Bloomberg Professional Services

This article was written by Qiao Yu and Utkarsh Agrawal, Index Product Managers at Bloomberg.

In an era of economic uncertainty, marked by high interest rates, geopolitical conflicts, growing trade protectionism, to name a few, identifying resilient investment opportunities has become increasingly challenging. While safe-haven assets like gold have performed well, equities remain in focus to capture the long-term growth potential. Companies with strong fundamentals are better equipped to navigate volatile periods, while the sectors with strong momentum adapt quickly to policy changes and economic shifts. These qualities of the companies make them appealing to those looking for stability and growth opportunities.

Just over two years ago, Bloomberg introduced the Bloomberg Global Industry Elite 55 Index (“Elite 55 Index”) with the vision of measuring the performance of largest and profitable companies from each sector with a strategy that emphasizes overweighting sectors demonstrating high momentum. In our previous blog, we discussed the robust methodology behind the Index. As we transition into 2025, let us revisit how this index has performed since its launch in November 2022.

The Elite 55 Index demonstrated strong outperformance vis-a-vis its parent universe, Developed Markets ex APAC Index (“DM ex APAC Index”), delivering a cumulative 24.64% higher return through the end of 2024. A detailed factor attribution analysis using Bloomberg’s PORT reveals that 8.12% of this outperformance stems from the Selection Effect, while 16.52% can be attributed to Factor contributions.

The Style Factors contributed 6.77% to the overall active return, with Momentum accounting for 3.89% of the active return. Industry as well contributed 6.67% to the active return. This outcome is well anticipated and reinforces confidence that the methodology performed as intended.

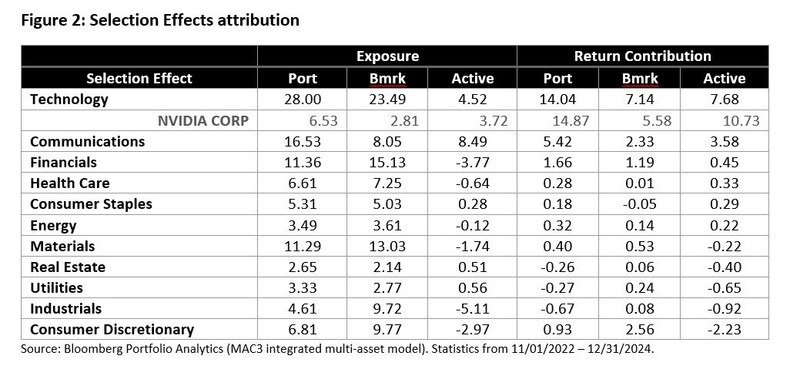

Diving deeper into the Selection Effect, Technology and Communications sectors dominated the active return contribution with highest overweight positions. Notably, NVIDIA, which was overweight by 3.73%, contributed a remarkable 10.73% to the active return. The Selection Effect over the period demonstrates that the methodology effectively leveraged the largest top performers within the sectors.

The live performance of the Elite 55 Index over the past two years reflected the robustness of its methodology in selecting leading companies across various sectors known for their growth potential and strong financial health. The approach has also proven resilient in other markets like Europe and Emerging Markets. A simulated Europe Elite 55 concept delivered 2.8% outperformance vis-a-vis Europe 600 Index, while the Emerging Markets Elite 55 concept outperformed Emerging Markets Index by 1.8% since March 30, 2015.

In this fast-paced and often volatile world of financial markets, identifying the right investment strategies sets the outcomes apart. As we look ahead, it will be interesting to see how this innovative approach to index construction continues to perform across global markets.

KGI Securities Investment Trust has launched the KGI Global Industry Elite 55 ETF based on the Bloomberg Global Industry Elite 55 Index (BGIE55T) under the ticker 00926 TT Equity.

Visit I<GO> on the Terminal or browse our website to find out more about Bloomberg’s indices and request a consultation with an index specialist.

BLOOMBERG, BLOOMBERG INDICES and Bloomberg Global Industry Elite 55 Index (the “Indices”) are trademarks or service marks of Bloomberg Finance L.P. Bloomberg Finance L.P. and its affiliates, including Bloomberg Index Services Limited, the administrator of the Indices (collectively, “Bloomberg”) or Bloomberg’s licensors own all proprietary rights in the Indices. Bloomberg does not guarantee the timeliness, accuracy or completeness of any data or information relating to the Indices. Bloomberg makes no warranty, express or implied, as to the Indices or any data or values relating thereto or results to be obtained therefrom, and expressly disclaims all warranties of merchantability and fitness for a particular purpose with respect thereto. It is not possible to invest directly in an Index. Back-tested performance is not actual performance. Past performance is not an indication of future results. To the maximum extent allowed by law, Bloomberg, its licensors, and its and their respective employees, contractors, agents, suppliers and vendors shall have no liability or responsibility whatsoever for any injury or damages – whether direct, indirect, consequential, incidental, punitive or otherwise – arising in connection with the Indices or any data or values relating thereto – whether arising from their negligence or otherwise. This document constitutes the provision of factual information, rather than financial product advice. Nothing in the Indices shall constitute or be construed as an offering of financial instruments or as investment advice or investment recommendations (i.e., recommendations as to whether or not to “buy”, “sell”, “hold”, or to enter or not to enter into any other transaction involving any specific interest or interests) by Bloomberg or a recommendation as to an investment or other strategy by Bloomberg. Data and other information available via the Indices should not be considered as information sufficient upon which to base an investment decision. All information provided by the Indices is impersonal and not tailored to the needs of any person, entity or group of persons. Bloomberg does not express an opinion on the future or expected value of any security or other interest and do not explicitly or implicitly recommend or suggest an investment strategy of any kind. Customers should consider obtaining independent advice before making any financial decisions. © 2025 Bloomberg. All rights reserved. This document and its contents may not be forwarded or redistributed without the prior consent of Bloomberg.