Bloomberg Professional Services

This article was written by Jas Singh, Senior Product Manager, Indices, Tejash V. Singh, Core Product Manager, Syndicated Loans & Direct Lending, and Brian Schelter, Loans and Private Credit Market Specialist at Bloomberg.

Standing at $2 trillion globally, Broadly Syndicated Loans (BSLs) are generally institutional, floating-rate debt issued to borrowers classified as below investment-grade (aka high yield). Traditionally, BSLs have often been viewed as a financing pool for leveraged buyouts (LBOs). Though, market evolution and evidence suggest that BSLs may have broadened in issuer type and investor base. This may be driven by:

- Floating-rate coupons (and consequently, low duration)

- Secured payment rank

- Potential credit diversification

Recent performance and duration

From January 2019 to April 2025, the Bloomberg US Leveraged Loan Index (Ticker: LOAN) delivered a cumulative return of 40.58%, surpassing almost every other US fixed income asset class (Figure 1). Note, while the performance period from January 2019 – April 2025 covers certain stress periods such as COVID, past performance may not be indicative of future performance.

In comparison, US High Yield, US Floating Rate, US Aggregate and US Treasury delivered returns of 35.77%, 23.01%, 9.21% and 6.46% respectively. While most other asset classes posted intermittent positive and negative returns over recent months, BSLs stood out with 21 consecutive monthly positive returns as of February 2025, before being interrupted by negative returns in March (-0.29%) and April (-0.17%). Given floating-rate coupons, durations of both LOAN Index and US Floating Rate Index were close to zero. In comparison, durations of US High Yield, US Aggregate and US Treasury stood at 3.02, 6.08 and 5.89 respectively as of April month-end.

Market composition: what’s inside the LOAN index?

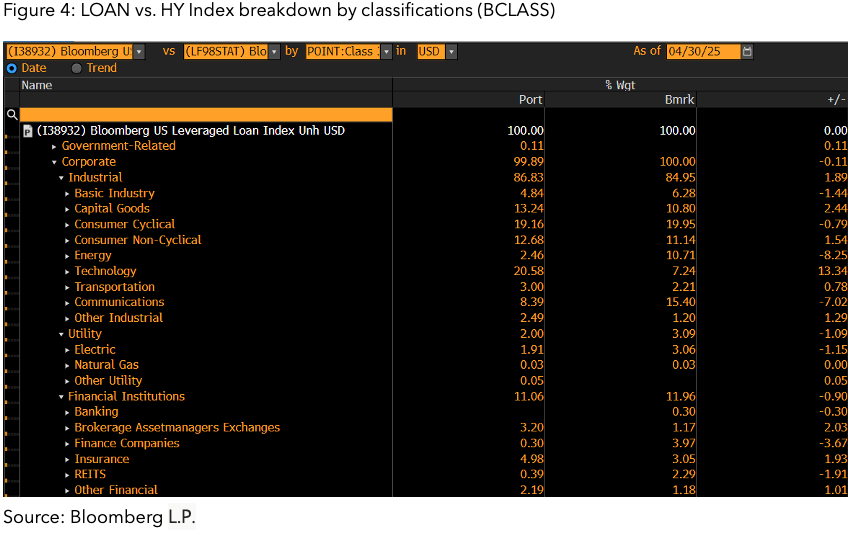

As of April 2025 month-end, the Bloomberg US Leveraged Loan Index included over 1,300 loans from over 1,100 borrowers, with $1.3 trillion in market value. Certain index breakdowns (by % market value) are below:

- Secured payment rank, with 98% first-lien loans, 2% second-lien

- Rating Distribution: 67.66% B-rated, 25.39% Ba-rated, 6.19% Caa, and 0.77% Ca-D

- Sector Allocation: 87% Industrials, 11% Financials, 2% Utilities

- Top Sub-Sectors: Technology (21%), Consumer Cyclical (19%), and Capital Goods (13%)

Potential credit diversification

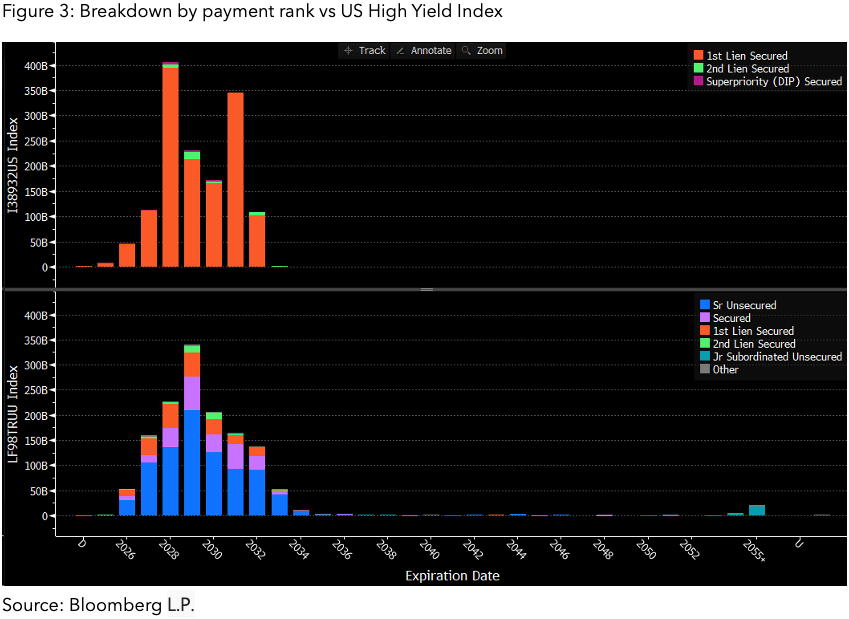

Payment rank of BSLs in LOAN Index is secured, with the majority of loans classified as first lien, and may be notable in comparison to high yield bonds (Figure 3), which are often unsecured. Divergence of sub-sector and rating bucket allocation vs. high yield bonds is also noteworthy. For example, the Technology sub-sector makes up 7% of high yield bonds vs. 21% of BSL market (see Figure 4). While B-rated loans make up around 70% of LOAN Index as of April month-end, they comprise less than 40% of the HY Index. Structural differences in payment rank, as well as divergence in composition across sectors and rating buckets, may offer potential credit diversification.

Potential risks

BSLs are not without risk, however. A rally in interest rates would negatively impact floating-rate coupons, making it less appealing to crossover investors. Further, if holding individual loans, it should be noted that trade settlement times can range from a week to multiple weeks, while bond trades settle in T+1. Finally, Collateralized Loan Obligations (CLOs) hold 65%-70% of the BSL market, and while having a captive investor is generally positive for the BSL market, any material disruption to the CLO market could put stress on the BSL market.

Conclusion

Floating-rate coupons and consequently strong performance in a high interest rate environment, coupled with secured payment rank and potential credit diversification, are structural traits that can influence how BSLs perform relative to other asset classes.

The data and other information included in this publication is for illustrative purposes only, available “as is”, non-binding and constitutes the provision of factual information, rather than financial product advice. BLOOMBERG and BLOOMBERG INDICES (the “Indices”) are trademarks or service marks of Bloomberg Finance L.P. (“BFLP”). BFLP and its affiliates, including BISL, the administrator of the Indices, or their licensors own all proprietary rights in the Indices. Bloomberg L.P. (“BLP”) or one of its subsidiaries provides BFLP, BISL and its subsidiaries with global marketing and operational support and service. Certain features, functions, products and services are available only to sophisticated investors and only where permitted. Bloomberg (as defined below) does not approve or endorse these materials or guarantee the accuracy or completeness of any information herein, nor does Bloomberg make any warranty, express or implied, as to the results to be obtained therefrom, and, to the maximum extent allowed by law, Bloomberg shall not have any liability or responsibility for injury or damages arising in connection therewith. Nothing in the Services or Indices shall constitute or be construed as an offering of financial instruments by Bloomberg, or as investment advice or investment recommendations (i.e., recommendations as to whether or not to “buy”, “sell”, “hold”, or to enter or not to enter into any other transaction involving any specific interest or interests) by Bloomberg. Information available via the Index should not be considered as information sufficient upon which to base an investment decision. All information provided by the Index or in this publication is impersonal and not tailored to the needs of any person, entity or group of persons. Absence of any trademark or service mark from this list does not waive Bloomberg’s intellectual property rights in that name, mark or logo. For the purposes of this publication, Bloomberg includes BLP, BFLP, BISL and/or their affiliates.

BISL is registered in England and Wales under registered number 08934023 and has its registered office at 3 Queen Victoria Street, London, England, EC4N 4TQ. BISL is authorised and regulated by the Financial Conduct Authority as a benchmark administrator.

© 2025 Bloomberg. All rights reserved.