Bloomberg Intelligence

This article was written by Bloomberg Intelligence Quantitative Equity Strategist Christopher Cain and Director of Equity Strategy, Chief Equity Strategist Gina Martin Adams. It appeared first on the Bloomberg Terminal.

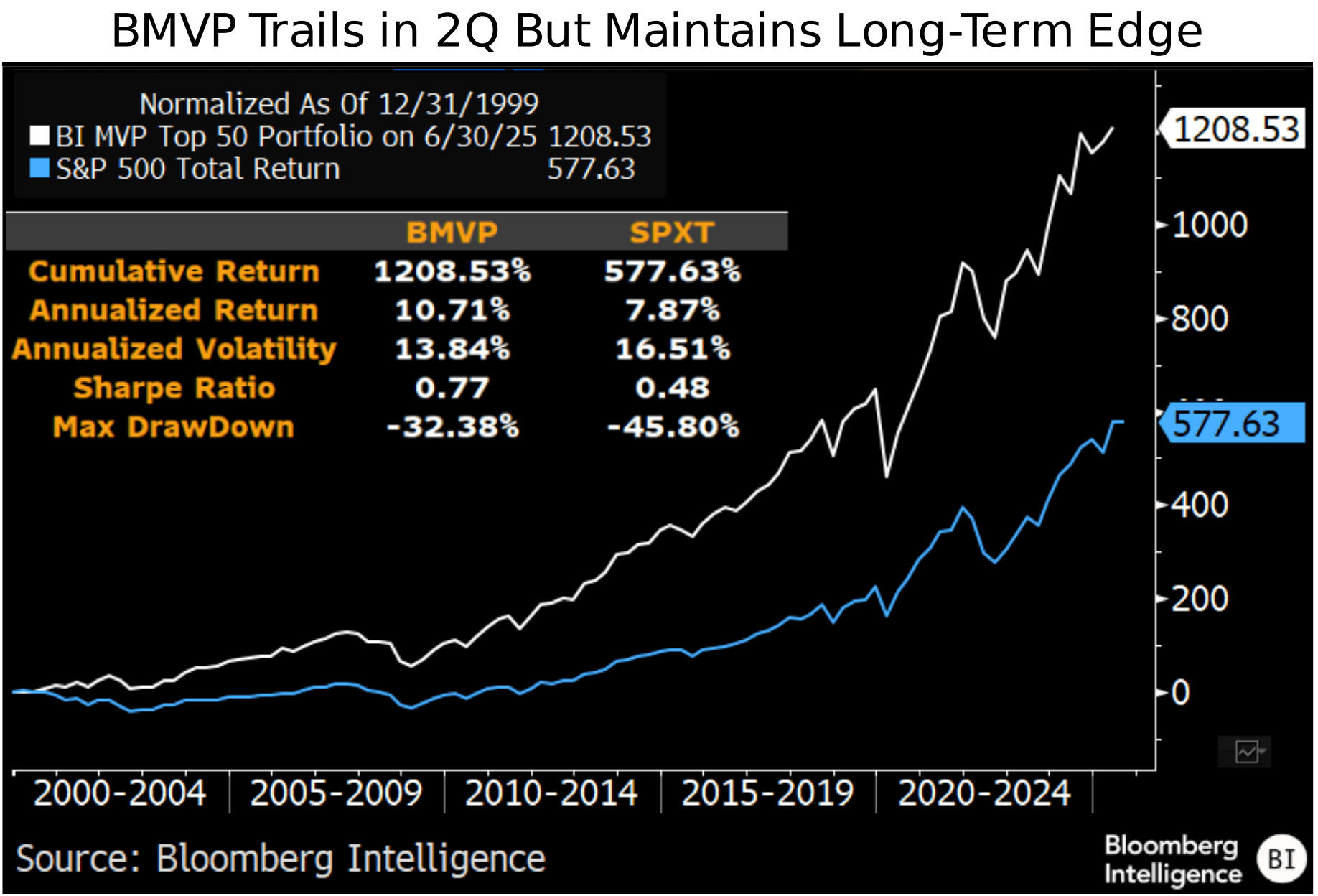

Bloomberg’s large-cap BMVP portfolio delivered positive returns in 2Q but trailed its benchmarks, held back by its defensive tilt during one of the fastest market rebounds on record. The primary drag came from its exposure to low-volatility stocks, which lagged as investors rotated into higher-risk names. Despite near-term underperformance, BMVP’s long-term record remains intact, with higher annualized returns and lower risk than both equal and market cap-weighted benchmarks — underscoring the value of a disciplined, multifactor approach.

Large-cap BMVP underperformed benchmarks in 2Q

Bloomberg’s large-cap BMVP portfolio underperformed its benchmarks in 2Q, weighed down by its defensive tilt — particularly the low-volatility component — during the fastest market rebound after a 15% drawdown on record. The BMVP portfolio returned 1.82% on the quarter, trailing the Bloomberg 500 equal-weight benchmark’s 5.46% gain. Low volatility was the weakest contributing factor, with the sector-neutralized Q1 cohort declining 58 bps on the quarter. Despite 2Q softness, the BMVP strategy maintains higher long-term returns (10.71% annualized) than both the equal-weight (7.87%) and market-cap-weight (8.82%) benchmarks, along with lower volatility and drawdowns.

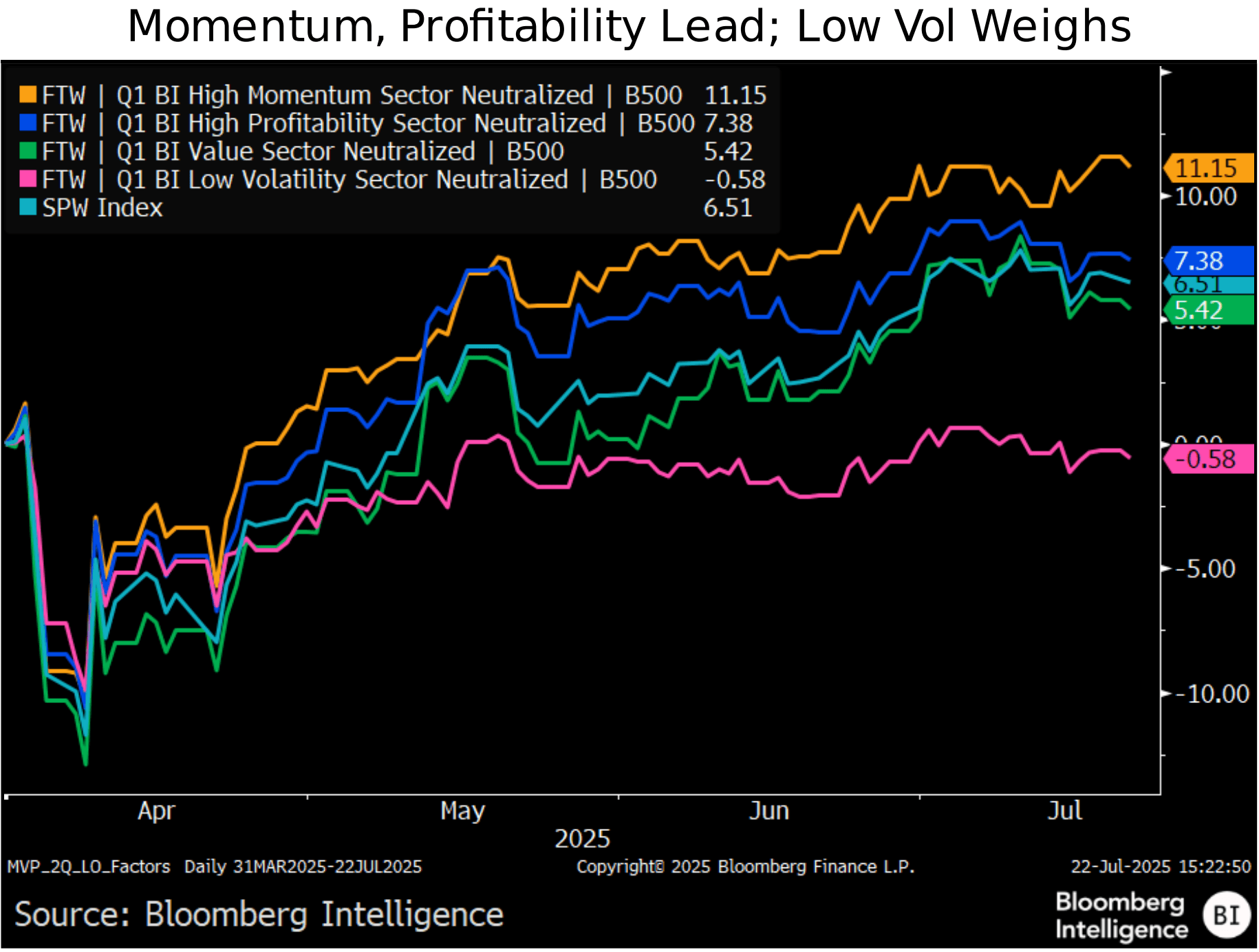

Low-volatility drag explains 2Q BMVP lag

A breakdown of individual factor performance helps explain Bloomberg’s large-cap BMVP portfolio underperformance in 2Q. Two of the long-only Q1 factor legs outpaced the S&P 500 Equal Weight benchmark (SPW), including high momentum (11.15%) and high BI profitability (7.38%). BI value trailed slightly, returning 5.42%, while low volatility was the clear drag, declining 0.58% for the quarter. As investors rotated out of low-risk names during the sharp post-April 2 rebound, lowvolatility exposure weighed heavily on BMVP’s relative performance.

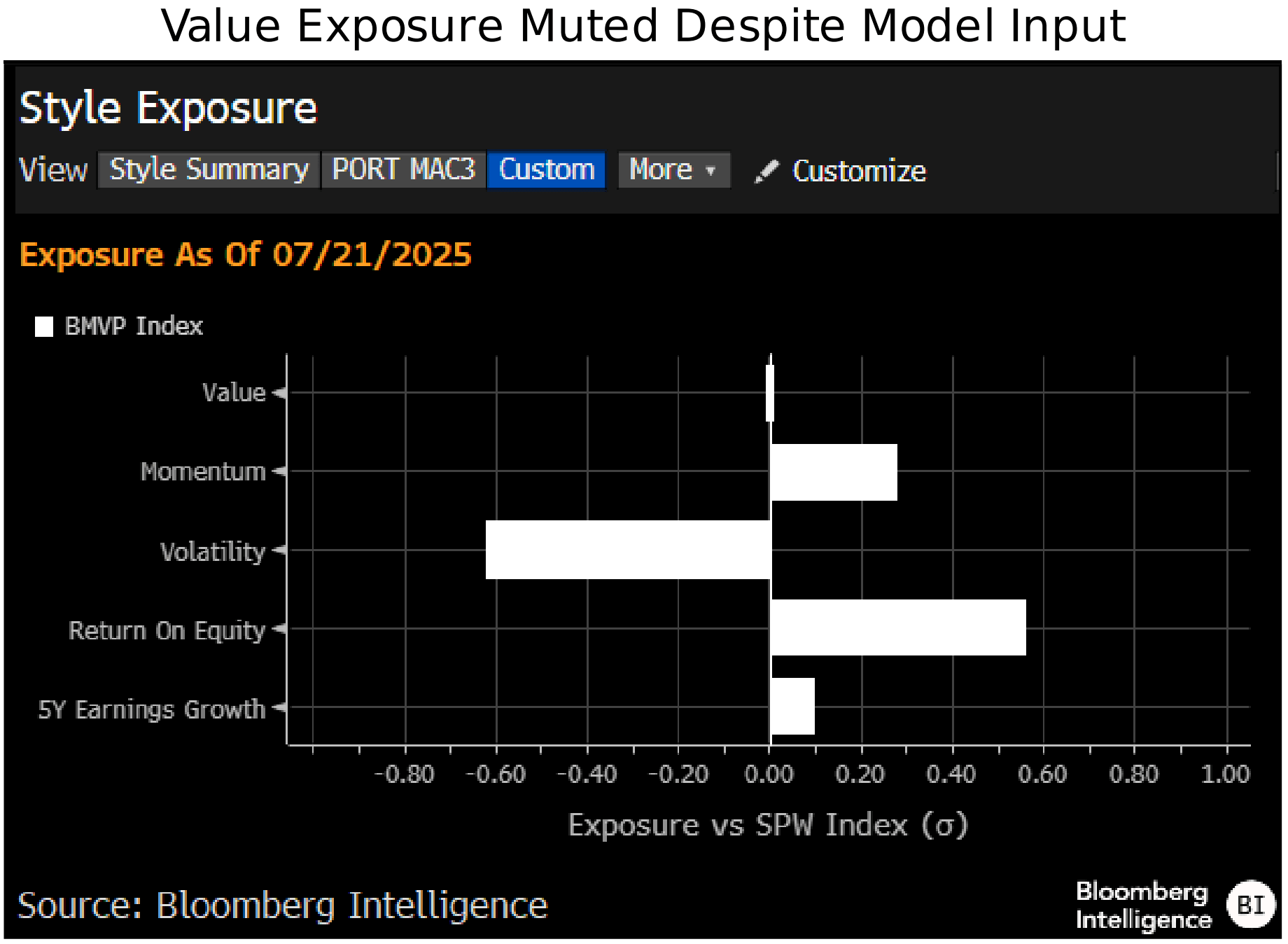

Low volatility and profitability lead BMVP factor profile

A cross-factor analysis of Bloomberg’s large-cap BMVP portfolio reveals strong exposures to low volatility and profitability, with minimal tilt toward value. The largest loading is to low volatility, at minus 0.62 sigma relative to the S&P 500 equal weight index, followed by return-on-equity (ROE) at positive 0.56 sigma. Momentum shows a modest positive tilt at 0.28 sigma. Interestingly, the portfolio’s value exposure is near neutral-despite being a model input. This reflects the fact that high momentum, high profitability and low volatility stocks carry elevated valuations, effectively offsetting the model’s value component.

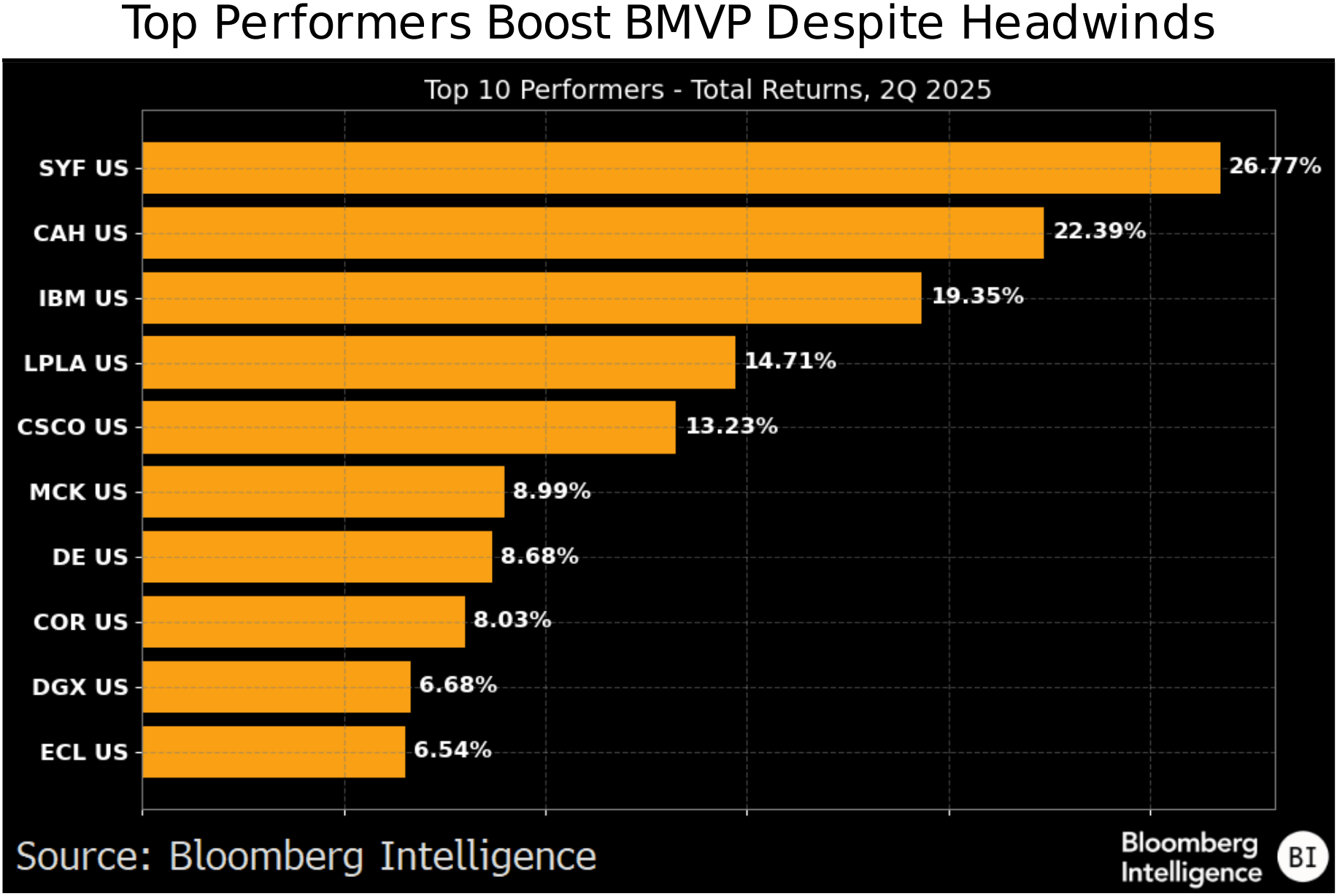

Synchrony, Cardinal Health, IBM lead BMVP portfolio in 2Q

Top contributors to Bloomberg’s large-cap BMVP portfolio in 2Q included Synchrony Financial, which returned 26.77%, and perennial factor standout Cardinal Health (CAH), with a 22.39% gain. Cardinal has been a factor star for some time, and currently ranks in the 99th percentile in BI’s multifactor model, showing especially strong scores in BI momentum (100th) and BI low volatility (94th). IBM also delivered strong performance, rising 19.35% for the quarter.

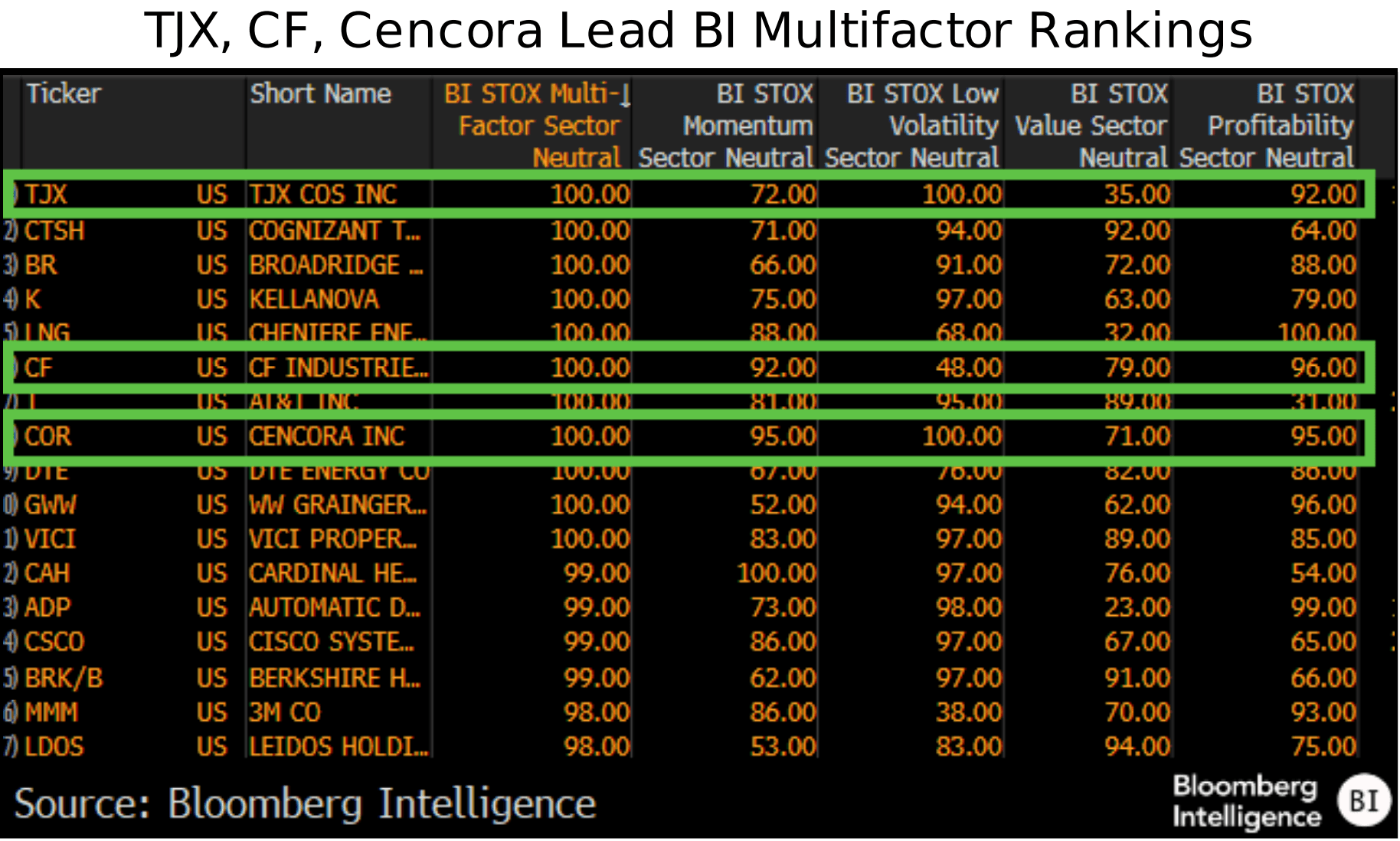

Top-ranked MVP stocks: TJX, CF Industries, Cencora

TJX, CF Industries and Cencora are all top-rated names in BI’s “MVP” multifactor model, ranking in the 100th multifactor percentile of the Bloomberg 500 index. TJX’s top ranking is driven by exceptional low-volatility (100th percentile) and profitability (92nd) scores. CF Industries combines strong momentum (92nd) with low volatility (96th). Cencora, a consistent factor standout, pairs a 100th percentile low-volatility score with 92nd percentile ranks in both momentum and profitability.

Click our visual or follow the link on the left for fully BI factor scores across the Bloomberg 500 universe. Factor scores are as of June 30. BI’s “MVP” multifactor equally combines BI momentum, value, low-volatility and profitability scores.

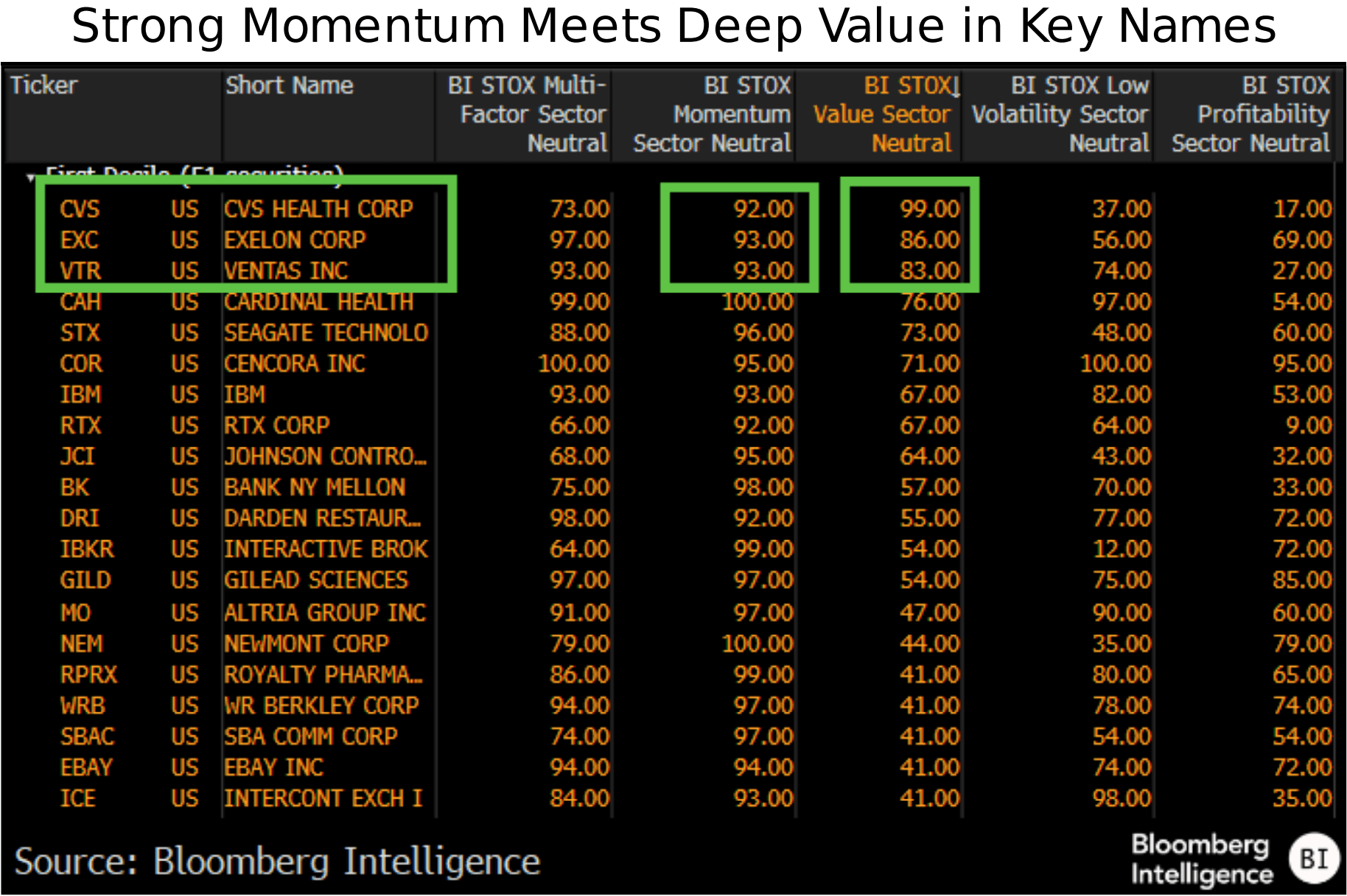

Trending value: The intersection of value and momentum

CVS, Exelon, and Ventas are standout examples of “trending value” stocks — Bloomberg 500 names that combine inexpensive valuations with strong recent performance. CVS ranks in the 99th percentile on BI’s value factor and the 92nd on momentum. Exelon shows a 93rd percentile momentum score alongside a 96th percentile value rank, with a price-to-sales ratio of just 1.85x vs. the 3.21x utilities sector average. REIT Ventas, with a 93rd percentile momentum score and an 83rd percentile value rank, has returned 28.91% over the past year vs. 9.92% for the real estate sector.

The data included in these materials are for illustrative purposes only. The BLOOMBERG TERMINAL service and Bloomberg data products (the “Services”) are owned and distributed by Bloomberg Finance L.P. (“BFLP”) except (i) in Argentina, Australia and certain jurisdictions in the Pacific Islands, Bermuda, China, India, Japan, Korea and New Zealand, where Bloomberg L.P. and its subsidiaries (“BLP”) distribute these products, and (ii) in Singapore and the jurisdictions serviced by Bloomberg’s Singapore office, where a subsidiary of BFLP distributes these products. BLP provides BFLP and its subsidiaries with global marketing and operational support and service. Certain features, functions, products and services are available only to sophisticated investors and only where permitted. BFLP, BLP and their affiliates do not guarantee the accuracy of prices or other information in the Services. Nothing in the Services shall constitute or be construed as an offering of financial instruments by BFLP, BLP or their affiliates, or as investment advice or recommendations by BFLP, BLP or their affiliates of an investment strategy or whether or not to “buy”, “sell” or “hold” an investment. Information available via the Services should not be considered as information sufficient upon which to base an investment decision. The following are trademarks and service marks of BFLP, a Delaware limited partnership, or its subsidiaries: BLOOMBERG, BLOOMBERG ANYWHERE, BLOOMBERG MARKETS, BLOOMBERG NEWS, BLOOMBERG PROFESSIONAL, BLOOMBERG TERMINAL and BLOOMBERG.COM. Absence of any trademark or service mark from this list does not waive Bloomberg’s intellectual property rights in that name, mark or logo. All rights reserved. © 2025 Bloomberg.