Bloomberg Professional Services

- Themes that supported strong commodity performance in 2025 may continue into 2026, with six emerging dynamics shaping supply-demand balances, pricing trends, and cross-asset correlations.

- Industrial metals may outperform precious metals in 2026 as supply deficits, infrastructure investment, and post-tariff growth support copper, aluminum, and nickel prices.

- Geopolitical conflict, weather-driven disruptions, and rising power demand from AI and data centers reinforce commodities’ role in portfolios amid volatility and stagflation risk.

This article was written by Jim Wiederhold, Commodity Indices Product Manager at Bloomberg.

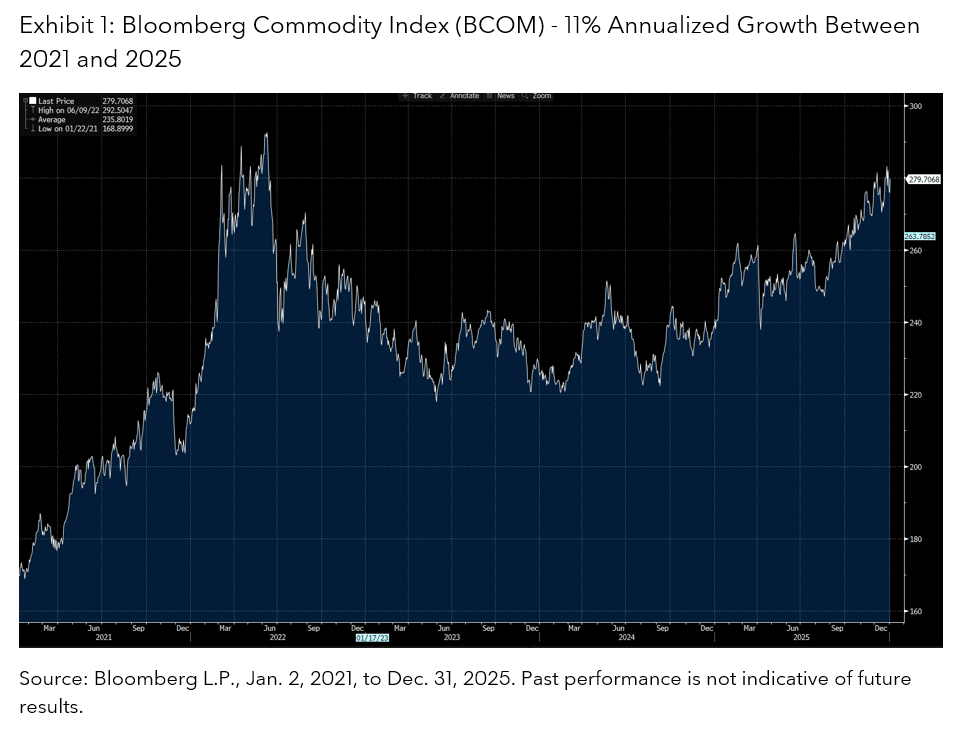

Commodities are proving to be worth their weight in gold over the last five years. The Bloomberg Commodity Index (BCOM) total return has risen 11% annualized so far in the 2020s, as shown in Exhibit 1.

PRODUCT MENTIONS

Themes which have driven the asset class higher in 2025 may continue to provide support through 2026. In this article, we present six new themes to consider over the coming year.

Theme 1: Blue collar vs blue blood – wealth gap shrinks as industrial outshines precious metals

After a historically strong two-year run for gold and other precious metals, the value of precious metals continued to increase compared to the less scarce and less valuable industrial metals – BCOMPRT was up 80% while BCOMINT gained 21% over 2025. However, 2026 may be the year precious metals take a back seat to the BCOM industrial metals of copper, aluminum, nickel, zinc, and lead.

Tight supply balances for industrial metals and a pickup in economic growth after tariffs have been digested could be the forces behind the value of blue collar industrial metals increasing versus blue blood precious metals in 2026.

Theme 2: Cutting off the flow – supply disruptions of raw materials

Geopolitical conflicts tend to cause shortages of commodities particularly in or near commodity producing regions around the world. Other force majeure events could have an effect after there has been a relatively calm three-year period for the broader commodity markets.

Theme 3: Temperature is rising – drought and weather issues

A world of rapidly rising temperatures has led to increased instances of drought and severe weather particularly in commodity growing regions. 2026 could be a difficult year for commodity production as the annual global surface air temperature is near +1.5°C above pre-industrial levels.

Theme 4: Sector and portfolio allocation rotation – trends may hit inflection points

Certain commodity sectors have had multi-year downtrends but seem to be stabilizing. Positioning by market participants could be an indicator showing potential for trend inflection.

Separately, the average allocation to commodities is still low compared to historical averages in asset owners’ alternatives exposure while private markets exposure has increased to levels above target allocations leading to a potential rotation to commodities exposure.

Theme 5: The future of energy is here – thirst for power will be unquenchable

Power prices surged in 2025 and the cost for the US consumer has risen as the power demand needs of AI and data centers are causing utility bills to skyrocket. With the world seemingly on the path to embrace AI, this new source of demand will be a factor for energy.

Theme 6: No stagflation party for markets in 2026 – stagflation risks rising

Inflation has remained tepid although at higher levels relative to the past 15 years. Underlying catalysts may boil to the surface this year to collectively raise the level of prices for raw materials which are the inputs to the global economy. If growth falters, this could create a stagflationary environment similar to what occurred in the 1970s.

Commodities outperformed other asset classes in prior periods and could be a positive diversifying contributor to portfolio performance in 2026.

Blue collar vs blue blood – wealth gap shrinks as industrial outshines precious

Banks are projecting copper in 2026 will have its biggest supply deficit in 22 years. Exhibit 2 shows BloombergNEF forecasts supply deficits for the major industrial metal through the next few decades.

Copper is the key industrial metal which is closely correlated to global economic data, which reached an all time high of $12,558 at the tail end of 2025. Fundamentally, the supply is expected to miss the mark to satisfy the expected demand on a going forward basis. After a historic rise in precious metals prices over the last two years, the industrial metals complex could take the baton and rise higher in 2026, as an alternative store of value that could appreciate further.

Cutting off the flow – supply disruptions of raw materials

Commodity prices reflect the spot supply/demand balance for the individual raw materials at any point in time. This contrasts with other asset classes like equities which tend to be priced based on the outlook 12 months or a year into the future. With this being the case, commodity prices tend to move with volatility when breaking news on supply disruptions affects the picture. Geopolitical conflict has risen in the 2020s and is one of the main reasons commodities prices have had higher returns this decade. Exhibit 3 shows geopolitical risks have increased, creating more opportunities for supply disruptions which cause increases in commodity prices. This has coincided with the most uncertain US economic policy after tariffs were introduced when looking back to 1985.

Temperature is rising – drought and weather issues

Weather is always a factor contributing to gyrations in commodity prices. The most sophisticated commodity traders use advanced weather forecasting models to project demand and potential supply issues for most of the major commodities traded today. 2025 was one of the three hottest years on record. Drought in commodity crop growing regions was prevalent and could continue into 2026 leading to lower crop yields and potentially higher prices for grains and softs. Livestock is also affected but to a lesser extent. Modern irrigation techniques can only do so much in a world of rising temperatures. When rains do come, they can lead to extreme weather and severe flooding which occurred in coffee growing regions in central Vietnam last year. Furthermore, extreme weather has impacted supply chains for copper with heavy flooding in Indonesia.

Sector and portfolio allocation rotation – trends may hit inflection points

Trends in commodity prices can be very short term but typically tend to be multi-year affairs similar to what is seen in other asset classes. Within sectors, we have seen some perform strongly like precious metals while grains have had three consecutive years of lower trending prices. 2026 could be when market participants consider rotating exposure from the winning sectors to the ones that seem to show the downward moves may be near trend exhaustion levels. Commodity trading advisors (CTAs) typically look at trend exhaustion as a consideration on how to size exposure and could shift long only exposure to certain sectors after trends in current exposure seem overdone. Exhibit 5 shows precious metals, livestock, and softs had strong performances over the last three years while energy and grains performance lagged. Industrial metals finally started to pick up in 2025 after three straight years of underperformance.

Another broader portfolio allocation theme related to the sector rotation possibility involves exposure to alternatives from the asset owner community. In portfolios particularly in North America, asset owners like pension plans have seen some of their exposure to alternatives like private equity and private credit balloon to percentage weights higher than their target allocations. If looking to maintain their alternatives’ exposure but considerate of potential overvaluation of private markets exposure, these asset owners could look to reduce and initiate or add commodity exposure.

There have been several instances in the news over the last year where large endowments highlighted they are concerned about their private markets exposure and commodities could be the asset class to continue to benefit from allocation rotation in the alternative sector or derisking from over-valued equities.

The future of energy is here – thirst for power will be unquenchable

It is not possible to have an outlook piece for 2026 without discussing Artificial Intelligence and how it may continue to transform the economy. As AI relates to commodities, it is important to consider which commodities will be in higher demand due to higher power use as well as demand from a projected pick up in overall global economic activity.

While traditional sources of energy from the commodity world continue to play an important role, nuclear energy could be the decisive contributor to satisfy the aggregate demand. Exhibit 6 shows actual and forecasted nuclear capacity with a clear pick up as the world becomes more aware of the needs of future energy.

No stagflation party for markets in 2026 – stagflation risks rising

Inflation is always a key theme to consider for commodities. 2025 proved inflation did not matter to the asset class as inflation continued to edge lower while commodities prices moved higher for other reasons. In 2026, there is a risk for inflation to pick up while growth potentially edges lower in a stagflationary environment. Commodities shine during these macroeconomic regimes and 2026 could be the year where history doesn’t repeat but could at least rhyme.

In this 2026 commodities outlook, we explored potential themes which could blossom throughout the year. Commodities have shown to contribute to portfolio performance and exposure through a broad commodities index like BCOM is becoming one of the most popular ways to track how raw materials react to a changing world.

The data and other information included in this publication is for illustrative purposes only, available “as is”, non-binding and constitutes the provision of factual information, rather than financial product advice. BLOOMBERG and BLOOMBERG INDICES (the “Indices”) are trademarks or service marks of Bloomberg Finance L.P. (“BFLP”). BFLP and its affiliates, including BISL, the administrator of the Indices, or their licensors own all proprietary rights in the Indices. Bloomberg L.P. (“BLP”) or one of its subsidiaries provides BFLP, BISL and its subsidiaries with global marketing and operational support and service. Certain features, functions, products and services are available only to sophisticated investors and only where permitted. Bloomberg (as defined below) does not approve or endorse these materials or guarantee the accuracy or completeness of any information herein, nor does Bloomberg make any warranty, express or implied, as to the results to be obtained therefrom, and, to the maximum extent allowed by law, Bloomberg shall not have any liability or responsibility for injury or damages arising in connection therewith. Nothing in the Services or Indices shall constitute or be construed as an offering of financial instruments by Bloomberg, or as investment advice or investment recommendations (i.e., recommendations as to whether or not to “buy”, “sell”, “hold”, or to enter or not to enter into any other transaction involving any specific interest or interests) by Bloomberg. Information available via the Index should not be considered as information sufficient upon which to base an investment decision. All information provided by the Index or in this publication is impersonal and not tailored to the needs of any person, entity or group of persons. Absence of any trademark or service mark from this list does not waive Bloomberg’s intellectual property rights in that name, mark or logo. For the purposes of this publication, Bloomberg includes BLP, BFLP, BISL and/or their affiliates.

BISL is registered in England and Wales under registered number 08934023 and has its registered office at 3 Queen Victoria Street, London, England, EC4N 4TQ. BISL is authorised and regulated by the Financial Conduct Authority as a benchmark administrator.

© 2026 Bloomberg. All rights reserved.