ARTICLE

LNG developers rethink greenlighting for next supply wave

BloombergNEF

This article was written by Lujia Cao, Gas/LNG Analyst at BloombergNEF. It appeared first on the Bloomberg Terminal.

Final investment decisions, or FIDs, on liquefied natural gas projects have accelerated this year, buoyed by regulatory support and competitive urgency as developers race to secure market share ahead of an expected supply glut.

These FIDs are also increasingly moving beyond conventional norms, such as requiring reputable developers and partners, nearly full long-term offtake contracts and all necessary regulatory permits. The three FIDs in the first half of 2025 seem to challenge this model, signaling a shift toward more agile, flexible and diverse project execution.

Decisions made this year and next could bring more capacity before 2030

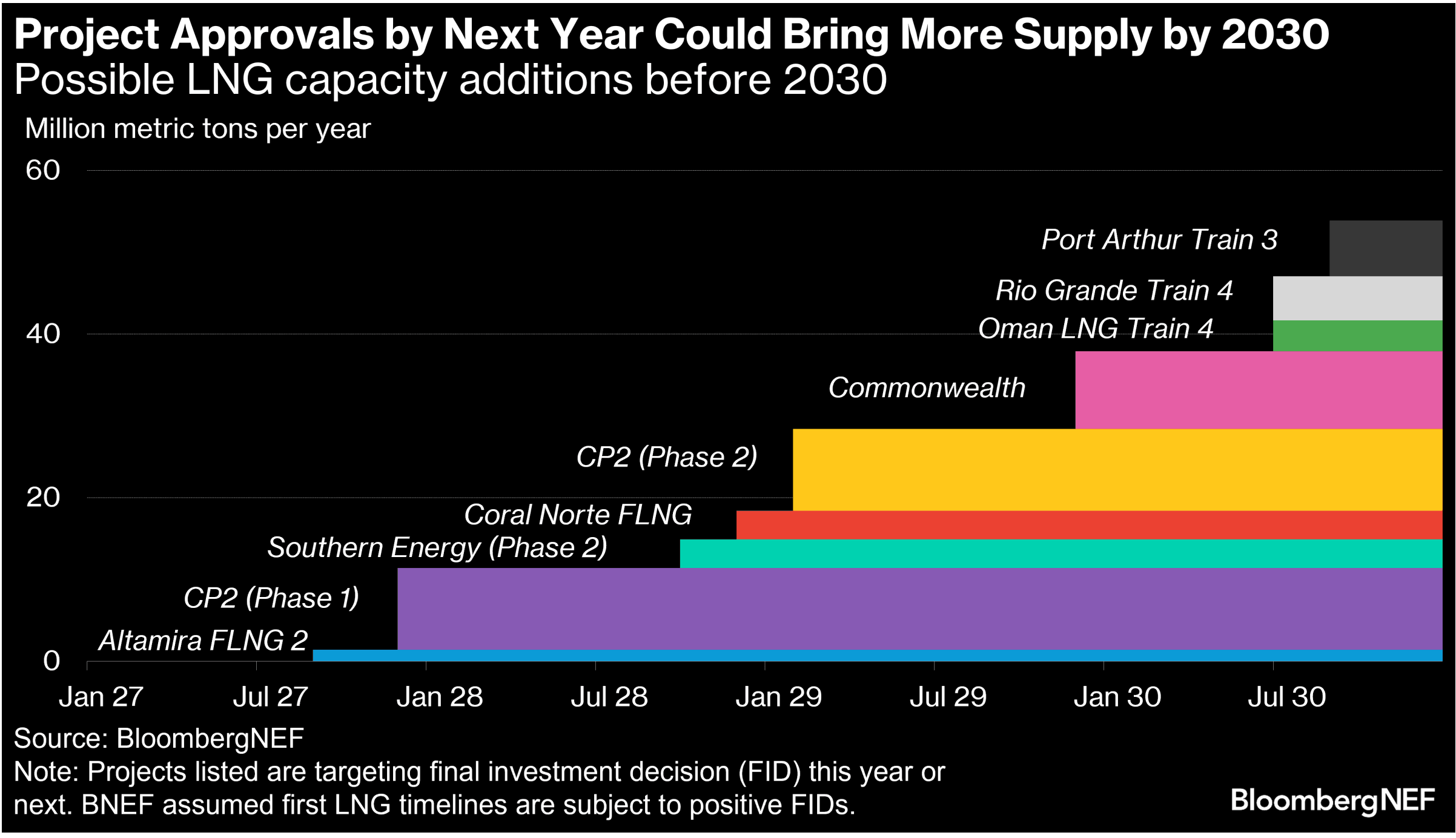

BloombergNEF identifies promising projects based on their target FID date within the next 18 months, the strength of developer backing, the project type (such as modular or expansion), and whether contracts have been signed or partnerships secured.

A project is considered to be a strong candidate for FID in 2025 or 2026 if it meets at least two of these criteria. If current momentum holds, BNEF estimates that additional project approvals could add up to 54 million metric tons a year of supply before 2030.

Venture Global’s CP2 and Kimmeridge’s Commonwealth LNG in the US are strong candidates for likely FID due to their modular designs. In the US, Port Arthur Phase 2 and Rio Grande Train 4 are both expansion projects targeting FID in 2025 with potential for first LNG before 2030. Outside of the US, Oman LNG’s Train 4 (Sur LNG) could also be approved and come online by 2030 despite lacking long-term contract commitments.

Three smaller floating LNG (FLNG) proposals could come online if they reach FID by year-end. Argentina’s Southern Energy Phase 2 might start in 2028 after vessel delivery in the fourth quarter of 2027, while Coral Norte FLNG, with government approval, also aims for a 2028 startup. Offshore Energy reported that New Energy Fortress’ Altamira second Fast LNG unit secured a $700 million loan and could begin operations as early as mid-2027.

US developers advancing projects despite pending permits

US LNG developers are increasingly confident in committing to LNG projects even with permits still pending, encouraged by the supportive regulatory environment under the Donald Trump administration.

Cheniere Energy Inc. in June announced that it had reached FID on its Corpus Christi Midscale Trains 8 and 9 expansion, despite not securing a non-free trade agreement export permit from the Department of Energy (DOE). The project benefits from its brownfield site and longstanding relationship with engineering, procurement, and construction (EPC) contractor Bechtel, enabling it to secure construction slots and optimize timelines. This proactive move underlines developers’ confidence in demand growth and a belief that US regulatory hurdles are diminishing.

The Trump administration has accelerated regulatory approvals for US LNG projects since taking office. The DOE resumed permit approvals in February this year, granting conditional permits to Commonwealth LNG and Venture Global’s CP2 LNG, while also extending deadlines for the under-construction Golden Pass and the proposed Delfin LNG project. In May, the DOE finalized its 2024 LNG export study initiated under the Joe Biden administration, signaling its full support for the planned projects.

Legal hurdles related to environmental clearances from the Federal Energy Regulatory Commission have also been resolved. The agency reauthorized permits for CP2 and Commonwealth LNG in May and June and had issued the draft supplemental environmental impact statement (SEIS) to Rio Grande and Texas LNG in March, with final reauthorization expected by November. All four projects are aiming for FID this year.

New ‘FID first, contracts sell-down later’ paradigm

The role of long-term contracts as a prerequisite for project FID is diminishing. Projects are increasingly reaching FID based on strong financial backing from strategic partners, with most long-term contracting capacity occurring thereafter.

Woodside Energy’s Louisiana project reached FID in April 2025 with only 1 million metric tons per year (Mtpa) of 16.5Mtpa contracted with Uniper. Private equity firm Stonepeak took a 40% stake, securing financial support for the project. Woodside plans to sell down around 50% more equity in the project, while likely retaining the remaining volumes for portfolio trading.

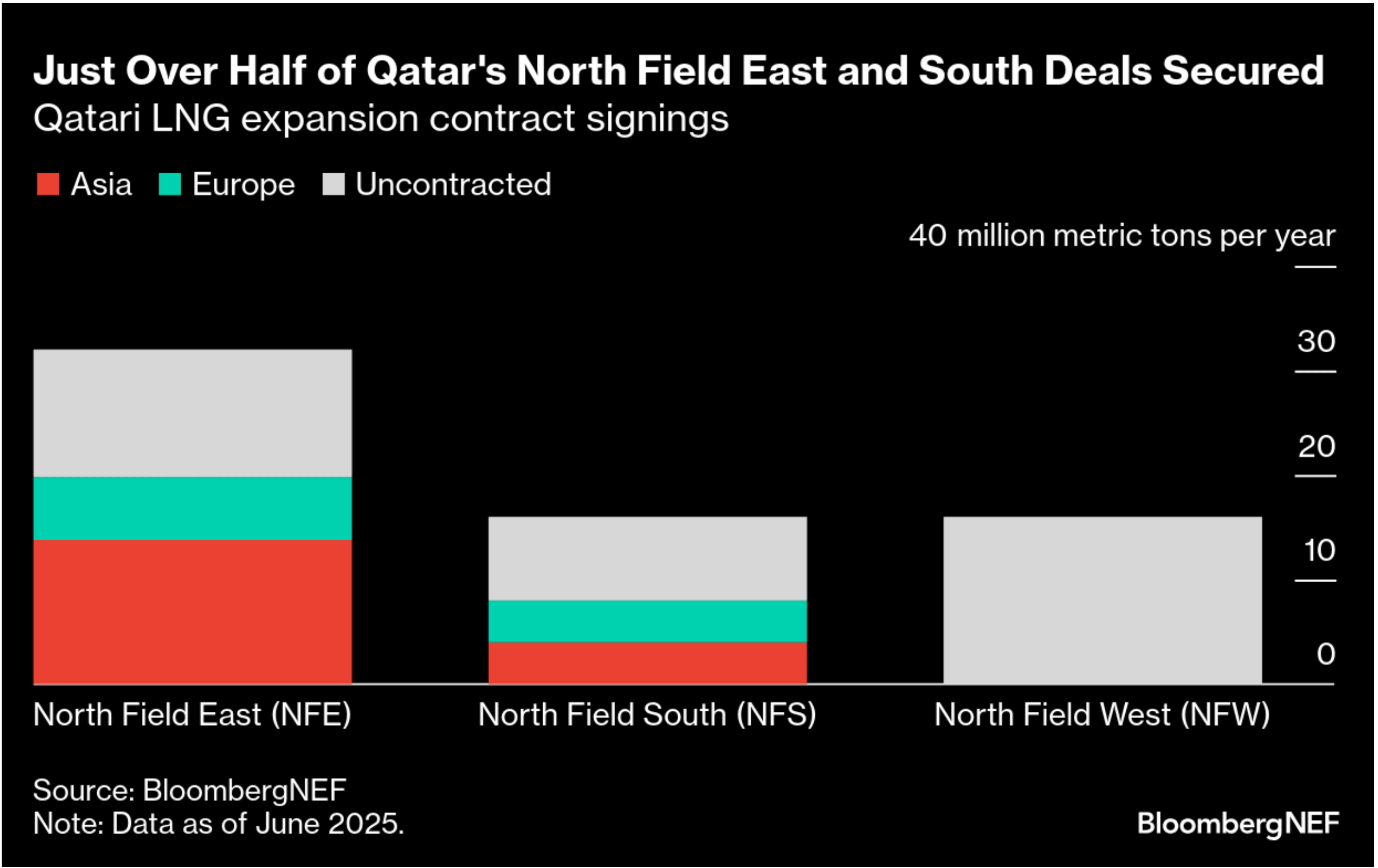

QatarEnergy has adopted a similar “FID first” approach and moved ahead with its mega North Field expansion projects with state backing. The North Field East (NFE) project reached FID in 2021, with partnerships announced between 2022 and 2024. Construction on North Field South (NFS) proceeded without a formal public FID announcement in 2023 and North Field West (NFW) is set to start construction in 2027.

Only 58% of NFE and NFS capacity is contracted, while NFW has yet to secure any deals or partners as of June 2025. QatarEnergy’s market dominance and reputation allow it to attract partners and secure long-term deals after FID.

These examples reflect an increasingly dynamic market where developers are more confident in progressing on projects based on market fundamentals, while retaining flexibility by absorbing a sizable portion of uncontracted supply for their trading portfolios.

Smaller, agile projects by emerging developers gain ground

Smaller LNG projects led by less-established developers are also advancing, sometimes even without formal FID announcements. These projects usually utilize compact, fast-track and flexible solutions, including FLNG technology, and are developed by a wider pool of companies beyond the traditional energy majors. This signals confidence in demand and a willingness to initiate projects with smaller phases, banking on market opportunities and efficient execution.

Argentina’s 2.5Mtpa floating project Southern Energy LNG, led by shale drillers and involving state-owned YPF, reached FID in May, marking the country’s return as an LNG exporter as soon as 2027. This smaller FLNG project is moving ahead first even though YPF has been planning a 5Mtpa onshore terminal to tap Vaca Muerta gas since 2019. YPF views the Southern Energy project as the first phase of its broader LNG exports strategy and aims to develop two more phases, targeting FID this year and next, partnering with Shell Plc and Eni SpA.

Projects such as Altamira Fast LNG in Mexico, Genting FLNG in Indonesia, and Canada’s Woodfibre LNG have progressed without formal public FIDs, marked instead by construction milestones. These projects often leverage existing infrastructure or employ modular construction for quicker deployment and lower capital expenditure, thus reducing commercial risks compared to large-scale LNG projects.

Key projects likely to start after 2030

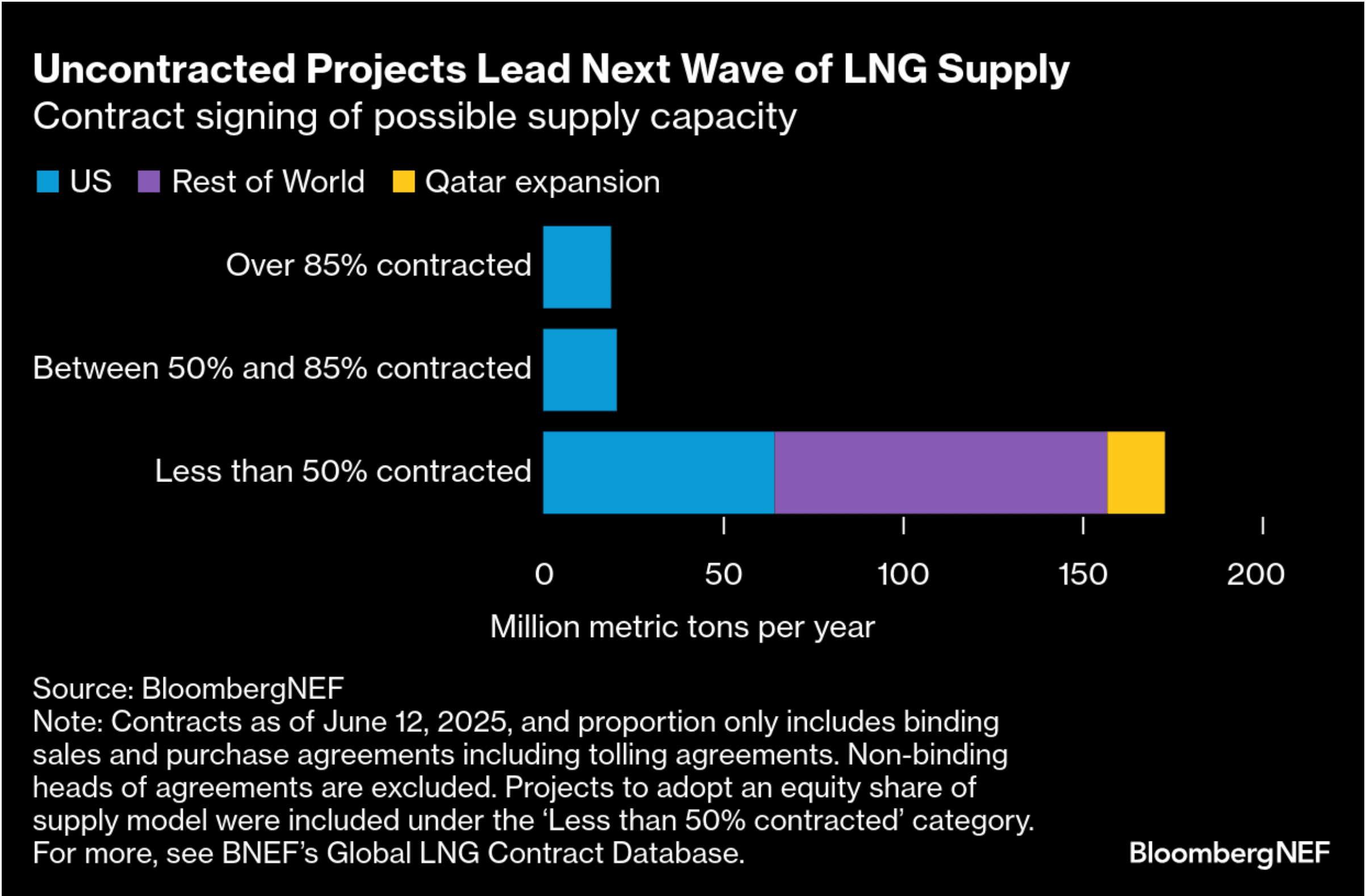

Beyond 2030, a larger pipeline of 159Mtpa of additional supply is on BNEF’s list of projects to watch, adding to more than 212Mtpa of total LNG capacity being considered. In an already potentially oversupplied market, FID progress will depend on securing demand. Notably, only around 19Mtpa of projects are more than 85% contracted and 21Mtpa are between 50% and 85% contracted – all based in the US.

Almost 40% of this 159Mtpa of possible capacity is US-sourced. Delfin FLNG is nearly fully contracted but is seeking a permit extension to 2031. Lake Charles and Texas LNG are over 50% contracted. Expansion projects, including Rio Grande Train 5 and Sabine Pass Stage 5, need more commercial momentum to advance. The longstanding Alaska LNG project has attracted significant interest from Asian buyers since Trump took office.

Among floating projects, Canada’s 12Mtpa Ksi Lisims LNG secured deals with Shell and TotalEnergies SE whereas Argentina’s YPF plans another 22Mtpa of capacity, partnering with Shell and Eni. Meanwhile, Nigeria UTM’s smaller FLNG is aiming for FID in the third quarter of 2025, potentially involving China’s Cosco for vessel construction.

BNEF assumes Qatar’s NFW expansion will proceed regardless of firm contracting levels. Among the projects with an equity-lifting structure, LNG Canada Phase 2 is targeting FID next year, as is Rovuma LNG, and Papua LNG is bidding for an EPC contract. Inpex’s Abadi project aims for FID next year and started front-end engineering design in April.

Interested in the latest perspectives on the energy transition? See more BNEF analysis here.

The data included in these materials are for illustrative purposes only. The BLOOMBERG TERMINAL service and Bloomberg data products (the “Services”) are owned and distributed by Bloomberg Finance L.P. (“BFLP”) except (i) in Argentina, Australia and certain jurisdictions in the Pacific Islands, Bermuda, China, India, Japan, Korea and New Zealand, where Bloomberg L.P. and its subsidiaries (“BLP”) distribute these products, and (ii) in Singapore and the jurisdictions serviced by Bloomberg’s Singapore office, where a subsidiary of BFLP distributes these products. BLP provides BFLP and its subsidiaries with global marketing and operational support and service. Certain features, functions, products and services are available only to sophisticated investors and only where permitted. BFLP, BLP and their affiliates do not guarantee the accuracy of prices or other information in the Services. Nothing in the Services shall constitute or be construed as an offering of financial instruments by BFLP, BLP or their affiliates, or as investment advice or recommendations by BFLP, BLP or their affiliates of an investment strategy or whether or not to “buy”, “sell” or “hold” an investment. Information available via the Services should not be considered as information sufficient upon which to base an investment decision. The following are trademarks and service marks of BFLP, a Delaware limited partnership, or its subsidiaries: BLOOMBERG, BLOOMBERG ANYWHERE, BLOOMBERG MARKETS, BLOOMBERG NEWS, BLOOMBERG PROFESSIONAL, BLOOMBERG TERMINAL and BLOOMBERG.COM. Absence of any trademark or service mark from this list does not waive Bloomberg’s intellectual property rights in that name, mark or logo. All rights reserved. © 2025 Bloomberg.