ARTICLE

Fed remarks point to capital-neutral Basel III Endgame in 2026

Bloomberg Intelligence

This analysis is by Bloomberg Intelligence Senior Government Analyst Nathan R Dean, with contributing analysis by Arnold Kakuda and Elliott Z Stein. It appeared first on the Bloomberg Terminal.

Comments from Fed Vice Chair for Supervision Michelle Bowman on Aug. 19, that a new proposal of a rule known as the Basel III Endgame will come “early next year” and will take into consideration international agreements, suggest to us that a capital-neutral rule is feasible. If regulators release the rule in 1Q, we think it’s probable it could be finalized in late 2026, with implementation beginning in 2027.

Our Thesis: Though Biden-era regulators failed to implement a rule known as the Basel III Endgame, which could have increased capital requirements 9%, Trump-era regulators could seek to push a more capital neutral rule by 2026. Fed Vice Chair for Supervision Michelle Bowman continues to name it as one of her four key pillars of reviewing bank capital levels.

What’s at stake for bank capital levels?

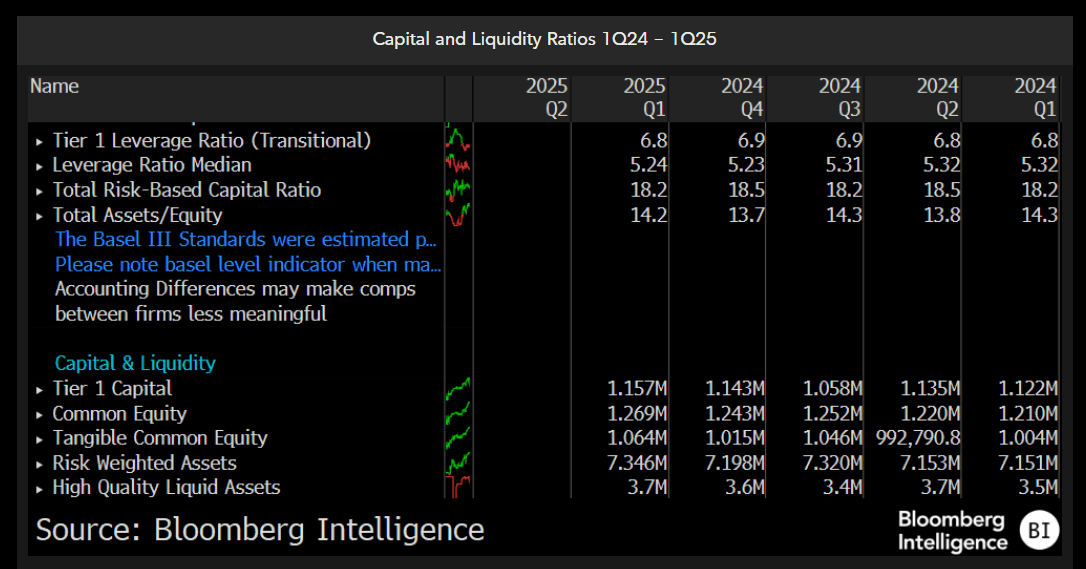

Status quo levels.

Under the original proposal, banks with more than $100 billion in assets would have faced an estimated 16% increase in capital requirements, with the brunt felt by the eight largest lenders (an anticipated 19% gain in CET1). That was later decreased to a plan that would raise capital requirements 9%. Now it is up to Trump-era regulators and Bowman to decide what to do next. Based on her previous comments, we think Bowman is inclined to move forward with a new Basel III Endgame proposal. It’s yet to be determined how much impact, it any, it would have on bank capital levels.

And…

Internal model restrictions.

Under the original proposal, banks would generally be prohibited from using internal models to calculate capital requirements for credit and operational risk, replacing them with a standardized model. For market risk, banks could use their own models, yet would be subject to “enhanced requirements” and a new “output floor” to limit how much an internal model might lower the amount of required capital. Whether these restrictions would remain in the new rule is likely be determined over the next 12 months.

What’s at stake for regional banks?

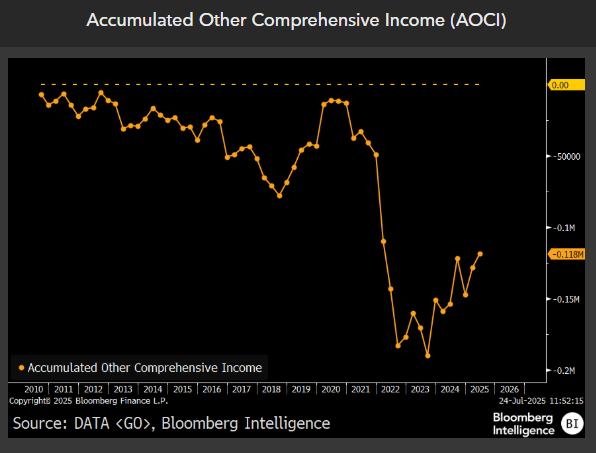

Accounting for unrealized gains and losses.

In the original proposal, regional banks would have to recognize what’s known as “accumulated other comprehensive income” when calculating regulatory capital, including accounting for unrealized losses and gains on available-for-sale securities. The move would have resulted in a 4.6% increase in CET1 for banks above $250 billion in assets and a 2.6% gain for those with $100-$250 billion. Though these banks will still have to adhere to this provision, lenders under $250 billion in assets will be exempt from the rest of the rule, resulting in an anticipated 3-4% gain in CET1 for those above $250 billion in assets.

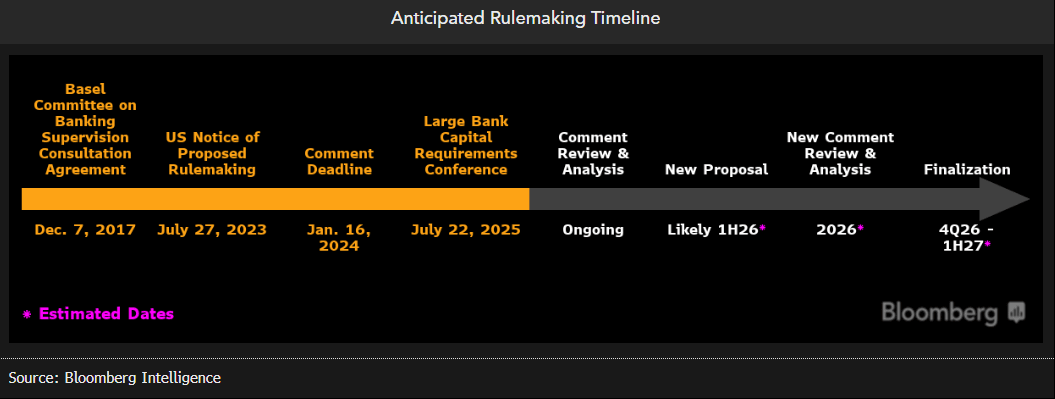

What’s the timeline?

What’s the outlook?

80% chance of new proposal by 1H26.

Comments on Aug. 19 from Bowman that a rule is coming “early next year” fits within our timeline. That would put finalization, if regulators move quickly, by 4Q26. Yet it’s worth noting that the Fed is embarking on four pillars of capital changes: leverage ratio, G-SIB surcharge, stress capital buffer and the Basel III Endgame. Bowman highlighted that the Basel proposal would likely be the last and any other delays regarding the others could push the timeline back. Still, a new Basel rule remains a high priority and so we believe a final rule is highly probable, with implementation beginning as soon as 2027.

What’s the issue?

Basel III “Endgame.”

The last remaining piece of Basel III, known informally as the Basel III Endgame, could alter capital levels for US banks as regulators recalibrate risk-weighting of assets and restrict internal models used to calculate credit and operational risks. The July 2023 proposal from the Fed, FDIC and the Office of the Comptroller of the Currency would have implemented the US version of an internationally agreed-upon consultation. It also came partly in response to bank collapses, such as California’s Silicon Valley Bank and New York’s Signature Bank, as Biden-era regulators expanded the scope to include all banks over $100 billion in assets rather than just the largest.

Bloomberg Terminal subscribers can access the full version of this analysis via BI<GO>.

The data included in these materials are for illustrative purposes only. The BLOOMBERG TERMINAL service and Bloomberg data products (the “Services”) are owned and distributed by Bloomberg Finance L.P. (“BFLP”) except (i) in Argentina, Australia and certain jurisdictions in the Pacific Islands, Bermuda, China, India, Japan, Korea and New Zealand, where Bloomberg L.P. and its subsidiaries (“BLP”) distribute these products, and (ii) in Singapore and the jurisdictions serviced by Bloomberg’s Singapore office, where a subsidiary of BFLP distributes these products. BLP provides BFLP and its subsidiaries with global marketing and operational support and service. Certain features, functions, products and services are available only to sophisticated investors and only where permitted. BFLP, BLP and their affiliates do not guarantee the accuracy of prices or other information in the Services. Nothing in the Services shall constitute or be construed as an offering of financial instruments by BFLP, BLP or their affiliates, or as investment advice or recommendations by BFLP, BLP or their affiliates of an investment strategy or whether or not to “buy”, “sell” or “hold” an investment. Information available via the Services should not be considered as information sufficient upon which to base an investment decision. The following are trademarks and service marks of BFLP, a Delaware limited partnership, or its subsidiaries: BLOOMBERG, BLOOMBERG ANYWHERE, BLOOMBERG MARKETS, BLOOMBERG NEWS, BLOOMBERG PROFESSIONAL, BLOOMBERG TERMINAL and BLOOMBERG.COM. Absence of any trademark or service mark from this list does not waive Bloomberg’s intellectual property rights in that name, mark or logo.

All rights reserved. © 2025 Bloomberg.