Bloomberg News

This article was written by John Tozzi and Clara Hudson. It appeared first on the Bloomberg Terminal.

Companies are telling their investors how President Donald Trump’s plan to radically remake the US government poses new risks to their businesses.

In recent weeks, Chipotle Mexican Grill Inc. warned about potential tariffs on avocados and limes. Johnson & Johnson sees a risk that Food and Drug Administration cuts will slow down medicine approvals. And American Airlines Group Inc. alerted shareholders to possible additional charges for aircraft and parts from outside the US.

Many of these disclosures are being tucked quietly into already lengthy “risk factor” language in annual regulatory filings, at odds with the upbeat tone some executives take publicly when describing their work with the White House.

CVS Health Corp. Chief Executive Officer David Joyner told analysts on a Feb. 12 conference call that he was “encouraged by the constructive dialogue with the new administration” about payment rates in private Medicare health plans, a crucial issue for the company.

Yet the same day, CVS filed its annual report to shareholders with a new paragraph about “uncertainty” around changing health-care rules. The company warned that “efforts to reform federal government processes and reduce expenditures” could limit funding for government programs “upon which our business depends.”

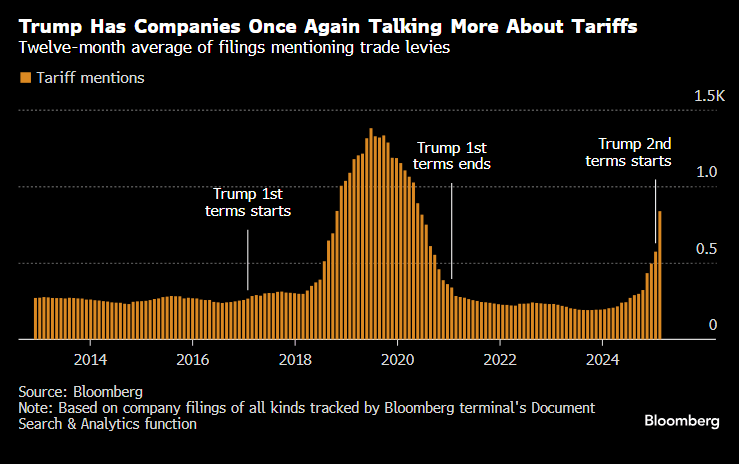

Confidence among businesses and consumers rose after Trump’s election win on optimism around deregulation, tax cuts and the broader economic outlook. But sentiment is now souring — and uncertainty is climbing — as the administration prioritizes enacting tariffs instead.

That’s set to raise costs for homebuilders, manufacturers, households and more at a time when inflation is barely cooling.

Trump, along with billionaire Elon Musk, is moving rapidly to shrink the federal workforce, raise barriers to trade and immigration, and expand the White House’s control of government agencies. Those moves have left companies racing to figure out where they might be exposed to policy changes or potential tariff hikes, and how they should communicate that to investors.

“As far as what’s material and what’s not, it’s a gray zone,” said Yaron Nili, a corporate law professor at Duke University School of Law. “Especially this early in the administration, it’s not clear that companies have formed a full understanding of how things are going to impact them.”

The annual reports that companies are required to file with the Securities and Exchange Commission routinely include a host of bad things that could happen such as cyberattacks, natural disasters or regulatory shifts. Changes in what companies choose to disclose reveal how they’re strategizing for political and global risks.

The disclosures add to confusion for investors trying to gauge the impact of Trump’s policies. Companies including General Motors Co. and Walmart Inc. have issued earnings guidance that doesn’t account for the impact of looming tariffs.