Bloomberg Professional Services

- While APAC insurers are currently thriving with high business volumes and healthy returns, falling interest rates and rising catastrophe claims are forcing a strategic shift toward more complex, higher-yield assets.

- Rapid growth is straining legacy infrastructures. To sustain performance, insurers must unify their front, middle, and back offices onto scalable platforms to ensure all teams operate on the same data and risk assumptions.

- As insurers move into private and complex assets, they face unprecedented scrutiny. Success now depends on integrating sophisticated liquidity risk and stress-testing into Asset Liability Management (ALM) to meet evolving IFRS 17 and RBC frameworks.

While success is always welcome, it sets expectations for future performance that can be challenging to meet. According to Bloomberg’s Midyear Outlook, insurers in the Asia-Pacific now find themselves in this situation.

The Outlook report reveals an industry that is thriving, with a steady increase in new-business volume, resilient underwriting margins and healthy investment results. At the same time, this growth is creating its own pressures. Insurers’ systems need to scale with new demand, while workflows must be integrated to ensure front-, middle- and back-offices are all operating on the same assumptions and data.

Furthermore, margins are being squeezed by premium inflation and rising natural catastrophe claims, while sustaining recent investment results is becoming more of a challenge amid falling interest rates, market volatility and regulatory change. Additionally, the rising proportion of private assets on insurers’ balance sheets has drawn unprecedented scrutiny from regulators around the attendant liquidity risks, forcing insurers to explicitly include liquidity considerations into their asset liability management (ALM) and own risk and solvency assessment (ORSA). Here we look at some of the specific challenges, and how Bloomberg’s suite of buyside products can help APAC insurers.

Enhancing returns through high-risk assets

Protecting and enhancing investment returns will be a key element of ensuring that APAC insurers can build on their recent successes. To date, they have weathered high levels of uncertainty around US trade relations and turbulence associated with conflict in the Middle East and Ukraine, but with major regional countries like China, India and Indonesia on an easing monetary trajectory, the Outlook notes that regional insurers are shifting away from guarantee products to more complex and higher-risk assets in order to alleviate the pressure from falling interest rates.

Bloomberg’s Asset and Investment Manager (AIM) provides insurers that are moving into higher-yielding asset classes not only with a multi-asset order management system that connects their front, middle and back offices, but one that provides the comprehensive pre-trade compliance and execution tools required to manage these new, riskier exposures. AIM allows insurers to proactively monitor their capital allocation and solvency ratios before a trade is executed, and is a scalable tool that keeps pace with an insurer’s growth trajectory.

Sustaining performance using advanced portfolio analytics

Shifting to a more complex range of assets also complicates the matching of asset and liability durations for Asia’s insurers. The Midyear Outlook reports, for example, that while some life insurers in Japan have largely matched their asset-liability durations from a whole-portfolio standpoint, there are still gaps in different cash-flow cohorts.

Sustaining recent investment performance will also require a more sophisticated approach to portfolio management, not just in terms of asset allocation but in terms of hedging against market volatility. It has therefore become vital for front offices to understand which parts of a portfolio are out-performing and why.

This is where Bloomberg’s PORT (Portfolio & Risk Analytics) comes in. From a single location, it offers portfolio managers a series of powerful, integrated equity and fixed income tools delivering consistent insight against benchmarks and peers.

A portfolio’s absolute or excess return can be analyzed by asset class, sector, geographic region, a custom classification and/or based on Bloomberg’s multi-factor risk model. As Asia’s insurers move into more complex assets, PORT allows them to learn what is working – and what isn’t – and respond in an agile way to improve returns.

Enhancing firm-wide ALM, managing unseen risks and meeting regulatory obligations

Asset managers must not only understand performance; they must also assess their portfolios against risk, a consideration that holds doubly true for insurers. The Midyear Outlook notes that P&C insurers have been keeping their budgets for natural-catastrophe claims at 29% above the five-year average, reflecting events such as the Los Angeles wildfires that in January destroyed some 16,000 structures.

Geopolitical and strategic risks stemming from the actions of governments are always a source of uncertainty, but full-scale trade wars have until recently been rare. Keeping on top of the related news and market activity related to trade disruption is only part of the picture when it comes to minimizing losses and maximizing gains.

This is further complicated by the fact that many APAC governments are moving to full implementation of IFRS 17 and new Risk-Based Capital (RBC) frameworks, with the regulatory burden changing accordingly. Other countries, by contrast, are easing restrictions on overseas capital, creating opportunities for asset managers – but only if they are able to identify those opportunities.

Bloomberg’s MARS is dedicated to analyzing, and mitigating, the impact of unexpected or lower-probability events on portfolios and underwriting margins. MARS Front Office offers advanced scenario and stress-test capabilities designed to integrate seamlessly with AIM, PORT and the Bloomberg Terminal, and with clients’ own systems, to provide pre-trade and ALM analytics. MARS also allows clients to seamlessly integrate liquidity and funding risks into an ALM framework, while at the same time meeting their market, credit and climate risk needs.

By using a consistent model to examine a full panoply of risks – regulatory, capital, market, liquidity – firms can boost confidence in their enterprise risk processes both internally and externally. That includes assuring regulators that a firm is meeting the “prudent person principle” whereby assets are invested in a manner resembling that of a careful, knowledgeable individual – a principle that is increasingly discussed in supervisory circles in many APAC countries.

Consolidating institutional research and data at scale

Growth prospects for APAC insurers are healthy, but to capitalize upon them firms must ensure their systems can scale to demand. This includes ensuring that teams all have access to the data and research they need, and that this data and research is common to all those teams across the front, middle and back offices. Without such common and current information, high-growth businesses face the risk of disjointed decision-making that negatively impacts underwriting margins, portfolio performance and ALM.

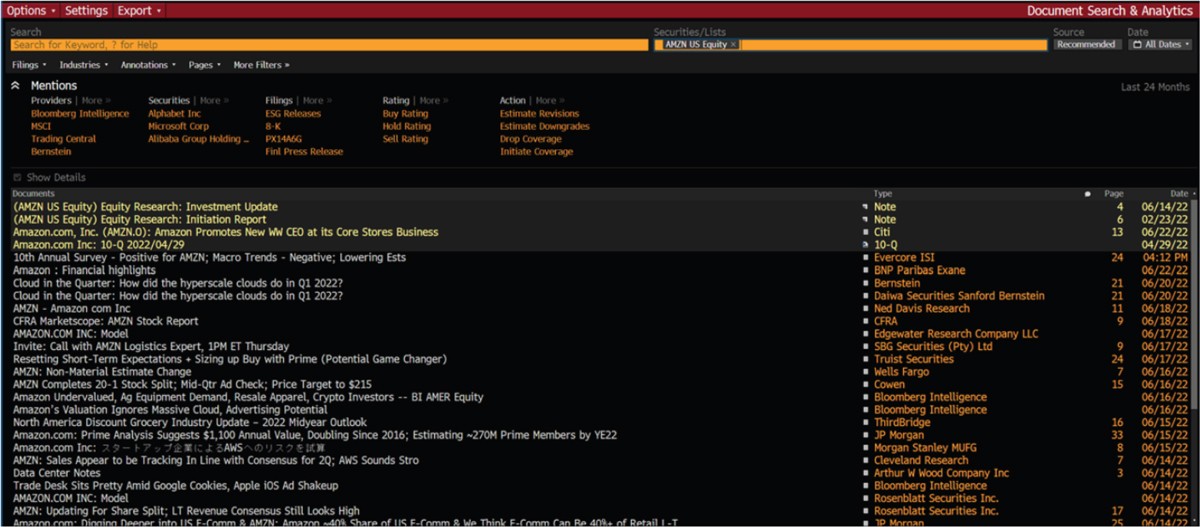

Users can access internal research alongside other content sets including third party research, filings and transcripts with the ability to search by tag or keyword in order to find relevant content quickly and efficiently.

Selecting an individual company or security lets you see the entirety of your firm’s relevant research at a glance.

Bloomberg’s RMS is designed to consolidate institutional knowledge in a central place in order to avoid this internal disarray. One leading insurer, for example, found that research was fragmented even between its buy-side teams, with the equity and multi-asset teams using one platform and fixed-income a different one.

They switched to RMS for various reasons, one being its integration with the Bloomberg Terminal. This allowed the insurer’s investment professionals to share and manage internal research on one system. An added benefit was that the data was integrated with PORT, making it easier to measure the performance of investment ideas and the impact of internal research, and to keep key data points continuously updated.

Lastly, RMS uses Bloomberg Vault, which archives internally generated research. This helps to reduce administrative burdens and ensure compliance with policies like IFRS 17 and RBC frameworks in Asian markets.

Overall, Bloomberg’s investment management solutions offer APAC insurers a foundation upon which they can build on recent successes, to ensure that those are not a high-water mark but rather a milestone on the way to even greater revenue and profitability. Trusted by major asset managers worldwide, Bloomberg provides the latest news and data to analytics systems that are built to support growth.