Bloomberg Professional Services

This article was written by Jaydeep Soni, Product Manager, Real-Time Data Solutions and Colette Garcia, Global Head Real-Time Platform and Content, Enterprise Data at Bloomberg.

Information beyond pricing data, previously the domain of back-office teams, now drives equity markets. Stock prices bounce across 16 public exchanges, while trades in private venues appear seconds later. Meanwhile, same-day options can turn a headline into a one-percent market move and overnight sessions such as Blue Ocean Session, an alternative U.S. equity trading system that operates during Asia‐Pacific business hours, can see events move U.S. stock prices well before the regular market opens.

PRODUCT MENTIONS

The speed is set to increase even further with the planned introduction of 24-hour, five-days-a-week trading for U.S. equities by Cboe Global Markets and the potential launch of new exchanges in the U.S. and Europe.

Against this backdrop, this article explores how a unified feed of real-time prices and machine-readable events, enables trading desks to act instantly on both price and its catalyst, keeping pace with faster, more fragmented equity markets.

Three shifts redefining the front desk

To set the context, let’s zoom in on three fundamental changes influencing decision-making, liquidity access, and risk management at the desk.

1. Integrated workflows for manual and automated trading.

More than 75% US equity volume is now handled by low-touch trading engines, and over 60% of European equity orders originate from algorithms.. According to Bloomberg Intelligence’s latest Institutional Equity Trading Study algorithmic strategies and direct market access (DMA) together account for 41% of institutional flow.

Yet, when bid-ask spreads widen or marked liquidity thins, large trades often fall back to human traders. Today’s trading desk functions less like a showdown between humans and machines, more like a pilot working with an advanced autopilot: algorithms are efficient at scale, but human judgment proves more effective when the news is unpredictable and liquidity is limited. That partnership breaks down if humans and machines rely on different data sources, even tiny feed skews have shown up in flash-crash post-mortems. A single, real-time data stream that informs both algorithms and traders is essential to keep both aligned.

2. Daily options turn headlines into sprints.

Research from Bloomberg Intelligence shows that same-day expiring options, known as 0-DTE (zero days to expiry) contracts, now make up 23% of total U.S. options market volume. 0-DTE contracts now drive 56% of SPX option volume and almost half of DAX daily-option flow. Daily contracts have now become the primary tool for trading around events.They account for 56% of trading in SPX options and nearly half of daily option activity in Germany’s DAX index.

These short-term contracts have become the primary way to trade around specific events. Academic studies link the hedging activity triggered by these contracts, often referred to as gamma amplification, to sharp increases in short-term volatility. In this environment, missing even a single quote can turn a well-structured hedge into a costly mistake.

3. Liquidity without a centre.

As of late 2024, primary exchanges now handle fewer than half of U.S. equity trades withTrade-Reporting Facilities and regional platforms accounting for 51% share.. Market fragmentation is bound to accelerate speed even further. Blue Ocean Alternative Trading System (ATS) already facilitates U.S. stocks trading from 8pm to 4am ET, Sunday through Thursday, enabling Asia-based investors to trade American equities while U.S. markets are closed.

Over in the U.S., Cboe has filed to run a 24×5 session for all symbols on its EDGX exchange in 2025, subject to SEC approval and the planned Texas Stock Exchange (TXSE) and at least five other startup exchanges and half-a-dozen new ATSs and option venues are in the regulatory queue for 2025-26. A similar trend is unfolding in Europe, where periodic auction books on Cboe Europe continue to siphon lit flow, hitting record notional shares in 2024.

With markets now operating across more venues, more time zones, and a growing overnight session, events like a China PMI release at 2:00 a.m. ET or an after-hours earnings call from a major company can shift portfolio valuations well before the U.S. cash market opens. Since best-execution standards apply around the clock, trading desks require a unified data stream that captures both prices and the events driving them—no matter when or where they occur.

What that looks like in practice

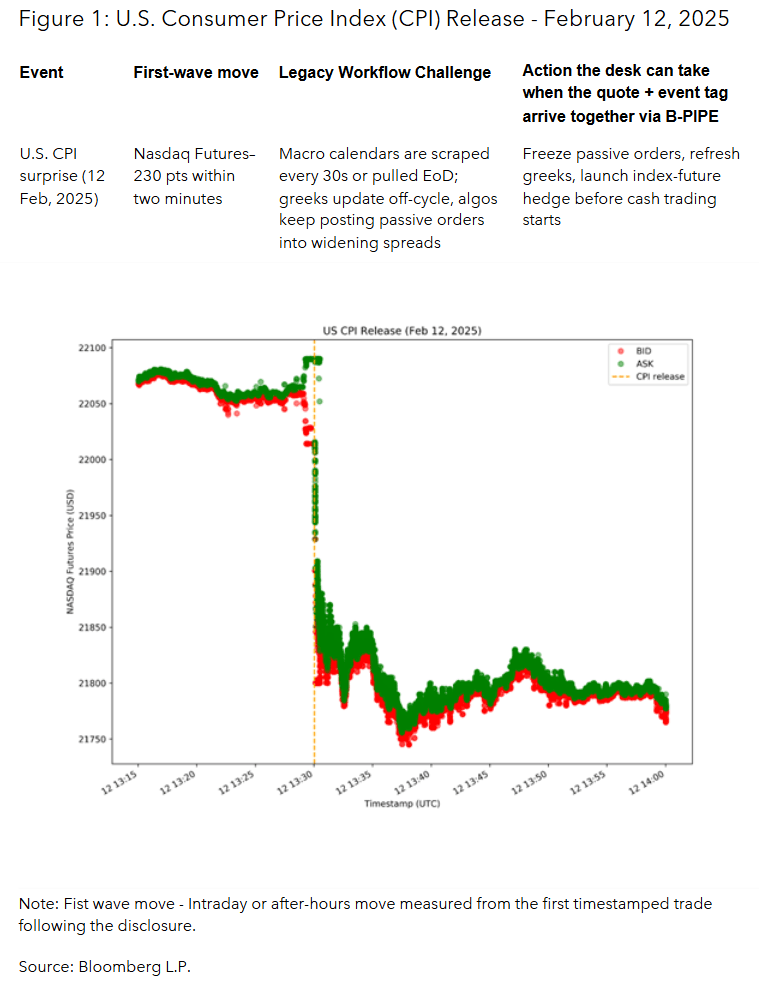

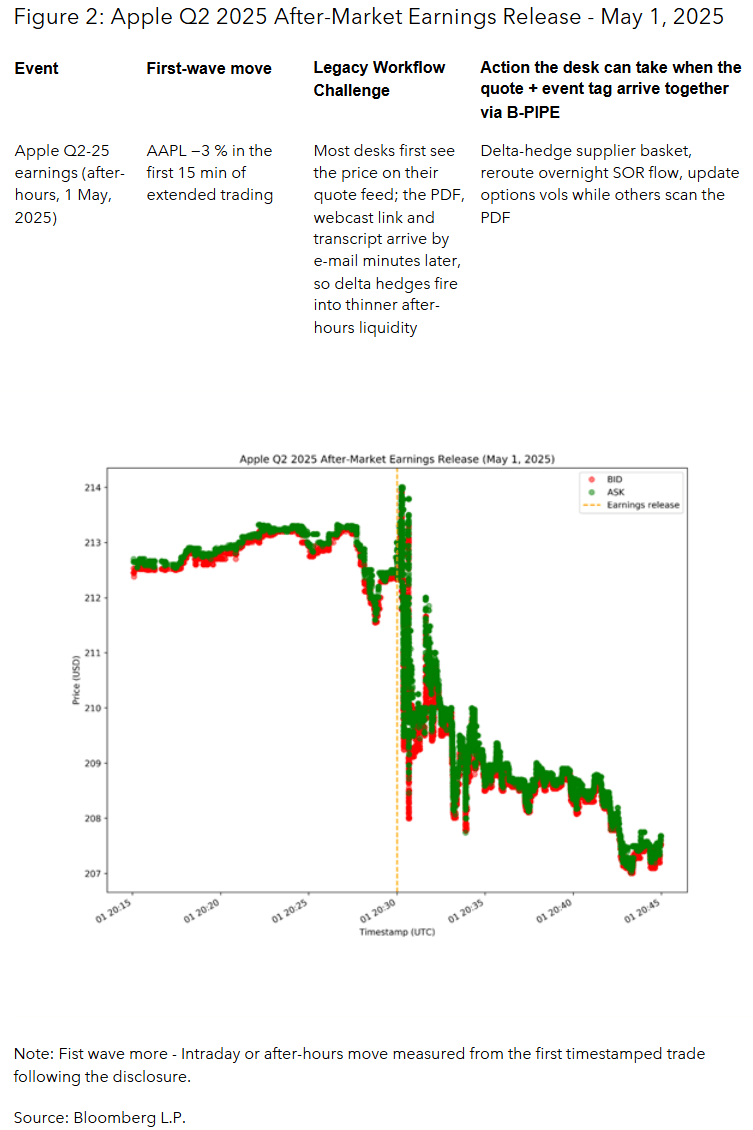

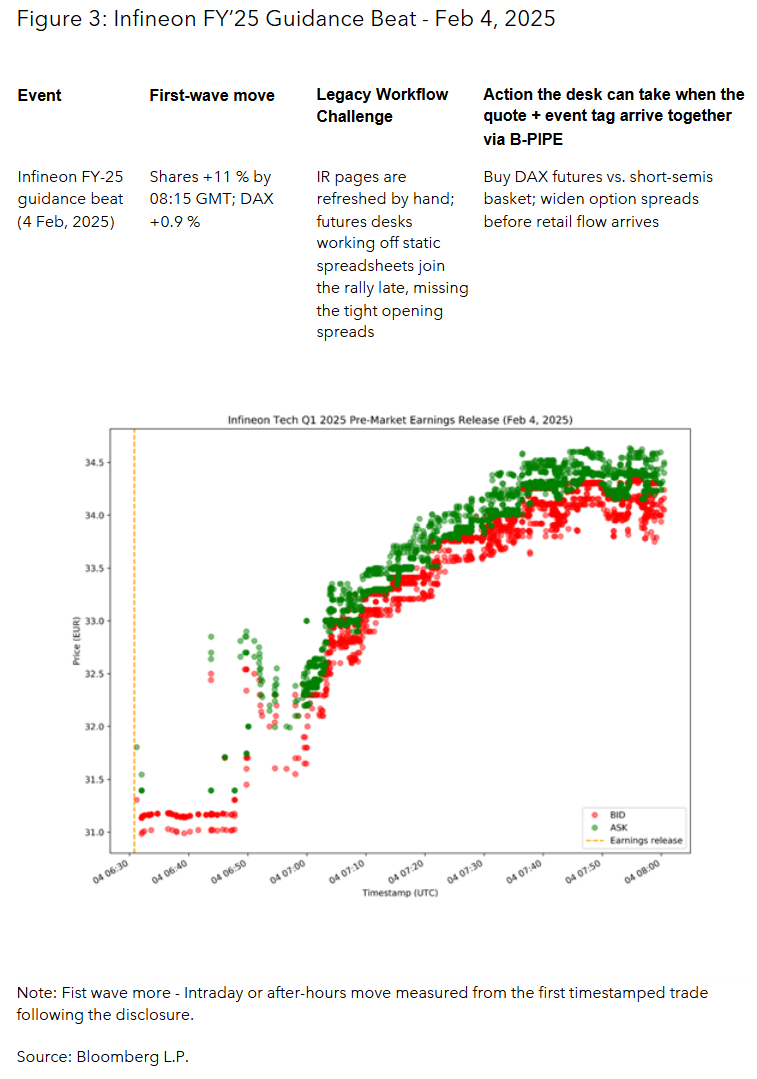

Corporate announcements and macroeconomic data still reach the market through PDFs, web interfaces, webcast slides, or press releases—often several minutes before being formatted into structured data feeds. But markets don’t pause for teams to manually scrape documents or refresh calendars.

To keep pace with the faster flow of information and the growing number of trading venues, front desks increasingly turn into real-time data via feeds. Let’s look at how that looks in practice using the example of Bloomberg’s recently launched Real-time Events Data solution, which enhances its real-time market data feed, B-PIPE.

In cases presented above, prices moved because new information hit the market. Desks that depended on end-of-day files or manual refreshes saw the price change before they understood the reason—by then, risk systems had frozen and hedges could be executed at unfavorable levels. When data feeds are out of sync, it can lead to misaligned risk, significant slippage, and compliance teams left piecing together what happened. Any delay between the “why” and the “where” in market movement can carry financial consequences.

How can we help?

With overnight U.S. equity sessions, and a growing pipeline of new exchanges and ATSs on both sides of the Atlantic, market structure continues to expand, and the trading day is quickly approaching a 24×5 reality. Meeting that challenge requires an infrastructure that delivers both price and context, whether desks are consuming a full-depth stream or a lower-bandwidth conflated version.

B-PIPE provides this through a single API. It streams real-time quotes from every lit and dark venue, along with the machine-readable events that drive them. The solution represents the next generation of content access—utilizing instrument identifiers (e.g., FIGI) to deliver a comprehensive suite of market data, pricing, events, news insights, and analytics that support front-office workflows such as trading, pricing, and risk management.

Interested to learn more about B-PIPE Real-Time Data Solutions, click here.