength.

This article was written by Jim Wiederhold, Commodity Indices Product Manager at Bloomberg.

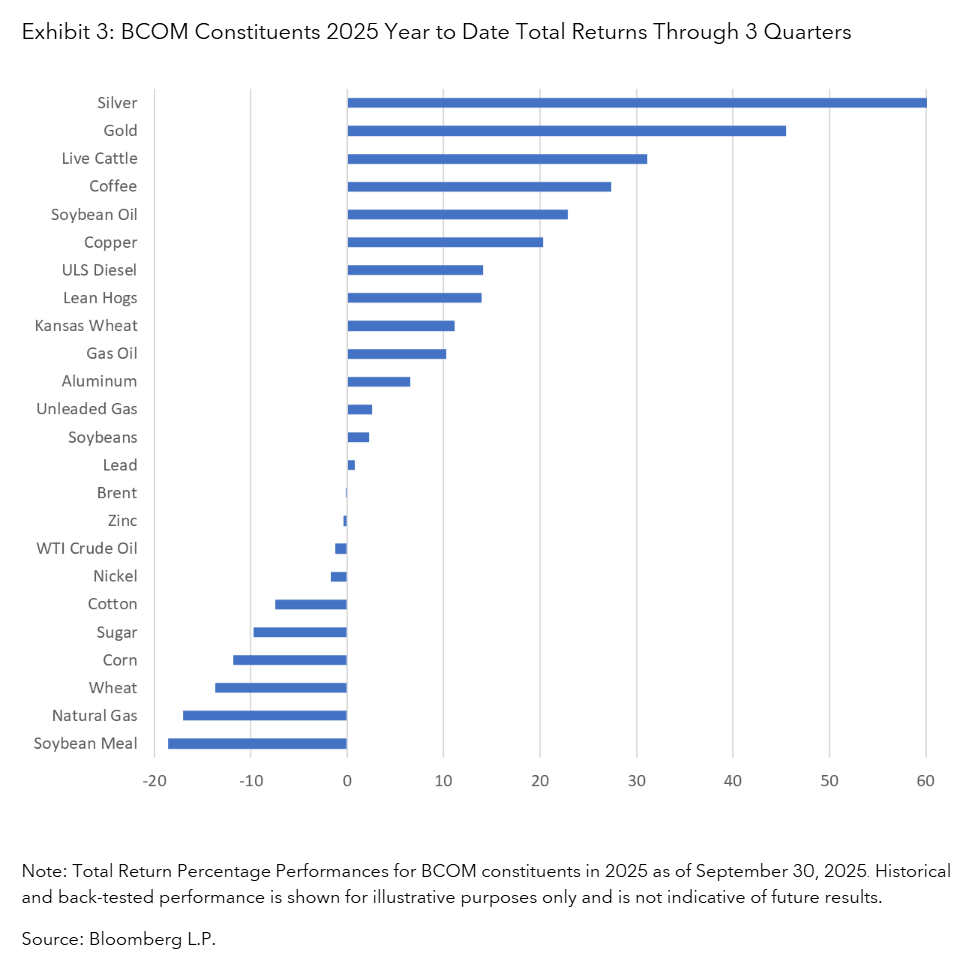

The Bloomberg Commodity Index (BCOM) rose 4% in the third quarter and is now up 9% for 2025. Precious metals drove a lot of the upside performance, as gold made new all-time highs. Four of the six BCOM sectors posted gains, with grains and energy as the exceptions. Within energy, natural gas was the only drag while the remaining oil-based constituents were positive and petroleum rose 4%.

PRODUCT MENTIONS

Tailwinds for the commodities asset class persisted through the third quarter and there is renewed interest from a broad base of market participants looking for not only diversification but also an inflation hedge in their portfolios. Whether this trend persists remains uncertain. However, looking back at historical macroeconomic environments such as the 1970s or the 2000s, a similar positive momentum set up for commodities could occur in the fourth quarter of 2025.

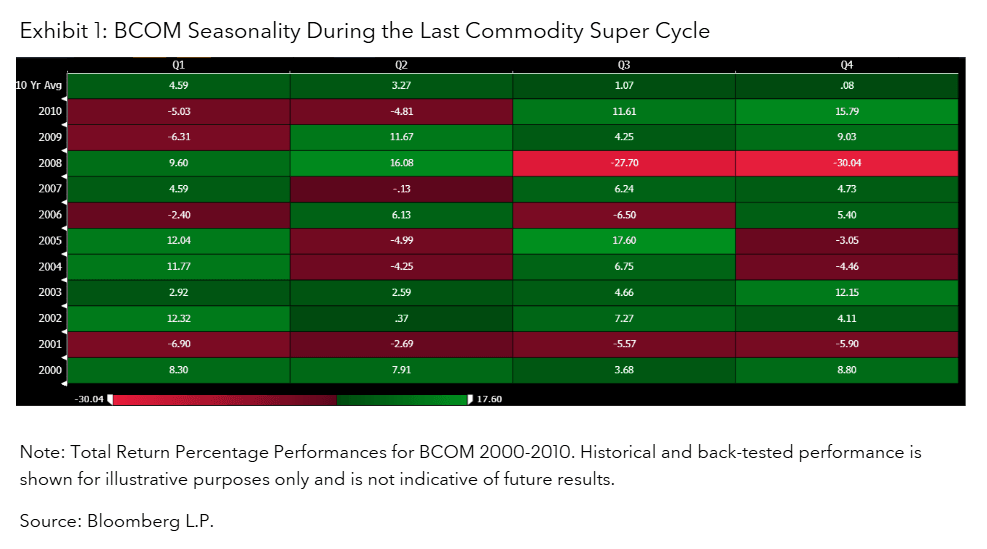

The 2020s so far have been described as the next commodity super cycle by some commodity experts. The last super cycle during the 2000s was driven by both similar and distinct factors for commodity outperformance but looking purely at 4th quarter performances that followed strong third quarters during that decade, BCOM continued to perform well in those years. Exhibit 1 shows fourth-quarter performance generally tracked third quarter trends during that decade. Whether this continues in 2025 is anyone’s guess but still positive economic data in the US shows demand is still there for raw materials and the effects of tariffs have not fully been accounted for within inflation data readings.

What metals are leading commodity gains?

Precious metals finished the third quarter strong and silver had its best quarterly performance in 15 years. Silver made a new all-time high to start the fourth quarter. In 2025, US dollar assets are not seen with the same lens from international investors as they have in the past. Earlier this year, we had one of the worst drops in value for the USD and large equity rotation into other markets outside the US.

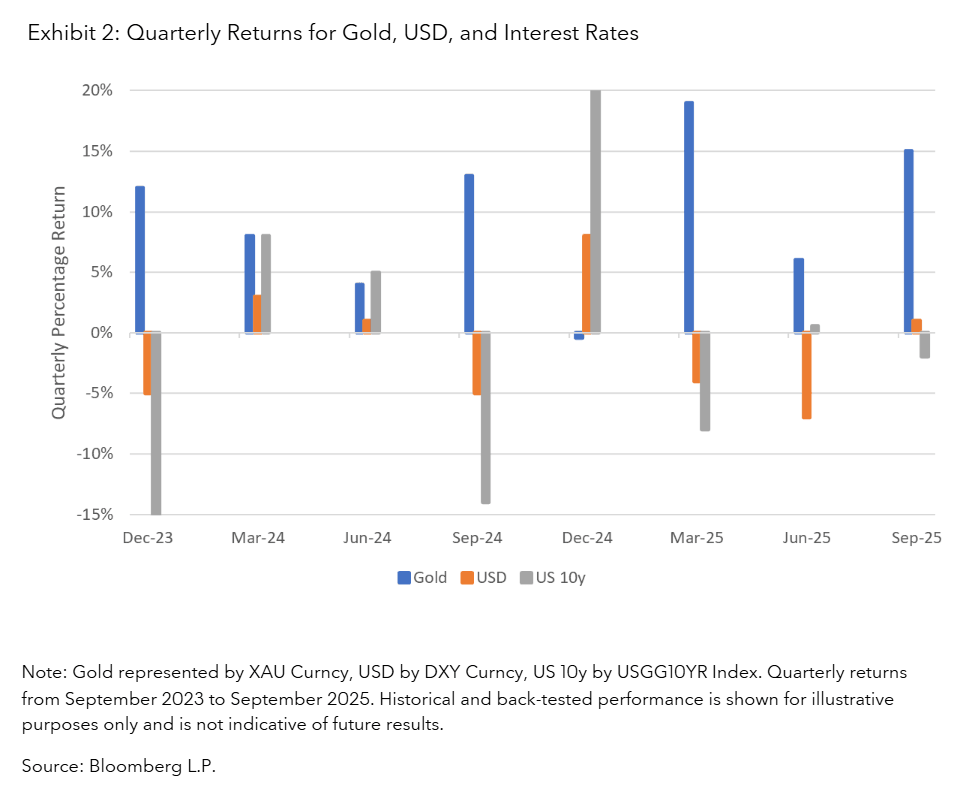

This coincided with greater appreciation for gold and silver. Gold and silver are often viewed as potential stores of value during periods of uncertainty. Last quarter’s performance reflected the historically inverse relationship between gold and the USD/interest rates. Exhibit 2 reflects the inverse relationship has mostly held over the last 5 quarters.

The remaining precious metals of silver, platinum, and palladium showed strong correlations to gold with third quarter returns of +29%, +16%, and +14%. This is something highlighted in previous blogs where these other metals have sometimes followed gold’s move but typically with more volatility, partially due to the smaller sizes of these individual markets. These metals also have competing drivers of performance because not only are they considered to be firmly within the precious metals sector but more than half of the use case for each is industrial in nature. So there have been times historically where they tend to have the same tailwinds associated with industrial metals like aluminum, copper, and nickel.

These precious metals (with the exception of gold), industrial metals, and battery metals make up the BCOM Global Commodity Transition Metals index which is now +24% higher for 2025. This suggests that energy transition demand for metals may be picking up. Most metals within BCOM are strongly contributing to the positive 2025 performance with only lead and zinc flat on the year. Exhibit 3 shows the year-to-date performances by commodity with two-thirds of BCOM constituents posting positive returns.

How is the agriculture sector contributing to commodity market gains?

Live cattle had another strong quarter but one commodity that rose strongly was coffee which had multiple themes driving price action. U.S. tariffs on imports from key coffee growing regions such as Brazil, Vietnam, and Colombia contributed to higher prices. Costs of production increased due to ongoing instability in the supply chain and logistics disruptions. One of the most important reasons has been the disruption to the coffee crop.

Climate change has intensified severe droughts in Brazil and Vietnam which has reduced overall crop yields as well as coffee bean quality. The supply shortage recently has been a key factor over the last two years and coffee prices have doubled since then.

Will commodity tailwinds persist into year-end?

The third quarter showed the tailwinds for the commodities asset class are still driving prices. As momentum has recently picked up, macro conditions supported commodities exposure in diversified portfolios.

Within modern portfolios, replication of BCOM is often employed for inflation hedging and diversification. As the year ends (with elevated equity valuations and tight credit spreads), inflows from market participants may continue as fundamentals and diversification benefits align.

Explore Bloomberg Indices and Commodity Indices to see how to use them in your investment strategy. Click here and here.

The data and other information included in this publication is for illustrative purposes only, available “as is”, non-binding and constitutes the provision of factual information, rather than financial product advice. BLOOMBERG and BLOOMBERG INDICES (the “Indices”) are trademarks or service marks of Bloomberg Finance L.P. (“BFLP”). BFLP and its affiliates, including BISL, the administrator of the Indices, or their licensors own all proprietary rights in the Indices. Bloomberg L.P. (“BLP”) or one of its subsidiaries provides BFLP, BISL and its subsidiaries with global marketing and operational support and service. Certain features, functions, products and services are available only to sophisticated investors and only where permitted. Bloomberg (as defined below) does not approve or endorse these materials or guarantee the accuracy or completeness of any information herein, nor does Bloomberg make any warranty, express or implied, as to the results to be obtained therefrom, and, to the maximum extent allowed by law, Bloomberg shall not have any liability or responsibility for injury or damages arising in connection therewith. Nothing in the Services or Indices shall constitute or be construed as an offering of financial instruments by Bloomberg, or as investment advice or investment recommendations (i.e., recommendations as to whether or not to “buy”, “sell”, “hold”, or to enter or not to enter into any other transaction involving any specific interest or interests) by Bloomberg. Information available via the Index should not be considered as information sufficient upon which to base an investment decision. All information provided by the Index or in this publication is impersonal and not tailored to the needs of any person, entity or group of persons. Absence of any trademark or service mark from this list does not waive Bloomberg’s intellectual property rights in that name, mark or logo. For the purposes of this publication, Bloomberg includes BLP, BFLP, BISL and/or their affiliates.

BISL is registered in England and Wales under registered number 08934023 and has its registered office at 3 Queen Victoria Street, London, England, EC4N 4TQ. BISL is authorised and regulated by the Financial Conduct Authority as a benchmark administrator.

© 2025 Bloomberg. All rights reserved.