Bloomberg Intelligence

This analysis is by Bloomberg Intelligence Senior Industry Analyst Jason F Miner and Senior Associate Analyst Ama Kyerewaa. It appeared first on the Bloomberg Terminal.

Significant new demand for US agricultural products could arise from tariffs should trading partners reduce barriers instead of ratcheting them up. With Southeast Asia a long-standing target for US export growth, Bangladesh appears to be an early example of breaking down such obstacles.

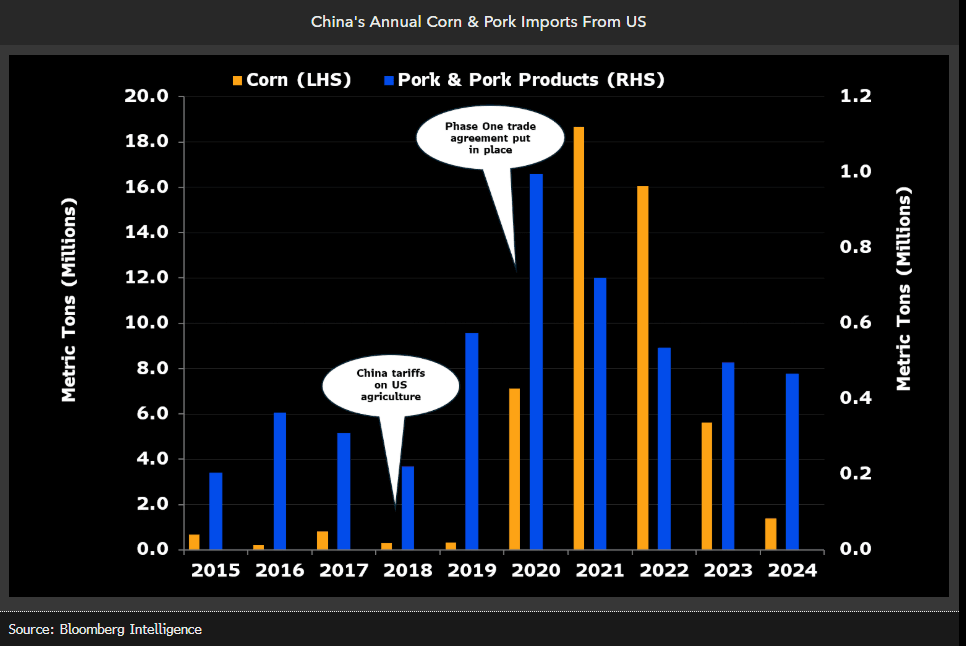

History hints at silver lining in trade salvo

History suggests the trade standoff could actually raise American agricultural exports — if partners lower barriers and the US follows suit. Following 2018’s trade conflict, a Phase One agreement between the US and China led to record US exports of corn, soybeans, pork and other products. The USDA and Office of the US Trade Representative, in an October 2020 report, calculated that $23 billion in purchases by China (71% of the deal’s target) would lead to record exports across an array of American agricultural products. Realistic concerns are driving dim views of 2025’s export potential. However, the seemingly unsustainable level of many tariffs — 20-50% on key importers of US agriculture — bolsters our suspicion that levies aren’t the endgame. A better resolution in 2026 and beyond is worth considering.

Long-sought markets hold potential for US agriculture

Removing barriers to US exports is a stated goal of the Trump administration, yet new markets could open should trading partners respond to tariffs by lowering, rather than raising, impediments. The EU, Japan, Canada and India are large export markets historically targeted by US agricultural-trade advocates. These appear to have relatively fewer substantial geopolitical disputes with the US and could significantly boost American imports. China holds huge potential, as evidenced by its increased soybean imports during a 2020 detente, yet the landscape is now complicated by myriad issues.

Initial reactions by Bangladesh, among the hardest hit under the new US trade regime, show that some partners may be willing to break rank and reduce barriers. Rising incomes have driven the USDA to highlight this market’s potential.

Agriculture-chain stocks lag, yet valuations hint at trough

Earnings along the agriculture chain remain squeezed as large crops keep a lid on prices. Yet improvements in upstream valuations suggest 2025 may increasingly be viewed as a cyclical bottom. Weak consumer spending is limiting margin gains downstream, extending the overall valuation discount.

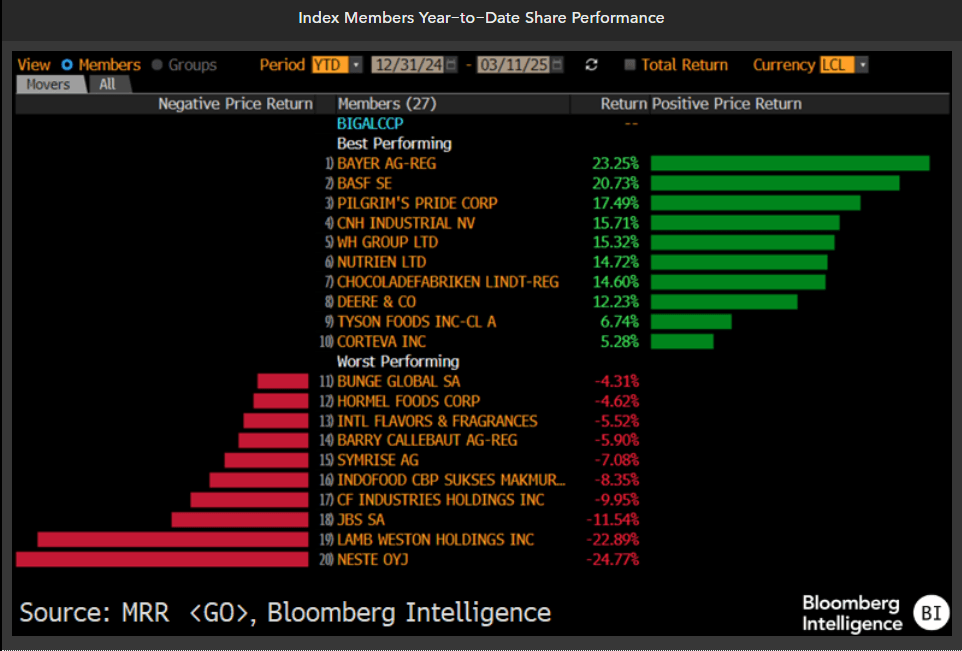

Ag shares mixed by volatile policy, crop prices

Volatile policy and corn prices are scrambling a long slide in the Bloomberg Intelligence upstream agriculture peer group against downstream peers, which followed weaker crop prices and farm profits. Both upstream and downstream indexes have trailed equities for 12 months, with the MSCI All Country World Index up 8% vs. last year, and corn prices (until recently up 20%) now just 7% higher. Equities have risen among downstream sellers of protein (Pilgrim’s Pride, JBS) and food (Marfrig, Cal-Maine). Downstream performance is restrained by weak consumer demand and a volatile policy facing biofuels producers (Neste, Verbio).

Year to date, upstream producers are up 5% vs. a 7% gain for downstream. Shares have begun climbing among upstream players that sell chemicals (Nutrien, Corteva) and equipment (Deere, CNH) to farmers.

Bloomberg Terminal subscribers can access full version of this analysis via BI <GO>.

The data included in these materials are for illustrative purposes only. The BLOOMBERG TERMINAL service and Bloomberg data products (the “Services”) are owned and distributed by Bloomberg Finance L.P. (“BFLP”) except (i) in Argentina, Australia and certain jurisdictions in the Pacific Islands, Bermuda, China, India, Japan, Korea and New Zealand, where Bloomberg L.P. and its subsidiaries (“BLP”) distribute these products, and (ii) in Singapore and the jurisdictions serviced by Bloomberg’s Singapore office, where a subsidiary of BFLP distributes these products. BLP provides BFLP and its subsidiaries with global marketing and operational support and service. Certain features, functions, products and services are available only to sophisticated investors and only where permitted. BFLP, BLP and their affiliates do not guarantee the accuracy of prices or other information in the Services. Nothing in the Services shall constitute or be construed as an offering of financial instruments by BFLP, BLP or their affiliates, or as investment advice or recommendations by BFLP, BLP or their affiliates of an investment strategy or whether or not to “buy”, “sell” or “hold” an investment. Information available via the Services should not be considered as information sufficient upon which to base an investment decision. The following are trademarks and service marks of BFLP, a Delaware limited partnership, or its subsidiaries: BLOOMBERG, BLOOMBERG ANYWHERE, BLOOMBERG MARKETS, BLOOMBERG NEWS, BLOOMBERG PROFESSIONAL, BLOOMBERG TERMINAL and BLOOMBERG.COM. Absence of any trademark or service mark from this list does not waive Bloomberg’s intellectual property rights in that name, mark or logo. All rights reserved. © 2025 Bloomberg.