Bloomberg Professional Services

This article was written by Sean Murphy and Mike Pruzinsky, Equity Index Product Managers at Bloomberg.

Regardless of 2024 performance, the scoreboard resets on January 1st. This new year seemingly has far more questions than answers, as it also comes with a new administration and many new appointees who have the power to change established policy. The Fed is also a key player to watch, with recent commentary pointing to a renewed focus on returning inflation to the 2% level, which could mean fewer rate cuts in 2025. With much in flux, here are a few equity indices and trends to pay attention to in the year ahead.

“Trump Trades” to watch

In the months leading up to election day, investors were scouring speeches, websites, social media, and their Bloomberg Terminal to get a sense of what areas may do well under a Trump 2.0 administration. With that day now in the rearview mirror, some segments of the market have rallied in anticipation of a more accommodating environment for certain businesses. But is a Trump presidency already priced in? While past performance is not indicative of future returns, it may help to examine how different investment themes and exposures performed during Trump’s first year of his first term and compare that to what we have seen since election day. Surprisingly, some popular “Trump Trades” have reversed course recently, potentially creating entry points for investors.

US size & style

Initially markets associated a Trump presidency with an easing regulatory environment, with small cap names viewed as a key beneficiary. Those early gains, however, have been reversed, largely as the result of changing interest rates. 2017 returns suggest that large cap may continue to outperform small. During that year, the Bloomberg Large Cap Index outperformed the Bloomberg 2000 Small Cap by nearly 8%. In a similar fashion, Growth has outperformed Value since the election, which mirrors what we saw in Trump’s first year in office.

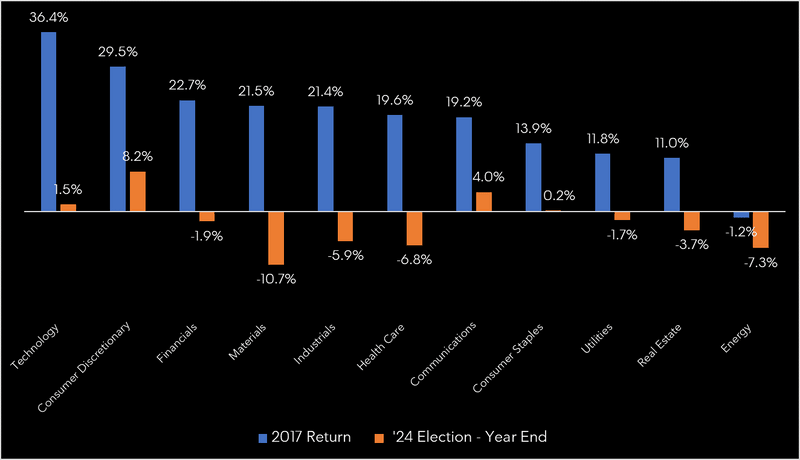

US sectors

One of the best performing sectors in 2017 was materials, with the Bloomberg US Material Index (B3000M) up over 20% that year. While there were many catalysts for this return, the impact of tariffs on industrial metals, particularly steel, led to increased demand for domestic sources. Interestingly, the material sector is the worst performing since election day, down over 11% since.

Figure 1: B500 BICS Sector Indices: 2017 Return vs Post-Election Day

Non-US

Despite the rattling of trade war, international equity markets held up surprisingly well in Trump’s previous first year. In fact, the Bloomberg Emerging Market Index (EM Index) outperformed US equities in 2017, returning a robust 36%. The Chinese equity market (CN Index) returned over 50% that year on the back of a strong domestic economy. But in the weeks since the 2024 election, emerging market equities are down nearly 5%, largely the result of continued weakness in China. Could the impact of tariffs and trade wars perhaps be overdone?

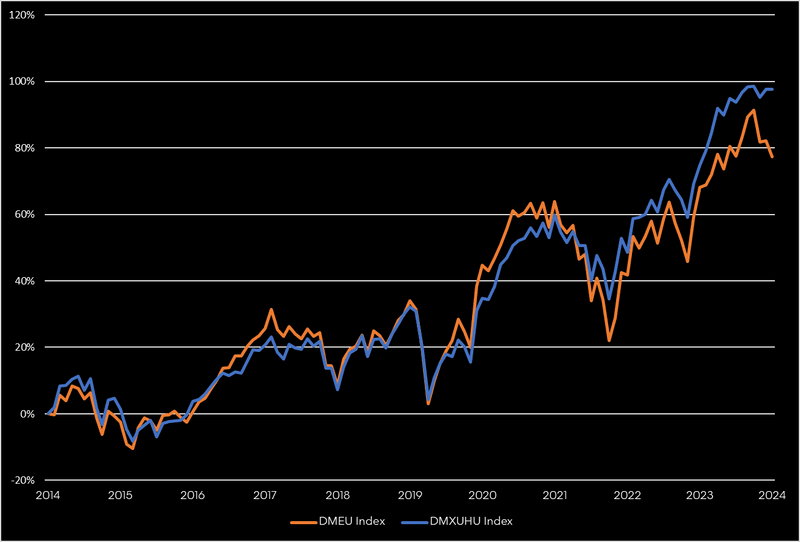

Developed international equities (DMEU Index) also had a positive 2017, albeit more muted than their EM counterpart, returning nearly 25%. While US dollar strength has been top of mind for many international investors, the DM dollar hedged index (DMXUHU Index) meaningfully lagged that year, returning only 16%. More recently, the dollar has rallied since the 2024 election versus many of its counterparts, gaining 4% on the Euro, and 3% versus the Yen and Pound. Yet in 2017, the dollar was meaningfully weaker than these same pairings, as many investors were concerned about US fiscal and monetary policy.

Figure 2: Developed Markets ex US 10 Year Returns: Hedged vs Unhedged

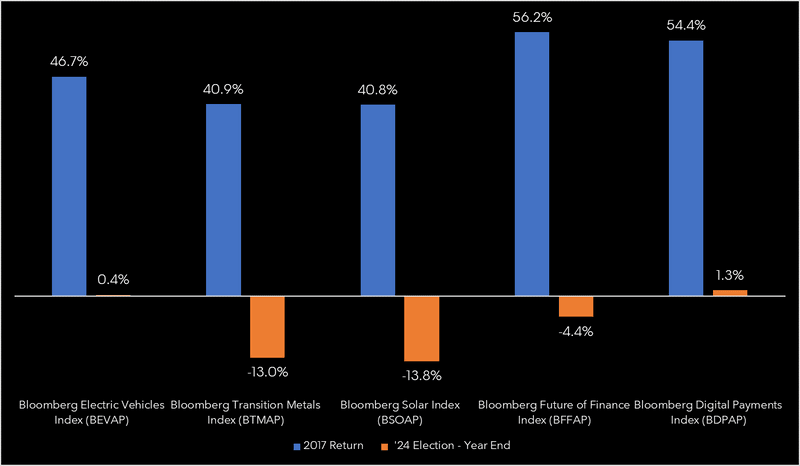

Thematic

Early indications are that a Trump second term may not be kind to environmentally friendly technologies like Solar (BSOAP Index), EV (BEVAP Index), or Transition Metals (BTMAP Index). Many such thematic indices have moved lower as some expect regulations and tax incentives that have benefitted the space to be rescinded. Yet these same themes thrived in 2017, with the Solar Aggregate Index returning 40%. And with the incoming president often referred to as “The Crypto President”, the financial space may be in for disruption. The Bloomberg Future of Finance Index (BFFAP Index) has sold off since the election, but was up 56% in 2017, with the Digital Payments Index (BDPAP Index) generating similar returns as well that year.

Figure 3: Select Bloomberg Thematic Indices: 2017 Return vs Post-Election Day

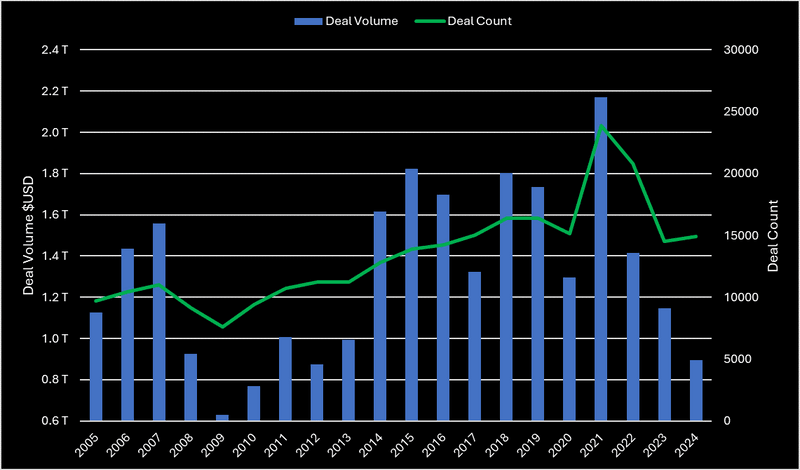

M&A

After two of the slowest years for dealmaking in the past decade, M&A activity in the U.S. is poised for a potential boom in 2025, driven by private equity capital, corporate restructuring initiatives, and a more favorable regulatory environment. The transition to the Trump administration widely viewed as being pro-business is expected to foster a more favorable regulatory environment, potentially easing antitrust enforcement, and facilitating an increase in M&A activities across various sectors. Consumer, healthcare, and technology companies could be in demand as heightened M&A activity is likely to be driven by innovation, the need for scale and consumer preferences. However, a rise in protectionism policies, including stricter scrutiny of foreign acquisitions and trade barriers, may deter international investors. These policies could limit foreign capital flows into U.S. markets, curbing cross-border deal-making and reinforcing domestic consolidation as the primary driver of M&A growth.

Figure 4: US M&A Activity 2005-24

Index returns may take their cue from earnings & shareholder return

Equity markets have witnessed significant valuation expansion in recent years, with many sectors trading at historically high price-to-earnings multiples. This leaves little room for further upside purely driven by valuation growth. Investors are now faced with a challenging environment where future returns are likely to depend more on fundamental performance rather than broad market sentiment or multiple expansion. Consequently, understanding the intrinsic value of companies and their growth prospects will become increasingly more important for making informed investment decisions.

Figure 5: Historical P/E Ratios of B3000 versus Core Earnings & Shareholder Yield

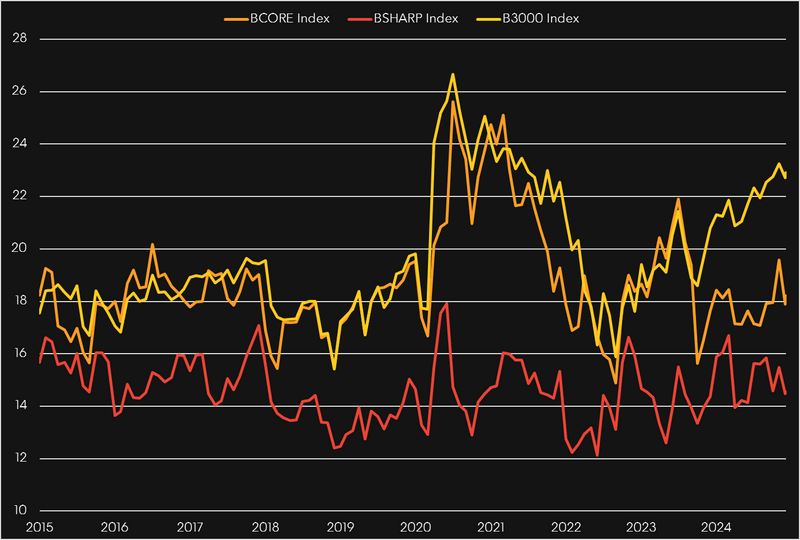

In this high-valuation environment, company earnings and shareholder return may play a critical role in sustaining and justifying elevated stock prices. Firms with resilient business models, innovative strategies, and consistent profitability will capture greater investor interest. Take the Bloomberg New Constructs Core Earnings Index (BCORE as seen in Figure 7) which leverages core earnings capture to select companies considered undervalued compared to intrinsic value, or the Bloomberg Shareholder Yield Total Return Index (BSHARP) which prioritizes shareholder returns (buybacks, dividends, and debt repayment). In each case, those fundamentally driven strategies are trading at some of the widest discounts on a price to earnings basis when compared to the broader US stock market as represented by the Bloomberg US 3000 Index (B3000). Meanwhile, companies unable to deliver tangible earnings improvements may see heightened volatility or underperformance as the market increasingly differentiates based on fundamentals.

Moving through 2025

While opportunities exist in certain pockets of the market fueled by innovation, such as technology and renewable energy, relatively elevated valuations necessitate a sharper focus on company fundamentals like earnings growth and shareholder returns. The new administration is worth monitoring closely as headlines are dominated by shifting policy sentiment, including deregulation and a likely uptick in M&A activity. Investors would be well served to stay disciplined and maintain a long-term perspective to navigate the market complexities of 2025.

Learn more about Bloomberg’s equity index offerings.