ARTICLE

Hydrogen’s reawakening has market on verge of a breakthrough

Bloomberg Professional Services

This article was written by Mike Pruzinsky, Equity Index Product Manager at Bloomberg Index Services Limited (BISL).

Once dismissed as too costly, too complex, or too early, hydrogen is staging a reawakening and this time, the conditions are different. Policy, technology, and industrial demand are aligning to make hydrogen a credible solution for decarbonizing Europe’s most difficult-to-abate sectors. As governments introduce binding mandates and offer generous subsidies, hydrogen is evolving into a clean technology solution capable of fostering the transition to the low carbon economy. The Bloomberg Hydrogen Screened Total Return Index (BHJENET) offers a systematic, research-based and compelling method for tracking the companies across the hydrogen supply chain.

Why hydrogen?

Hydrogen solves a core energy transition dilemma: how to decarbonize sectors where electrification falls short. Industrial processes such as steel and cement production, long-haul aviation, and maritime shipping require energy intensity and storage capabilities beyond what batteries or grid electricity can offer. That has led to a search for an energy source capable of meeting climate goals. Hydrogen can meet those demands in two ways: by being burned directly (it burns more cleanly than fossil fuels producing only water vapor) or through fuel cells that generate electricity via electrochemical reactions.

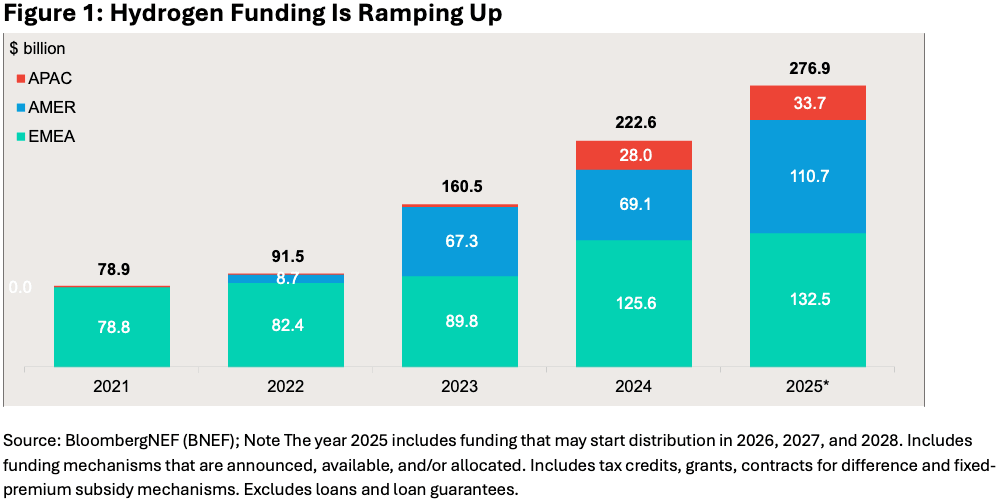

This has led to governments around the world ramping up financial support for hydrogen, signaling strong commitment to scaling low-carbon fuel production. From a regional perspective, the EU and member states offer the most funding with $118 billion.

European policy tailwinds are accelerating demand

What was once a theoretical policy goal is becoming legislative reality. The European Commission’s proposed “delegated act” on low-carbon hydrogen, expected to take effect by late 2025, will formally include both blue hydrogen (natural gas with carbon capture) and nuclear-derived hydrogen in low-carbon fuel quotas, subsidies, and tenders. This represents a meaningful shift and could lead to new incentives as well as target formation for low-carbon fuels.

BloombergNEF (BNEF) projects that this framework could unlock demand for up to 1.8 million metric tons of low-carbon hydrogen by 2035, with aviation and heavy industry leading that growth.

Adoption and cost convergence is underway

Today, gray hydrogen produced from natural gas without carbon capture remains the cheapest, costing as little as $1 per kilogram (kg) in some markets. But that dynamic is changing. Renewable hydrogen, generated via renewable-powered electrolysis, still costs up to $8/kg in some markets. However, BNEF projects that green hydrogen will become competitive with gray starting in 2030. Declining renewable energy prices, better electrolyzer efficiency, and supportive carbon pricing mechanisms are accelerating this trajectory.

Despite its potential, hydrogen still faces meaningful obstacles. Much of the existing energy infrastructure is not built to handle hydrogen transport, storage, or use. Retrofitting steel mills, refineries, and gas pipelines to support hydrogen often requires significant capital investment, posing a barrier to widespread adoption. While these challenges exist, industry and government stakeholders continue to push ahead. Announced projects have soared in recent years with SSAB, a Swedish steel producer, leading the way by setting the most ambitious targets aiming to be net zero by 2030. This integration into production at commercial scale reflects a growing conviction that hydrogen is not only viable but necessary.

A targeted way to invest in the hydrogen complex

Investing in the hydrogen economy requires selectivity. The Bloomberg Hydrogen Screened Index (BHJENET) provides targeted exposure to companies poised to benefit most directly from hydrogen’s adoption. This includes firms focused on hydrogen production and distribution, electrolyzer and fuel cell manufacturing and industrial applications in chemicals, energy, and heavy transport.

The index is powered by insights from Bloomberg Intelligence and BNEF, focusing on companies with strong thematic alignment and meaningful revenue exposure. This helps investors avoid more speculative names with limited commercial traction. One standout holding unique to the Bloomberg Hydrogen Index is GE Vernova, which has nearly doubled in value year to date. In a December episode of the Bloomberg Zero podcast, CEO Scott Strazik stated that 100% of GE’s gas turbine fleet will be capable of running on 100% hydrogen by the end of this decade.

Looking ahead

Hydrogen is transitioning into a mainstream decarbonization pathway. As policy becomes more supportive, costs continue to decline, and industrial deployment gains traction, hydrogen seems on the verge of a breakthrough. The question for investors is no longer if hydrogen will scale, but who will be positioned to benefit. The Bloomberg Hydrogen Screened Index offers a research-driven approach to track the companies at the forefront of this opportunity.

- Amundi has licensed the Bloomberg Hydrogen Screened Index to track the Amundi Global Hydrogen UCITS ETF under the ticker ANRJ.

The data and other information included in this publication is for illustrative purposes only, available “as is”, non-binding and constitutes the provision of factual information, rather than financial product advice. BLOOMBERG and BLOOMBERG INDICES (the “Indices”) are trademarks or service marks of Bloomberg Finance L.P. (“BFLP”). BFLP and its affiliates, including BISL, the administrator of the Indices, or their licensors own all proprietary rights in the Indices. Bloomberg L.P. (“BLP”) or one of its subsidiaries provides BFLP, BISL and its subsidiaries with global marketing and operational support and service. Certain features, functions, products and services are available only to sophisticated investors and only where permitted. Bloomberg (as defined below) does not approve or endorse these materials or guarantee the accuracy or completeness of any information herein, nor does Bloomberg make any warranty, express or implied, as to the results to be obtained therefrom, and, to the maximum extent allowed by law, Bloomberg shall not have any liability or responsibility for injury or damages arising in connection therewith. Nothing in the Services or Indices shall constitute or be construed as an offering of financial instruments by Bloomberg, or as investment advice or investment recommendations (i.e., recommendations as to whether or not to “buy”, “sell”, “hold”, or to enter or not to enter into any other transaction involving any specific interest or interests) by Bloomberg. Information available via the Index should not be considered as information sufficient upon which to base an investment decision. All information provided by the Index or in this publication is impersonal and not tailored to the needs of any person, entity or group of persons. Absence of any trademark or service mark from this list does not waive Bloomberg’s intellectual property rights in that name, mark or logo. For the purposes of this publication, Bloomberg includes BLP, BFLP, BISL and/or their affiliates.

BISL is registered in England and Wales under registered number 08934023 and has its registered office at 3 Queen Victoria Street, London, England, EC4N 4TQ. BISL is authorized and regulated by the Financial Conduct Authority as a benchmark administrator.

© 2025 Bloomberg. All rights reserved.