Bloomberg Professional Services

This analysis is by Bloomberg Intelligence Chief Equity Strategist Gina Martin Adams and Senior Equity Strategist Michal Casper. It appeared first on the Bloomberg Terminal.

While most of the earnings cues that have historically mattered for stock prices remain poor, the consensus bar has at least been lowered to single-digit growth expectations, and cyclical sector growth is still expected to outpace defensives this year. That said, margin expectations are plummeting and earnings breadth is deteriorating. In general, the fundamental backdrop is still choppy, though signals for price may be slightly less bad now than they were to start 2025.

Stocks’ bar has been lowered, can they hurdle it?

Consensus expectations for earnings growth were too high entering 2025, but they’ve come down significantly to more attainable levels in line with macro indicators. In 2024, S&P 500 EPS growth averaged a quarterly gain of 11.3%. While going into 2025, the bar was notably high, tariff concerns pushed hurdles much lower — 1Q forecasts were cut almost in half from 11.4% in January to 6.6% pre-earnings season before index earnings surged 13.1%. Likewise, the bar for the rest of the year is just an average 6%. If companies can beat this relatively low bar, it may enable equity markets’ recovery.

Consensus forecasts imply growth will slow materially in the next few quarters before bouncing back in 2026. Tech is forecast to post the strongest EPS growth this year, followed by health care. Energy earnings could contract most.

Earnings breadth is stalling out despite huge 1Q beat

Earnings breadth hit a cycle low in 2023, but after making a new cycle high in 2Q24, it’s stalled out and hit its lowest level in a year in 1Q. Breadth, measured by the share of companies that record year-over-year profit gains, reached a high in 2Q21 at 86.4%, and when it turned, it hinted at a troubled outlook for equities. Breadth faded to 56.2% by the end of 1Q23 earnings, roughly coinciding with the trough in the index’s earnings growth. Breadth improved to 70% by 2Q24 and nearly hit that mark again with 4Q reports, but is now back to 66.3% in 1Q despite results that doubled the preseason forecast growth.

At the 2Q20 bottom, 38.6% of the S&P 500 reported EPS growth, and in the 2015-16 cycle, breadth slid below 55% — similar to the low in 2023. It’s expected to slip to 60% in 2Q.

Cyclical earnings expected to outpace defensives in 2025

Even after downward revisions to growth forecasts, cyclicals are expected to continue to outpace defensives’ growth in 2025, offering a bit of hope yet for stocks facing otherwise poor earnings cues. Cyclicals lost ground to defensives throughout 2022, helping to explain ebbing momentum in stocks. The latter took the lead in 1Q23, but relinquished it after six quarters with the 3Q earnings season, as cyclicals outpaced defensive sector growth by more than 100 bps. Cyclical sectors are now expected to open up an average 892 bps earnings lead on an average 266 bps revenue advantage in 2025.

The sectoral picture is expected to brighten, albeit unevenly. EPS growth breadth weakened in 1Q with four sectors posting year-over-year declines versus just three in 4Q24 — and another seven could drop in 2Q before recovering in 3Q.

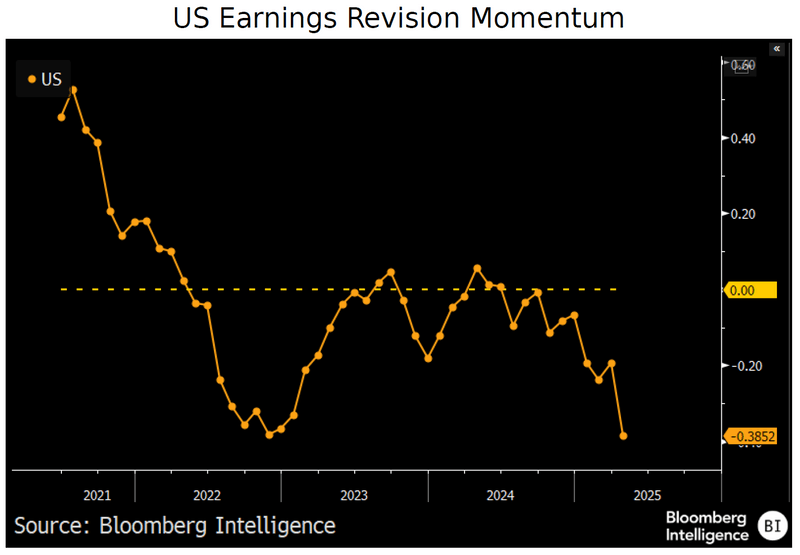

Earnings revision momentum is weaker than the last bear market

US earnings revision momentum has been weakening since mid-2024, and dipped to levels lower than the 2022 bear market as analysts rapidly pared back forecasts as tariffs mounted. Earnings-revision momentum — the number of stocks in the MSCI US index with higher year-ahead EPS forecasts over the past three months minus the number that are lower over the total number of companies with revisions — sits at minus 38.5%. This represents a break below November 2022’sminus 38.2% reading, and suggests the EPS outlook for stocks is weakening for more companies than strengthening.

US revision momentum hasn’t been meaningfully positive since the end of the 2021-22 bull market, and it’s moving in the wrong direction to support stocks.

Margin outlook is deteriorating as tariffs drag

The consensus operating margin forecast is a good leading indicator of stock price direction. After stalling out last fall, margin forecasts re-accelerated to surpass the 2022 high, helping to boost the outlook for stocks. However, stalling disinflation and peak tech sector growth challenged the trend by late 2024, and tariff s are now taking a big bite out of the outlook, with forecasts sliding 30 bps in aggregate since the March high. Now, four of 11 GICS sectors are expected to see margin contraction this year, led by real estate, energy and discretionary.

Margin forecasts play a critical role in driving sentiment and are especially strong indicators of emerging tops. Ahead of the S&P 500’s routs in 2011, 2015, 2018 and 2020, reduced projections ultimately hurt prices.

The data included in these materials are for illustrative purposes only. The BLOOMBERG TERMINAL service and Bloomberg data products (the “Services”) are owned and distributed by Bloomberg Finance L.P. (“BFLP”) except (i) in Argentina, Australia and certain jurisdictions in the Pacific Islands, Bermuda, China, India, Japan, Korea and New Zealand, where Bloomberg L.P. and its subsidiaries (“BLP”) distribute these products, and (ii) in Singapore and the jurisdictions serviced by Bloomberg’s Singapore office, where a subsidiary of BFLP distributes these products. BLP provides BFLP and its subsidiaries with global marketing and operational support and service. Certain features, functions, products and services are available only to sophisticated investors and only where permitted. BFLP, BLP and their affiliates do not guarantee the accuracy of prices or other information in the Services. Nothing in the Services shall constitute or be construed as an offering of financial instruments by BFLP, BLP or their affiliates, or as investment advice or recommendations by BFLP, BLP or their affiliates of an investment strategy or whether or not to “buy”, “sell” or “hold” an investment. Information available via the Services should not be considered as information sufficient upon which to base an investment decision. The following are trademarks and service marks of BFLP, a Delaware limited partnership, or its subsidiaries: BLOOMBERG, BLOOMBERG ANYWHERE, BLOOMBERG MARKETS, BLOOMBERG NEWS, BLOOMBERG PROFESSIONAL, BLOOMBERG TERMINAL and BLOOMBERG.COM. Absence of any trademark or service mark from this list does not waive Bloomberg’s intellectual property rights in that name, mark or logo. All rights reserved. © 2025 Bloomberg.