Bloomberg Intelligence

This analysis is by Bloomberg Intelligence Chief Equity Strategist Gina Martin Adams and Senior Equity Strategist Michael Casper. It appeared first on the Bloomberg Terminal.

Stocks may come under increasing pressure this year, as policy prerogatives amplify the rotation away from early-cycle winners to new leadership. Cycle recovery may continue to spread to unloved corners of the US equity market, as long as a consumer-led recession is avoided and the Federal Reserve stays onboard with easing, yet this may be offset by policy pressures on multinationals that already face slowing earnings momentum. Meanwhile, multiples for the S&P 500 and Russell 2000 are now above what our macroeconomic models imply as fair, indicating the expectations bar is quite high to start the year.

The S&P 500’s earnings recovery has helped power stocks to new highs, but it’s starting to send mixed messages for 2025. Cyclical sectors’ growth is still improving, though margin expectations have stalled and earnings revisions have turned south. A period of easy beats is likely ending for much of the index, suggesting the US earnings backdrop may become choppier for the stock market in 2025.

Conservative analysts made for easy beats

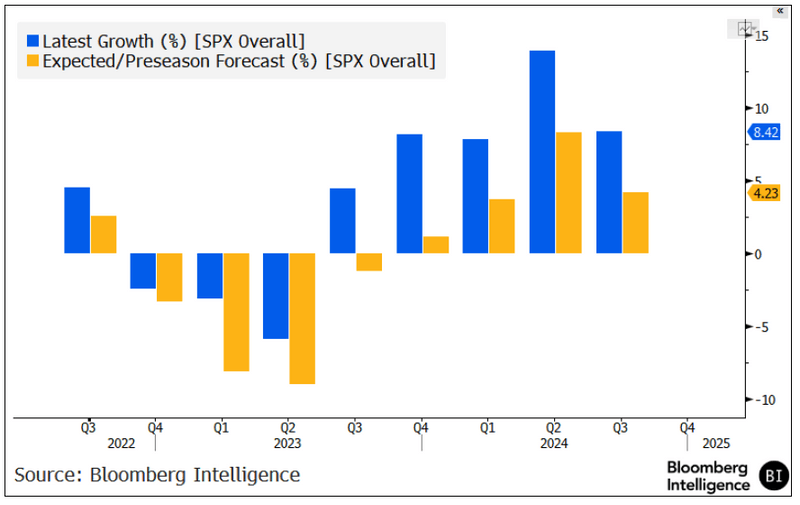

Low bars led to beaten expectations in 2024 (as figure below demonstrates) but views may be tougher to beat in 2025. The four reporting seasons in 2023 boosted optimism about equities as company results cruised past analyst estimates. S&P 500 EPS growth was 9.6% on average, more than 2x analyst forecasts for just 4.4% growth. Revisions though fell for each of the next four quarters during the fall reporting season. At just 4.2% EPS growth toward the end of 2024, the bar proved to be quite low, but analysts expect double-digit growth on average from 4Q24-3Q25 — likely making hurdles considerably more difficult for stocks in the year ahead.

Materials could post the largest acceleration in earnings growth in 2025, on average, while communications and utilities slow the most relative to the prior year.

Analysts’ low bar allowing for beats

Earnings breadth hit a cycle low in 2023 but after surging to 70% for the first time since 2021, it backed off somewhat in late 2024. That sent a slightly more cautious signal on the outlook for stocks. Breadth, measured by the share of companies that record year-over-year profit gains, reached a high in 2Q21 at 86.4%, and when it turned, that hinted at a troubled outlook for equities. It faded quickly, hitting 56.2% by the end of 2Q23 earnings, which also likely marked a trough in the index’s earnings growth. Breadth improved to 70% with 2Q reports — the highest mark since 4Q21’s 73% — but slipped to 66.2% in 3Q.

At the 2Q20 bottom, only 38.6% of the S&P 500 reported EPS growth, and in the 2015-16 cycle, breadth slid below 55% — similar to the low in 2023. It’s expected to recover to about 80% in 1H25.

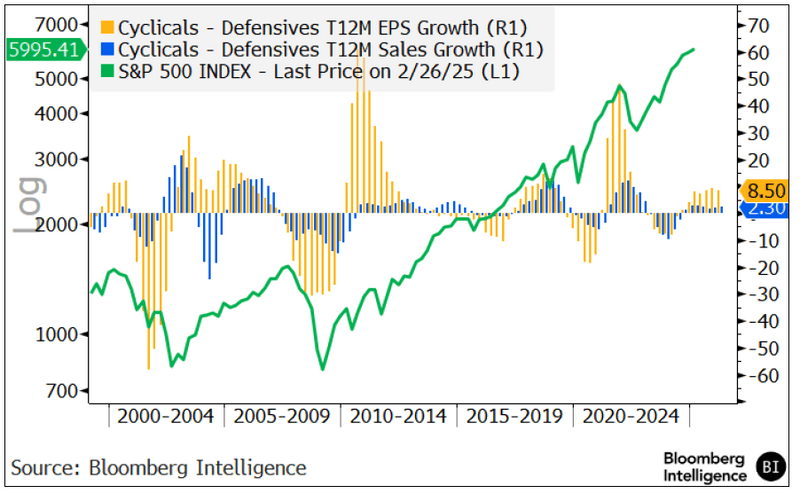

Cyclical-sector earnings started growing faster than defensive ones in the later part of 2024, possibly providing more support for stocks (see Fig. 12.) Cyclicals lost ground to defensives throughout 2022, helping to explain ebbing momentum in stocks. The latter took the lead in 1Q23, but relinquished it after six quarters with the 3Q earnings season, as cyclicals outpaced defensive sector growth by more than 100 bps. Cyclical sectors are now expected to open up an average 758 bps earnings lead on an average 215 bps revenue advantage in 2025, further supporting stocks.

The sectoral picture is expected to brighten, albeit unevenly, into 2025. Three of the 11 GICS sectors — energy, industrials and staples — are pegged for declines in 4Q, while one (energy) could drop in 1H25. Consensus suggests all cyclicals should be posting year-over-year gains by 3Q25.

Cyclicals relative EPS growth gaining in 2H24

Earnings-revision momentum weakens, margins wobble

US earnings-revision momentum has been weakening for several months and dipped to the lowest point since the beginning of 2024, implying analysts are losing confidence in the year-ahead outlook. Earnings-revision momentum — the number of stocks in the MSCI US index with higher year-ahead EPS forecasts over the past three months minus the number that are lower over the total number of companies with revisions — sits at minus 11.4%. This represents a break below July’s minus 9.5% reading and suggests the EPS outlook for stocks is weakening for more companies than strengthening.

US revision momentum hasn’t been meaningfully positive since the end of the 2021-22 bull market and is still off its low of minus 38.2% in November 2022. But it’s moving in the wrong direction to support stocks.

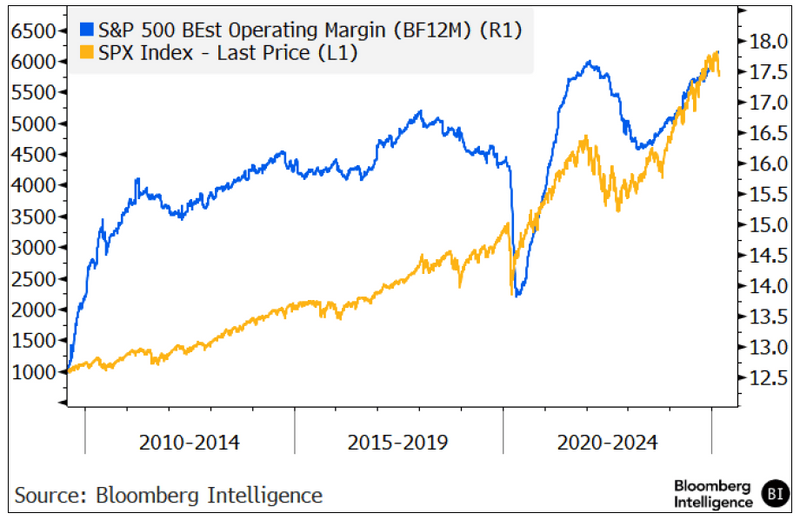

The consensus operating-margin forecast is a good leading indicator of stock-price direction. It’s been stalled in a tight range as of late, after rising persistently in support of equity gains from early 2023 until September. As inflation decelerated, margin expectations climbed, helping to boost the outlook for stocks, but the disinflation support may be largely in the past. Consensus sees most sectors as likely to record margin expansion in the year ahead, but the tech sector is an exception and, given its size, a margin drop would most likely seriously dampen the mood for stocks.

Margin forecasts play a critical role in driving sentiment and are especially strong indicators of emerging tops. Ahead of S&P 500 routs in 2011, 2015, 2018 and 2020, reduced projections ultimately hurt prices.

Margin trends are enabling stocks recovery

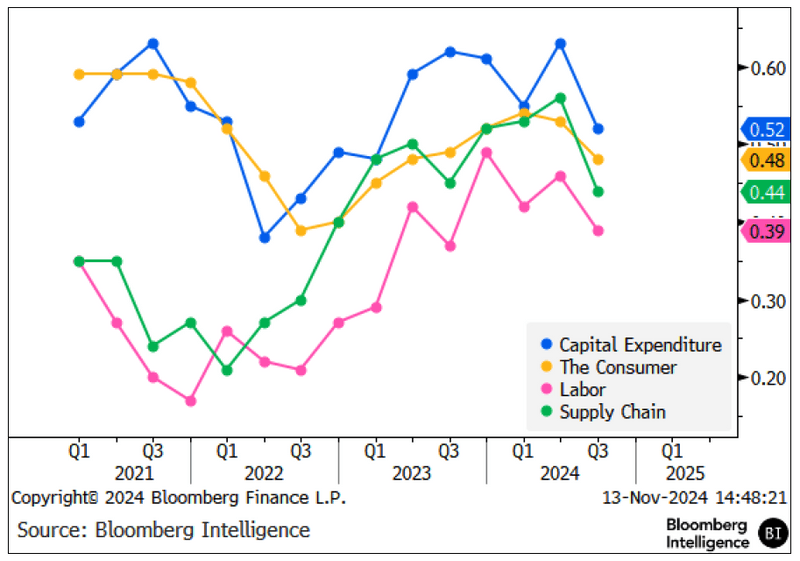

S&P 500 companies’ management tone notably ticked down in third-quarter transcripts (as figure below illustrates) yet the market barely blinked. Typically, sentiment changes are predicted by stocks: In 17 of the past 18 quarters, the S&P 500 gained quarter on quarter when company sentiment either increased or stayed flat, and dropped when it fell, suggesting the benchmark historically prices in poor earnings-call sentiment prior to earnings reports. For instance, the index fell in 3Q23 along with earnings call sentiment on a quarter-over-quarter basis. Even though the releases didn’t come until that October-November, the negative tone was predicted.

Management sentiment dropped across nine of the 11 S&P 500 GICS sectors quarter on quarter, matching the poor breadth seen in past index-level sentiment declines, with energy and health care the lone exceptions. Health-care management was the most positive since 2Q21. In contrast, energy management had a modest improvement in mood after a downtrend in sentiment since 2Q23. Financial firm management sentiment, despite declining QoQ, hit its second-highest level in history going back to 4Q19 (behind only 2Q24).

Consumer discretionary and materials sentiment declined the most vs. last quarter and tech firm management delivered their first QoQ sentiment decline in a year. Both consumer discretionary and staples expressed their worst sentiment since late 2022, indicating concerns around the US consumer could be growing.

Management’s tone when discussing “the consumer” has consistently grown more negative, which may primarily reflect international concerns. The tone struck around consumers has waned for two straight quarters, despite decelerating CPI in the US. Several companies, like Starbucks and Disney, cited consumer softness in Asia that hindered revenue growth. Disney said domestic park activity was healthy, and that its expectation going forward is for a “gradual strengthening in the consumer.”

Trump’s campaign pledge to impose tariffs on all imports into the US contributed to the sentiment decline around supply chains. Home Depot’s management, as one example, cited potential disruptions that could occur as a result of sourcing from Southeast Asia and China.

Management sentiment toward hot topics

Management’s sentiment when answering analyst questions remained unchanged from 2Q, though a better tone surrounding labor offset a major decline in sentiment when discussing China and renewed concerns about the supply chain. Mettler-Toledo Management cited “challenging” market conditions in China. Several firms, like Solventum, Skyworks and Ralph Lauren, tried to assuage investor concerns around China by noting their small revenue share from the nation, and their attempts to “derisk” their position with China.

When discussing the consumer in response to analyst questions, management’s tone deteriorated less than when discussing the topic in pre-prepared remarks, indicating investors may be more concerned about consumer health than management, with executives trying to ease their concerns.

The data included in these materials are for illustrative purposes only. The BLOOMBERG TERMINAL service and Bloomberg data products (the “Services”) are owned and distributed by Bloomberg Finance L.P. (“BFLP”) except (i) in Argentina, Australia and certain jurisdictions in the Pacific Islands, Bermuda, China, India, Japan, Korea and New Zealand, where Bloomberg L.P. and its subsidiaries (“BLP”) distribute these products, and (ii) in Singapore and the jurisdictions serviced by Bloomberg’s Singapore office, where a subsidiary of BFLP distributes these products. BLP provides BFLP and its subsidiaries with global marketing and operational support and service. Certain features, functions, products and services are available only to sophisticated investors and only where permitted. BFLP, BLP and their affiliates do not guarantee the accuracy of prices or other information in the Services. Nothing in the Services shall constitute or be construed as an offering of financial instruments by BFLP, BLP or their affiliates, or as investment advice or recommendations by BFLP, BLP or their affiliates of an investment strategy or whether or not to “buy”, “sell” or “hold” an investment. Information available via the Services should not be considered as information sufficient upon which to base an investment decision. The following are trademarks and service marks of BFLP, a Delaware limited partnership, or its subsidiaries: BLOOMBERG, BLOOMBERG ANYWHERE, BLOOMBERG MARKETS, BLOOMBERG NEWS, BLOOMBERG PROFESSIONAL, BLOOMBERG TERMINAL and BLOOMBERG.COM. Absence of any trademark or service mark from this list does not waive Bloomberg’s intellectual property rights in that name, mark or logo. All rights reserved. © 2025 Bloomberg.