Bloomberg Professional Services

This article was written by David Krein, Head of Real-Time Pricing Research at Bloomberg.

In the US Investment Grade market, portfolio trading (PT) has seen substantially increased adoption over the last five years. In March 2025, 26.4% of institutionally-sized client-dealer risk trades were executed via PT, up from 23.4% in February and 21.1% in January, our analysis shows.

PT streamlines the trading of large baskets of corporate bonds through a single price negotiation. This “one-touch” approach makes it a particularly powerful solution for liquidity events, exposure adjustments, and portfolio rebalancing. Its efficiency is further enhanced by a suite of pre-trade insights that help traders optimize for speed, anonymity, security selection, and market impact.

PRODUCT MENTIONS

The controls and operational benefits of PT are well-known, but to evaluate the efficacy of this approach, traders need to go a layer deeper and consider questions like:

- How do PT’s pricing outcomes compare to line-by-line negotiation and execution?

- How do certain groups or types of bonds affect PT results?

Bond liquidity, market volatility, security concentration, and other considerations are also likely to be impactful. Balancing these potential tradeoffs is essential to maximizing success.

Pricing Insights series provides analysis on the fixed income market sector. For more analysis in this series, click here.

How to assess portfolio trading outcomes

To assess PT performance, we utilize the “PT flag” introduced by TRACE on May 15, 2023. This flag allows us to compare PT trades against non-PT trades for various bond cohorts. This analysis provides insights into where PTs may offer the most value or incur higher costs, ultimately informing trading strategies to optimize outcomes.

Our analysis focuses on the US Investment Grade markets, which have the highest PT share. We benchmark Q1 2025 TRACE trades against Bloomberg’s intraday pricing solution, IBVAL, for institutionally-sized, client-dealer risk trades during normal market hours. Performance is measured as the side-aligned, per-bond difference between the trade price and the IBVAL price. The result, expressed in dollars (where 0.01 equals 1 cent), is the median of these differences.

Using IBVAL as a baseline ensures an unbiased comparison, since IBVAL is designed to reliably reflect the overall market. Therefore, when we analyze PT trades vs. IBVAL, we can effectively gauge their performance relative to the market.

- Positive results: Indicate PT outperformance (PT trades were better than or inside IBVAL and the overall market).

- Negative results: Indicate PT underperformance (PT trades were worse than or outside IBVAL and the overall market).

Key findings of portfolio trading performance analysis

The following charts illustrate key dynamics in PT performance.

Monthly Performance: Chart 1 shows PT’s strong outperformance in January and February, with a more muted performance in March.

Weekly Performance: Chart 2 examines weekly performance over the same three months. Most notably, March performance is inconsistent, likely due to market volatility, with underperformance concentrated in the weeks ending March 8th and 22nd. The first and last weeks shown are partial weeks, and should be interpreted cautiously.

Dealer Buys vs. Dealer Sells: Chart 3 segments PTs by dealer buys (client sells) and dealer sells (client buys). Outperformance is observed on both sides, with dealers providing stronger bids for PTs compared to offers.

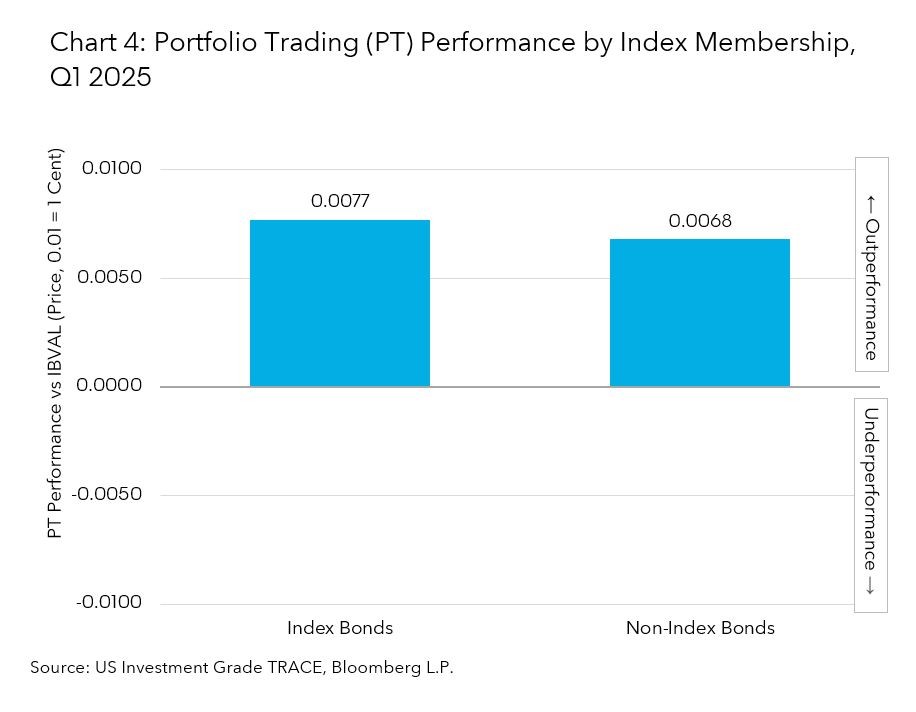

Bond Liquidity: Chart 4 analyzes PTs by bond liquidity, comparing bonds in the Bloomberg US Corporate Bond Index (liquid) to those outside (less liquid). Both segments show similar outperformance.

Trade Size Buckets: Chart 5 examines PTs by trade size. Smaller sizes outperform, but this advantage decreases with size and inverts around $3 million.

Detailed Trade Size Buckets: Chart 6 provides a more detailed view of trade sizes, highlighting the inflection point between $3 million and $3.5 million. It also includes smaller-sized buckets for reference (highlighted in purple), though they are excluded from the “institutionally-sized” dataset used elsewhere.

PT continues to draw interest for a range of use cases, and even expand into other markets, such as US High Yield bonds, Euro-denominated corporate bonds, and Emerging Market bonds. The results shown here are all starting points for a deeper analysis on benchmarking PTs, which can then be compared to results on other trading protocols and approaches. This process allows traders to use the tool to achieve optimal outcomes for specific market objectives.

Interested to learn more about using IBVAL for your pricing needs? Click here.

The data included in these materials are for illustrative purposes only. The BLOOMBERG TERMINAL service and Bloomberg data products (the “Services”) are owned and distributed by Bloomberg Finance L.P. (“BFLP”) except (i) in Argentina, Australia and certain jurisdictions in the Pacific Islands, Bermuda, China, India, Japan, Korea and New Zealand, where Bloomberg L.P. and its subsidiaries (“BLP”) distribute these products, and (ii) in Singapore and the jurisdictions serviced by Bloomberg’s Singapore office, where a subsidiary of BFLP distributes these products. BLP provides BFLP and its subsidiaries with global marketing and operational support and service. Certain features, functions, products and services are available only to sophisticated investors and only where permitted. BFLP, BLP and their affiliates do not guarantee the accuracy of prices or other information in the Services. Nothing in the Services shall constitute or be construed as an offering of financial instruments by BFLP, BLP or their affiliates, or as investment advice or recommendations by BFLP, BLP or their affiliates of an investment strategy or whether or not to “buy”, “sell” or “hold” an investment. Information available via the Services should not be considered as information sufficient upon which to base an investment decision. The following are trademarks and service marks of BFLP, a Delaware limited partnership, or its subsidiaries: BLOOMBERG, BLOOMBERG ANYWHERE, BLOOMBERG MARKETS, BLOOMBERG NEWS, BLOOMBERG PROFESSIONAL, BLOOMBERG TERMINAL and BLOOMBERG.COM. Absence of any trademark or service mark from this list does not waive Bloomberg’s intellectual property rights in that name, mark or logo. All rights reserved. © 2025 Bloomberg.

BVAL, IBVAL and BVAL Derivatives (collectively, “BVAL”) are services provided by Bloomberg Finance L.P. and its affiliates (“Bloomberg”). BVAL valuations do not express an opinion on the future or projected value of any instrument and are not investment recommendations (i.e., recommendations as to whether or not to “buy,” “sell,” “hold,” or to enter or not to enter into any other transaction involving any specific interest), a recommendation as to an investment or other strategy, or commodity trading advice. No aspect of the BVAL valuation or other data is based on the consideration of a customer’s individual circumstances and information available via BVAL should not be considered as information sufficient upon which to base an investment decision. Customers should determine on their own whether they agree with BVAL valuations. BVAL may not be available in certain jurisdictions. BVAL is not recognized or licensed as an official pricing provider in any jurisdiction, and should not be relied upon to comply with any laws or regulations that prescribe the use of prices issued by authorized pricing providers. BVAL should not be construed as tax, accounting, legal or regulatory advice or opinions, or sufficient to satisfy any tax, accounting, legal or regulatory requirements. Customers are solely responsible for the selection and use of appropriate parameters, inputs, models, formulas and data for meeting their tax, accounting, legal or regulatory requirements. Bloomberg believes that the information it uses in providing the BVAL services comes from reliable sources, but does not guarantee BVAL’s accuracy. Employees involved in the BVAL services may hold positions in the securities included in the BVAL services.

BVAL valuations may include indices, rates or other values (collectively, “Values”) that could be considered ‘benchmarks’ under the EU and/or UK benchmark regulation and/or similar regulation (collectively, “BMR”) if used in a regulated manner. Customers may not use Values in any manner that could be construed as regulated ‘use’ as a benchmark under the BMR (including to determine the value of financial instruments, to measure the performance of an investment fund for the purpose of tracking the return of such Value, to define the asset allocation of a portfolio, or to compute performance fees) unless such Values are administered by an authorized or registered administrator of such Values under the BMR. Among Bloomberg and its affiliates, only Bloomberg Index Services Limited (BISL) is an authorized or registered administrator of such Values under the BMR. BISL and Additional Data providers of such Values may require direct licensing with customers depending on customers’ use.

This communication is directed only to market professionals and is communicated, as applicable, by Bloomberg Trading Facility Limited, a limited company incorporated in England and Wales under Company No. 09019569, authorised and regulated by the U.K. Financial Conduct Authority (“FCA”) No. 629485; Bloomberg Trading Facility B.V., a limited liability company incorporated in the Netherlands, registered in the commercial register of the Chamber of Commerce under number 71621679, authorised and regulated by the Autoriteit Financiële Markten and the Dutch Central Bank; Bloomberg Tradebook LLC, a registered broker-dealer with the U.S. Securities and Exchange Commission, a member of the U.S. Financial Industry Regulatory Authority, Inc., a member of the U.S. Municipal Securities Rulemaking Board, and a member of the U.S. Securities Investor Protection Corporation (“SIPC”) (For more information about SIPC visit www.sipc.org or call +1 (202) 371-8300.); Bloomberg Tradebook Singapore Pte Ltd, an operator of an organised market regulated by the Monetary Authority of Singapore; Bloomberg SEF LLC, an operator of a swap execution facility regulated by the U.S. Commodity Futures Trading Commission; and Bloomberg L.P., a service company authorised and regulated by the FCA No. 206006. The BLOOMBERG TERMINAL service and Bloomberg data products (the “Services”) are owned and distributed by Bloomberg Finance L.P. (“BFLP”) except (i) in Argentina, Australia and certain jurisdictions in the Pacific Islands, Bermuda, China, India, Japan, Korea and New Zealand, where Bloomberg L.P. and its subsidiaries (“BLP”) distribute these products, and (ii) in Singapore and the jurisdictions serviced by Bloomberg’s Singapore office, where a subsidiary of BFLP distributes these products. BLP provides BFLP and its subsidiaries with global marketing and operational support and service. Certain features, functions, products and services are available only to professional clients, and only where permitted. BFLP, BLP and their affiliates do not guarantee the accuracy of prices or other information in the Services. Nothing in the Services shall constitute or be construed as an offering of financial instruments by BFLP, BLP or their affiliates, or as investment advice or recommendations by BFLP, BLP or their affiliates of an investment strategy or whether or not to “buy”, “sell” or “hold” an investment. Information available via the Services should not be considered as information sufficient upon which to base an investment decision. The following are trademarks and service marks of BFLP, a Delaware limited partnership, or its subsidiaries: BLOOMBERG, BLOOMBERG ANYWHERE, BLOOMBERG MARKETS, BLOOMBERG NEWS, BLOOMBERG PROFESSIONAL, BLOOMBERG TERMINAL and BLOOMBERG.COM. Absence of any trademark or service mark from this list does not waive Bloomberg’s intellectual property rights in that name, mark or logo. All rights reserved. © 2025 Bloomberg.