Bloomberg Intelligence

This analysis is by Bloomberg Intelligence Quantitative Equity Strategist Kumar Gautam and Data Scientist Claudio Fontana. It appeared first on the Bloomberg Terminal.

For Asia-Pacific stock returns, country matters more than industry, though the latter’s influence is rising. This increase is broad based and not specifically tied to the tech sector. A long-term tilt to any particular industry or country doesn’t consistently generate alpha, though style bets do pay off — especially momentum and valuation.

1. Country Dominates APAC Returns Despite Rising Sector Influence

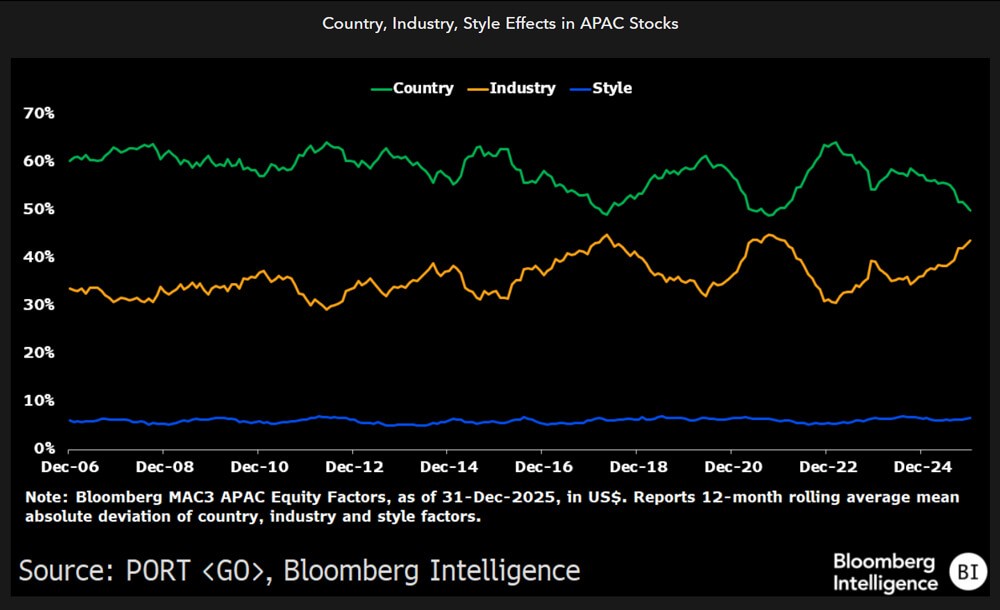

Country grouping’s influence on Asia-Pacific stock returns has moderated, but still outweighs sector and style effects. The mean absolute deviations (MAD) of monthly country, sector and style factor returns are 2.9%, 2.6% and 0.4%, implying respective contributions at 49.8%, 43.5% and 6.7%, vs. 63.3%, 31.3% and 5.5% three years ago.

We use Bloomberg’s MAC3 Asia-Pacific Risk Model, which isolates 18 country, 36 industry and 14 style factors. These are commonly referred to as pure factors, as each portfolio’s exposure is distinctly separated from the influence of other factors. For passive managers, country, industry, or style MAD shows the significance of each grouping in determining stock returns, whereas for active managers, it indicates excess return or tracking error from specific tilts.

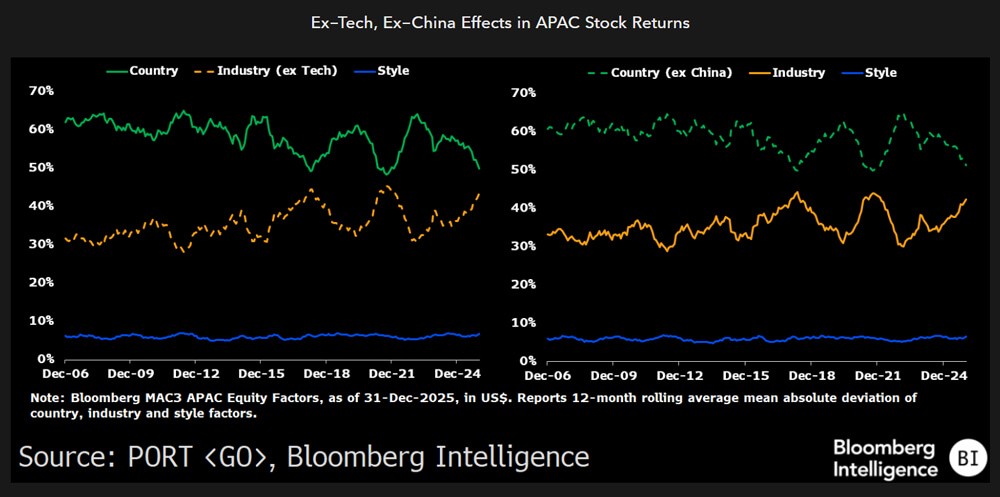

2. Country, Industry Shifts Are Broad-Based

While it seems intuitive to attribute the increasing significance of industry or declining influence of country factors to specific portfolios, our analysis doesn’t support this assumption. For instance, we assessed whether the growing impact of industries is driven by the technology sector by recalculating industry MAD after excluding sectors such as semiconductors and communications. Yet the proportional effect remained consistent at about 43%. Similarly, when excluding markets such as China, the country MAD also remained stable at around 50%.

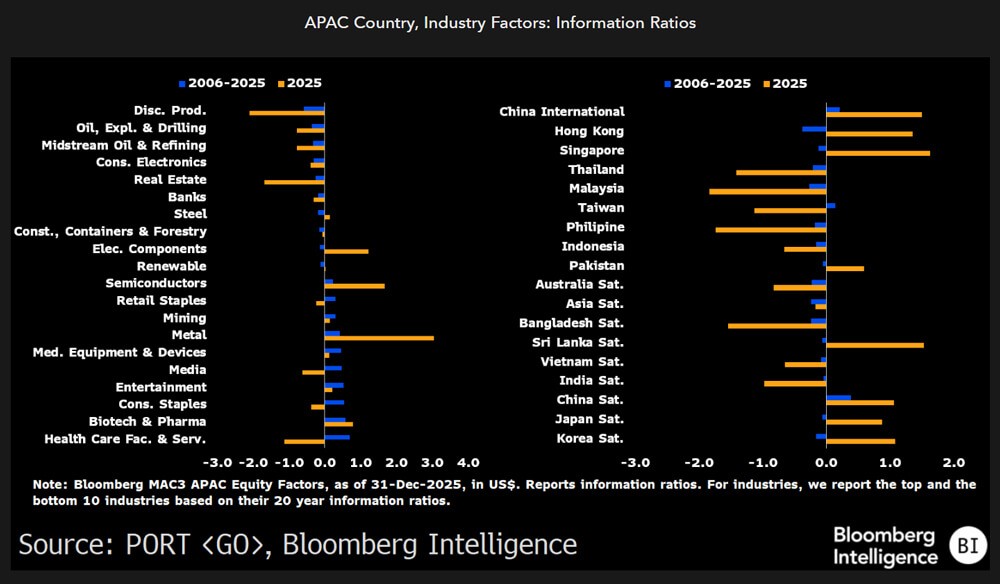

3. Country, Industry Tilts Lack Consistent Long-Term Alpha

Some industries and countries exhibited high risk-adjusted returns — or information ratios — in 2025, but only a few are statistically significant over the past 20 years. With a threshold t-statistic of two and 20 years of data, an industry or country portfolio should have a minimum absolute information ratio of about 0.45 to be considered significant. Consequently, only seven out of 36 industry factors and no country factors show significance. This underlines that taking a country or sector bet generally fails to generate consistent alpha. While there can be subperiods when such tilts can produce alpha, capturing these opportunities is largely a matter of the timing skills of the active portfolio manager.

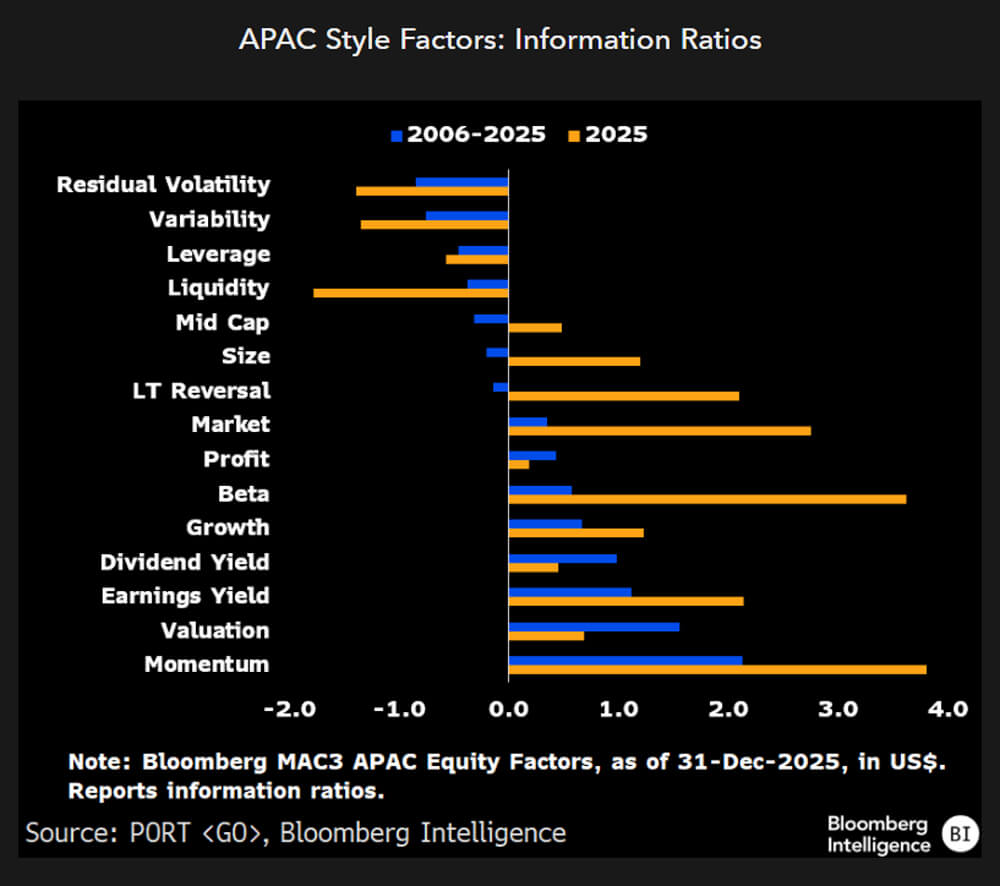

4. Style Factors a Source of Long-Term Alpha

Nine of the 14 style factors show a significant information ratio over the past 20 years, supporting evidence that styles are a long-term source of risk and reward. Momentum has the highest information ratio (2.13), followed by valuation (1.56) and earnings yield (1.12). Factors such as profit, long-term reversal, size, mid-cap and liquidity don’t exhibit a significant information ratio. In 2025, momentum, beta, earnings yield and long-term reversal generated information ratios more than 2.