Bloomberg Intelligence

This analysis is by Bloomberg Intelligence Senior Industry Analysts Richard Bourke and Alon Olsha, with contributing analysis by Grant Sporre. It appeared first on the Bloomberg Terminal.

Canada and Mexico are the leading exporters of steel to the US, but most of their products likely can be readily produced in the US, which runs a steel trade surplus with Mexico. Among European producers, SSAB may benefit from its US mills, while ArcelorMittal is vulnerable to tariffs, since it exports steel to the US from plants in Canada and Mexico.

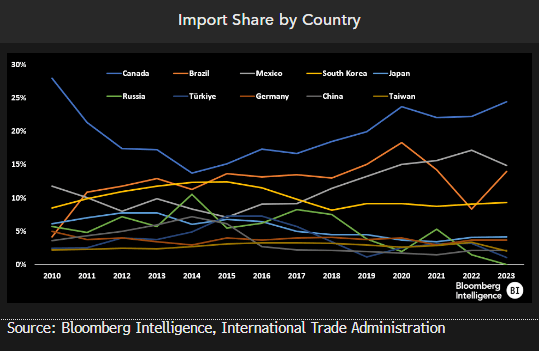

Leading importers to US are no-tariff countries

The top five countries that export steel to the US are Canada, Mexico, Brazil, South Korea and Japan. Together, they account for over two-thirds of imports since 2010. Before the announcement of 25% tariffs on Canada and Mexico that were to start on Feb. 4 — since paused for 30 days — neither was subject to tariffs. For Brazil, South Korea and Japan, a quota system suspends tariffs on a set volume of steel imports.

Canada and Mexico, the leading exporters, are party to the USCMA, a free-trade agreement with the US that replaced NAFTA. Through November the US ran a steel trade deficit with Canada, importing 5.5 million metric tons while exporting 3 million. With Mexico, the US ran a trade surplus, exporting 3.9 million tons and importing 2.9 million.

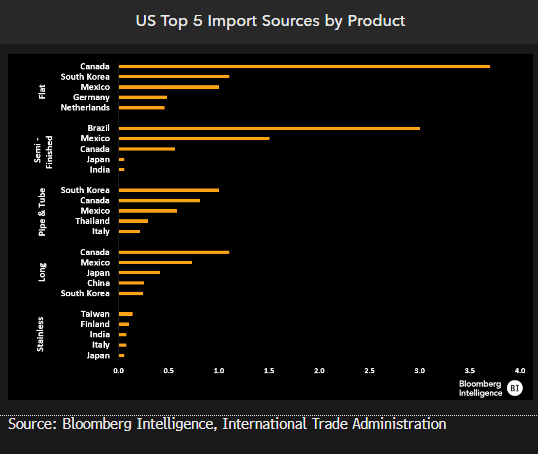

Canada, Mexico lead US imports across products

The top source countries for US imports by volume vary across types of steel products. The US imported the largest share of flat products from Canada in 2023 at 3.7 million metric tons, followed by South Korea at 1.1 million. Canada was also the largest source of long-product imports at 1.1 million tons, with Mexico No. 2 at 732,000.

US imports of semi-finished steel were led by Brazil’s 3 million tons, followed by Mexico’s 1.5 million. For pipe and tube, South Korea led in exports to the US at 1 million tons, and Canada was second at 812,000. Taiwan was the largest source of imported stainless products at 141,000 tons, followed by Finland’s 103,000.

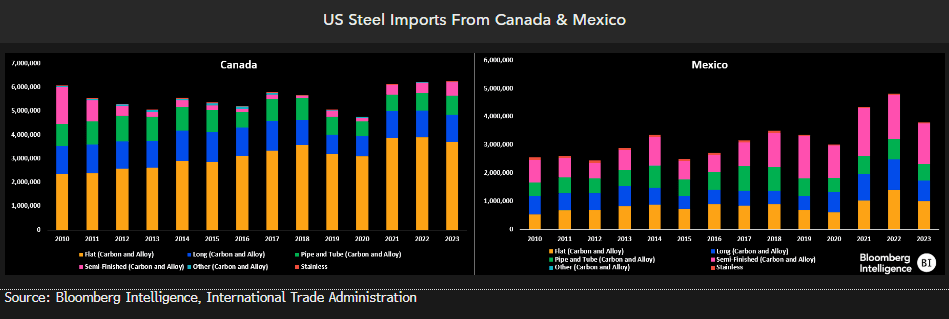

Imports from Mexico appear opportunistic

Canada and Mexico, the leading exporters of steel to the US, are exempted from tariffs due to the USCMA trade agreement. The largest category of imports from Mexico has been semi-finished slabs, which have been imported from Brazil or may come from China via Vietnam, according to recent industry claims. This was behind the recent requirement to “melt and pour” in Mexico to be exempt from 25% tariffs.

Canada has long been a major supplier of steel, particularly flat-rolled, to the US due to its proximity and a strong trade relationship. Canadian producers are competitive on quality and costs, aided by investment to modernize production processes, lower labor costs due to a publicly funded health-care system and access to natural resources such as iron ore and met coal.

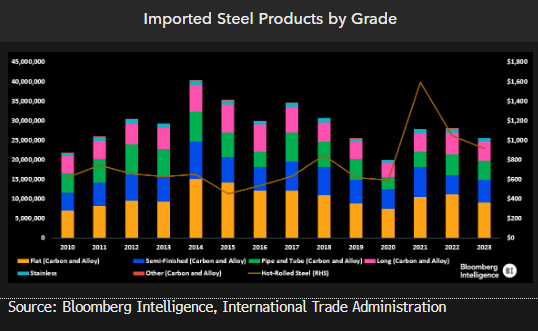

Specialty steels comprise subset of imports

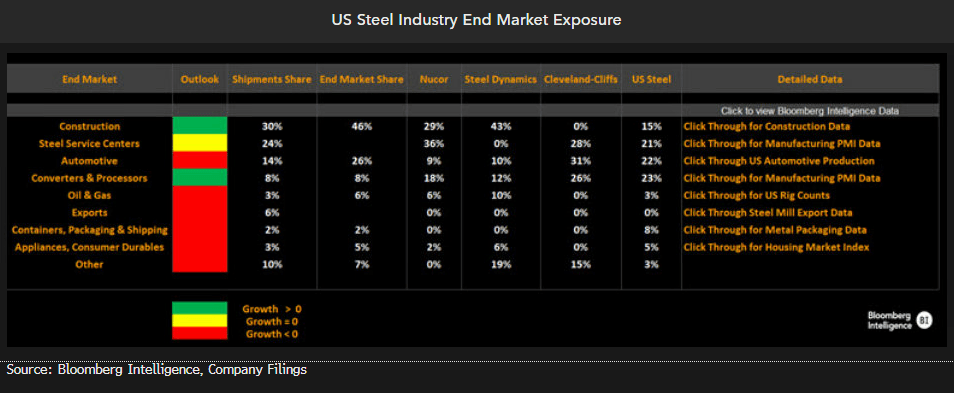

One-third to half of the average 29 million tons of steel that the US imports annually are specialty steels that might not be readily available domestically, our analysis shows. Unique grades of steel, alloys or specialized products include stainless, electrical, tool, high-strength low alloy, pipe, oil country goods and plate.

Relative pricing drives the remainder of imports. High US prices make lower-priced imports of commodity steel products such as hot-rolled coil attractive despite tariffs. Since 2010, carbon and alloy slabs are the most imported grade and one of the cheapest. Slabs are semi-finished steel products processed to create a variety of final products, such as sheet metal, pipes and tubes. Imports compete with products from Nucor, Steel Dynamics, US Steel and Cleveland-Cliffs.

Consumer shift may negate auto tariff benefits

The introduction of higher tariffs by the incoming Trump administration may benefit US steelmakers tied to the automotive market, but a shift in consumer preferences could derail that thesis. The WTO Computable General Equilibrium Model used by Bloomberg Economics has identified the automotive sector as possibly benefiting from increased tariffs. Domestic production in sectors with big trade deficits and lower existing import tariffs tend to benefit more from the rise in US duties.

But with an average transaction price of over $47,000, the US auto market is under pressure. Consumers are pulling back, leading to automakers cutting sales and production forecasts. A shift to cheaper, smaller cars is an advantage for imports, not the Detroit 3 as a shift away from SUVs and pickups hurt them, along with Cliffs and US Steel.

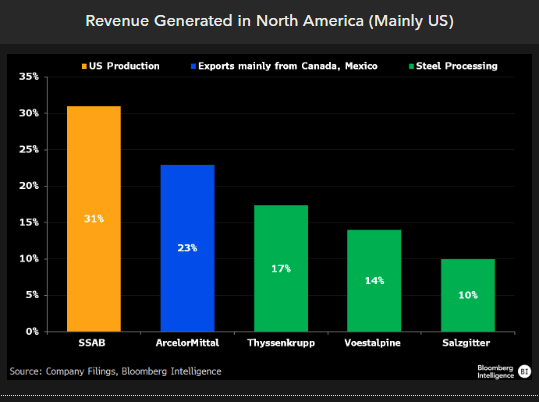

SSAB has US footprint; ArcelorMittal vulnerable

European steelmakers generate 10-30% of their revenue in the US, but only SSAB is protected from tariffs due to its US-based production. ArcelorMittal generated 13% of its sales in the US, out of 23% from North America, and we estimate that most of that was from steel exported from its Canadian and Mexican plants across the border. That steel may become 25% more expensive, and some of the steel sold in Canada and Mexico could eventually be at risk as well if auto plants in those countries relocate to the US.

SSAB generates 31% of sales in the US from its plants in Alabama and Iowa so may be able to sell its heavy plate closer to import parity prices. Other European steelmakers don’t produce steel in the US but rather re-roll intermediate products.

The data included in these materials are for illustrative purposes only. The BLOOMBERG TERMINAL service and Bloomberg data products (the “Services”) are owned and distributed by Bloomberg Finance L.P. (“BFLP”) except (i) in Argentina, Australia and certain jurisdictions in the Pacific Islands, Bermuda, China, India, Japan, Korea and New Zealand, where Bloomberg L.P. and its subsidiaries (“BLP”) distribute these products, and (ii) in Singapore and the jurisdictions serviced by Bloomberg’s Singapore office, where a subsidiary of BFLP distributes these products. BLP provides BFLP and its subsidiaries with global marketing and operational support and service. Certain features, functions, products and services are available only to sophisticated investors and only where permitted. BFLP, BLP and their affiliates do not guarantee the accuracy of prices or other information in the Services. Nothing in the Services shall constitute or be construed as an offering of financial instruments by BFLP, BLP or their affiliates, or as investment advice or recommendations by BFLP, BLP or their affiliates of an investment strategy or whether or not to “buy”, “sell” or “hold” an investment. Information available via the Services should not be considered as information sufficient upon which to base an investment decision. The following are trademarks and service marks of BFLP, a Delaware limited partnership, or its subsidiaries: BLOOMBERG, BLOOMBERG ANYWHERE, BLOOMBERG MARKETS, BLOOMBERG NEWS, BLOOMBERG PROFESSIONAL, BLOOMBERG TERMINAL and BLOOMBERG.COM. Absence of any trademark or service mark from this list does not waive Bloomberg’s intellectual property rights in that name, mark or logo. All rights reserved. © 2025 Bloomberg.