Bloomberg Professional Services

How did commodities perform compared to major asset classes in 2025? Based on Bloomberg Commodity Index (BCOM) data, this look-back highlights volatility spikes, tariff impacts, metal market divergence, laggard mean reversion, and supply and inflation trends that shaped commodity performance through November 2025.

This article was written by Jim Wiederhold, Commodity Indices Product Manager at Bloomberg.

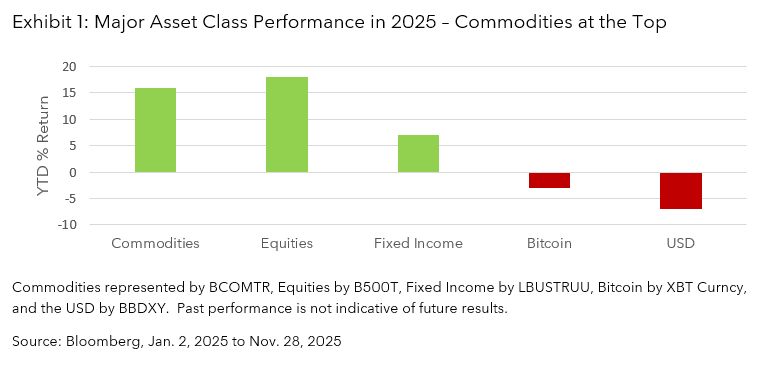

2025 was another year which showcased how having a commodities allocation in a portfolio can help dampen volatility and provide both diversification and inflation hedging benefits. Within the BCOM, sector performance was mostly positive with only Energy and Grains down 3% and 2% respectively. Metals performed very well with Precious Metals rising 64% and Industrial Metals 13%. Livestock rose 14% and Softs finished the end of November up 7% for 2025. In Exhibit 1, we see through the end of November commodities was one of the two best performing major asset classes through November.

PRODUCT MENTIONS

This year was defined by a pickup in volatility more broadly, effects of tariffs introduced, laggards mean reverting and several other tailwinds contributing to the outperformance by the commodities asset class.

Note, any forward-looking statements in this article are based on current market trends and historical data. They are not guarantees of future performance and are subject to change.

Looking back to the 2025 outlook for commodities published in January, we presented five themes to watch out for throughout the year – a return of volatility, tariffs effects, laggards mean reverting, supply peaking, and reinflation. Of the five, three themes were clearly present while it can be debated if the other two were too early. Even if some of these themes were too early, longer-term structural themes may continue to influence commodity performance with exact timing and magnitude unknowable. Historically, commodity supply is always restrained once prices move to cost of production levels or lower and inflation tends to come back often in an unexpected fashion.

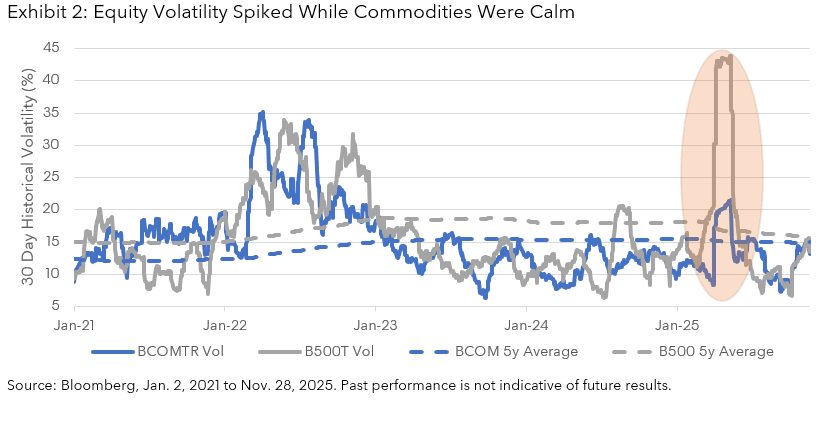

Volatility returns

Our 2025 theme with no debate was the return to volatility. After two years of low volatility for equities and commodities below 20%, we saw big pick ups in 2025 around April 2nd when broad global tariffs were announced. Exhibit 2 shows 30-day equity volatility spiking past 40 while BCOM volatility rose past 20. This also highlights commodity volatility has been much lower than equity volatility over the last five years averaging around 15% while the equities asset class has been a few percentage points higher. Market participants tend to believe commodities are more volatile than equities and they can be on an individual basis but when combined into a diversified broad commodities exposure like BCOM, the asset class demonstrates much less volatility than a broad equities exposure.

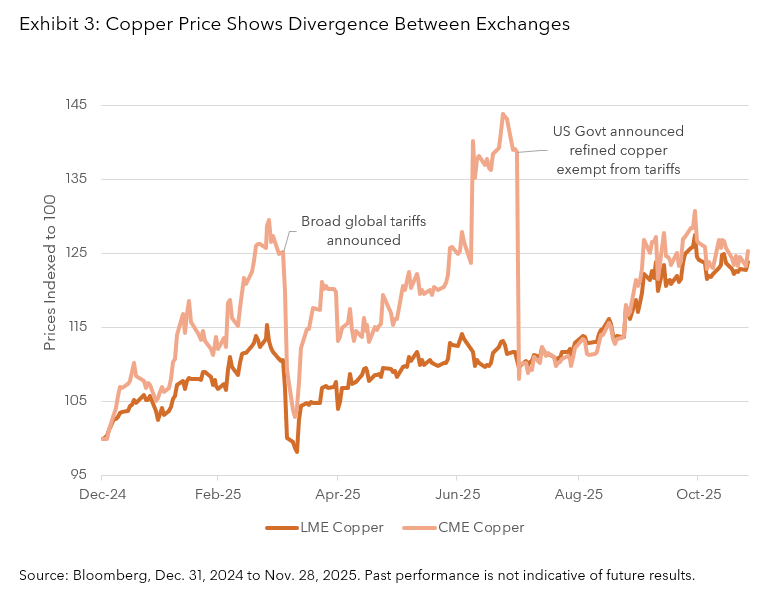

Tariffs effect

The enactment of tariffs caused ripple effects across the commodities markets. Uncertainty led to a rush of stockpiling and moving commodities ahead of implementation dates which caused volatile moves across some of the major commodity markets. Nowhere was this more prominent than in the copper market. Copper traded on the CME spiked while the LME copper contract prices were less volatile. This was due to a flood of traders moving metal into the US ahead of expected tariffs and then news on copper tariffs changing throughout the year.

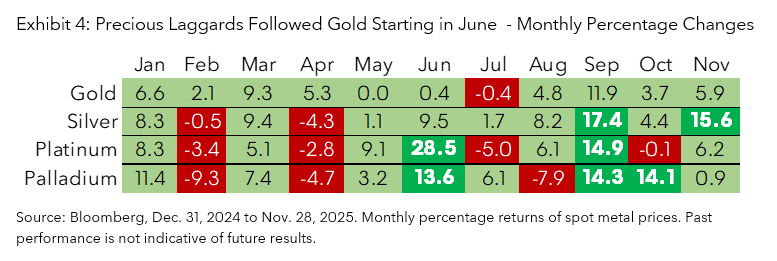

Laggards mean reverting

Gold continued making new all-time highs in 2025 and a classic commodity trade presented itself in 2025. This trade stems from the tendency for the smaller precious metals markets to move in the same direction as gold usually with a lag but with a more volatile move. This year it appeared to the upside. Silver spiked above $50 (it reached this level only twice before historically) and did so after gold had already made a steady stream of new highs over an almost two year period. Silver tends to follow gold and this happened again this year. Another reason was the perceived chance of tariffs effecting the silver trade and a rush to deliver the metal similar to what happened for copper earlier in the year. The other major precious metals (Platinum and Palladium) also rose in a lagged move to gold. These metals which are much more industrial in nature have had supply deficits lending a fundamental reason to the price action in 2025. Exhibit 4 shows the monthly percentage price moves of the major precious metals. Gold was on a steady uptrend for the first six months of the year which continued the moves from 2024 while the other precious prices were choppy until June when they finally moved higher to follow gold in the classic lagged move.

The last two themes of peak supply and reinflation can be debated as to whether they were correct to forecast for 2025.

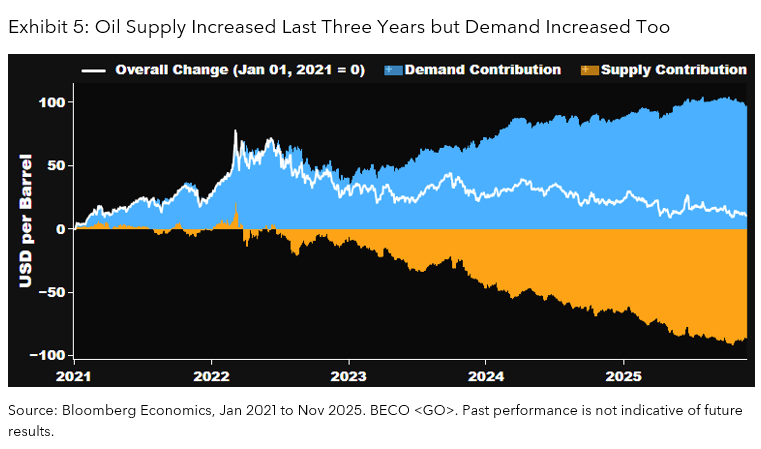

Peak supply

Supply of oil has only increased and forecasters are projecting a several million barrel glut for 2026. The US has been increasing production dramatically, which has helped to offset some of the supply risks stemming from geopolitical developments. Exhibit 5 shows how demand and supply contribute to the price of oil and in which direction each pulls the price. Oil supply steadily increased over the last three years but demand has also picked up which explains why oil prices, while down on the year, have not completely deteriorated. From this chart, it seems as though the supply contribution may be at an inflection point this year or in other words – Peak Supply.

In other commodity sectors, grains crops are still robust and softs like cocoa have had healthy yields so far after issues in the most recent years. The two areas where supply has had issues were metals and livestock. A massive mudslide at the Grasberg mine in Indonesia cut off a major global source of copper, gold, and silver. Within livestock, cattle prices were up nearly 20% for the year, hitting new 5 year highs, with smaller herds due to disease and droughts. Over the last month, prices receded.

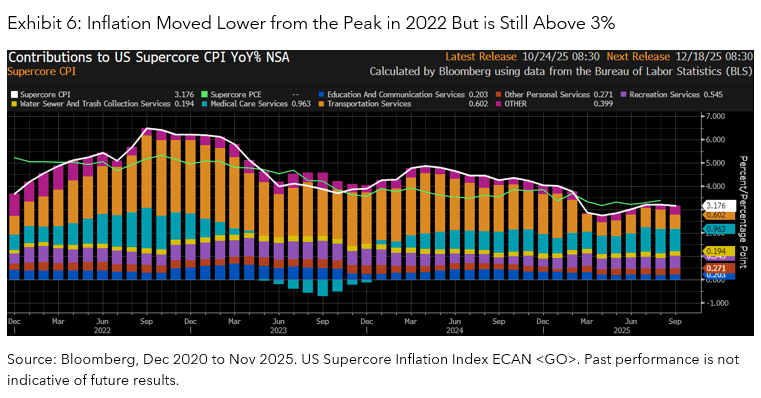

Reinflation

Most often cited as the main driver of commodities prices is inflation and it dropped around the volatile second quarter of 2025 but has seemingly picked up over the last few months and was above 3% as of the last delayed reading in the US. Inflation, as measured by the US Consumer Price Index (CPI), does not necessarily move in a straight line but there seems to be a pick up which started over the summer. Black Friday holiday shopping in the US show prices higher than last year as there has been some pass through of tariffs to consumers. Based on the CME Group’s FedWatch tool, there is an over 80% chance the FED cuts rates in December but the FED could state it will be on hold based on what they are seeing on the inflation front. Some market participants have the belief the FED has made a policy mistake by cutting rates this year. If they continue on a dovish path, there is concern inflation could come storming back like it did in the 1970s. Exhibit 6 shows inflation has continued to come down since peaking in late 2022 but still remains stubbornly above the FED’s target. At 3.17%, supercore inflation is above any level of inflation seen during the 2010s. If inflation comes back like it did in the 1970s after a few years of moderation, the FED may have to start hiking rates again.

In this blog, we looked back at 2025 and showed what happened to volatility, tariffs, laggards mean reversion, supply, and reinflation as they pertain to the commodities markets. Based on the outlook from a year ago, we’ll give ourselves a four out of five (a passing grade). What will 2026 have in store for the commodities asset class? Will traditional drivers continue to play roles like inflation, weather, and geopolitics? Be sure to look out for the 2026 commodities outlook in January. We will have new themes in play as we continue through the second half of the 2020s where tailwinds for commodities continue to propel the asset class higher.

The data and other information included in this publication is for illustrative purposes only, available “as is”, non-binding and constitutes the provision of factual information, rather than financial product advice. BLOOMBERG and BLOOMBERG INDICES (the “Indices”) are trademarks or service marks of Bloomberg Finance L.P. (“BFLP”). BFLP and its affiliates, including BISL, the administrator of the Indices, or their licensors own all proprietary rights in the Indices. Bloomberg L.P. (“BLP”) or one of its subsidiaries provides BFLP, BISL and its subsidiaries with global marketing and operational support and service. Certain features, functions, products and services are available only to sophisticated investors and only where permitted. Bloomberg (as defined below) does not approve or endorse these materials or guarantee the accuracy or completeness of any information herein, nor does Bloomberg make any warranty, express or implied, as to the results to be obtained therefrom, and, to the maximum extent allowed by law, Bloomberg shall not have any liability or responsibility for injury or damages arising in connection therewith. Nothing in the Services or Indices shall constitute or be construed as an offering of financial instruments by Bloomberg, or as investment advice or investment recommendations (i.e., recommendations as to whether or not to “buy”, “sell”, “hold”, or to enter or not to enter into any other transaction involving any specific interest or interests) by Bloomberg. Information available via the Index should not be considered as information sufficient upon which to base an investment decision. All information provided by the Index or in this publication is impersonal and not tailored to the needs of any person, entity or group of persons. Absence of any trademark or service mark from this list does not waive Bloomberg’s intellectual property rights in that name, mark or logo. For the purposes of this publication, Bloomberg includes BLP, BFLP, BISL and/or their affiliates.

BISL is registered in England and Wales under registered number 08934023 and has its registered office at 3 Queen Victoria Street, London, England, EC4N 4TQ. BISL is authorised and regulated by the Financial Conduct Authority as a benchmark administrator.

© 2025 Bloomberg. All rights reserved.