Bloomberg Economics

This analysis is by Bloomberg Economics Chief Economist Tom Orlik. It appeared first on the Bloomberg Terminal.

A US attack on Venezuela, a grand jury subpoena for Fed chair Jerome Powell, new tariff threats against Canada and South Korea, and China’s AI ambitions accelerating. 2026 is off to a tumultuous start. Here’s some of the charts Bloomberg Economics will be tracking to make sense of it all.

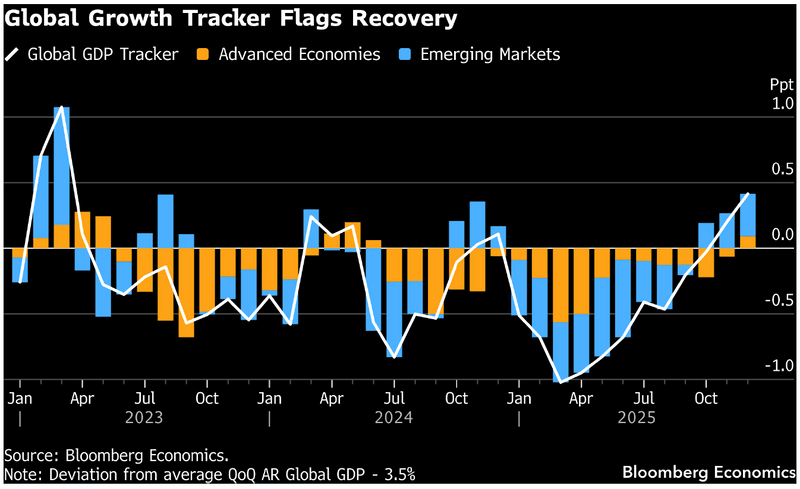

Global growth accelerating…

Global growth fared surprisingly well in 2025, with acceleration into the end of the year despite strain from tariffs and geopolitics. Bloomberg Economics global growth tracker – updated shortly after the end of each month – will show if the pace is maintained and is available for Bloomberg Terminal users.

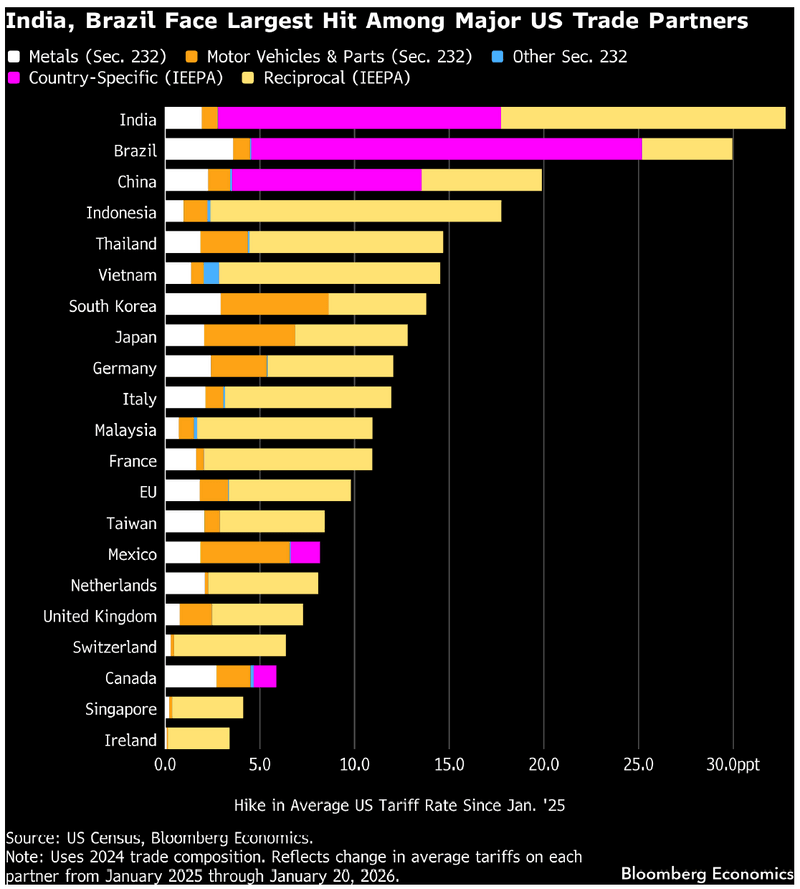

Tariffs in flux…

Trump has pushed the average US effective tariff rate from 2.3% to 14% – a level last seen in the 1930s. India and Brazil have seen the largest increases. Recent threats against Europe, Canada and South Korea underscore that tariffs remain in flux. Bloomberg Terminal users can track the latest at BECO MODELS TRADE <GO>.

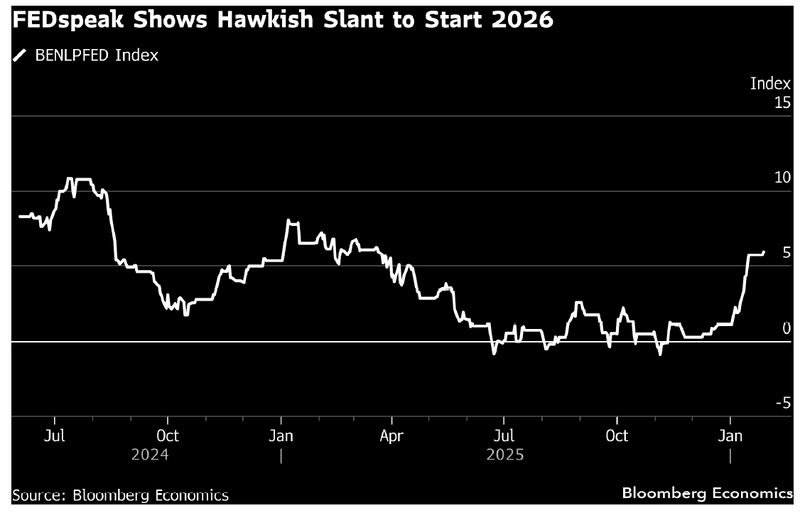

Fed in a fix…

A grand jury subpoena for Powell, a Supreme Court case to determine the future of governor Lisa Cook, Powell’s exit from the Chair – but maybe not the Board – in May, inflation above target and the labor market cooling adds up to a challenging year for the Fed. Our Fedspeak index captures sentiment from policy makers and is available for Bloomberg Terminal users. Right now, it shows a hawkish tilt.

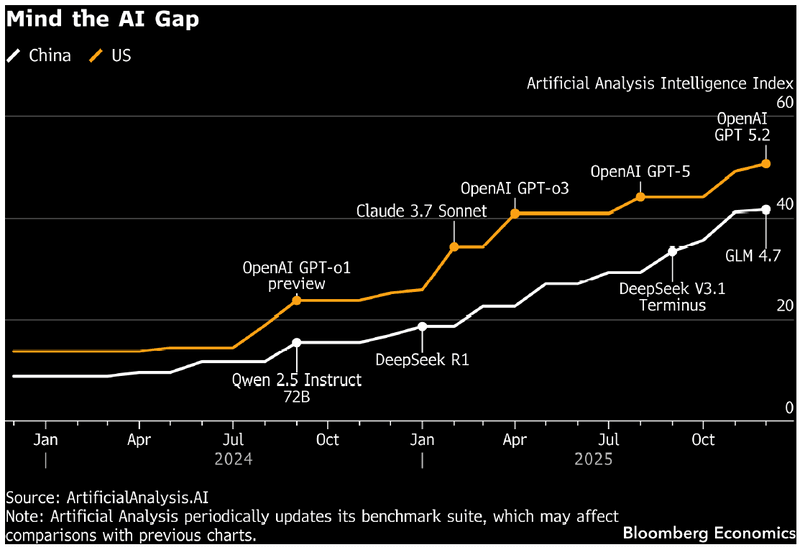

AI race…

China has maintained its AI trajectory and continued to close the gap with US models despite US export controls and a huge capex disparity. Washington’s attempts to throw sand into the circuit boards have slowed China down but haven’t stopped it. US controls may prove more decisive on blocking deployment – which requires access to advanced chips on a large scale.

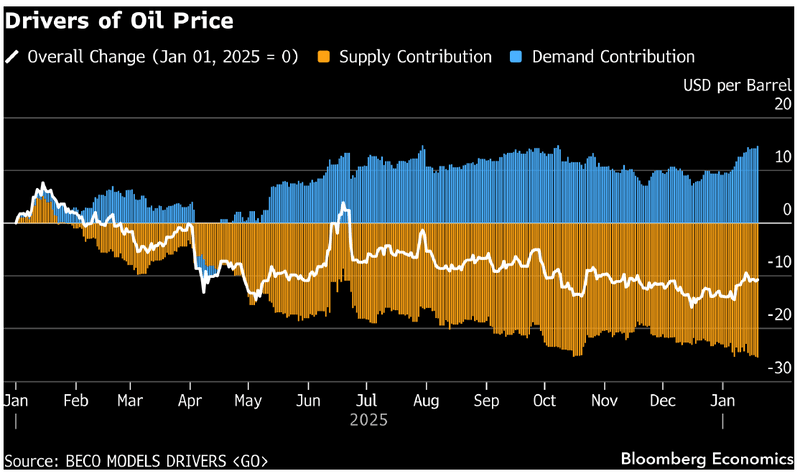

Oil and geopolitics…

For over two years, Middle Eastern geopolitics have flared up, yet oil prices have fallen. A key question for2026 is whether the decoupling between geopolitics and oil will continue. A possible US-Israeli war with Iran will put this to a test. Bloomberg Terminal users can track the impact of supply shocks on oil prices at BECO MODEL DRIVERS <GO>.

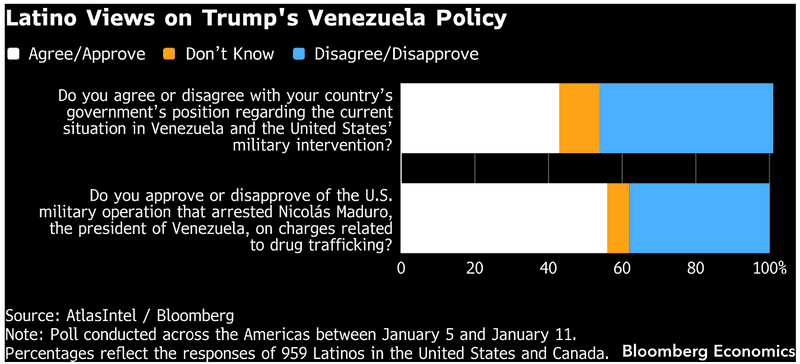

Venezuela vision…

Will Venezuela advance toward a stable, market-friendly, democratic government? Or will it remain under authoritarian rule and US oversight for an extended period? One factor to watch: public opinion among US Latino voters, who will likely press the Trump administration for a timely transition. Bloomberg Terminal users can track debt forecasts at BECO MODELS FISCAL <GO>.

The data included in these materials are for illustrative purposes only. The BLOOMBERG TERMINAL service and Bloomberg data products (the “Services”) are owned and distributed by Bloomberg Finance L.P. (“BFLP”) except (i) in Argentina, Australia and certain jurisdictions in the Pacific Islands, Bermuda, China, India, Japan, Korea and New Zealand, where Bloomberg L.P. and its subsidiaries (“BLP”) distribute these products, and (ii) in Singapore and the jurisdictions serviced by Bloomberg’s Singapore office, where a subsidiary of BFLP distributes these products. BLP provides BFLP and its subsidiaries with global marketing and operational support and service. Certain features, functions, products and services are available only to sophisticated investors and only where permitted. BFLP, BLP and their affiliates do not guarantee the accuracy of prices or other information in the Services. Nothing in the Services shall constitute or be construed as an offering of financial instruments by BFLP, BLP or their affiliates, or as investment advice or recommendations by BFLP, BLP or their affiliates of an investment strategy or whether or not to “buy”, “sell” or “hold” an investment. Information available via the Services should not be considered as information sufficient upon which to base an investment decision. The following are trademarks and service marks of BFLP, a Delaware limited partnership, or its subsidiaries: BLOOMBERG, BLOOMBERG ANYWHERE, BLOOMBERG MARKETS, BLOOMBERG NEWS, BLOOMBERG PROFESSIONAL, BLOOMBERG TERMINAL and BLOOMBERG.COM. Absence of any trademark or service mark from this list does not waive Bloomberg’s intellectual property rights in that name, mark or logo. All rights reserved. © 2025 Bloomberg.