Bloomberg Professional Services

This article was written by Jim Wiederhold, Commodity Indices Product Manager at Bloomberg.

The Bloomberg Commodity Index (BCOM) will have a new commodity constituent entering the index during the annual reconstitution taking place in January 2026. After a 21-year hiatus, cocoa will be reintroduced after passing the minimum threshold two years in a row per the BCOM methodology.

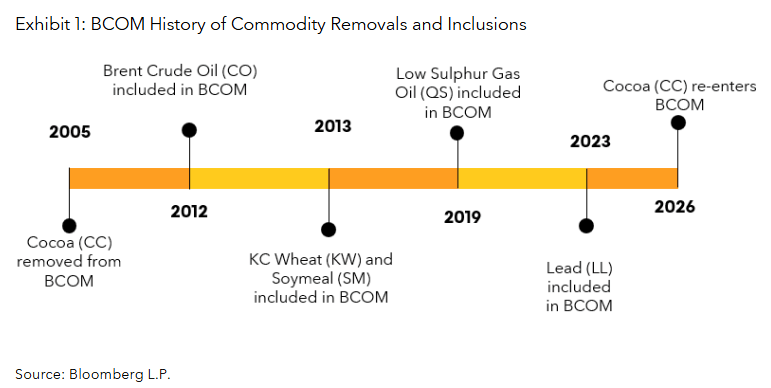

After cocoa futures traded in a range between $2,000 to $3,000 a ton from 2018 to 2022, prices started to gain momentum in 2023 before surging to over $12,000 a ton in 2024. This price increase was accompanied by a sharp increase in trading volumes. A five-year average of futures trading volumes is used in the initial annual target weight calculation for BCOM. The rise in cocoa trading volume starting in 2023 led to the inclusion for 2026. Exhibit 1 shows the history of removals and inclusions for BCOM over time with cocoa leaving the index in 2005 and re-entering in 2026.

Per Exhibit 1, the makeup of BCOM does not significantly change from year to year. The overall changes between the target weight announcements from 2025 to 2026 are minimal across all commodities and highlights the continuous nature of BCOM. This broad commodities index seeks to keep the basic construction stable while adjusting for the changing dynamic commodities markets in a slow, balanced manner over time.

PRODUCT MENTIONS

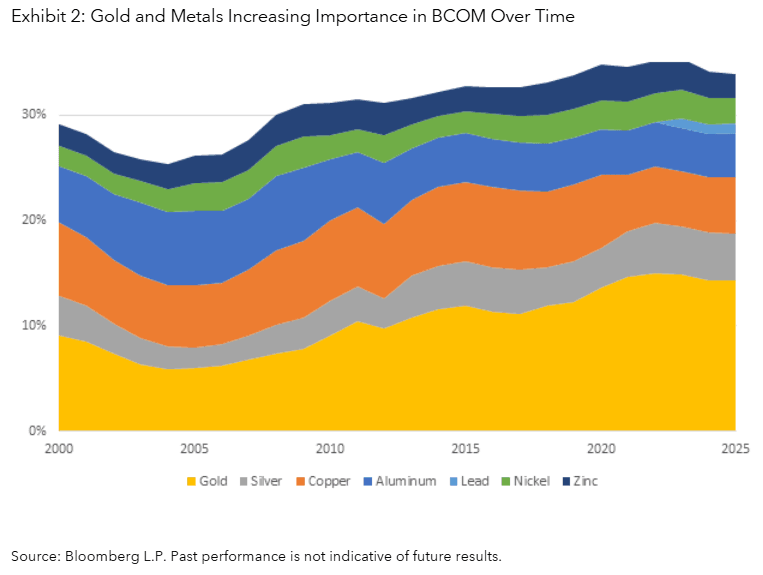

Looking more closely at the BCOM weights, several trends stand out. Precious metals continue to play an important role. Gold prices rose over 50% year-to-date through October 20, 2025, reaching an all-time high. Gold held the biggest single commodity future contract weight in the Bloomberg Commodity Index (BCOM) to start 2025 (14.29%), and at the peak in prices on October 20th, the observed price percentage of gold floated as high as 20.48%.

Gold has never had such a high observed weight in the history of BCOM. With the release of the 2026 BCOM Target Weights, we see the weight of gold will fall to 14.90% during the annual reconstitution in early January. This overall trend of increasing significance of gold can be seen in Exhibit 2, which shows it is the single biggest contributor to the overall weight increase for metals over the last twenty years.

Although gold is the largest single commodity futures contract, crude oil reaches the 15% single commodity cap in BCOM. Crude oil is represented by two futures contracts (WTI and BRENT) so the target weights for each commodity future are less than gold but together bring the crude oil exposure higher than gold which uses one futures contract.

Within the crude oil exposure, Brent crude oil recently overtook WTI in weight and is expected to have its highest target weight since its inclusion in the index. This highlights the trend of growing importance of Brent crude among commodity market participants and shows BCOM’s ability to adapt over time as the underlying commodities markets evolve.

Commodity markets evolve over time, with certain commodities gaining significance as others lose relevance. These shifts tend to happen gradually and BCOM is designed to adapt as the market slowly changes. One of the key pillars of BCOM is continuity which means the index will be responsive to the changing nature of commodity markets in a manner that does not completely reshape the character of the index from year to year.

This means BCOM can be a stable benchmark so end-users can be reasonably confident that historical performance data is based on a structure that remains broadly consistent. Exhibit 3 shows how the target weights of BCOM do not change dramatically from year to year even with the inclusion of cocoa into the index. Cocoa enters the index in 2026 with a weight of 1.71% which would mean it takes weight away from other commodities. This is seen clearly in the overall reduction in the target weight of the grains sector reduced by 2% from last year’s weights.

Strikingly, no single commodity in BCOM universe saw its target weight decrease by more than 61 basis points. This showcases how BCOM has continuity and even with the rare introduction of a new commodity, it does not change the general look of the index from year to year.

With over 25 years of history, BCOM remains a stable and transparent benchmark for commodity market participants. As commodities regain significance in diversified portfolios, BCOM’s rigorous methodology- anchored in trading volume and production data- offers a liquid and rules-based reference point for commodity exposure. In a context where many allocators are reviewing alternatives strategies, BCOM provides a representative and economically grounded view of global commodity markets.

The data and other information included in this publication is for illustrative purposes only, available “as is”, non-binding and constitutes the provision of factual information, rather than financial product advice. BLOOMBERG and BLOOMBERG INDICES (the “Indices”) are trademarks or service marks of Bloomberg Finance L.P. (“BFLP”). BFLP and its affiliates, including BISL, the administrator of the Indices, or their licensors own all proprietary rights in the Indices. Bloomberg L.P. (“BLP”) or one of its subsidiaries provides BFLP, BISL and its subsidiaries with global marketing and operational support and service. Certain features, functions, products and services are available only to sophisticated investors and only where permitted. Bloomberg (as defined below) does not approve or endorse these materials or guarantee the accuracy or completeness of any information herein, nor does Bloomberg make any warranty, express or implied, as to the results to be obtained therefrom, and, to the maximum extent allowed by law, Bloomberg shall not have any liability or responsibility for injury or damages arising in connection therewith. Nothing in the Services or Indices shall constitute or be construed as an offering of financial instruments by Bloomberg, or as investment advice or investment recommendations (i.e., recommendations as to whether or not to “buy”, “sell”, “hold”, or to enter or not to enter into any other transaction involving any specific interest or interests) by Bloomberg. Information available via the Index should not be considered as information sufficient upon which to base an investment decision. All information provided by the Index or in this publication is impersonal and not tailored to the needs of any person, entity or group of persons. Absence of any trademark or service mark from this list does not waive Bloomberg’s intellectual property rights in that name, mark or logo. For the purposes of this publication, Bloomberg includes BLP, BFLP, BISL and/or their affiliates.

BISL is registered in England and Wales under registered number 08934023 and has its registered office at 3 Queen Victoria Street, London, England, EC4N 4TQ. BISL is authorised and regulated by the Financial Conduct Authority as a benchmark administrator. © 2025 Bloomberg. All rights reserved.