Bloomberg Professional Services

This article was written by David Weisberg, Product Manager, Company Events & Transcripts, and Louis Bellamacina, Product Manager, Company Research & Analysis and Grant Gordan, Product Manager – Company Financials.

Delivering successful investment ideas depends on managing complexity and consistently outthinking the market. Financial analysts need comprehensive insights into whether a company has met or missed broker expectations. And with earnings here, it’s time to get prepared.

Bloomberg has tools to get you through earnings season, and below we will explore some of the equity tools designed to help analysts save time and react quickly during earnings season volatility. Key takeaways include how to manage coverage with greater efficiency, how to identify and rapidly respond to new catalysts, and how to utilize the power of natural language processing and AI analytics.

Prepare: Events management and tailored news

Earnings season releases are a crucial part of effective analysis. Last year alone, over 46,000 earnings calls were posted on the Bloomberg Terminal.

For example, EVTS <GO> enables you to stay abreast of event details and associated artifacts for a specific company, portfolio, watchlist, or index. Link your portfolio or watchlist to get real-time company releases. Users can access live and final transcripts, company presentations, models and estimates for earnings events and non-earnings event types. Events results can be grouped, filtered by date/security, and most importantly integrated with a user’s Microsoft Outlook calendar so they never miss critical events. To sync with an Outlook Calendar, users can click on the Outlook Sync button found in the red toolbar. With one additional click the user’s search is synced directly to their Outlook calendar.

Anticipate: Earnings analysis

Being able to absorb, interpret and understand company financials during earnings season reporting is vital to staying ahead. MODL <GO>empowers analysts to do just that. It is a Terminal function that allows an analyst to prepare and respond during the volatility of earnings season.

MODL <GO> captures robust consensus estimates across hundreds of key line items, including granular KPIs and segment-level detail. This tool allows an analyst to benchmark their own forecasts vs market consensus with full earnings detail.

On earnings day, MODL captures company-reported data within seconds to show you how a company performed vs consensus. You no longer need to juggle company press releases – Bloomberg automates earnings day for you.

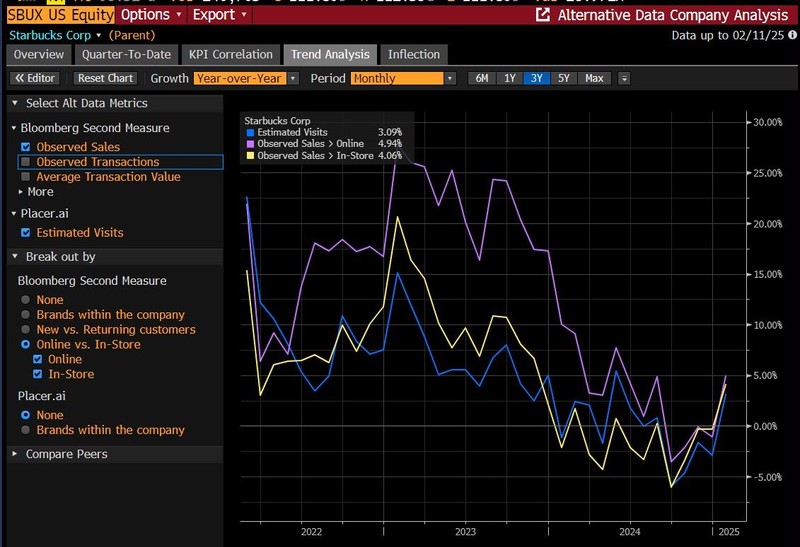

Investigate: Alternative data

ALTD <GO> helps you gain near real-time insights into company performance using alternative data such as consumer transaction data analytics and foot traffic data analytics.

Understand the historical accuracy and predictive power of alternative data in getting ahead of company-reported metrics using ALTD KPI <GO>. Dive deeper into alternative data estimates for unreported quarters with ALTD QTD <GO> side-by-side with consensus estimates.

You can export data from ALTD <GO> to an Excel spreadsheet for further analysis, and the exported data uses BQL to update dynamically via the Bloomberg API.

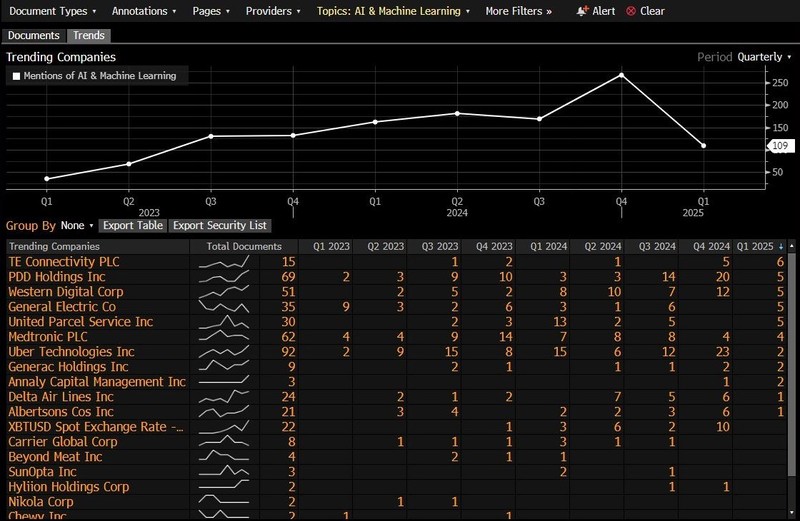

Interpret: Document search

Combine the power of quantitative information on MODL <GO> with the management comments available on DS <GO>. Using DS<GO>, analysts can spot trending topics from earnings calls on a single stock, an industry, a portfolio, or index.

DS <GO> uses AI to provide clients with modern search capabilities, allowing them to initiate research on companies, stay on top of company earnings, and identify emerging themes. To help Bloomberg clients quickly find what they need, AI models identify the important topics being discussed across 200 million trusted source documents. The frequency of topic mentions are then aggregated to create trend analytics. These trend analytics allow clients to spot emerging themes and shifts in discussions, as well as companies relevant to a theme.

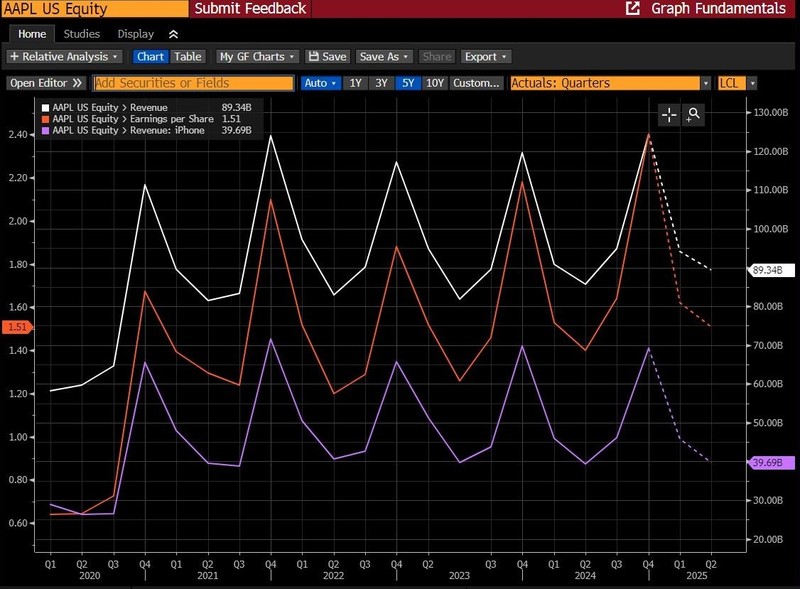

Visualize: Graph fundamentals

Graphing company fundamentals with GF<GO> means that ability chart even more company specific metrics, including segments and KPIs, with reported actuals linked to robust consensus or broker-specific estimates. For example, see how iPhone sales growth compares vs trends in Apple’s other products,understand how estimates have changed leading into earnings season, or benchmark a company’s performance vs guidance. You can quickly put a company’s earnings surprise into context by comparing it against historical performance.

Altogether, GF <GO> provides a robust tool for analyzing estimated changes leading up to earnings season, or a company’s historical performance versus published guidance to better inform your earnings analysis.

Bloomberg helps clients be prepared for earnings season

Delivering successful investment ideas depends on quickly and effectively digesting, analyzing and reacting to newly released company filings, particularly during earnings season, when staying ahead of the pack is vital. Stay up to date on these issues and more via Bloomberg Terminal and take your knowledge and analysis to the next level.

To get started or learn more, request a demo today.