Bloomberg Professional Services

This article was written by the Bloomberg Enterprise Investment Research Data team: Sundeep Agrawal, Maris Serzans, and Jerome Barkate.

Amid an increasingly volatile macroeconomic climate shaped by evolving tariff policies, investors face mounting challenges. The unpredictability of these trade measures underscores the need for comprehensive data on the sources of geographic and industrial origins of companies’ revenues and costs via their supply chain network. Given that, this special edition of Data Spotlight focuses on how research data, such as supply chain information and the soon to be launched geographic segment fundamentals, can be utilized to run company analysis in the context of macro events like tariff policy changes.

Understanding these factors is crucial for making informed investment decisions. For example, the impact of new tariffs creates uncertainty around revenue and earnings forecasts. Having the tools to assess and measure the impact of tariffs can help better manage portfolio risk and navigate the uncertain macro environment.

Geographic segmentation data

To better empower investors with tools that help to navigate such an environment, in the next few months Bloomberg will make a geographic segment fundamentals data product available to customers. This solution will offer a comprehensive view of companies’ reported and estimated geographic revenues. This product is set to provide normalized geographical insights of companies’ revenue and other valuable metrics by utilizing both reported as well as estimated data when necessary.

More specifically, the geographic segment fundamentals data product is designed to have a multi level standardized hierarchy covering broad regions and specific countries providing a comprehensive and granular view of a company’s revenue breakdown. The estimated data will be derived using a proprietary Bloomberg methodology utilizing GDP and intercountry trade flows to estimate revenues for regions and countries which are not reported by companies. It provides insights into the geographic distribution of company revenues.

For the latest information on our new products, visit our Press Announcements page and subscribe to the Enterprise Data and Tech Download newsletter here.

Company screening use case

Our research data, including the upcoming geographic segment fundamentals dataset mentioned above, allows investors to perform deep company and industry analysis. For illustration purposes, we gather data for a universe of companies (Bloomberg US Large Cap Index, B500), and build a sensitivity score based on their revenue exposures to various countries and industries (see Table 1). Those sensitivities can be thought of as potential Revenue-at-Risk for companies. This helps investors assess the potential impact of tariffs on their portfolios, enabling them to make informed investment decisions.

Using a bottom up approach, we compare various indices from the US (Bloomberg US Large Cap Index), Europe (Bloomberg EMEA Large & Mid Cap Index) and APAC (Bloomberg APAC Large & Mid Cap Index) based on the same sensitivity scoring. This comparison reveals how different regions and sectors are affected by the new tariff policies, offering investors valuable insights into their portfolios enabling them to enhance their risk management. Our analysis shows that, of the three regions, the European index (EMEAP) is the most sensitive to current macroeconomic conditions (Chart 2).

Uncovering indirect macroeconomic risks with supply chain data

While measuring risk on a company’s revenue is important, another factor to be considered is the risk around costs. Continuing with the auto example, building a car requires purchasing parts from overseas suppliers which could be subject to tariffs resulting in higher costs leading to lower margins.

Combining our sensitivity scores with supply chain data helps uncover cost-related risks for companies. This integrated analysis offers a deeper understanding of how companies are affected by global trade dynamics, enabling investors to identify potential risks and opportunities. The component related to suppliers can be considered potential Cost-at-Risk, as it reflects the risk of suppliers raising prices, thereby impacting customer costs.

To illustrate this concept, we measured the contribution of suppliers to various sensitivities for index constituents (see Chart 3). The results indicate that indirect exposure to tariffs can be significant and may have a substantial impact on companies’ financial performance. Note, indirect sensitivity (related to exposure to suppliers ) highlighted in light colors in the chart below shows the importance of supply chain considerations for macro factors.

Industrial focus: Automotive Sector

Applying this methodology to a sector such as Automotive, we can use Company Financials data such as profit margin, operating margin or ebitda margin to establish a risk/opportunity mapping (Chart 4). For example, investors focusing on risk management might want to avoid large exposure to companies with low margin and high sensitivity to tariffs (bottom-right) to favor companies with higher margin and low sensitivity to tariffs (top-left), all else being equal.

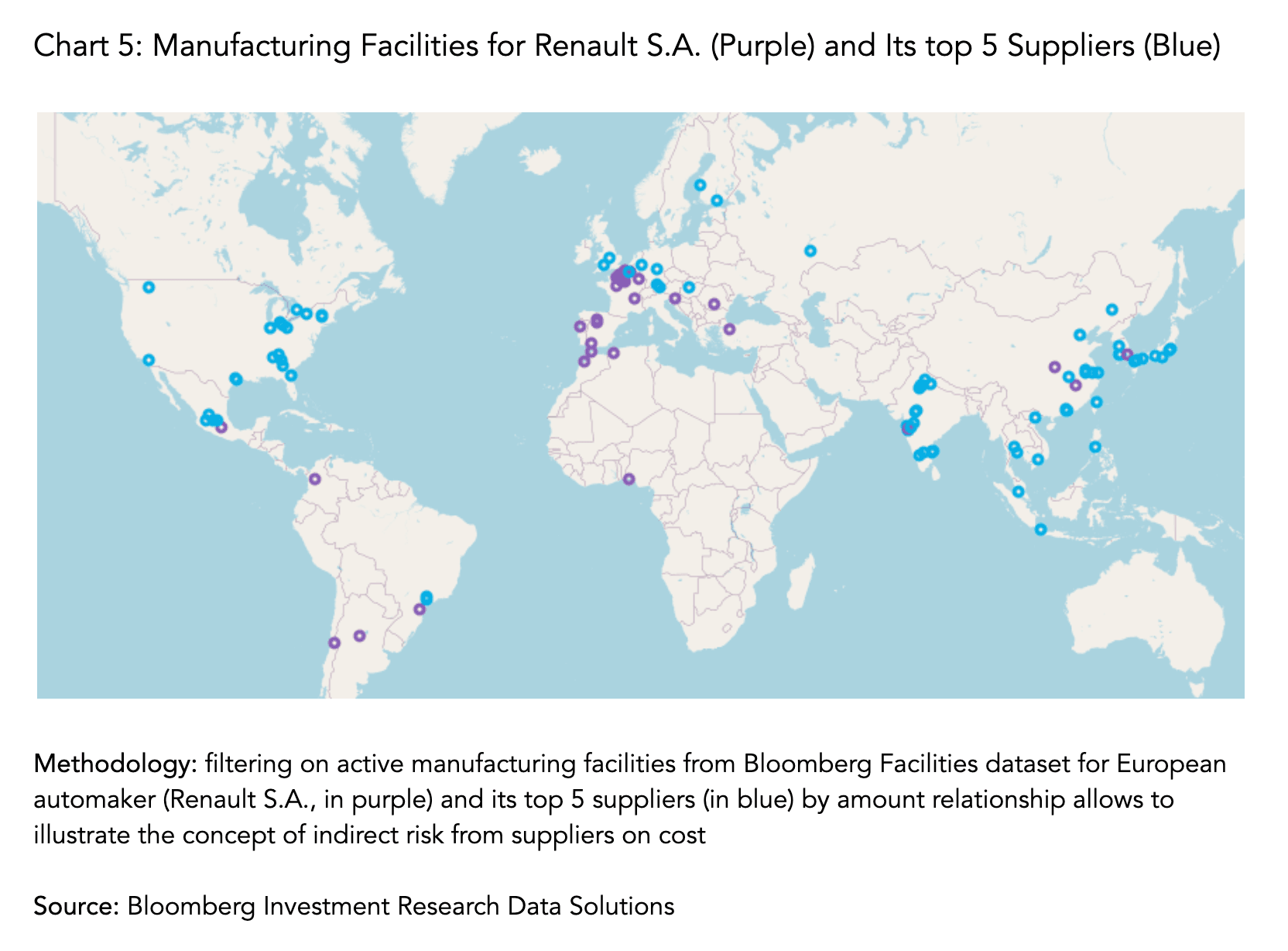

Taking this analysis a step further, data on the location of manufacturing facilities can be used to assess geographic footprint of companies from a manufacturing perspective, as well as their indirect exposure as the result of their suppliers’ geographic footprint. As illustrated in Chart 5, Renault S.A.—which manufactures outside the U.S. and therefore should not be directly impacted by U.S. tariff policies when selling cars in Europe—actually relies on suppliers that produce components in the U.S. These suppliers could face increased costs if European countries implement reciprocal tariffs, potentially raising the price of components. As a result, the European carmaker faces a risk to its production costs.

Unlocking deeper insights with data

While this note illustrates just a few examples of what investors can achieve with Bloomberg Company Research data, it highlights the importance of having the appropriate data at the right time. Note, additional key considerations such as industry specific metrics, monetary policy response or investor positioning to only mention a few – should be included in this type of analysis to get a deeper understanding of how companies, sectors, regions and indices are potentially impacted by macro changes such as tariffs.

Theme: Macro Investing, Company Analysis

Roles: Quants, Portfolio Managers, Risk Managers, Strategists, Analysts

Bloomberg Datasets: Operating Segment Fundamentals, Supply Chain, Facilities, Company Financials, Estimates and Pricing Point-in-Time, Geographic Segment Fundamentals (coming soon)

The data included in these materials are for illustrative purposes only. The BLOOMBERG TERMINAL service and Bloomberg data products (the “Services”) are owned and distributed by Bloomberg Finance L.P. (“BFLP”) except (i) in Argentina, Australia and certain jurisdictions in the Pacific Islands, Bermuda, China, India, Japan, Korea and New Zealand, where Bloomberg L.P. and its subsidiaries (“BLP”) distribute these products, and (ii) in Singapore and the jurisdictions serviced by Bloomberg’s Singapore office, where a subsidiary of BFLP distributes these products. BLP provides BFLP and its subsidiaries with global marketing and operational support and service. Certain features, functions, products and services are available only to sophisticated investors and only where permitted. BFLP, BLP and their affiliates do not guarantee the accuracy of prices or other information in the Services. Nothing in the Services shall constitute or be construed as an offering of financial instruments by BFLP, BLP or their affiliates, or as investment advice or recommendations by BFLP, BLP or their affiliates of an investment strategy or whether or not to “buy”, “sell” or “hold” an investment. Information available via the Services should not be considered as information sufficient upon which to base an investment decision. The following are trademarks and service marks of BFLP, a Delaware limited partnership, or its subsidiaries: BLOOMBERG, BLOOMBERG ANYWHERE, BLOOMBERG MARKETS, BLOOMBERG NEWS, BLOOMBERG PROFESSIONAL, BLOOMBERG TERMINAL and BLOOMBERG.COM. Absence of any trademark or service mark from this list does not waive Bloomberg’s intellectual property rights in that name, mark or logo. All rights reserved. © 2025 – Bloomberg.