Bloomberg Intelligence

This article was written by Bloomberg Intelligence Senior Industry Analyst Henik Fung and Senior Associate Analyst Chia Chen. It appeared first on the Bloomberg Terminal.

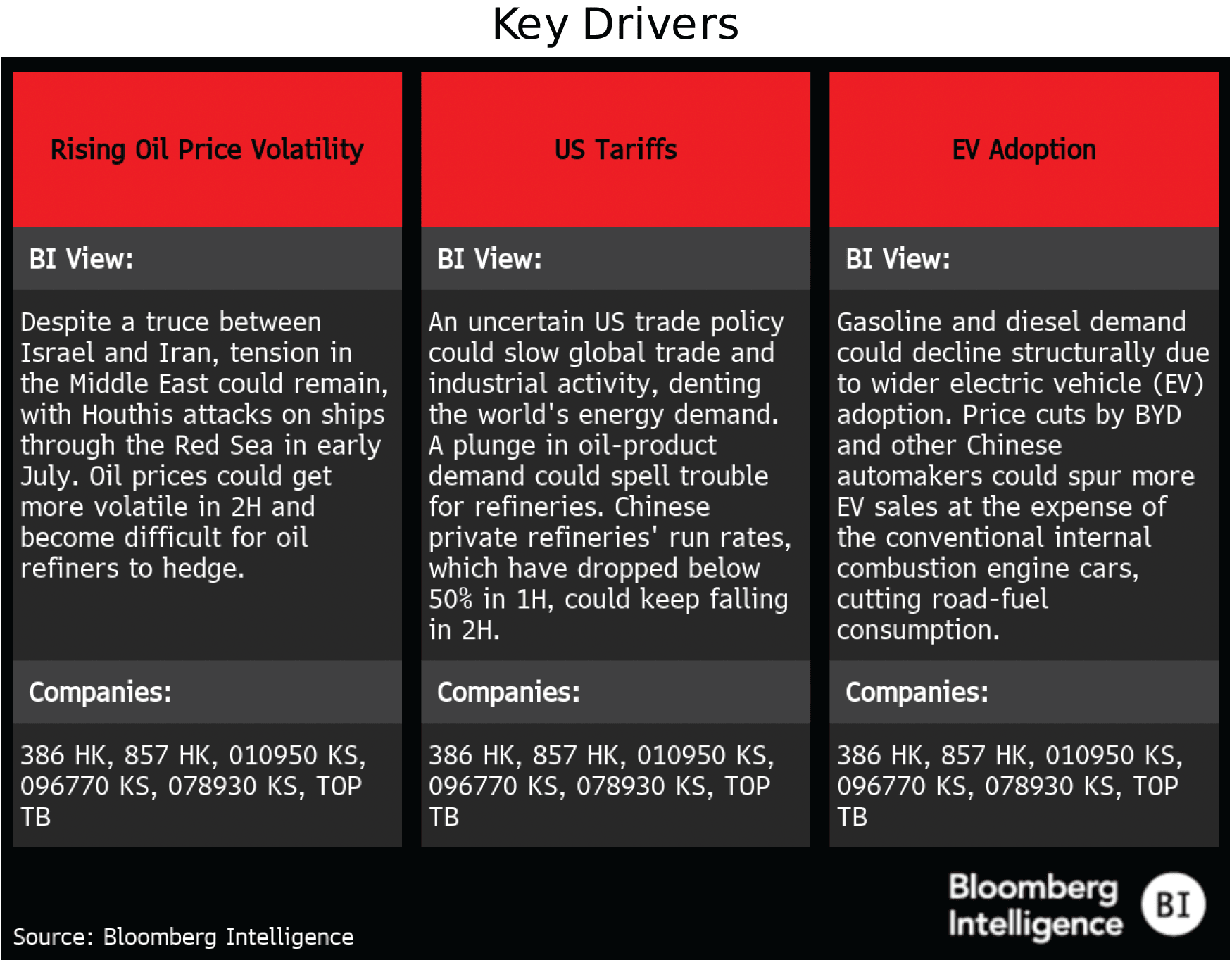

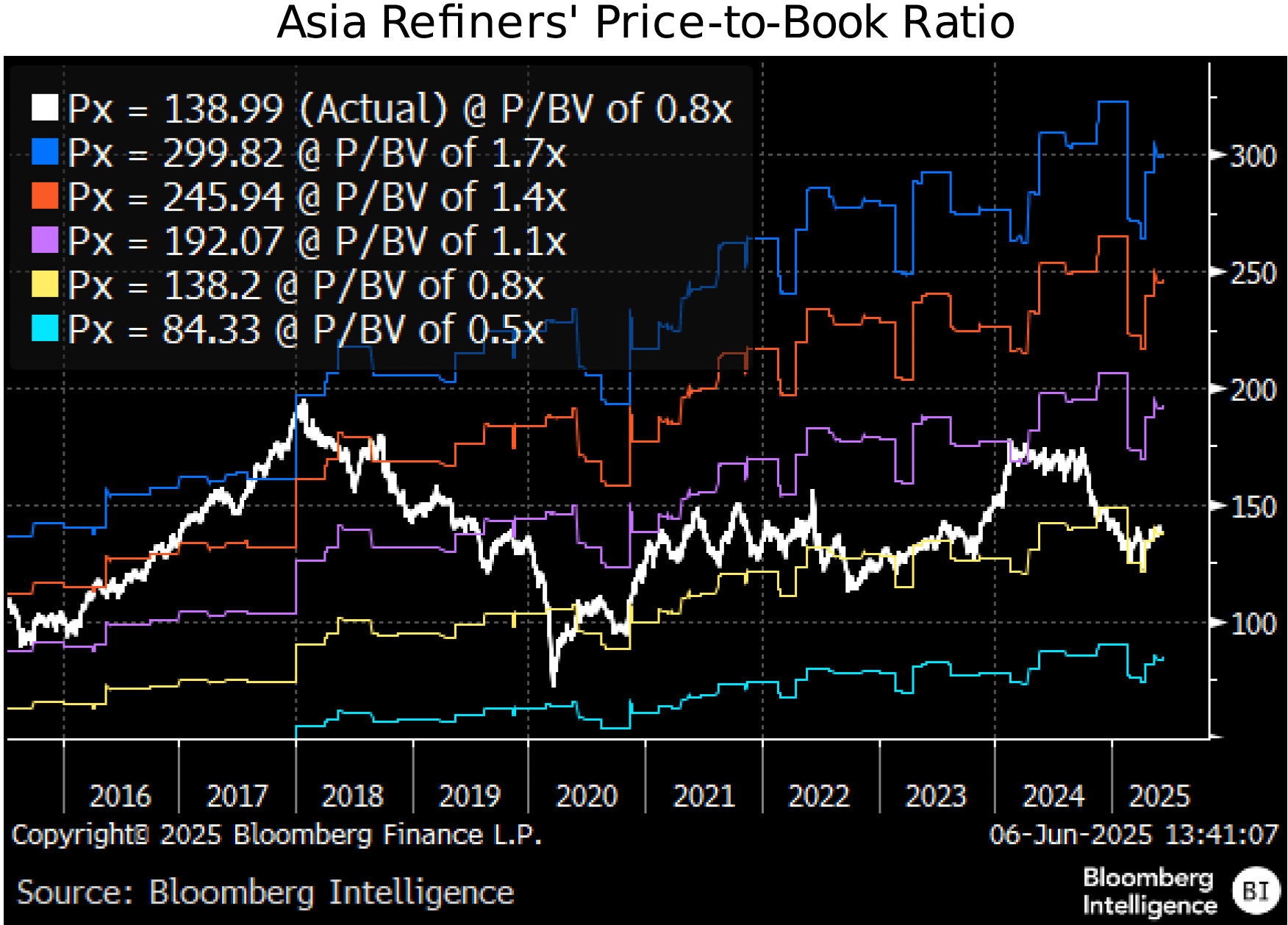

Asian oil refiners could face stronger margin headwinds in 2H if demand slumps and crude costs spike. Sluggish China exports and industrial activity as a result of US tariffs could deliver a blow to diesel demand. Meanwhile, the availability of more affordable electric vehicles would accelerate wider adoption, weakening gasoline consumption. Escalating MiddleEast tensions could keep the price of oil higher for longer amid widening risk premiums. All these point to a slump in Asia refining margins. BI Asia-Pacific refining peers traded at 0.8x book value as of June 10, below their 10-year average of 1.1x.

Three keys for 2H: Asia-Pacific oil refining

Asian refiner valuations pressured by demand slump, supply glut

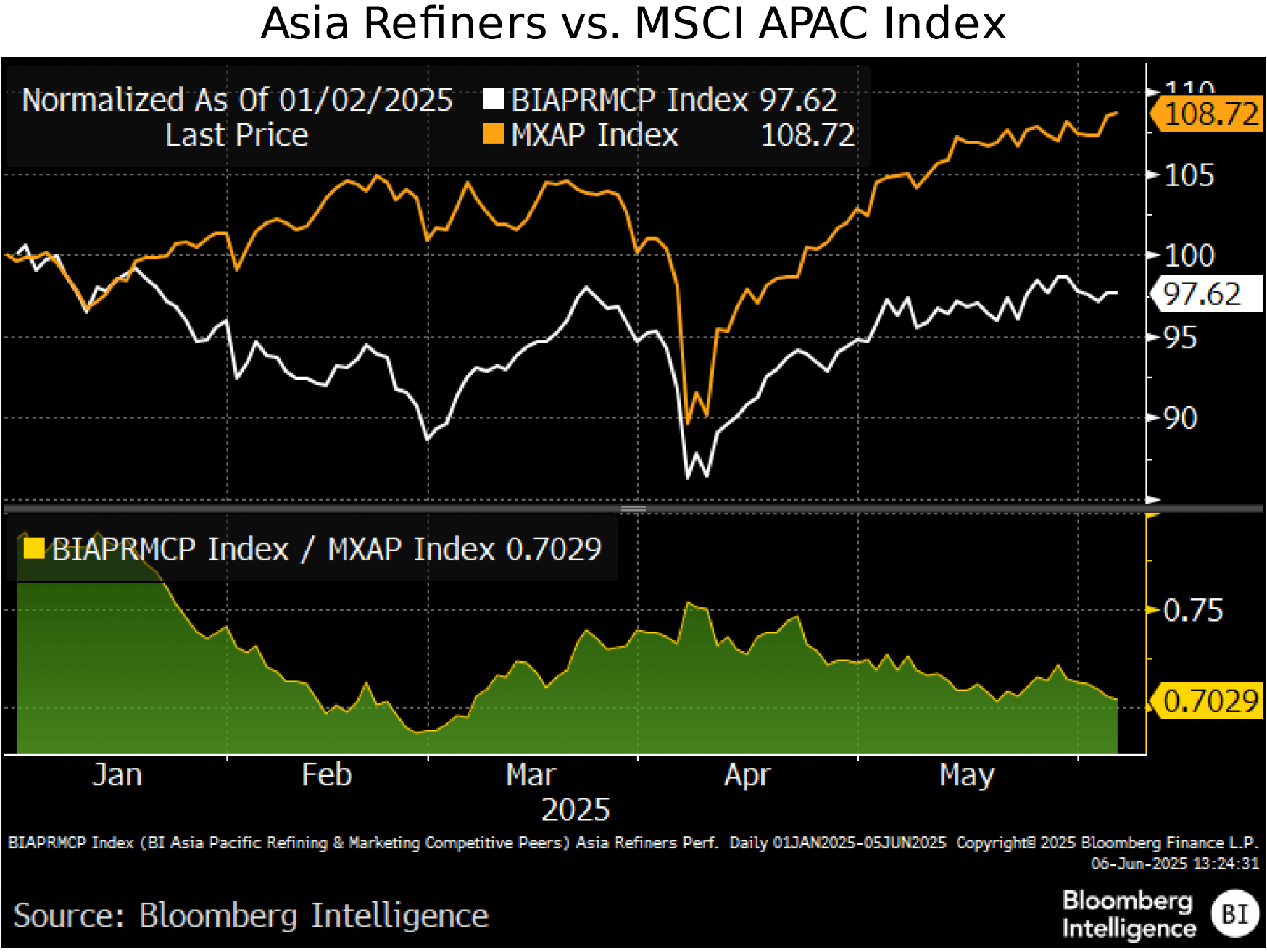

The BI Asia Pacific Refining Peers Index lagged behind the equity market from Jan. 2-June 5, likely dragged by weaker oil-product demand amid shrinking global trade, falling industrial activity and widening EV adoption. The group trades at a book value of 0.8x, below its 10-year average of 1.1x, suggesting the market might be factoring in demand risks.

Refiners’ shares weaken on oil-product demand dip

Shares of Asian oil refiners have trailed the MSCI Asia Pacific Index this year until June 5 due to waning oil-product demand amid US tariffs. Weak domestic consumption could compel Chinese refiners to raise fuel exports, which would exacerbate the regional supply glut and squeeze refining margins. Overcapacity and stiffer earnings headwinds can pressure Asian refiners in 2H.

The BI Asia Pacific Refining Peers Index underperformed the MSCI Asia Pacific Index by 11.1 percentage points between Jan. 2-June 5.

Valuation discount suggests demand risk

The average price-to-book valuation is 0.8x for Asian refiners, 27% below the 10-year average of 1.1x, which might signal concerns about how the dimming global economic outlook due to US tariffs could hinder oil-product demand. Wider electric vehicle adoption is reducing gasoline demand as well, particularly in China. The valuation discount to its long-term average might widen if the supply-demand imbalance increases.

Terminal subscribers can access full version of this report via BI <GO>.

The data included in these materials are for illustrative purposes only. The BLOOMBERG TERMINAL service and Bloomberg data products (the “Services”) are owned and distributed by Bloomberg Finance L.P. (“BFLP”) except (i) in Argentina, Australia and certain jurisdictions in the Pacific Islands, Bermuda, China, India, Japan, Korea and New Zealand, where Bloomberg L.P. and its subsidiaries (“BLP”) distribute these products, and (ii) in Singapore and the jurisdictions serviced by Bloomberg’s Singapore office, where a subsidiary of BFLP distributes these products. BLP provides BFLP and its subsidiaries with global marketing and operational support and service. Certain features, functions, products and services are available only to sophisticated investors and only where permitted. BFLP, BLP and their affiliates do not guarantee the accuracy of prices or other information in the Services. Nothing in the Services shall constitute or be construed as an offering of financial instruments by BFLP, BLP or their affiliates, or as investment advice or recommendations by BFLP, BLP or their affiliates of an investment strategy or whether or not to “buy”, “sell” or “hold” an investment. Information available via the Services should not be considered as information sufficient upon which to base an investment decision. The following are trademarks and service marks of BFLP, a Delaware limited partnership, or its subsidiaries: BLOOMBERG, BLOOMBERG ANYWHERE, BLOOMBERG MARKETS, BLOOMBERG NEWS, BLOOMBERG PROFESSIONAL, BLOOMBERG TERMINAL and BLOOMBERG.COM. Absence of any trademark or service mark from this list does not waive Bloomberg’s intellectual property rights in that name, mark or logo. All rights reserved. © 2025 Bloomberg.